FinovateEurope’s Alumni Alley is a great way for our pioneering alums to show that, more than a decade later, they are still driving fintech innovation. Check out our Finovate Alumni Alley hub for more information on how to get involved.

To celebrate the launch of this new opportunity, we’re going to highlight alums that demoed their technologies at some of the earliest FinovateEurope events. From Best of Show winners to late blooming breakouts, FinovateEurope has spent the past dozen years showcasing the companies that have become many of fintech’s favorites. Over the next few weeks heading into the winter holidays, we will share their stories here.

A Best of Show Winner – Meniga

One of four companies to win Best of Show in our inaugural FinovateEurope in 2011, Meniga introduced itself as a mobile PFM solution provider for retail banks in Europe. Hailing from Reykjavik, Iceland, and founded in 2009, the company partnered with Íslandsbanki to help its technology reach 5% of households within the first year of launch.

Today the company has grown into a digital innovation partner for more than 165 banks around the world and grown its workforce ten-fold. From its start as a white-label PFM innovator, Meniga has added to its finance management offering with Cashflow Assistant and Smart Money Rules solutions, and added a suite of data management solutions for consolidation, enrichment, and discovery to its product mix. The company also now offers Beyond Banking solutions for banks, as well. These products include customer engagement/empowerment solutions like Carbon Insight and solutions for SME customers such as Cashback Rewards and Market Intelligence.

Long-time Meniga CEO and co-founder Georg Ludviksson stepped down in August. The company’s new CEO, Simon Shorthose, said in a statement that the company was in a “prime position for growth” due to the “rapid modernization of banking technology and the move to real-time cloud infrastructures.” He added “Meniga’s solutions are at the forefront of helping banks take their digital banking experience to the next level of hyper-personalization.”

A Late Blooming Breakout – Linxo

One of the benefits of FinovateEurope is not just the ability to showcase for companies in Europe in general, but also for the opportunity of countries not always associated with fintech innovation to show what entrepreneurs in their nations are up to.

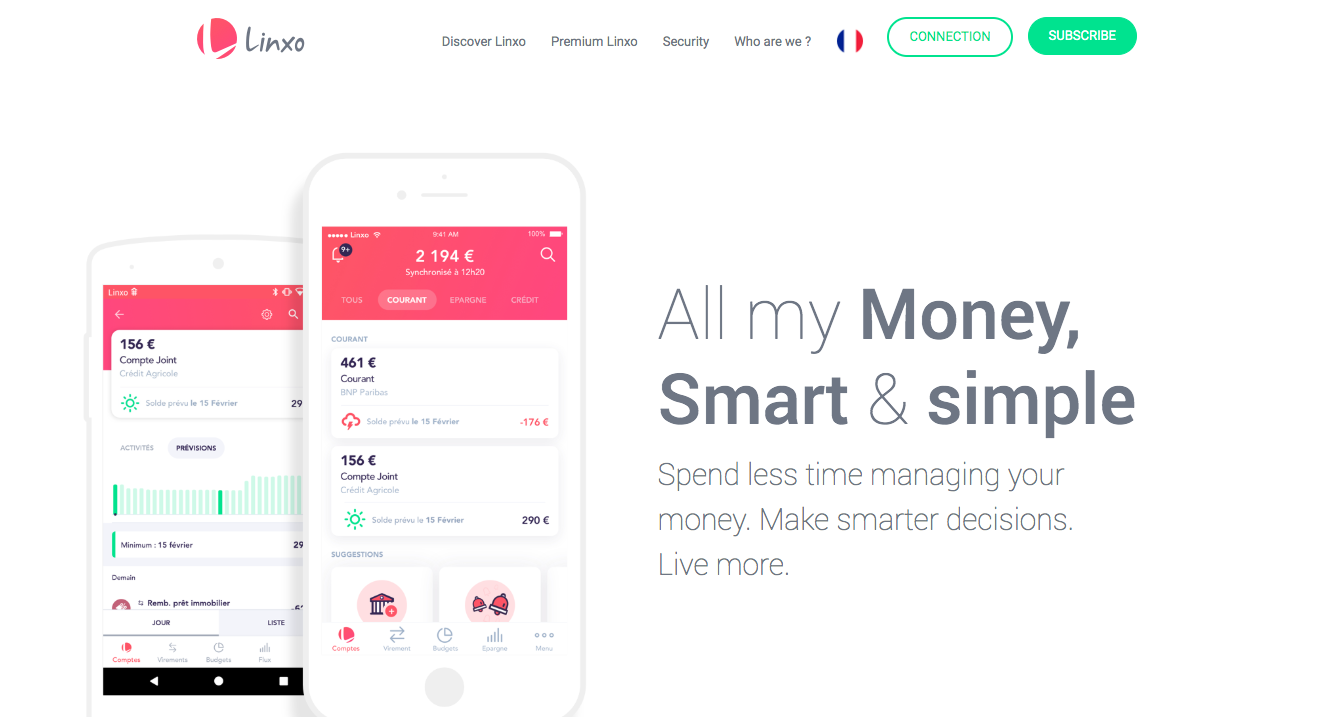

France is one example of such a country and Linxo – which made its Finovate debut in 2011 and, nine years later, was acquired by Credit Agricole for an undisclosed sum – is one example of just such a company. Co-founded in 2010 by CEO Bruno Van Haetsdaaele and headquartered in France, Linxo demoed its platform that represented the first bank account aggregation service for French financial institutions.

“This transaction enables us to accelerate and strengthen our services for the Crédit Agricole Group, while giving us the opportunity to develop our offering in France and internationally for our clients and prospects with Oxlin, our ACPR-authorized payment institution, and to continue the development of Linxo, one of France’s most popular personal financial management apps,” Van Haetsdaele said when the acquisition was announced.

More than three million users in France leverage Linxo’s mobile app to manage their budgets and simplify their finances. Linxo had raised more than $26 million in funding prior to its acquisition.

From Good to Great and Still Going – eToro

Helping investors navigate the financial markets was the goal of many fintechs that demoed their technologies on the Finovate stage in the early years. But one of the innovators in this space to make a big first impression that only has grown bigger over time is eToro.

Another company to win Best of Show in the first FinovateEurope, eToro was an established investing network with more than 1.5 million registered users from 120+ countries in 2011. The company is among the pioneers in social investing, with innovative solutions that helped novice traders and investors learn from successful, veteran traders and investors, and improve their own outcomes in the market.

Among the more popular companies to demo at FinovateEurope, with six Best of Show trophies won from 2011 through 2017, eToro today is still one of the biggest social investing communities in the world with more than 30 million registered users currently sharing their investment strategies on the platform. The company launched its mobile app in 2012, offered trading in cryptocurrencies in 2017 and, this year, unveiled both fractional share investing with zero commissions and eToro Options for options traders in the U.S.

This month, eToro teamed up with Broadridge Financial Solutions to enable proxy voting for investors on its platform. The ability to cast proxy votes will extend to investors holding fractional shares, as well. The partnership is a victory for advocates of corporate accountability by enabling eToro investors to weigh in on issues ranging from mergers and executive pay to ESG initiatives and goals.