This post is part of our live coverage of FinovateEurope 2014.

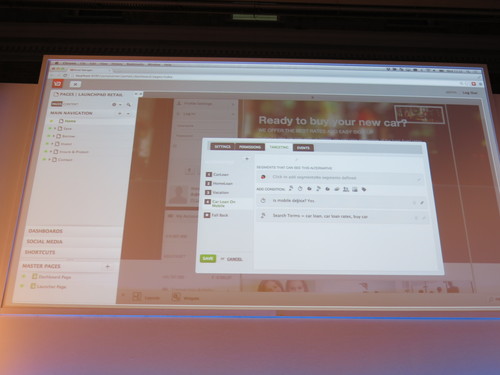

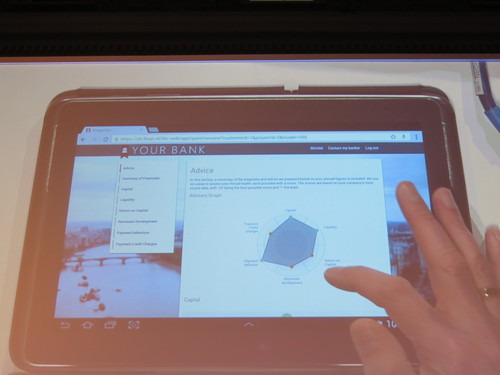

Making their way to the stage now is the team from NF Innova, a software company that specializes in omni-channel customer interaction products.

“Personal Experience Module, a part of iBanking product suite, enables banks to offer their customers a truly unique and tailored user experience. Namely, instead of static, CRM-based rules used for segmentation, this module provides for the adaptive behavior of the entire system, tailoring the user interface for each individual client, without the administration by the bank’s staff.It monitors the subscribed products and services, user’s behavior on the digital touch points (portal, mobile devices, etc.), and automatically provides the exact mash-up of functionalities that are most appropriate for the specific customer at the given time and the communication device.”