According to StockViews co-founder and CEO Tom Beevers, the only thing worse than the amount of money spent on Wall Street research is the fact that the research often isn’t very good. For many fund managers and advisers, managing money with Wall Street research is like dining at a restaurant known more for its reputation than for the real quality of the food.

“Billions are spent on equity research each year to help fund managers beat the market,” Beevers said from the stage at FinovateSpring 2015. “But these experts rarely [get] it right.”

So Beevers’ solution is two-fold. First, top analysts, especially independent analysts, need a way to get their opinions and research to the professional investing public. Second, professional investors like fund managers need a way to both connect with these analysts, as well as a way to determine which of them consistently beat the market—and show the research to back it up.

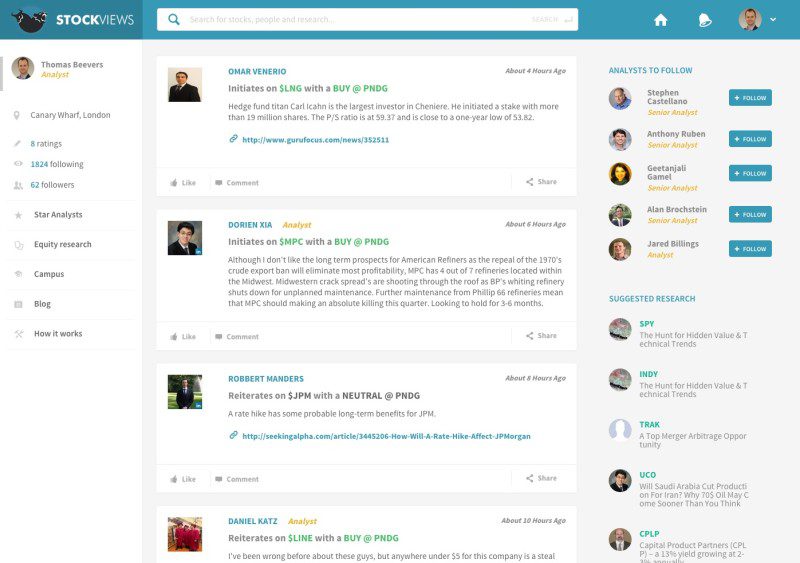

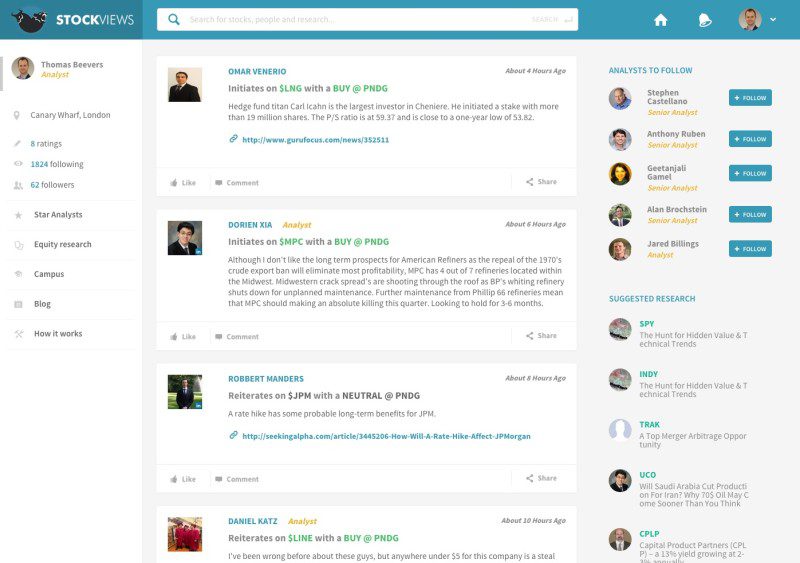

The resulting platform, StockViews, and its signature feature, StockViews Signal, was unveiled this year at FinovateSpring 2015. StockViews now has more than 500 advisers on the platform generating ratings, opinions, and research, providing better results and lower costs for fund managers.

StockViews CEO and co-founder Tom Beevers demonstrated his company’s technology at FinovateSpring 2015 in San Jose.

“The platform is a way for fund managers to tap into something that was never there before,” Beevers said. He described a multi-billion dollar wealth management industry that is dominated by tradition and inefficiency not only on the financial advisor’s side, but on the client side, as well. “The lack of knowledge by customers doesn’t help,” Beevers added. “Customers don’t realize that they are paying for research and not the fund manager.”

Company facts:

- Founded in May 2014

- Headquartered in London, United Kingdom

- Features more than 500 active contributing analysts on platform

- Generated more than 23,000 ratings since May 14

- Tom Beevers is CEO

How it works

StockViews is designed to do three things:

- Make it easy for analysts to join the platform to provide market opinion and research

- Provide a way for fund managers to readily determine which analysts consistently outperform the market

- Deliver actionable buy, sell, or hold ratings that are better than those from Wall Street research

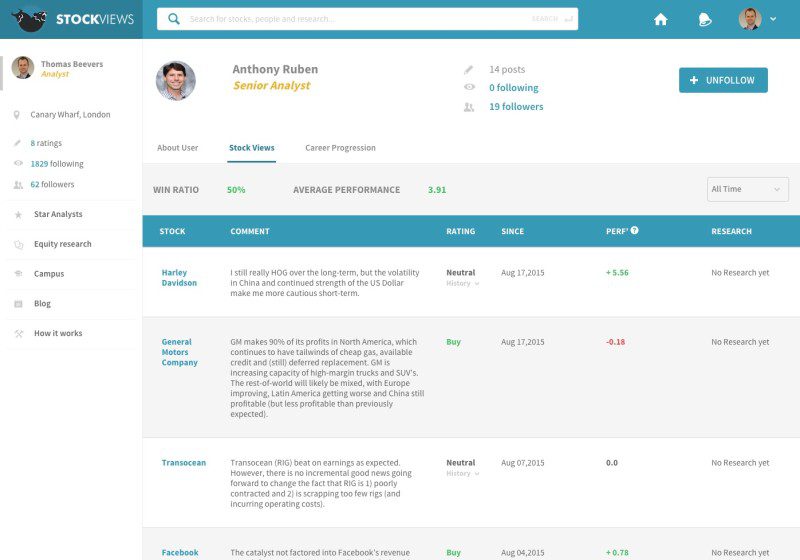

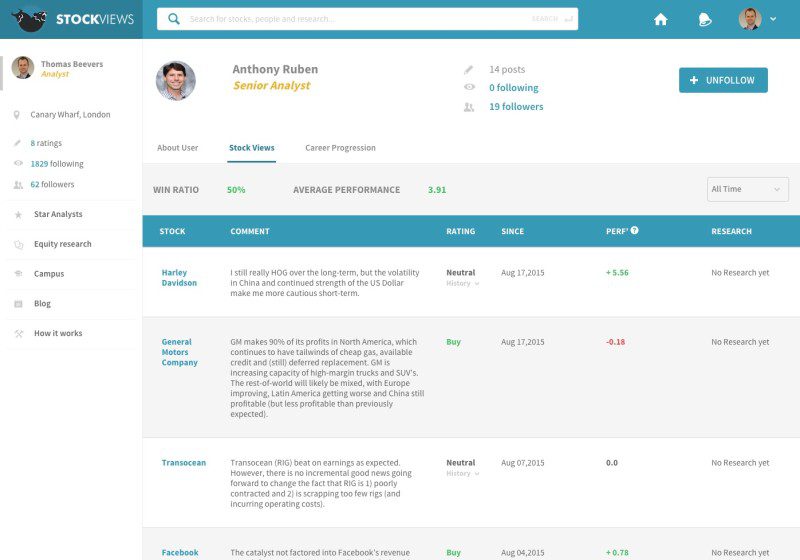

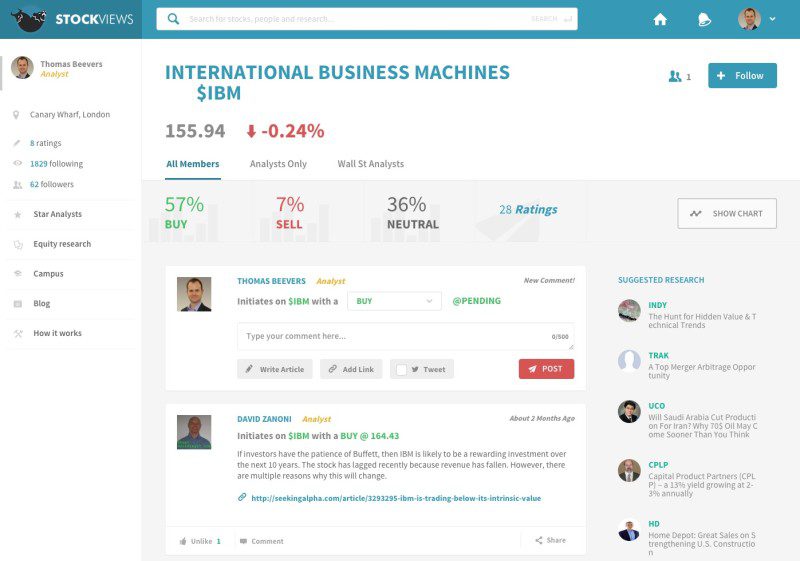

Each analyst on the platform has his or her own page where fund managers can read current opinions and analysis, as well as more historical market calls and research. Analysts are designated as analyst, senior analyst, or vice president based on their overall performance in terms of (1) market price outperformance, (2) breadth and duration of coverage (more markets for a longer time is generally stronger than fewer markets for a shorter time), and (3) peer-reviewed research. This last factor adds human, non-quantifiable input regarding which analysts produce not only good performance metrics, but also cite research to explain and support the outperformance.

“The next Warren Buffet may come from Bangladesh,” said Beevers. “The next George Soros may come from South Korea.” Beavers is a big fan of the revolution in self-teaching, which he thinks is key to the development of independent analysis of the equity markets in recent years. He notes that part of his inspiration for launching StockViews came from watching his fund-management colleagues move away from Wall Street research and toward independent research, increasingly available online. “And what we’re doing is isolating those people who can consistently outperform the market, and then aggregating their collective wisdom,” Beevers explained. “For a fund manager, this provides a valuable tool.”

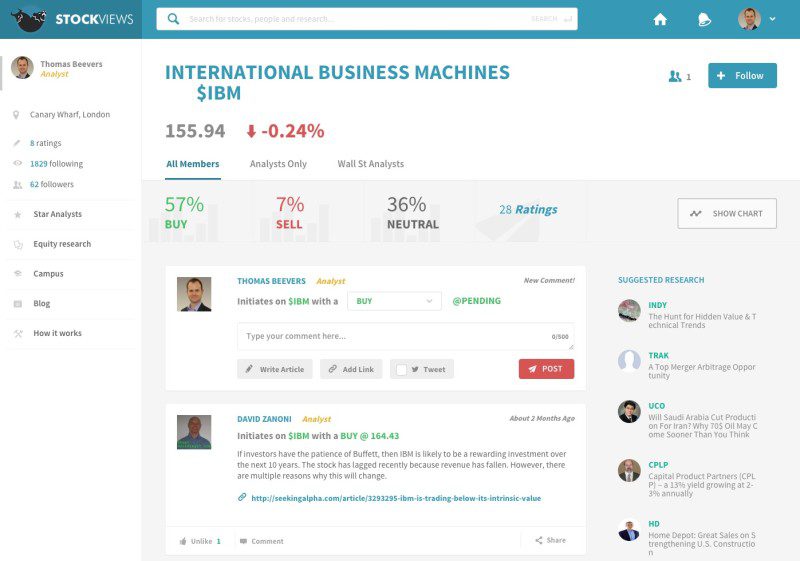

The StockViews Signal, unveiled at FinovateSpring 2015, takes the information from the platform’s hundreds of analysts to provide a crowdsourced take on which stocks deserve buy, sell, or hold ratings. The Signal compares market ratings done by the platform’s analysts—particularly, the top analysts—with market ratings provided by Wall Street. Fund managers can use the Signal to spot instances of significant divergence between Wall Street opinion and the opinions of historically outperforming analysts on StockViews’ platform.

For example, it may not be especially significant if Wall Street is 20% in favor of buying a stock and the analysts on the StockViews platform are at 50% in favor. But if the top analysts—the Signal can be subdivided to show opinions of all platform members, analysts, vice presidents, or Wall Street analysts—are 70% in favor, the divergence between the top analysts and Wall Street may be worth investigating.

The future

With the launch of StockViews Signals this spring, the main task is to turn its community into a true marketplace. “We’ve built a good community and are starting to look at ways to monetize that talent,” Beevers says. He says while most of the platform will be free, the opinions and research from top analysts will be a behind a paywall. Beevers believes fund managers will pay “a few hundred dollars a month” for access, and says “eighty percent of the fee will be passed on to top analysts.”

On the funding side, the company raised $16,000 in seed investment in July, and is continuing to build support from the investment community. The platform has more than 1,800 members, and has provided more than 26,000 ratings to date.

Beevers admits he envisions a world in which Wall Street research is no longer required reading for fund managers. He says that in ten years, “investors’ requirements for research can be efficiently matched with analytical talent online. And in the process, we can strip out the unnecessary cost of the Wall Street machine.”

That’s a tall order. But innovation in fintech often boils down to one of two approaches: (1) build a better mousetrap or (2) build a better way at accessing the better mousetraps built by others. For fund managers looking to escape the world of expensive and often overrated Wall Street research, StockViews may be a rare example of both.

Check out the StockViews live on stage at FinovateSpring 2015 in San Jose.

The Sneak Peek series looks at the innovators demoing live on stage at FinovateFall 2015. Be sure to pick up your tickets to our annual autumn conference, and we’ll see you in New York!

Voitrax is the only complete solution to comply with Dodd-Frank trade reconstruction requirements. It links and tags all of your trade communications exactly as regulators want them.

Voitrax is the only complete solution to comply with Dodd-Frank trade reconstruction requirements. It links and tags all of your trade communications exactly as regulators want them. Presenters

Presenters Craig Eagle, COO, Co-Founder

Craig Eagle, COO, Co-Founder

TransferTo

TransferTo Eric Barbier, CEO

Eric Barbier, CEO Charles Damen, EVP Global BD, Mobile Money

Charles Damen, EVP Global BD, Mobile Money

RedCloud’s

RedCloud’s

Soumaya Hamzaoui, Chief Product Officer

Soumaya Hamzaoui, Chief Product Officer

Ethoca

Ethoca Julie Fergerson, SVP, Industry Solutions

Julie Fergerson, SVP, Industry Solutions Steve Durney, SVP, Issuer Relations

Steve Durney, SVP, Issuer Relations

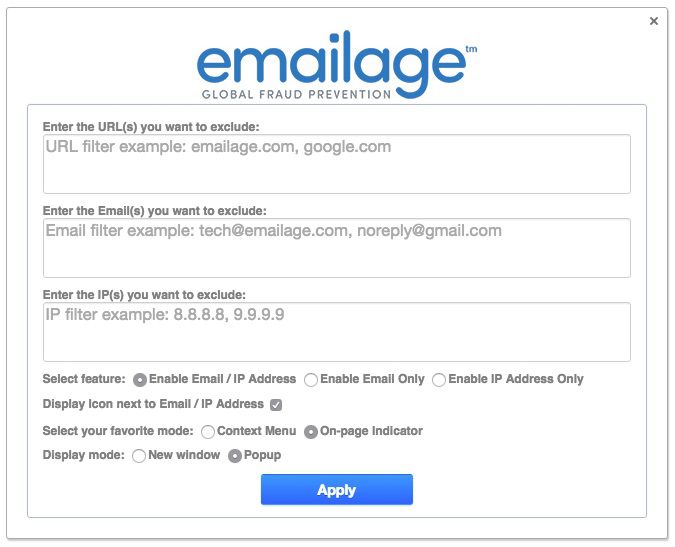

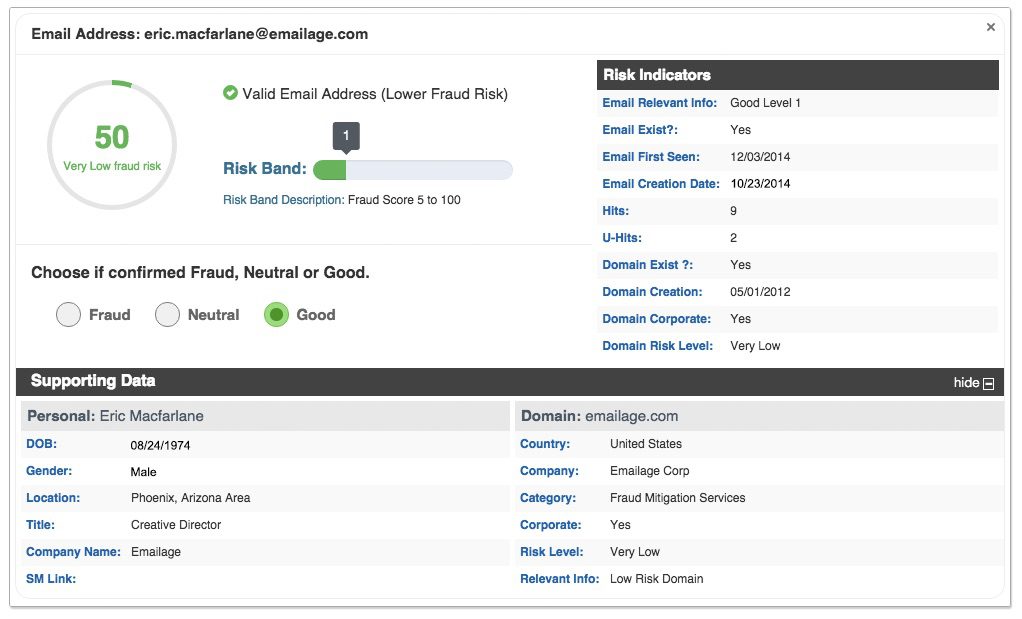

1) Receive email addresses

1) Receive email addresses

Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to

Blockstack.io

Blockstack.io Peter Shiau, CEO and co-founder

Peter Shiau, CEO and co-founder Lior Saar, CPO and co-founder

Lior Saar, CPO and co-founder

Darren Collins, Global Director, Financial Services and Insurance

Darren Collins, Global Director, Financial Services and Insurance