The last few times I’ve tried to use Apple Pay, it’s not worked. And when that happens at the POS, you pretty much look like an idiot waving your fancy phone around and smacking it against the terminal (as if that would help). So yeah, I’m that guy holding up the line, although in my defense, not nearly as long as that person that still uses paper checks.

When Apple Pay is on the fritz, besides my looking like a fool, I’m at a bit of a loss as to what to do next. I tweeted this today:

While it may appear snarky, it’s a serious question. When Apple Pay doesn’t work, there is no clear path to resolution. So here is what happened when I tried the various methods in my tweet.

A. Google it

At first glance, there seems to be promising results, including Apple Support. But alas, its FAQ makes no mention of it “not working,” but it does offer a way to get through the help topics and to an online/phone support area (see C below). And while there is much discussion on the Apple forums, the best advice was to “reboot” your phone, which is surprisingly effective for many.

Grade: Incomplete. While I was able to find Apple support within a few minutes, I had to go to the chatbot for a full diagnosis (see B below)

B. Contact Apple

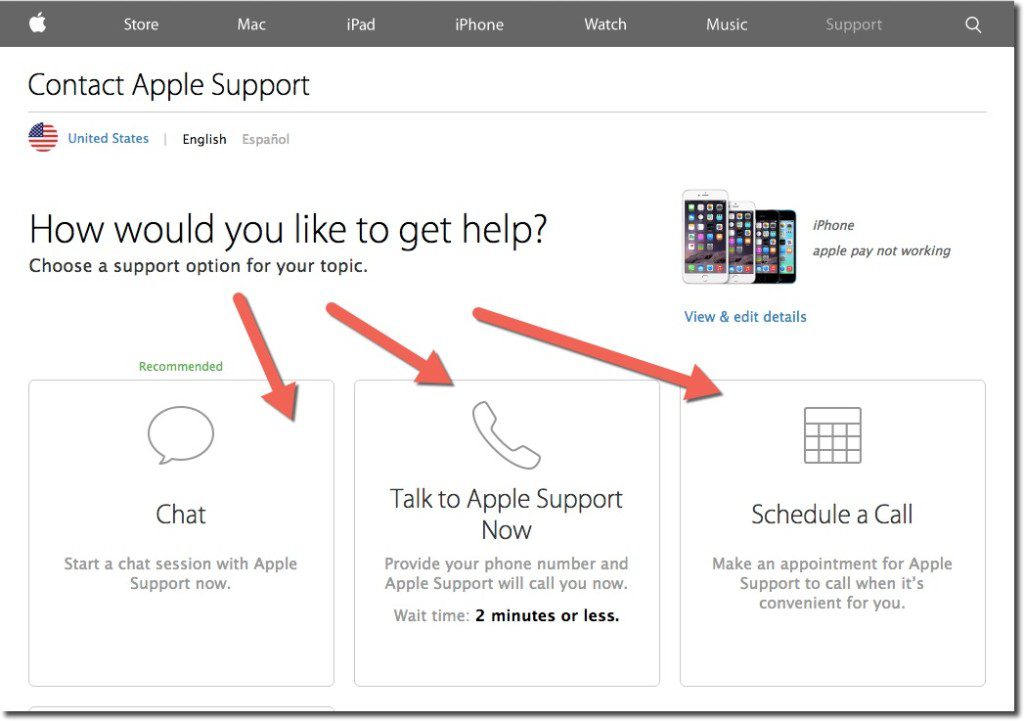

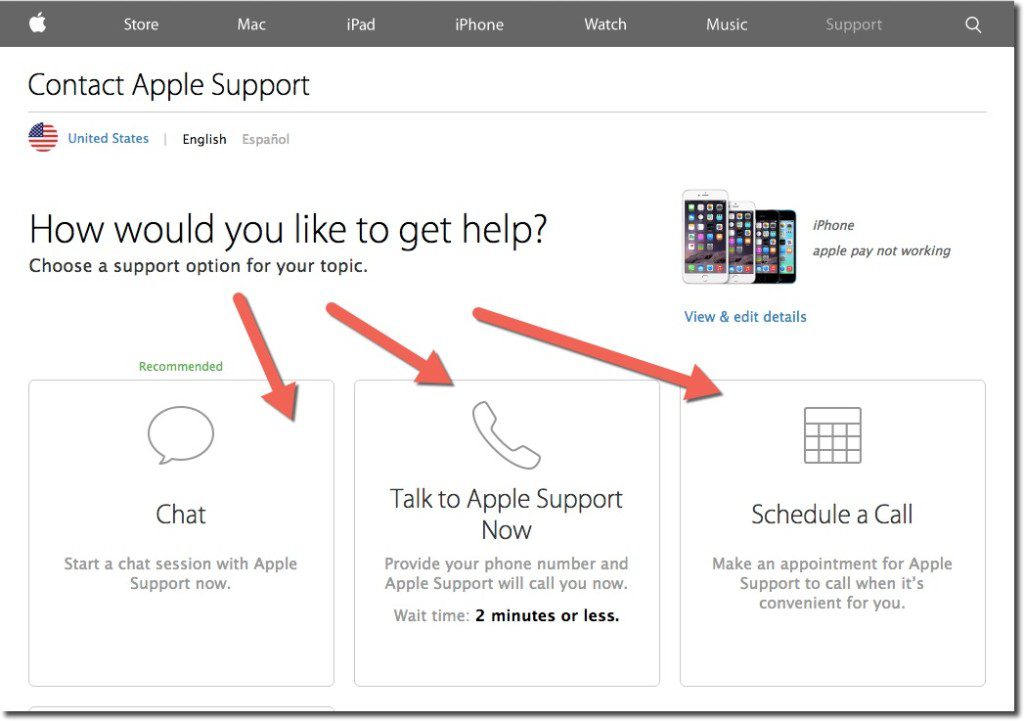

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

As always, I chose online chat. The chatbot was good (not sure if/when a human stepped in), but it took a full 13 minutes to diagnose the problem (including looking up my serial number at the outset). Apple suggested I delete the existing payment card and add the new one, which was the right answer.

If you try to figure out the problem directly on your phone, a search for “Apple Pay” within the phone, i.e., Spotlight Search, directs users to the Passbook app. If you select the “i” button for more information, you are directed to the bank’s call center (see C below). Alternatively, you can navigate directly to Settings, find Passbook & Apple Pay (below the fold), and locate the bank contact number.

Grade: C >> for the 13 minutes it took through Apple Care chat support

C. Call the bank (BofA)

I had just a single card, issued by Bank of America, hooked to Apple Pay. Although I try to avoid call centers if at all possible, I have been very pleased with BofA call center support in the past, so I called the number on the back. And while SIRI, or whatever their voice recognition is called, was not able to understand Apple Pay questions (“I hear that you want to make a payment, is that right?”) I had passed authentication and was put through to a live operator in about 3 minutes. I’d already figured out the problem during my 13 minutes with Apple Care (old card number), so I didn’t torture BofA and play dumb. But had I not known the answer already, the CSR was prepared to get Apple Pay support on the line for help.

Grade: B- >> for being able to get to Apple Pay phone support within 4 to 5 minutes (though did not test their diagnostic skills)

D. Use the mag stripe

Honestly, if I wasn’t into this stuff for my job, I would have just started using the mag-strip card and forgot about Apple Pay until v2.0.

Grade: A >> for the 5 to 7 seconds it took to get the plastic out of my wallet, swipe, and stop holding up the line

———-

The fix

As mentioned in B above, my Apple Pay problem could be solved either through the Passbook app itself or through the Passbook settings within the iPhone Settings area.

As mentioned in B above, my Apple Pay problem could be solved either through the Passbook app itself or through the Passbook settings within the iPhone Settings area.

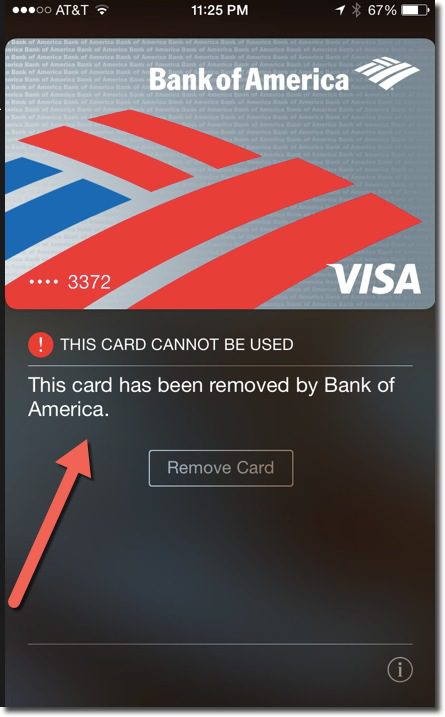

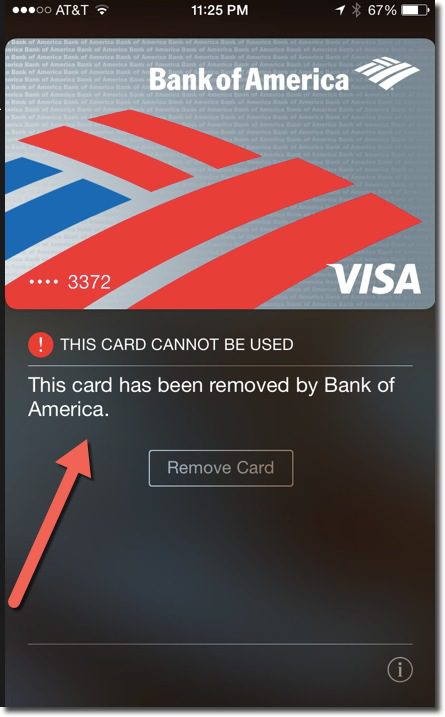

Here’s what I saw when clicking on my “card” in Passbook (see inset).

And that was the reason why Apple Pay had stopped functioning. Bank of America had revoked my card a few months prior during a breach-related reissue.

But I’m not sure how I was supposed to know that I needed to update my Apple Pay card. I’ve searched my email from Bank of America, but I see no message from them on the subject. While it could have been trapped by the SPAM filters, that would be unusual for messages from my card issuer.

It’s completely understandable why the bank would pull my card out of Apple Pay if it was cancelled and replaced by a new number. But they either need to inform me, along with good instructions on what to do next, or better, simply replace my old card with the new one within Apple Pay, with notification of course (see update below).

But that’s probably v2.0 customer support. Until then, I’m glad there’s still a mag-stripe as backup.

—–

Update 19 Aug 2015: Apparently, Citibank is automatically replacing new card numbers into Apple Pay when the old one is canceled. Not sure if this applies to its entire portfolio or selected customers. Thanks to Ian Kar for the pointer.

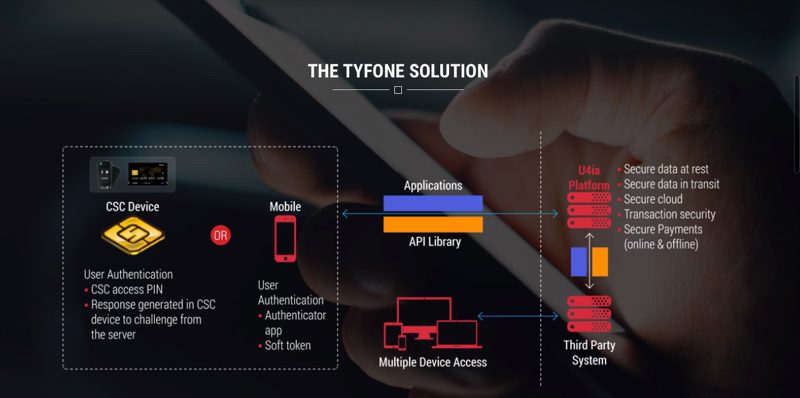

Cross-border payments platform

Cross-border payments platform

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

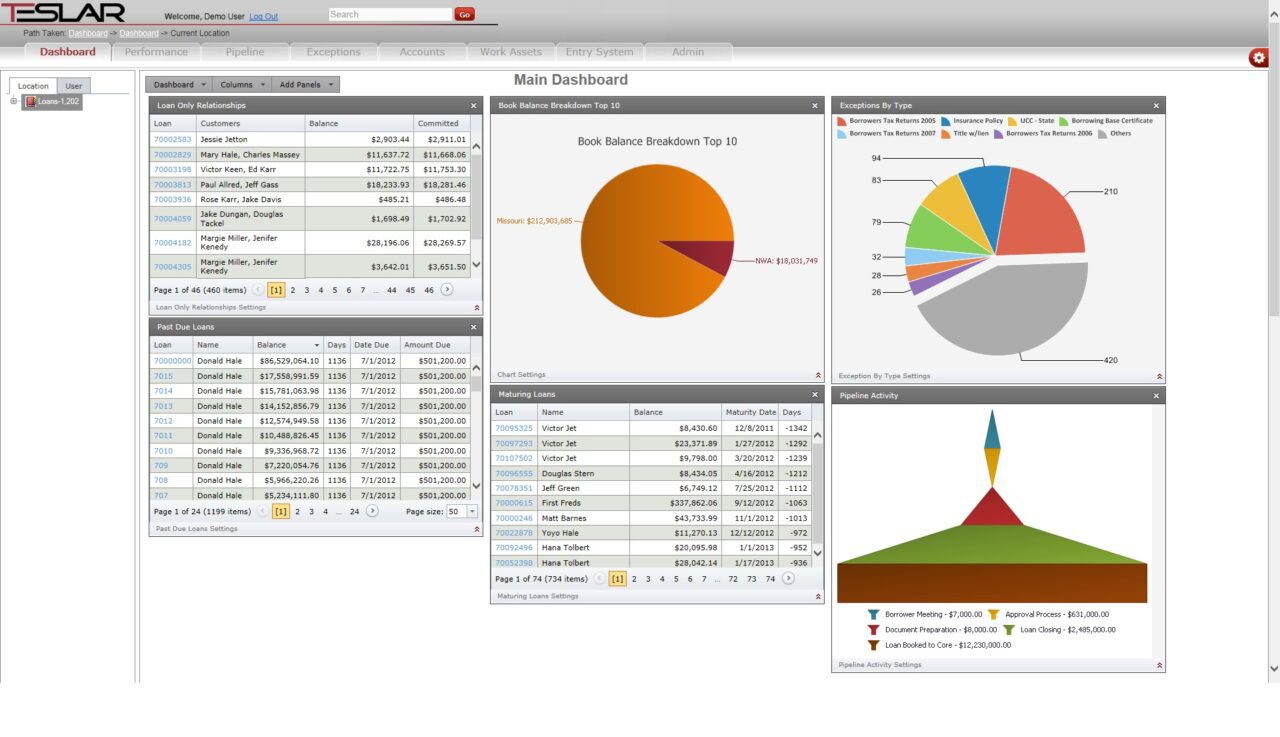

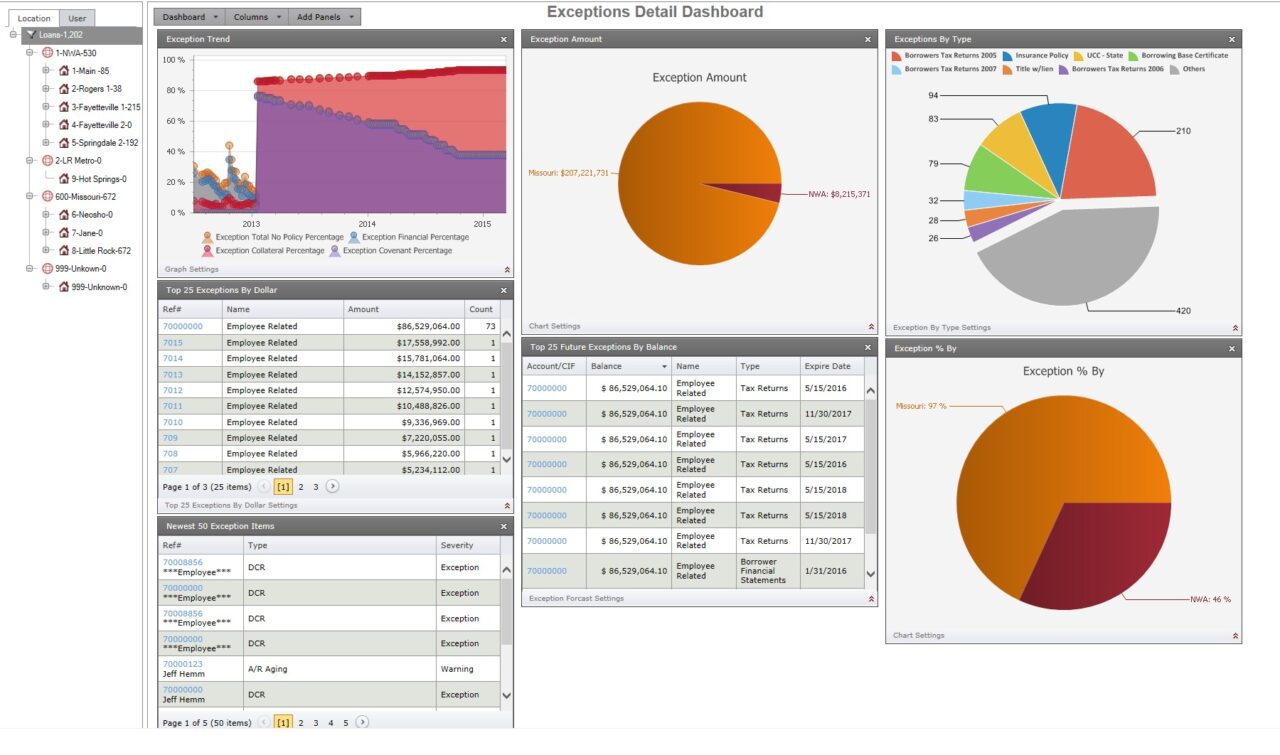

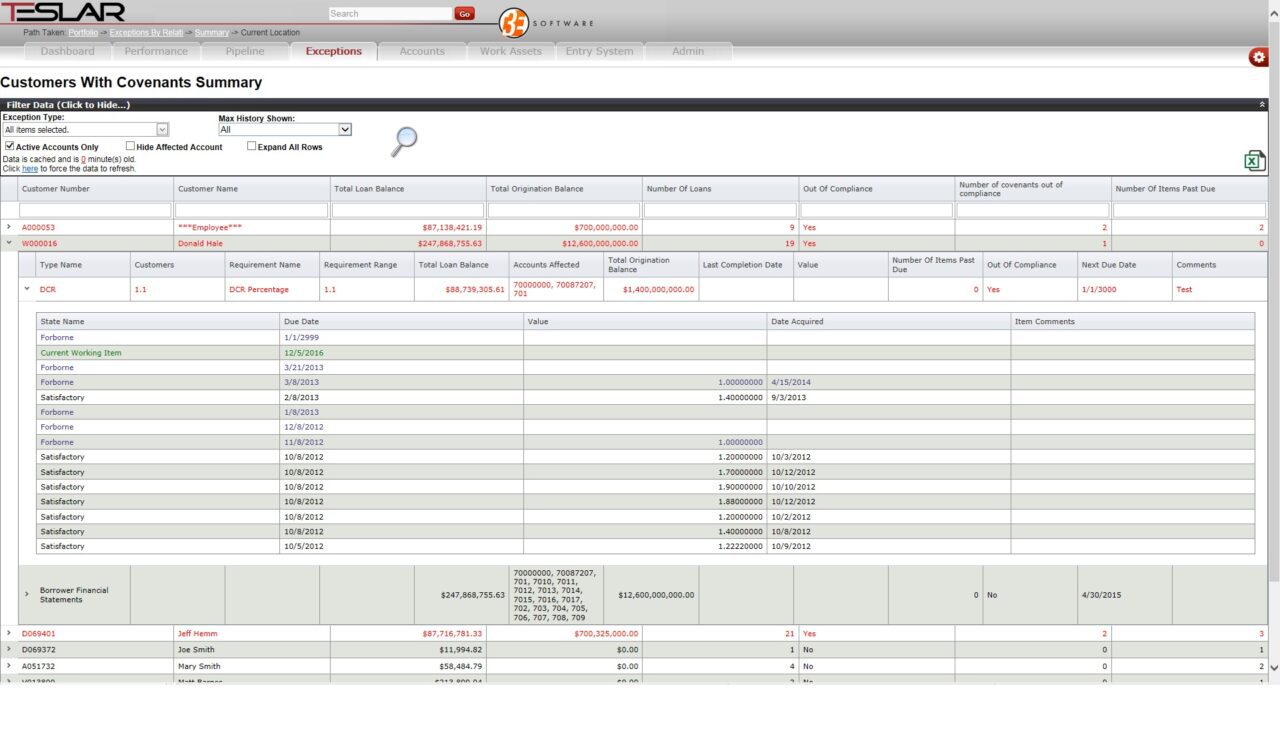

Summary of Customers with Covenants (above)

Summary of Customers with Covenants (above)

Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to