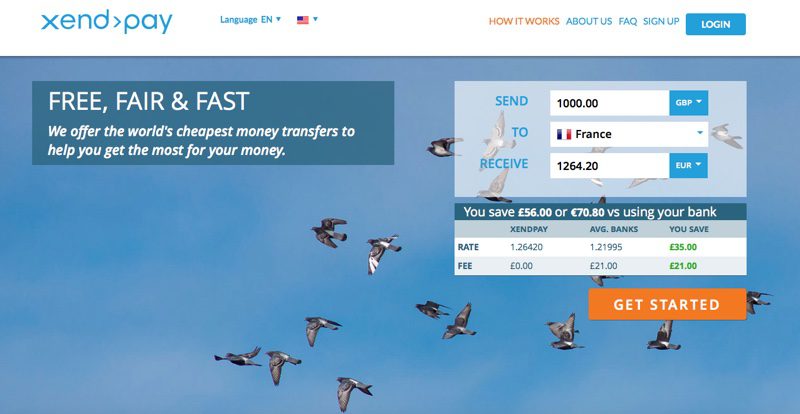

Via strategic partnerships with mobile network operators M-Pesa-Vodafone of Tanzania and Air Tel Money of Burkina Faso, online money-transfer specialist Xendpay is expanding its services in Africa to the east and west at the same time.

The goal, according to Xendpay CEO Rajesh Agrawal, is to make transferring money into and out of Africa “easier, more transparent, and cost-effective.” Talking about money remittance and its impact on developing economies, Agrawal suggested that services like Xendpay can help drive economic growth, and promote political stability in emerging nations. “[Remittance] is a key tool for international development,” he said.

Additionally Xendpay will add Nigeria’s currency to its new currencies portfolio. The company currently serves more than 170 different countries and more than 45 different currencies.

Xendpay CEO Rajesh Agrawal demonstrated his company’s online money transfer service at FinvoateEurope 2013.

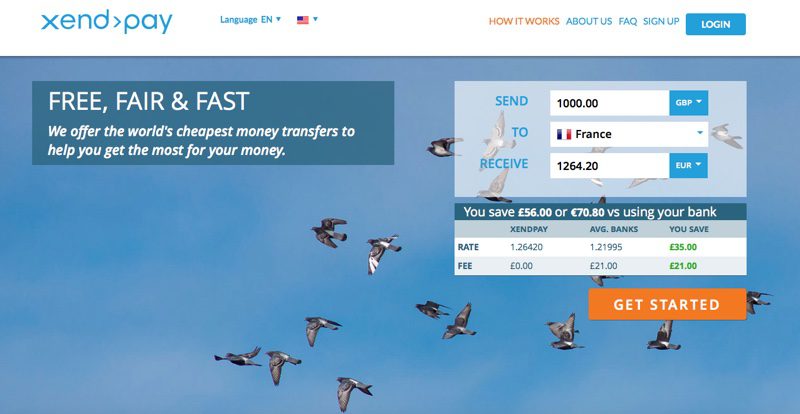

Xendpay’s “pay what you want” approach makes the company unique among the growing field of international remittance companies. Xendpay recommends an amount for customers to pay for each money transfer to help cover costs. But the company stands behind its “no compulsory fees” business model, its emphasis on cash-to-cash transfers, and its commitment to spanning not just geography, but the generational distance between Xendpay customers, as well.

“Often there is a gap between [sender and receiver], and that gap is not just geographical, but generational, economical,” Agrawal explained during his company’s appearance at FinovateEurope: “Somebody like myself sending money back to my parents: I cannot use a company like PayPal, like eWallet. My father doesn’t even know how to operate a computer,” he said.

“We designed Xendpay to be so simple that our first-ever customer was a 76-year-old English lady living in France who was using Xendpay to transfer money from her U.K. bank account to her French account,” Agrawal added.

Xendpay accounts are free to open, and offer competitive exchange rates, online checks, and the ability to pay by bank transfer, credit or debit card, as well as Sofort. Transfers involving euros, pounds, and American dollars are typically sent the same day as funds received. For other countries such as Vietnam, Mexico, and Egypt, two-to-three working days is standard.

Xendpay was founded in 2012 and is headquartered in London. A member of the Rational Group of companies and a sister company to RationalFX, Xendpay demonstrated its money-transfer technology at FinovateEurope 2013.

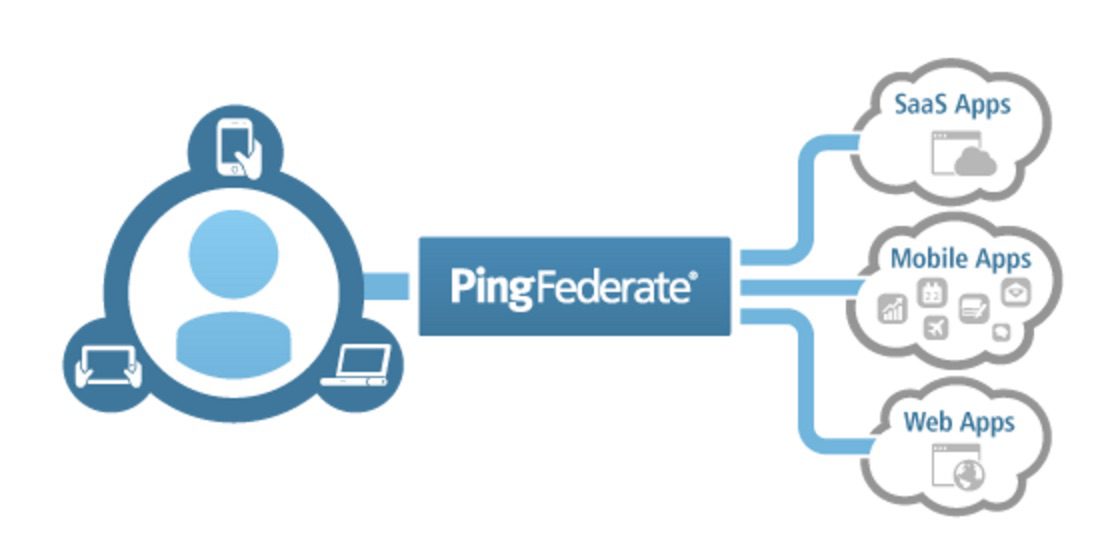

The enhancements are for Ping Federate, which offers banks an omnichannel authentication and access-management solution that uses multi-factor authentication (MFA), single sign-on, and limited access security.

The enhancements are for Ping Federate, which offers banks an omnichannel authentication and access-management solution that uses multi-factor authentication (MFA), single sign-on, and limited access security.

Karkal credits BBVA’s current initiatives in this direction, both its Open Talent hackathons and collaborations with companies like Dwolla. To get the Open APIs project underway, BBVA has set up a closed group of partners to build new applications before opening up the project to outside developers.

Karkal credits BBVA’s current initiatives in this direction, both its Open Talent hackathons and collaborations with companies like Dwolla. To get the Open APIs project underway, BBVA has set up a closed group of partners to build new applications before opening up the project to outside developers.

We’re

We’re