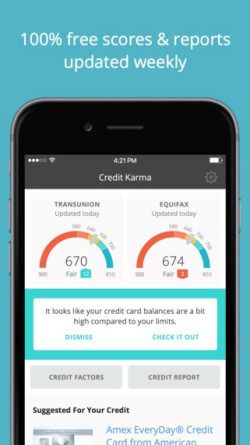

Maybe it’s the change in seasons. Just days after Paypal announced it would redesign its iOS and Android mobile apps, Credit Karma reports a new design for its mobile app.

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said.

Calling the redesign a “major reimagining,” Jonathan Chao, mobile product manager for Credit Karma, noted that user behavior strongly influenced the new look and feel of the app. “It has some of our most direct, specific and proactive product features to date, and we’re excited that we can finally show it off to our members,” Chao said.

What do members get with the redesign? Credit score information – letting users know of any changes in their score and likely reasons for the change – will now be available directly from the home screen. Also from the home screen, members can run credit simulations (courtesy of Transunion) to see how factors like reducing their overall credit card debt can positively affect their credit score.

The new app also includes opt-in credit monitoring via push notification, and lets members compare and shop for new credit cards or loans from Credit Karma’s new credit card and loan marketplace.

Credit Karma’s new app is available on iOS and Android.

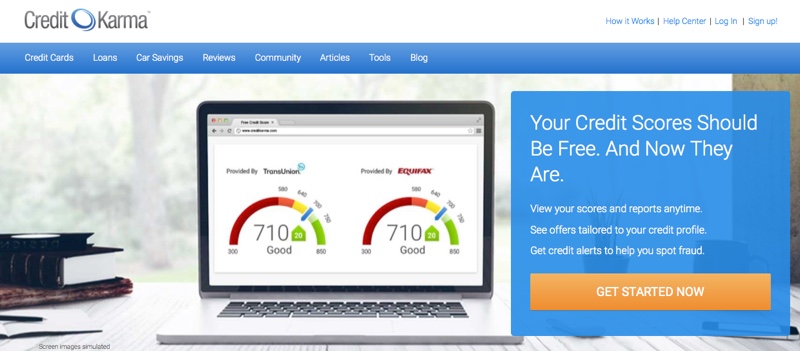

Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the acquisition of Snowball, a debt-repayment app. The company also reported in January that it had surpassed 50 million users managing $3 trillion in debt.

Credit Karma’s new app redesign isn’t the only news the company is making in 2016. In January, Credit Karma announced the acquisition of Snowball, a debt-repayment app. The company also reported in January that it had surpassed 50 million users managing $3 trillion in debt.

Founded in 2007 and based in San Francisco, Credit Karma demonstrated its Debt Manager solution at FinovateSpring 2009. The company has raised more than $368 million in funding, giving the company a valuation of $3.5 billion. In December, Credit Karma won a spot on Fast Company’s 2015 Silicon Valley’s “Nice” list, and in November, Credit Karma celebrated giving out its billionth free credit score.

Today’s round, when added to the Texas-based company’s 2014 Seed round of $2 million, brings its total funding to $4 million.

Today’s round, when added to the Texas-based company’s 2014 Seed round of $2 million, brings its total funding to $4 million.

We’re

We’re

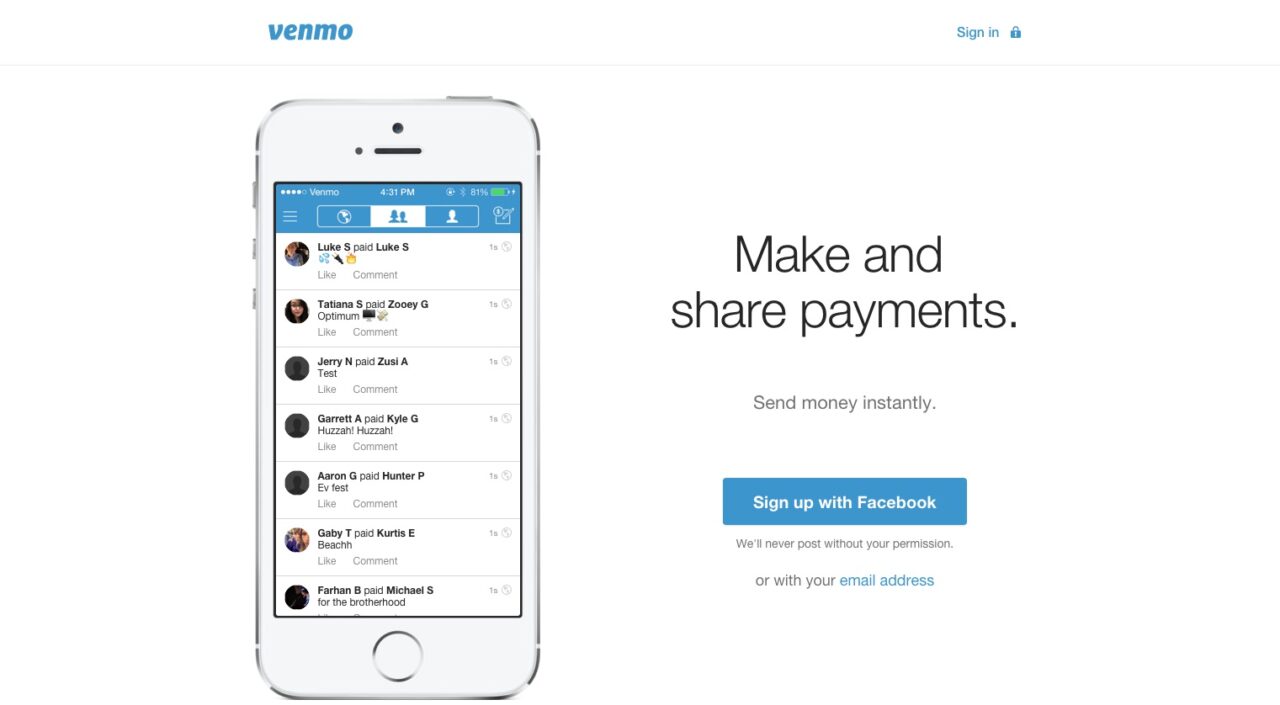

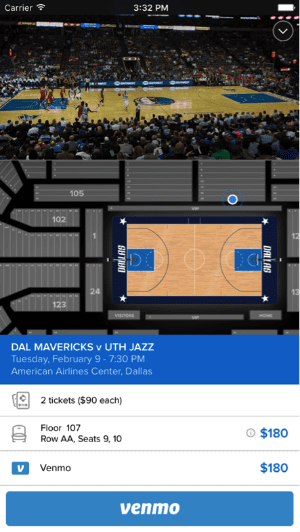

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.