Total fundings in second quarter hit $8 billion as 30 more companies raised $390 million the second week of May. Nearly half of that ($188 million) was debt earmarked for Avant’s U.K. subsidiary.

Total fundings in second quarter hit $8 billion as 30 more companies raised $390 million the second week of May. Nearly half of that ($188 million) was debt earmarked for Avant’s U.K. subsidiary.

The deals were widely dispersed around the world, with only 4 of the 30 headquartered in California. London beat that this week with 5, followed by 3 in NYC, and 2 each from Chicago, Florida and Germany.

The total number of deals YTD stands at 494, nearly double last year’s 266. Total dollars raised YTD is now $14.7 billion, more than twice the $6.7 billion raised during the same period a year ago.

Notable raises included Finovate alum Tagit which brought in nearly $9 million to supercharge its mobile application development platform.

——-

Fintech deals by size from 7 May to 13 May, 2016:

Avant (AvantCredit U.K.)

Consumer alt-lender

Latest round: $188 million Debt (for AvantCredit U.K.)

Total raised: $1.92 billion ($654 million Equity, $1.26 billion Debt)

HQ: Chicago, Illinois

Tags: Consumer, credit, loans, underwriting, lending

Source: Crunchbase

Bridge2Solutions

Incentive & rewards systems for financial institutions

Latest round: $35 million Series A

Total raised: $35 million

HQ: Daytona Beach, Florida

Tags: Consumer, enterprise, rewards, payments gamification, employees, human resources, loyalty, retention

Source: Crunchbase

Capital Float

Working capital financing

Latest round: $25 million Series B

Total raised: $41 million

HQ: Bangalore, India

Tags: SMB, lending, financing, commercial loans, invoice financing, factoring

Source: Crunchbase

Wincor Nixdorf (AEVI subsidiary)

Payments technology

Latest round: $23 million Post-IPO Equity

Total raised: Unknown

HQ: Germany

Tags: Enterprise, cashless payments

Source: FT Partners

orderbird

iPad POS system for the hospitality industry

Latest round: $22.8 million Series C

Total raised: $37 million

HQ: Berlin, Germany

Tags: SMB, payments, mobile, merchants, acquiring, security, credit/debit cards

Source: Crunchbase

Simplee

Healthcare finance platform

Latest round: $20 million

Total raised: $37.8 million

HQ: Palo Alto, California

Tags: SMB, patient finance, billing, payments, insurance, credit, underwriting, B2B2C

Source: Crunchbase

AutoFi

Auto financing platform

Latest round: $17 million

Total raised: $17 million

HQ: San Francisco, California

Tags: B2B2C, SMB, consumer, lending, auto loan, vehicle credit, underwriting, secured, captive financing, lead gen

Source: FT Partners

EuroCCP

Equities clearing

Latest round: $16 million (from Euronext)

Total raised: Unknown

HQ: Amsterdam, The Netherlands

Tags: B2B, enterprise, trading software, investing services, back office

Source: FT Partners

Tagit

Mobile financial applications

Latest round: $8.75 million

Total raised: $8.75 million

HQ: Singapore

Tags: Enterprise, banking, mobile application development, developers, Finovate alum

Source: Finovate

TechBureau

Blockchain technology

Latest round: $6.2 million

Total raised: $6.2 million

HQ: Osaka, Japan

Tags: SMB, blockchain, distributed database, payments, crypto-currency, bitcoin

Source: FT Partners

WealthBar

Online financial adviser

Latest round: $5.5 million

Total raised: $5.5 million

HQ: Vancouver, British Columbia, Canada

Tags: Consumer, investing, robo-adviser, ETF, wealth management

Source: Crunchbase

Healthcare Interactive

Healthcare & insurance technology

Latest round: $3.4 million Series A

Total raised: $11.8 million

HQ: Glenwood, Maryland

Tags: Enterprise, healthcare, payments, insurance

Source: FT Partners

Tandem

Digital bank

Latest round: $3.4 million Equity Crowdfunding ($95 million valuation)

Total raised: $34.8 million

HQ: London, England, United Kingdom

Tags: Consumer, banking, payments, deposits, loans, debit card

Source: Crunchbase

AppZen

Expense report automation

Latest round: $2.9 million

Total raised: $3.0 million

HQ: Sunnyvale, California

Tags: SMB, accounting, bookkeeping, expense reporting, compliance, fraud protection

Source: Crunchbase

Sure

Mobile on-demand insurance

Latest round: $2.6 million Seed

Total raised: $2.6 million

HQ: New York City, New York

Tags: Consumer, travel insurance, mobile

Source: Crunchbase

Inkassogram

Debt collection platform

Latest round: $2.45 million

Total raised: $2.45 million

HQ: Sweden

Tags: SMB, accounting, payroll, bookkeeping, billing, payments, invoicing

Source: Crunchbase

Fluent

Blockchain B2B network

Latest round: $1.65 million Seed

Total raised: $2.5 million

HQ: New York City, New York

Tags: SMB, payments, blockchain, crypto-currency, bitcoin, payments

Source: Crunchbase

AccessPay

Online payments & cash management for small businesses

Latest round: $1.45 million Debt

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: SMB, payments, accounting, treasury management, commercial banking

Source: Crunchbase

FattMerchant

Payment processor

Latest round: $1.4 million

Total raised: $2.25 million

HQ: Orlando, Florida

Tags: SMB, payments, mobile, merchants, acquiring, security, credit/debit cards

Source: Crunchbase

StoreHub

Mobile point-of-sale solution

Latest round: $850,000 Seed

Total raised: $850,000

HQ: Petaling, Malaysia

Tags: SMB, payments, mobile, merchants, acquiring, credit/debit cards, mobile, POS

Source: Crunchbase

Bridge Financial Technology

Back-office platform for financial advisers

Latest round: $722,000

Total raised: $722,000

HQ: Chicago, Illinois

Tags: Advisors, B2B2C, investing, trading, wealth management

Source: Crunchbase

Selequity

Online commercial real estate investing platform

Latest round: $590,000 Seed

Total raised: $590,000

HQ: St. Louis, Missouri

Tags: SMB, investors, commercial mortgage, P2P lending, credit, underwriting, real estate

Source: Crunchbase

Cushion

Financial & time management service for freelancers

Latest round: $500,000

Total raised: $500,000

HQ: Brooklyn, New York

Tags: SMB, accounting, payroll, bookkeeping, billing, payments, invoicing, PFM

Source: Crunchbase

Olivia

AI-powered financial assistant

Latest round: $500,000 Seed

Total raised: $500,000

HQ: San Francisco, California

Tags: Consumer, personal finance, mobile, artificial intelligence, customer service, chatbot

Source: Crunchbase

Shares.com

Asset crowdfunding platform

Latest round: $300,000 Angel

Total raised: $300,000

HQ: London, England, United Kingdom

Tags: Consumer, collectibiles, investing, asset-based lending, artwork

Source: Crunchbase

PaySur

Bitcoin exchange

Latest round: $275,000

Total raised: $275,000

HQ: Leon, Mexico

Tags: Consumer, payments, cryptocurrency, bitcoin, blockchain, remittances

Source: Crunchbase

DebitShield

Online debit card security

Latest round: Not disclosed

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Consumer, security, payments, direct debit, online billpay

Source: Crunchbase

FairCent

Marketplace lender

Latest round: Undisclosed Series A

Total raised: $4.25 million (before the Series A)

HQ: Haryana, India

Tags: Consumer, lending, P2P, person-to-person, credit, lending, investing

Source: Crunchbase

iBondis

Marketplace lender to small businesses

Latest round: Not disclosed

Total raised: Unkown

HQ: London, England, United Kingdom

Tags: SMB, P2P lending, crowdfunding, commercial loans, person-to-person, credit, underwriting, investing

Source: Crunchbase

Savesta

Stealth personal finance

Latest round: Not disclosed

Total raised: Unknown

HQ: Bellevue, Washington

Tags: Consumer, personal finance, PFM

Source: Crunchbase

—–

Image licensed from Shutterstock

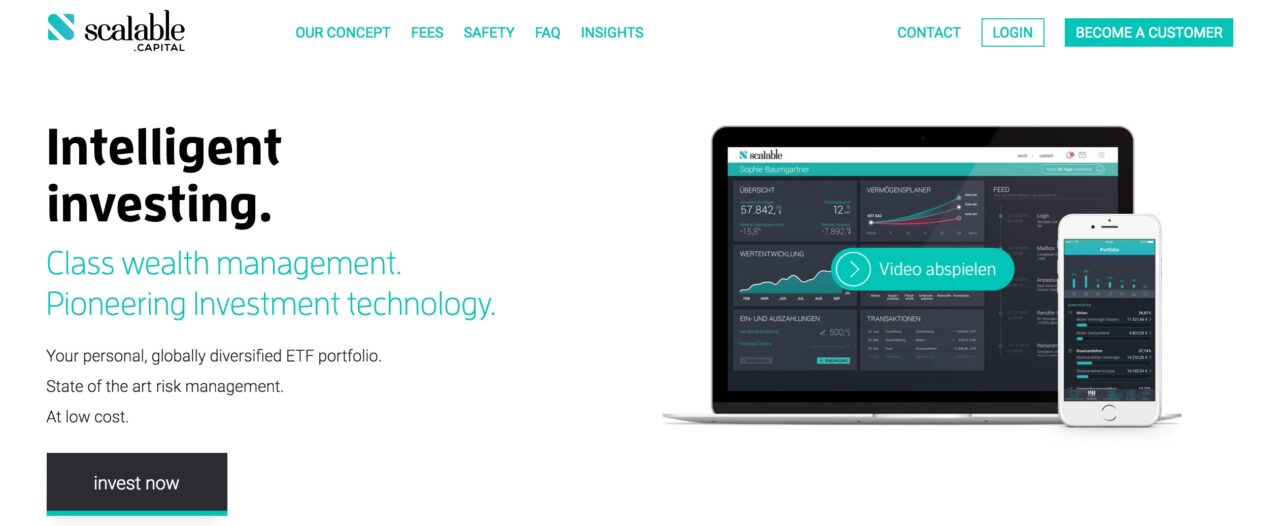

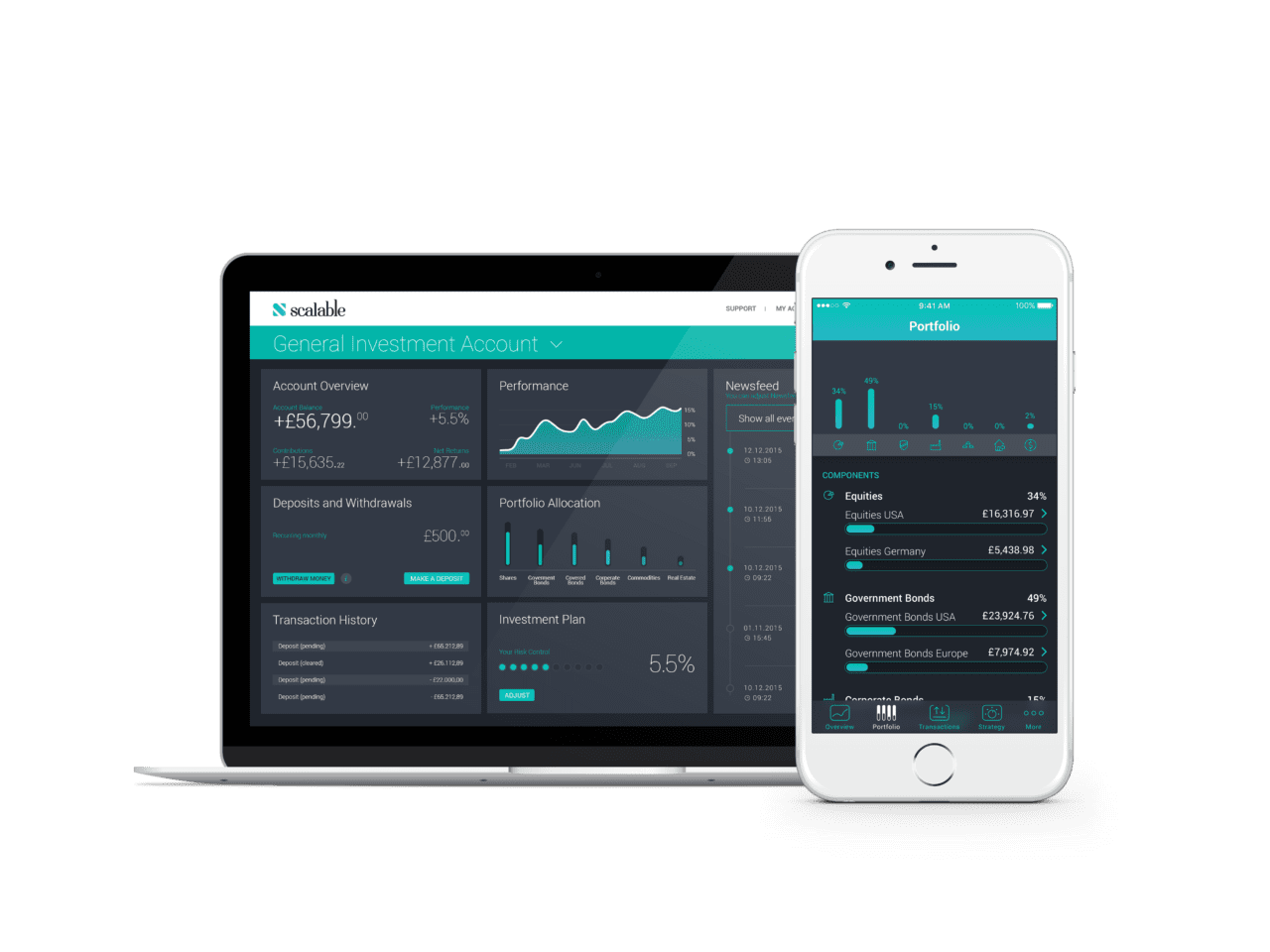

A group of select clients on the waiting list will be guided through Scalable Capital’s risk assessment module before their funds go live on the platform. The Germany-based company received approval from the FCA in February and will open up to the general U.K. public in early July.

A group of select clients on the waiting list will be guided through Scalable Capital’s risk assessment module before their funds go live on the platform. The Germany-based company received approval from the FCA in February and will open up to the general U.K. public in early July.

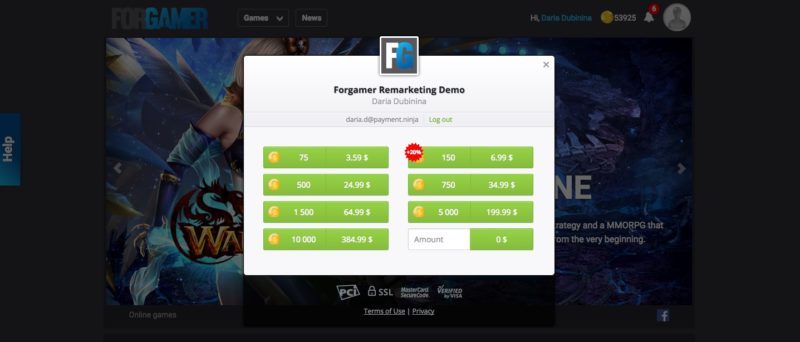

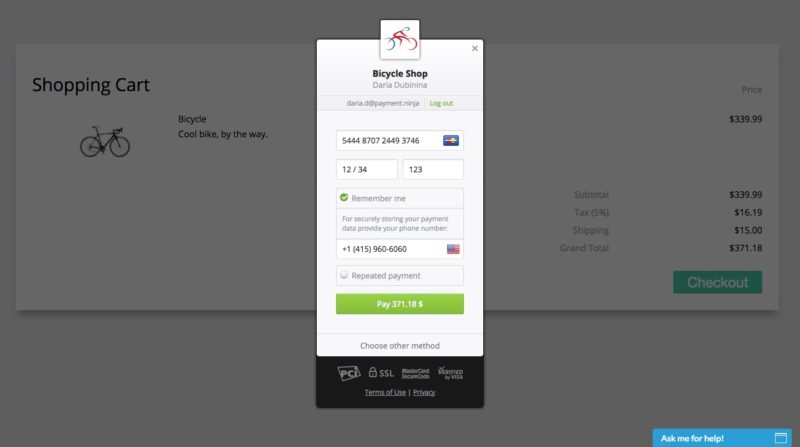

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.

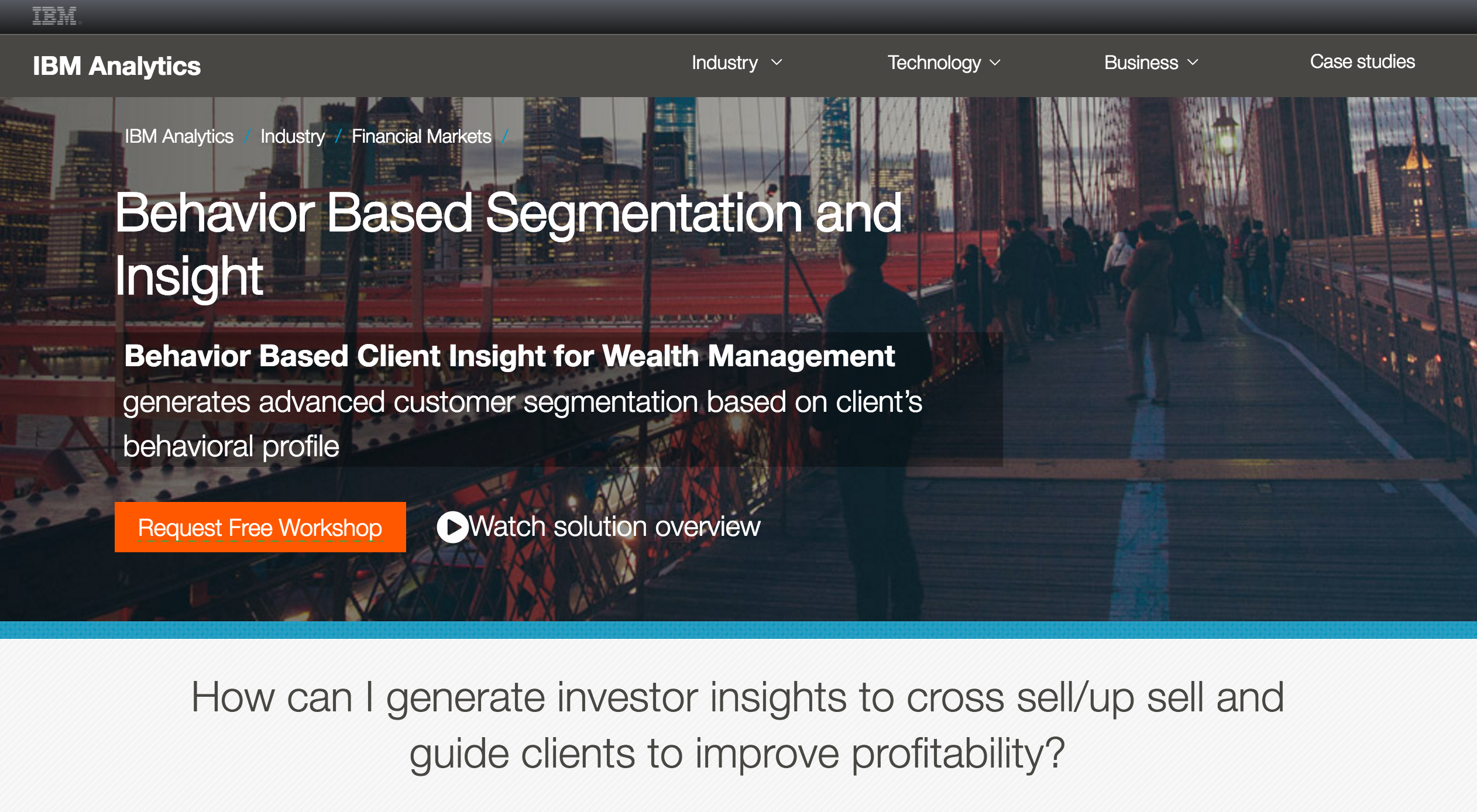

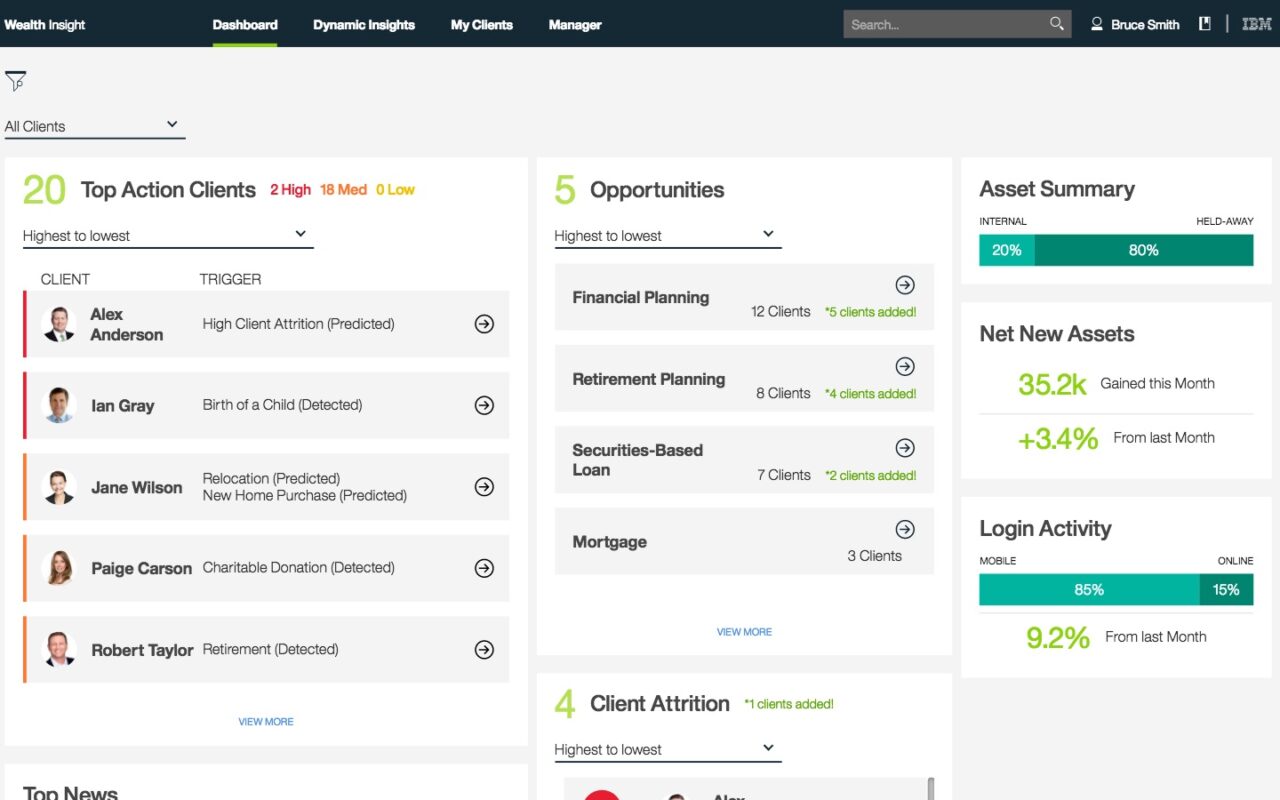

Financial adviser dashboard

Financial adviser dashboard Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016.

Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016. We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering:

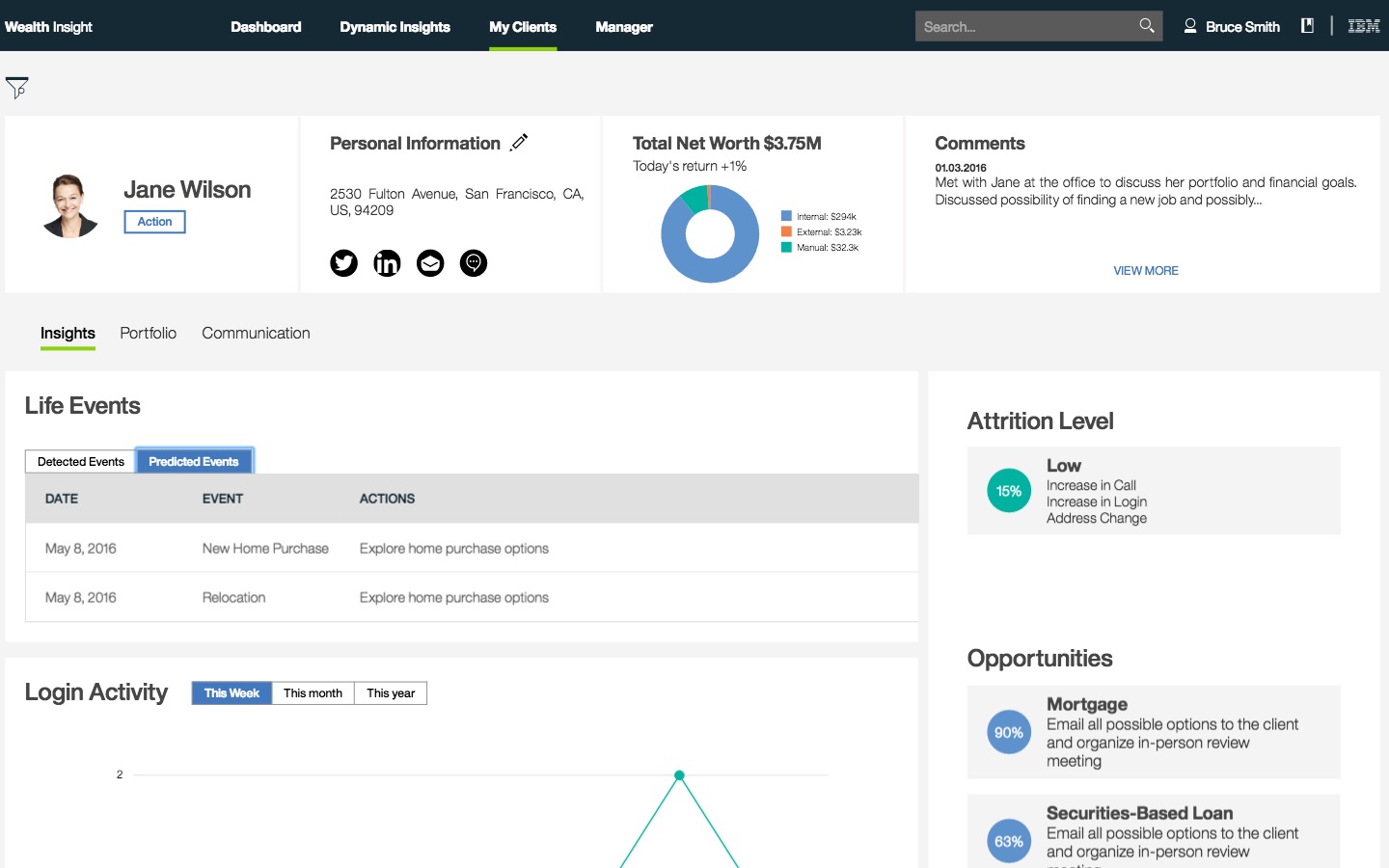

We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering: Client Profile screen

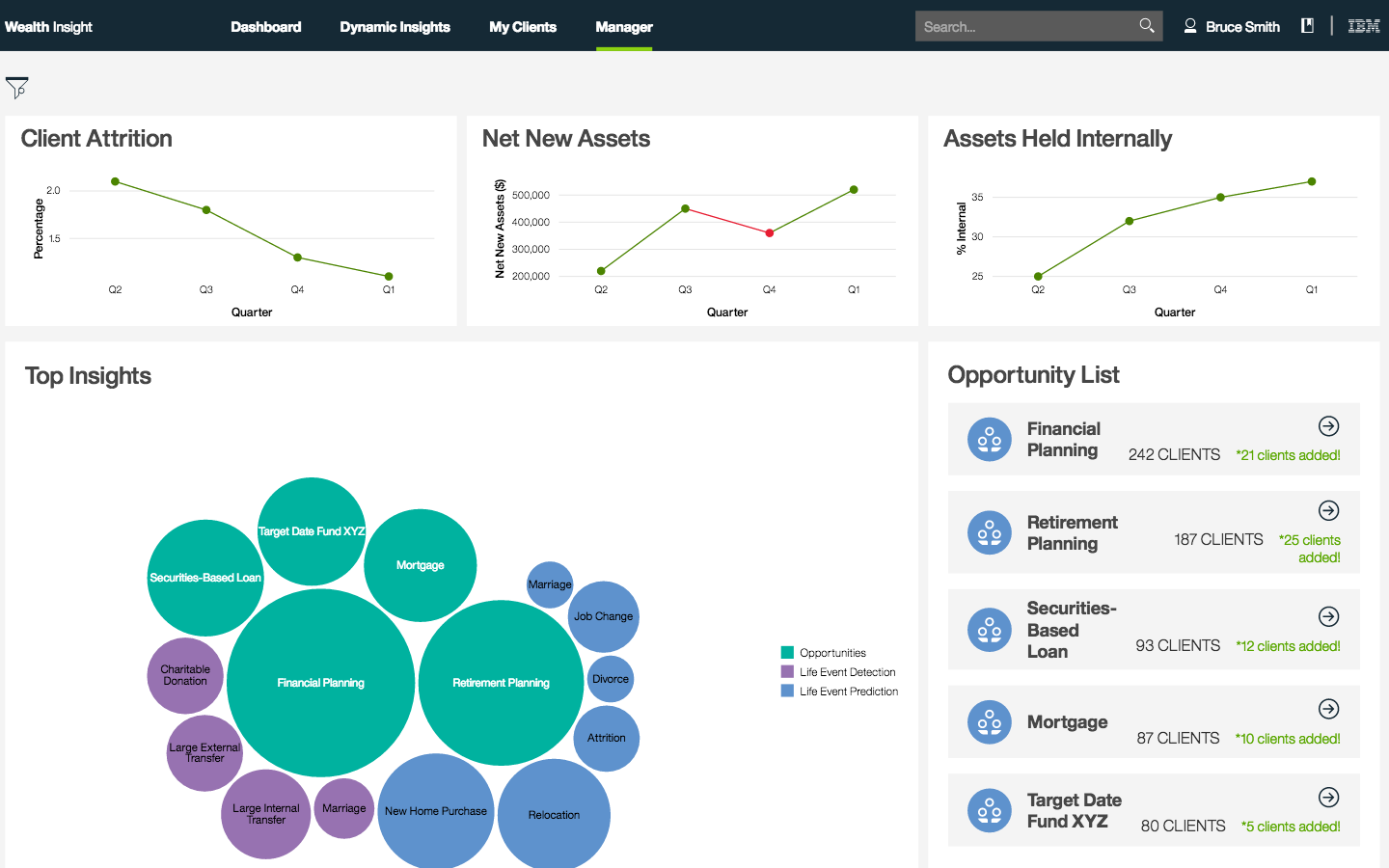

Client Profile screen The Branch Manager dashboard

The Branch Manager dashboard

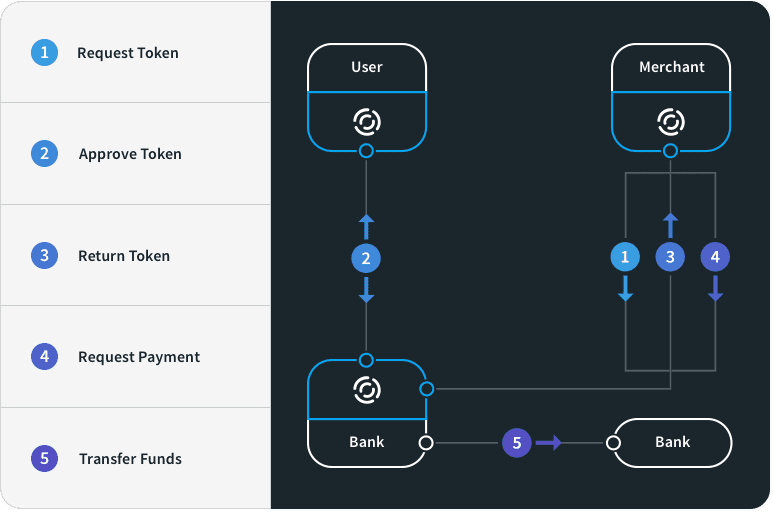

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works:

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works: