You may or may not agree with his politics, but his taste in investments is hard to beat.

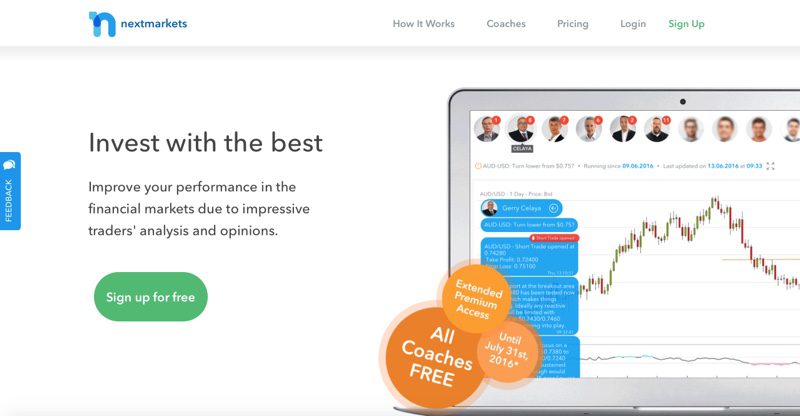

At least that’s our take on Peter Thiel’s latest $3.5 million investment in Cologne, Germany’s nextmarkets GmbH. The stake reportedly is part of a larger “seven-figure sum” the company is raising in its current investment round, which features participation from FinLab and EXTOREL.

Already looking forward to seeing nextmarkets put the capital to use growing the business, Stefan Schutze, CEO of FinLab, praised both the company’s platform and its ability to get “such strong and well-known partners” to invest in nextmarkets’ vision of democratizing the financial markets. Dominic Heyden, co-founder and CTO of FinLab, said, “After nearly two years in development, we can now offer the world’s most innovative platform that intelligently combines e-learning with trading.”

Manuel and Dominic Heyden, who in 2008 co-founded another Finovate alum, the social trading app ayondo, (and sold it for a significant profit in 2014), have leveraged their experience combining trading and technology to create nextmarkets. The platform gives average traders and investors everyday, real-time access to the strategies used by professionals. The trading coaches on the platform also provide risk-management advice for investors who follow their trades and investments. nextmarkets calls its approach “curated investing and it applies to equity trading, FX trading, as well as other markets.

Speaking of the investment, Heyden was effusive in his praise of both his company’s new investors as well as the funding’s potential to drive nextmarkets’ growth. “We see it as a clear endorsement of both our concept and business model as well as our long-term vision,” Manuel Heyden said. “(We are) very proud that we were able to win over experienced investors.”

Founded in 2014 and headquartered in Cologne, Germany, nextmarkets demonstrated its web and iOS app at FinovateEurope 2015.

A look at the companies demoing live to 1,500+ fintech professionals on September 8 & 9. Register today.

A look at the companies demoing live to 1,500+ fintech professionals on September 8 & 9. Register today.