What does it take to win a spot on the 2016 CNBC Disruptor 50? Ask alternative online broker Motif Investing. They’ve done it three times in a row.

“We’re very proud to be continuously recognized by CNBC for our hard work and commitment to making smart investing easy,” Motif founder and CEO Hardeep Walia said. “The CNBC Disruptor list is a well-respected industry benchmark and we’re honored to be ranked on the list for the past three years.”

Or ask cloud communications and authentication specialist Twilio, a FinDEVr alum (FinDEVr San Francisco 2015) enjoying its third consecutive year on CNBC’s Disruptors List of companies “whose innovations are revolutionizing the business landscape.”

Sponsored by Nasdaq, the CNBC Disruptor 50 for 2016 was released last week. And among some of the easy-to-call favorites like Uber and SpaceX and Snapchat, there are additional familiar faces, especially to fans of Finovate and financial technology. This year more than 750 companies competed for the 50 spots in CNBC’s Disruptor roster. Combined, the 50 companies in this year’s roster have raised more than $40 billion in venture capital and have an implied market valuation of $242 billion. Joining Motif Investing and Twilio in this year’s roster are alums Klarna at #8 and Kabbage at #35. This marks Klarna’s second year in a row on the list, and Kabbage’s first.

Klarna was featured earlier this month in PYMNTS.com in a look at the tech scene in Stockholm and, in May, the company’s CEO Sebastian Siemiatkowski was interviewed in BankNxt. In April, Klarna announced a partnership with U.K. e-commerce provider EKM. CNBC Disruptor 50 newcomer Kabbage just reached $2 billion in loans underwritten last month. Also in May, Kabbage announced a partnership with fellow Finovate alums OnDeck and CAN Capital to launch a pair of new initiatives: the Innovative Lending Platform Association and Smart Box. Both projects are geared toward improving transparency among online lenders and borrowers. In April, Kabbage teamed up with Santander to bring same-day financing to small businesses in the U.K.

Here’s a quick look at Finovate alums that have made the CNBC Disruptor 50 in years past.

- 2015 CNBC Disruptor 50 featured alums TransferWise, Personal Capital, Motif Investing, Zen Payroll, Coinbase, Klarna, Wealthfront, Betterment, Twilio, Narrative Science

- 2014 CNBC Disruptor 50 featured alums Motif Investing, TransferWise, Personal Capital, Wealthfront, Lending Club, Coinbase, Bill.com, Nexmo, Betterment, Twilio

- 2013 CNBC Disruptor 50 featured alums Boku, Lending Club, Twilio, Wealthfront

Motif Investing demoed its Advisor Platform at FinovateSpring 2014. At FinDEVr San Francisco 2014, Twilio discussed the challenges of multifactor authentication in its presentation, “Authy 2FA in 20 Minutes.” Klarna demonstrated its e-commerce solution at FinovateSpring 2012. And Kabbage demoed its small business line of credit, the Kabbage Card, at FinovateSpring 2015.

Schiphol Airport Retail B.V. She has several years experience in accounting with Deloitte and Arthur Andersen, and has degrees in business administration and financial auditing from Erasmus Universiteit Rotterdam.

Schiphol Airport Retail B.V. She has several years experience in accounting with Deloitte and Arthur Andersen, and has degrees in business administration and financial auditing from Erasmus Universiteit Rotterdam.

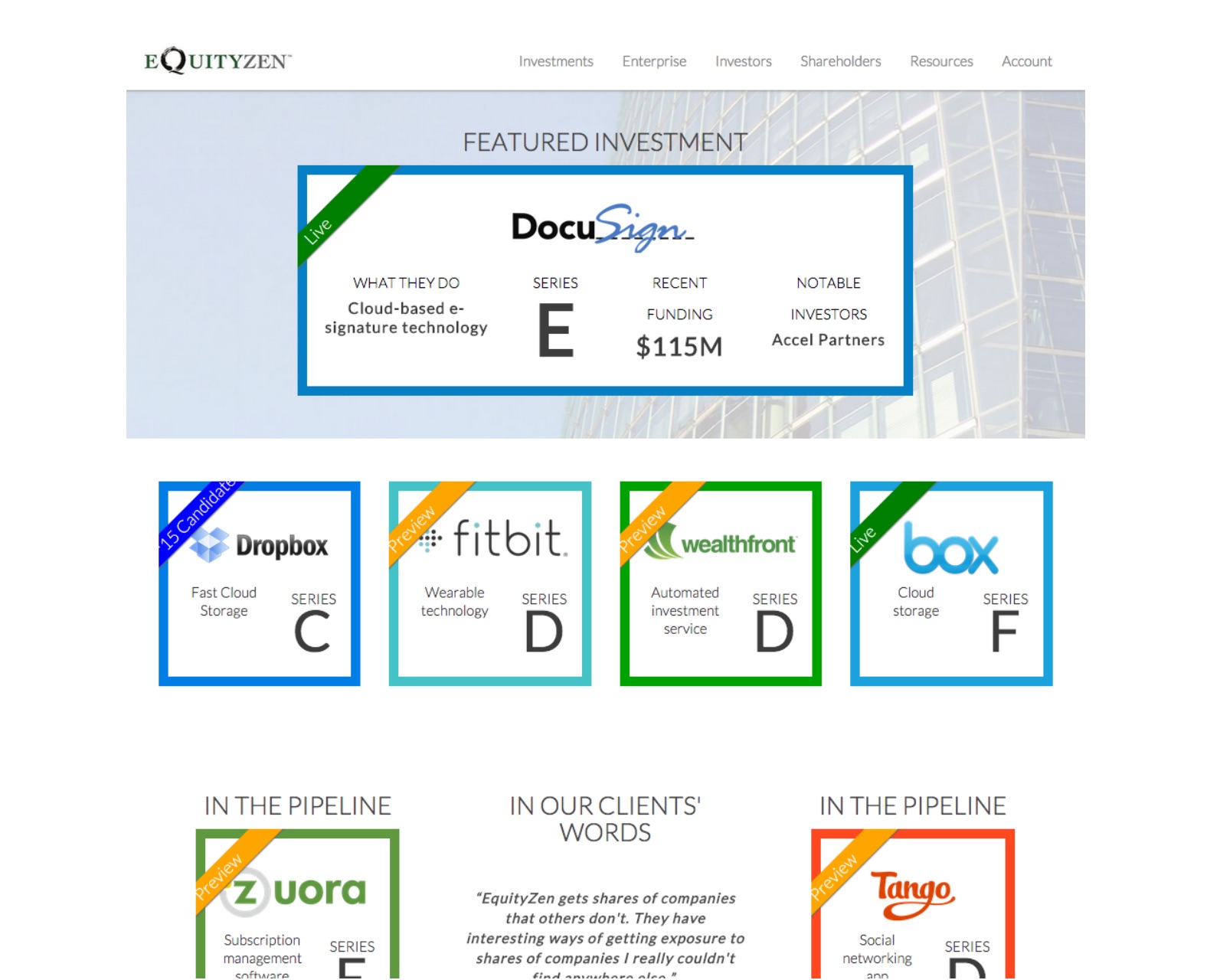

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been