In a venture round featuring investments from new and existing investors, direct carrier billing and mobile payments leader Boku has raised $13.75 million in additional funding. The financing brings Boku’s total capital to $91 million, and will help fuel the company’s global growth. Participating in the venture round were existing investors Khosla Ventures, Benchmark Capital, NEA, Index Ventures, and DAG Ventures. Additional new and existing investors from the U.K., the U.S., and Asia were also involved.

“Carrier billing is evolving from being a niche product for phone-centric content into a mainstream payment method used by the world’s major brands for all types of digital products,” Boku CEO Jon Prideaux explained. With most customers of carrier billing traditionally coming from developing countries where access to credit and payment cards can be a challenge, Prideaux noted that the company has experienced “explosive growth” in more developed markets, thanks largely to partnerships it has forged with merchants and carriers.

“The world’s biggest tech companies see tremendous potential in the power of the phone as a source of funds,” Prideaux added. He said the combination of improved technology and increased awareness are two trends driving greater adoption of carrier billing as a viable payment option in both emerging and developed markets.

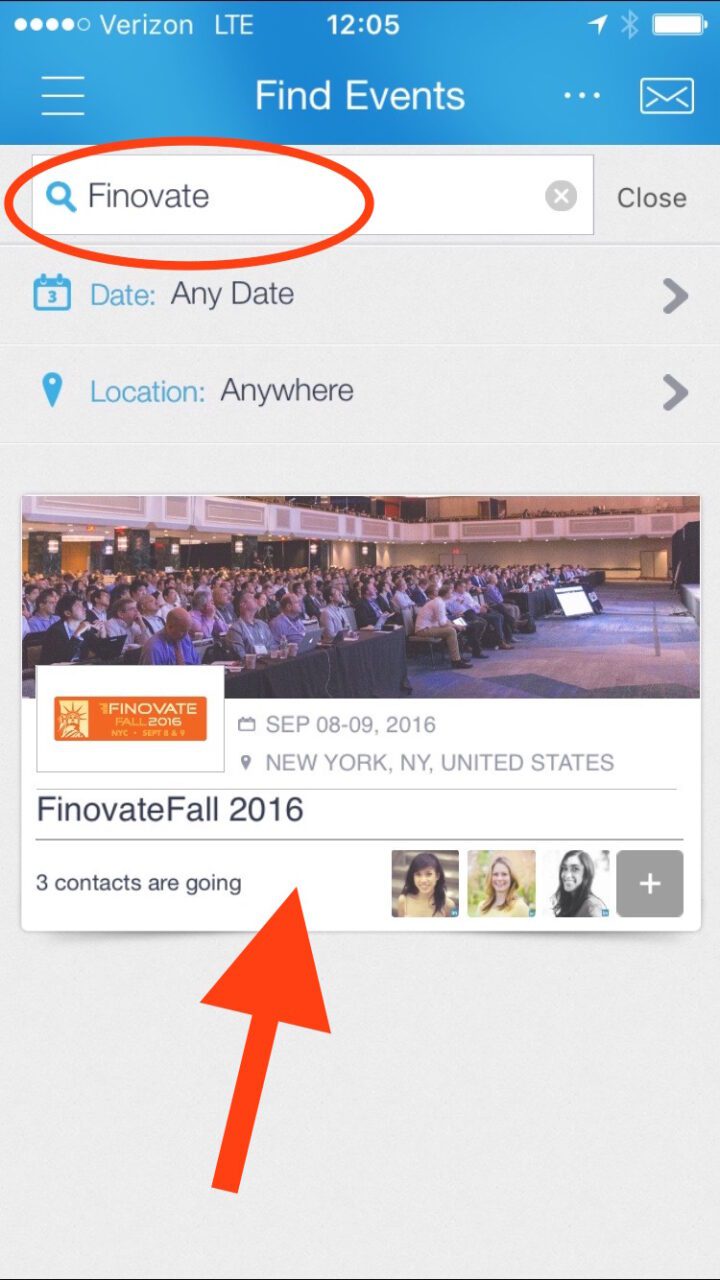

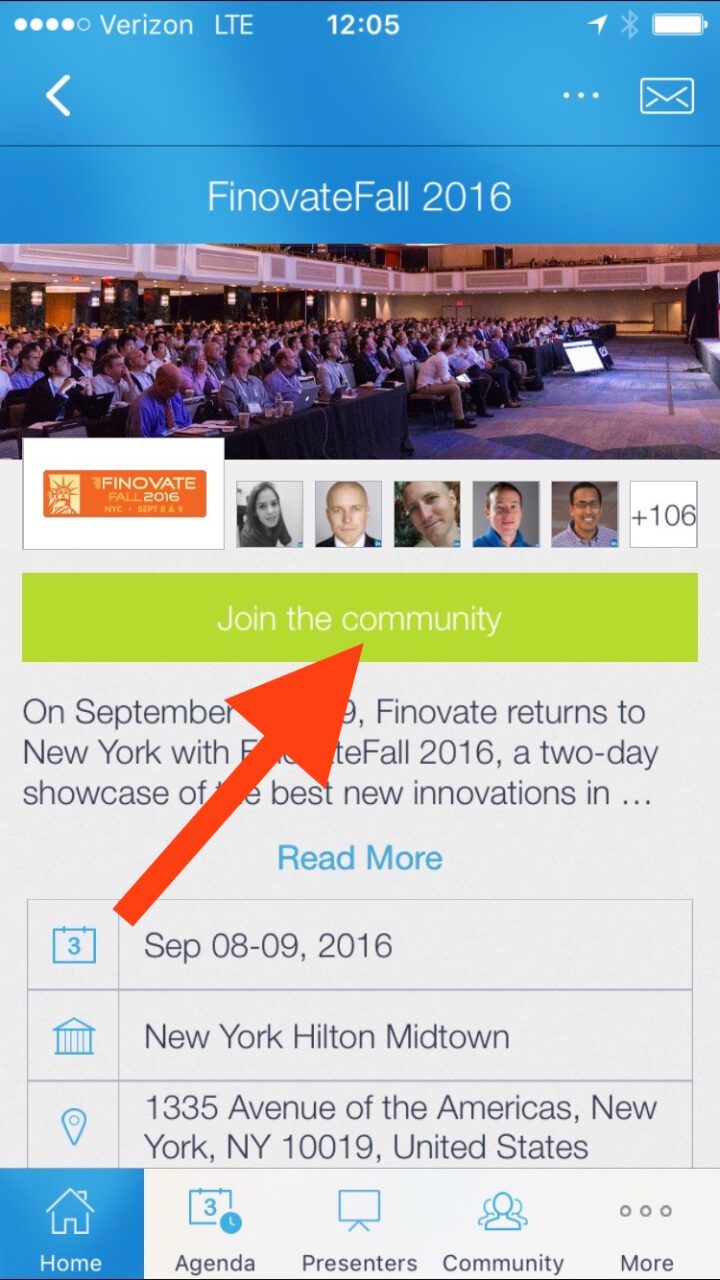

Founded in 2008 and headquartered in San Francisco, California, Boku demonstrated its mobile payment service at FinovateEurope 2011. The company announced a partnership with Google that will make carrier-billing a payment option on Google Play in Lithuania, as well as an agreement that brings direct carrier billing to Windows 10 phones in both the U.K. and Italy. Boku announced that it would power carrier billing for Spotify in Germany and Italy and do the same for Google Play with four new partners in Germany, the Netherlands, and Belgium.

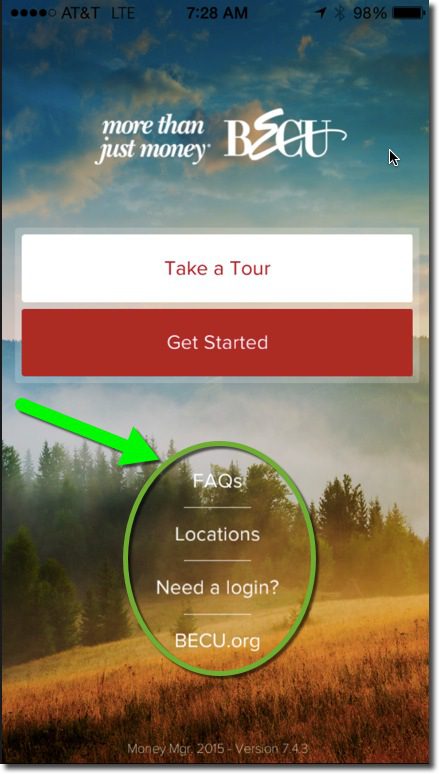

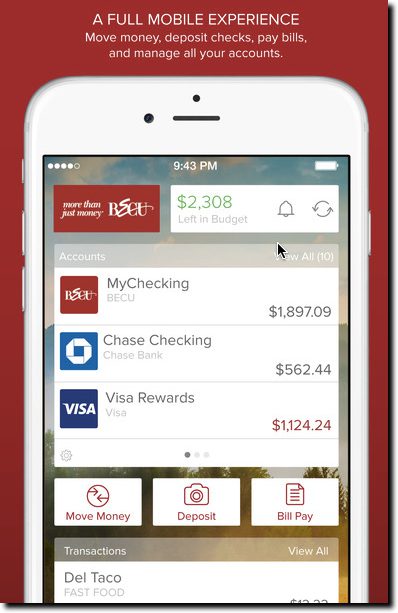

The ongoing migration to mobile provides financial institutions a chance to reboot their approach to delivering information digitally. Digital banking v1.0 (desktop online banking) was primarily about porting paper-based statements into an online format. It was a huge change and made banking more convenient, though not really any more effective than the paper-and-call-center system it replaced.

The ongoing migration to mobile provides financial institutions a chance to reboot their approach to delivering information digitally. Digital banking v1.0 (desktop online banking) was primarily about porting paper-based statements into an online format. It was a huge change and made banking more convenient, though not really any more effective than the paper-and-call-center system it replaced.

The bank isn’t commenting on this particular loan application, so we don’t know if there are other extenuating circumstances. Perhaps the couple had a debt go into collection or other credit problems. But since I’ve personally run into similar problems while maintaining excellent credit, I believe the couple’s story is probably accurate.

The bank isn’t commenting on this particular loan application, so we don’t know if there are other extenuating circumstances. Perhaps the couple had a debt go into collection or other credit problems. But since I’ve personally run into similar problems while maintaining excellent credit, I believe the couple’s story is probably accurate.