While everyone else was playing Pokemon Go last month, I was doing something more appropriate for someone my age, crowdfunding a house flip in La Jolla. Amazingly, I was able to view the property and public records (Google Streetview, Bing, Zillow, Redfin, Trulia); check out the construction-cost estimates; review the revised floor plan; and check out the actual appraisal for the as-built value against four comps in detail, all from the comfort of my home.

Ever since a brief stint in the early 1990s at a mortgage bank, I’ve known there was great demand, and tidy profits, in financing major home rehabs. I never thought I’d have the guts to flip a house myself, and I still don’t, but I can do the next best thing: loan money to real estate rehabbers through crowdfunding sites such as Realty Mogul, Patch of Land, RealtyShares and the like.

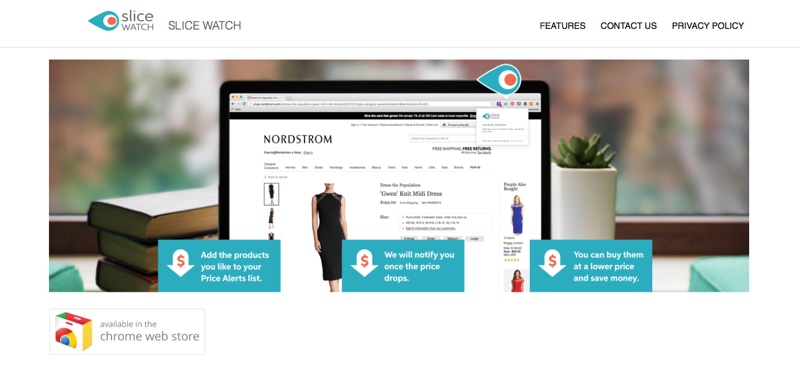

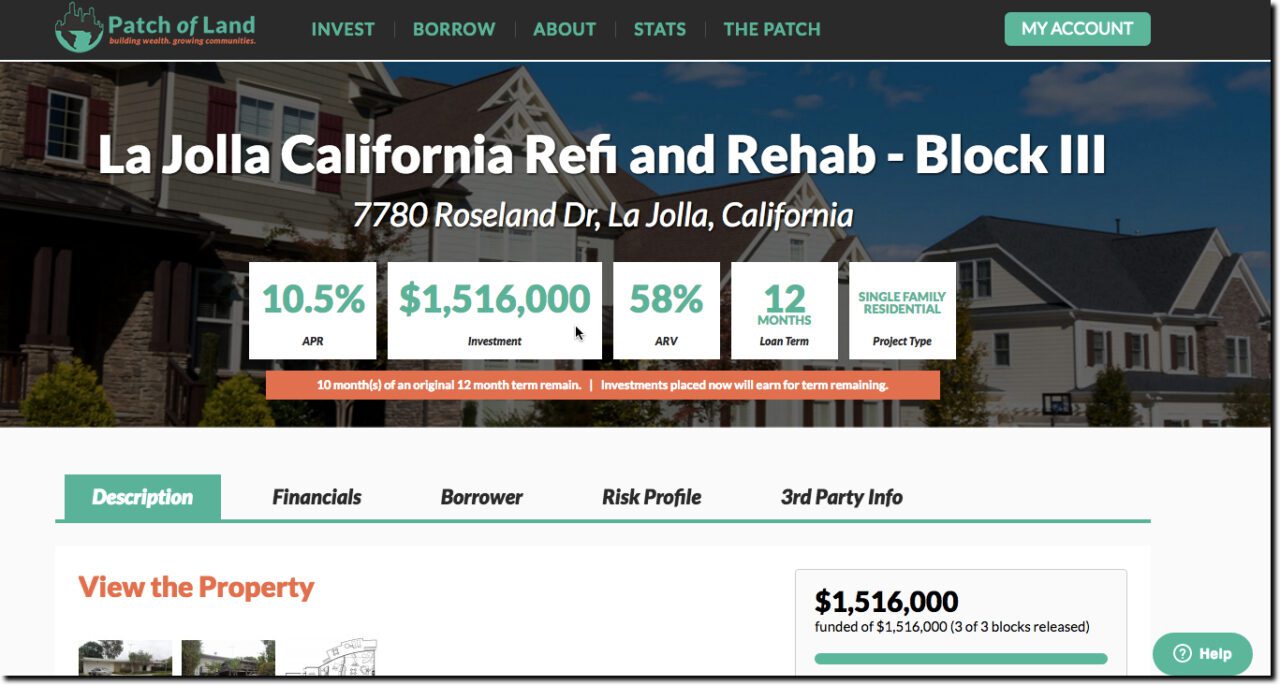

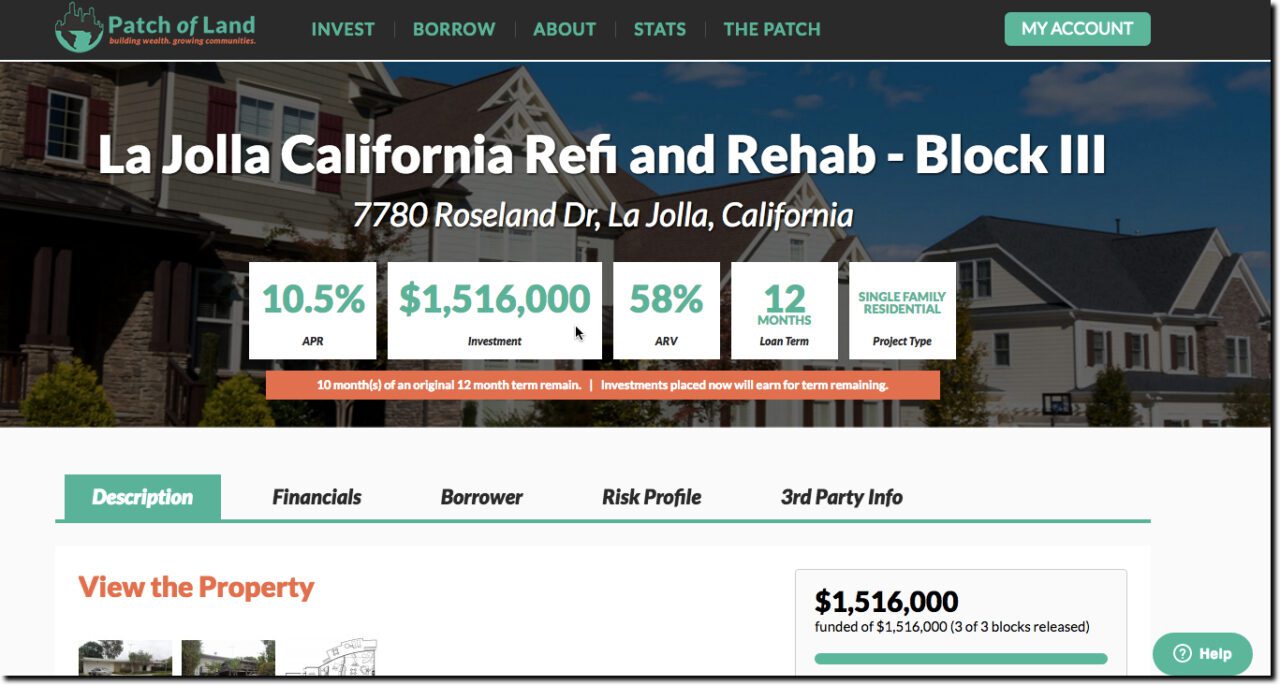

For my first try, I chose Patch of Land because they are a Finovate alum (see note 1), but mostly because their email showcasing a new rehab investment opportunity in La Jolla, California (where I honeymooned) caught my attention (see investment page above). The developer bought a 3-bedroom, 3-bath house in May for $1.3 million and is putting $500,000 into a major remodel, creating a 4-bedroom, 2-bath (which the appraiser objected to by the way). The work has already begun, but Patch of Land was still looking to fund the final 10% of the loan. The startup prefunds the projects with its own money, then resells them to investors. This particular house will pay 10.5% interest for the 11 months remaining on the original 1-year term; however, it is likely to be paid off early if all goes well and the house is sold before the end of the 12-month period.

The real estate crowdfunding industry is already bigger than I expected. I haven’t found reliable stats for 2015, but the market was estimated at $1 billion in funding in 2014. Patch of Land has done $150 million since inception, and Realty Mogul, more than $200 million. According to (an undated post) in the Real-Estate Crowdfunding Review, more than 100 such sites exist. They rated eight as all-stars, including two Finovate alums: Realty Mogul ($200 million in cumulative originations) and Patch of Land ($100 million in originations as of March 2016), along with Acquire Real Estate, LendingHome, Peer Street ($75 million in originations), Real Crowd, Realty Shares ($130 million through Feb 2016) and Roofstock.

Bottom line: If you are looking for alternative investments to recommend to clients, consider working with a major crowdfunder to white-label or co-brand the service.

——-

Note: If anyone wants to talk real estate crowdfunding, or anything else, at Finovate NYC in two weeks, drop me a line ([email protected]).

A look at the companies to demo live to 1,500+ fintech professionals on 8/9 September 2016. Register today.

A look at the companies to demo live to 1,500+ fintech professionals on 8/9 September 2016. Register today. Presenters

Presenters Ondrej Grich, CTO

Ondrej Grich, CTO

Presenters

Presenters John Sarreal, Senior Director, Product Management

John Sarreal, Senior Director, Product Management

Presenters

Presenters Mark Krofchik, Chief Technology Officer

Mark Krofchik, Chief Technology Officer

Presenters

Presenters Keval Mehta, Account Manager

Keval Mehta, Account Manager