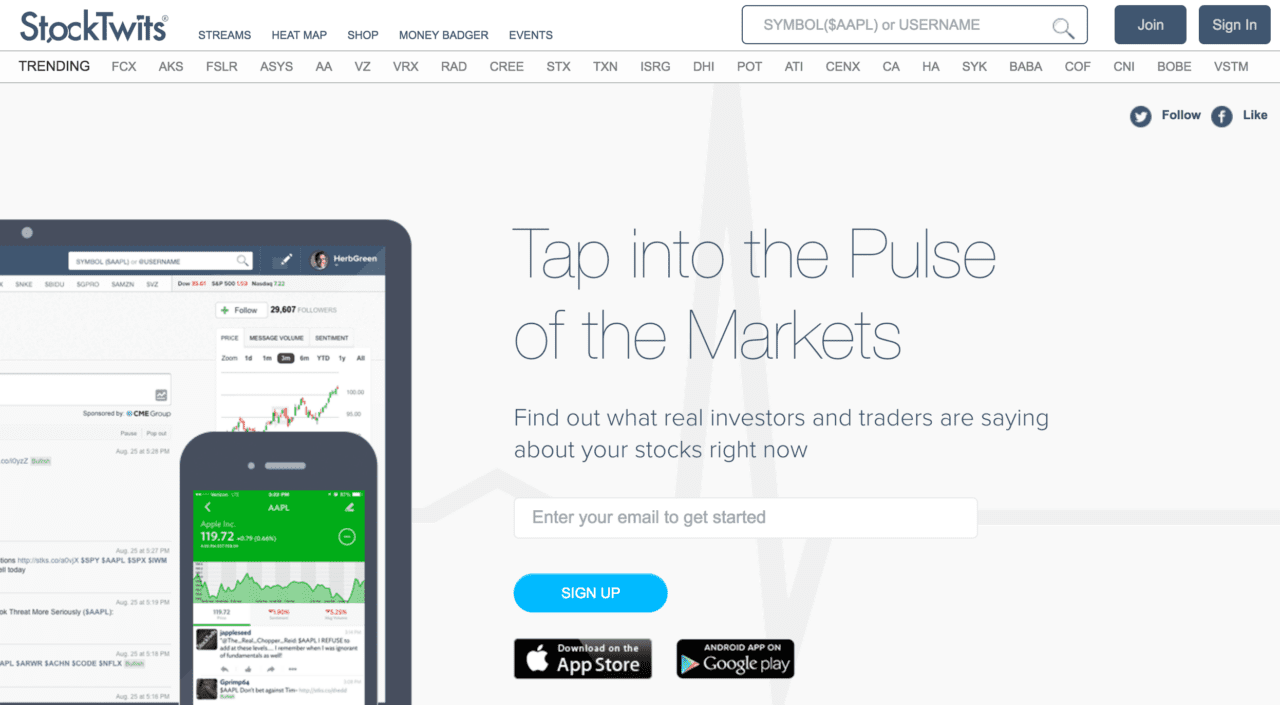

StockTwits announced today it has partnered with TradeIt to expand the number of brokerages through which its users can trade. With the new integration, traders and investors can now place trades via large brokerages directly within the StockTwits mobile app.

This is the San Diego-based company’s second brokerage partnership. StockTwits first introduced brokerage functionality into its iOS app through a partnership with Robinhood in November 2015. Since launch, 40,000 Robinhood accounts have been connected, making a total of 1,000 trades per day on the StockTwits iOS app.

In a press release, StockTwits CEO Ian Rosen said, “We’ve had so much success with our Robinhood integration that we are excited to get more brokerages used by our community connected.” While the press release did not mention the number of “major brokerages” the TradeIt partnership gives the StockTwits community access to, it made clear that the new addition, “expands StockTwits’ broker offering considerably.”

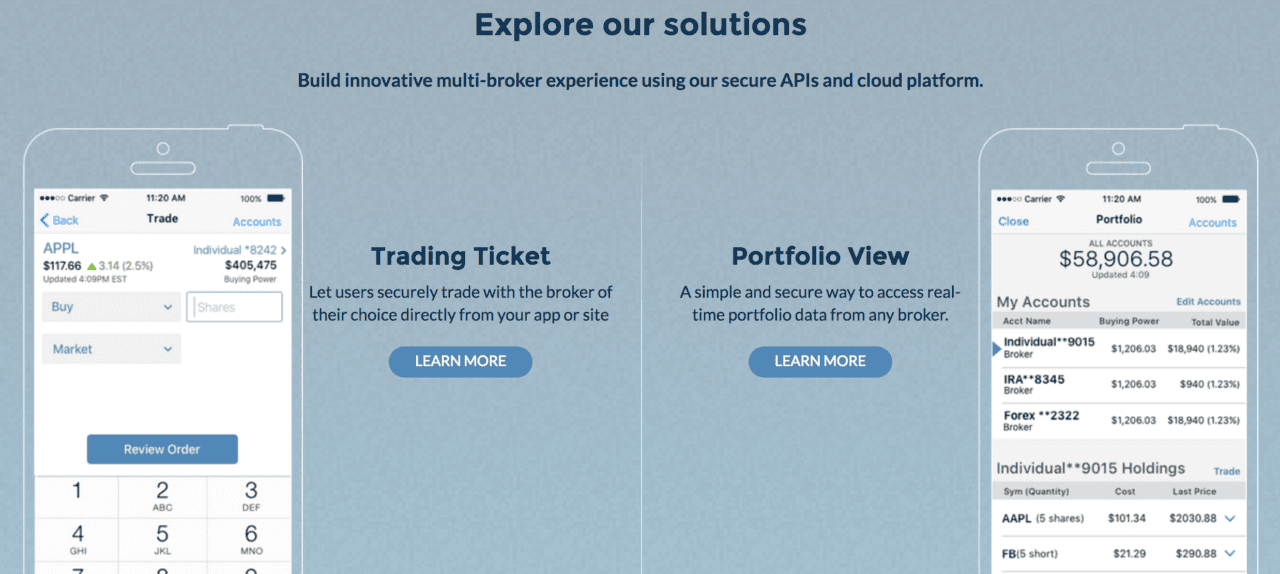

Above: TradeIt’s multi-broker integration

Above: TradeIt’s multi-broker integration

The newest version of the StockTwits app is available in the app store now.

Founded in 2008, StockTwits serves as one of the top trading communities and social investing platforms. The company facilitates 200 messages each minute across 7,500 individual stocks and tickers. StockTwits launched its blog network and StockTwits Connect at FinovateEurope 2011. At FinDEVr Silicon Valley 2014, the company’s then-CEO Howard Lindzon gave a presentation titled Investing in a Social, Local, and Mobile World. StockTwits appointed a new CEO, Ian Rosen, in July of 2016.

Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

Finovate/FinDEVr alums raised more than $700 million in the fourth quarter of 2016. Total fourth quarter investment in Q4 2016 was more than double last year’s Q4 total, and represented a gain of more than 40% over the previous quarter’s total.

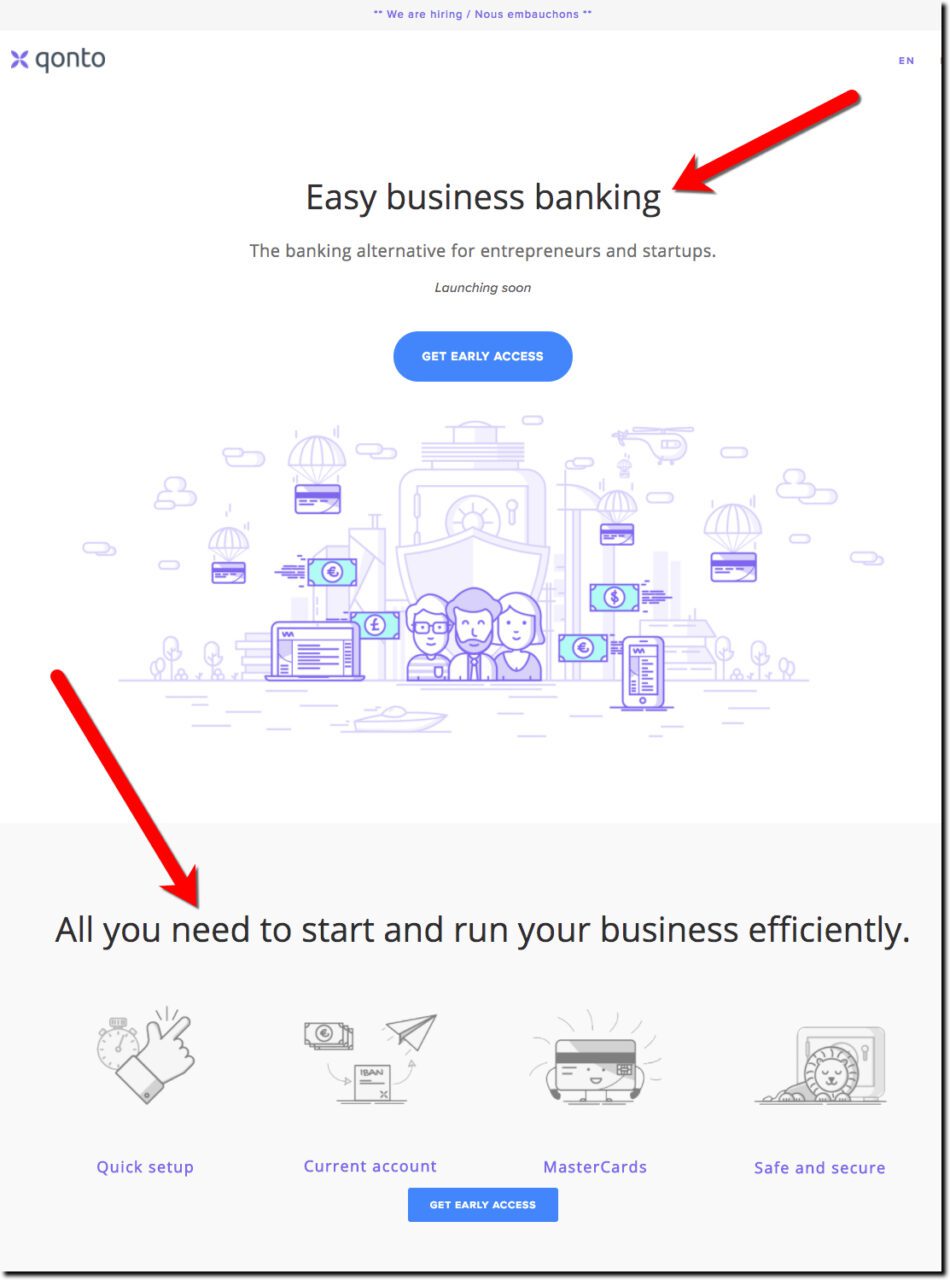

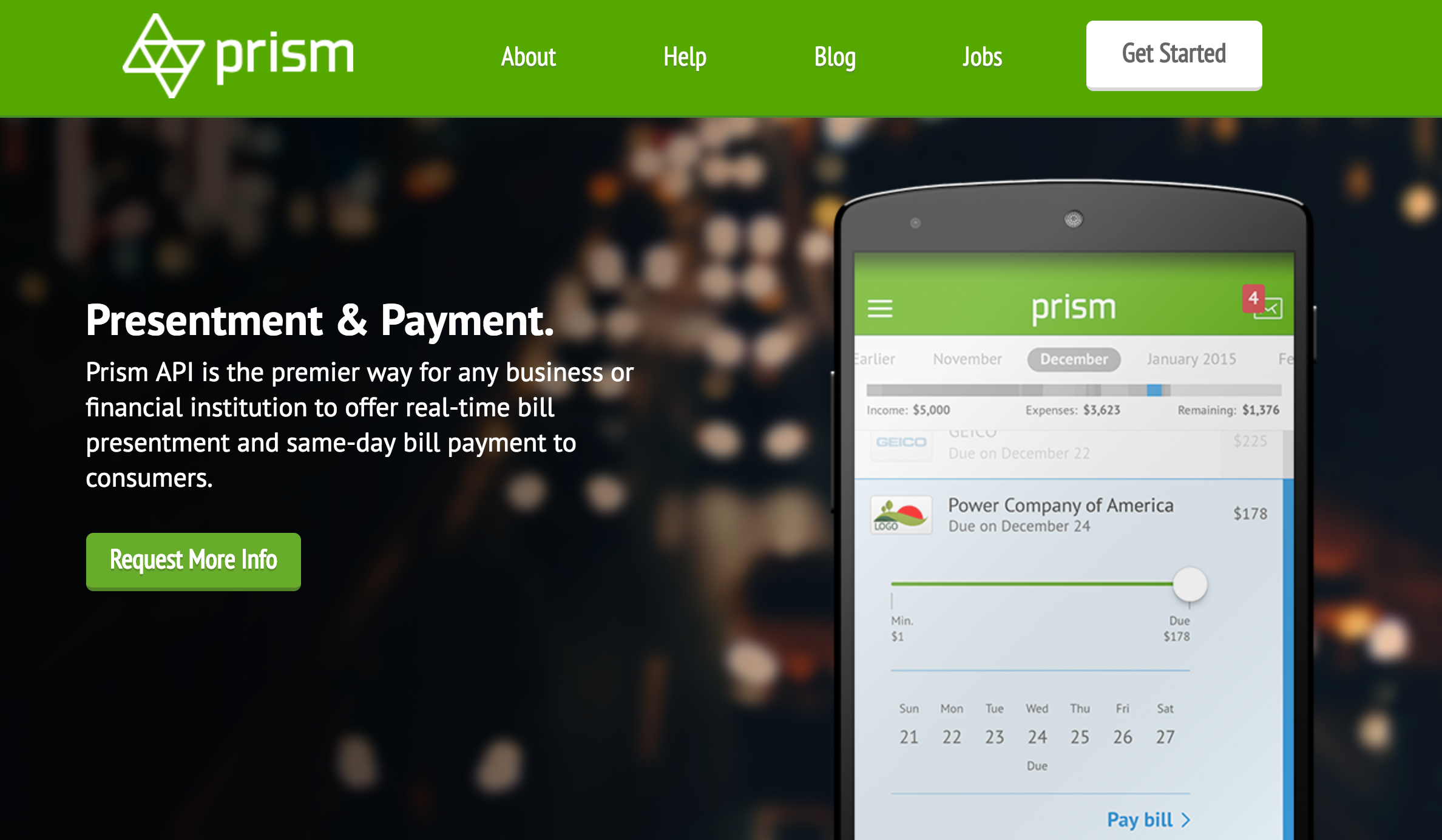

Prism’s bill presentment

Prism’s bill presentment

Laven called Addario a “perfect fit” for the task of helping create solutions that will enable companies to take advantage of “new and emerging business models” without being limited by legacy technology. “Ed will play a key role in developing the tools that we provide,” Laven said, “to allow our customers to build the best solution for their business needs.”

Laven called Addario a “perfect fit” for the task of helping create solutions that will enable companies to take advantage of “new and emerging business models” without being limited by legacy technology. “Ed will play a key role in developing the tools that we provide,” Laven said, “to allow our customers to build the best solution for their business needs.”