PayPal’s stablecoin, PayPal USD (PYUSD), was officially added to the Solana Blockchain last week. This shift comes after the California-based company launched on Ethereum blockchain last summer. Now, PayPal stablecoin users can send PYUSD on Ethereum or Solana when transferring out to external wallets.

“For more than 25 years, PayPal has been at the forefront of digital commerce, revolutionizing commerce by providing a trusted experience between consumers and merchants around the world. PayPal USD was created with the intent to revolutionize commerce again by providing a fast, easy, and inexpensive payment method for the next evolution of the digital economy,” said PayPal Senior Vice President of the Blockchain, Cryptocurrency, and Digital Currency Group Jose Fernandez da Ponte. “Making PYUSD available on the Solana blockchain furthers our goal of enabling a digital currency with a stable value designed for commerce and payments.”

In addition to enabling PYUSD transfers on both Ethereum and Solana, this move will have significant implications for PayPal, consumers, banks, and the crypto markets.

Impact on PayPal users

Faster transactions: Because Solana’s blockchain is known for its high-speed processing capabilities, PYUSD transactions on Solana will be much quicker, which will enhance the experience for end users.

Lower transaction costs: Solana offers low transaction fees, which will not only reduce the cost of sending and receiving PYUSD, but it will also make Solana a more attractive option for users looking to save on transaction costs.

More flexibility: Offering both Solana and Ethereum will offer users more choices for their transactions. Offering multiple blockchain allows users to choose different options based on their preferred cost and transaction speed.

Impact on Banks

Integration challenges: Traditional banks seeking to participate in the stablecoin market may need to adapt their systems to accommodate transactions that involve PayPal’s stablecoin on the Solana blockchain. These adaptations could require significant technical and regulatory challenges.

Competition: The race to stablecoin dominance has quieted among most traditional financial services providers in the U.S., but cross-border payments in all of their forms are still top-of-mind for many. As PayPal leverages the blockchain to offer faster and cheaper transactions, traditional banks may face increased competition.

Regulatory scrutiny: PayPal’s move onto Solana may attract further attention from regulators. This increased regulatory scrutiny may require financial institutions to pay more attention to their own operations and closely monitor regulatory developments to ensure that their own operations are compliant.

Impact on the Crypto market

Increased credibility: While it is not a bank, PayPal is a reputable player in the traditional financial services space. Because of its tenure and reputation in the space, the company’s adoption of Solana for its stablecoin operations offers credibility to the blockchain and crypto industries.

Boost for Solana: Solana will likely benefit from the partnership, as PayPal’s move serves as a vote of confidence for the blockchain and may lead to increased demand for Solana’s native token and may result in further adoption by other enterprises.

Shifting competition: PayPal’s selection of Solana may put pressure on Ethereum to improve its scalability and cost efficiency.

Overall, PayPal’s move is likely to enhance the efficiency and appeal of its digital currency offerings, drive broader adoption of blockchain technology, and spur innovation and competition in both the traditional financial sector and among crypto players.

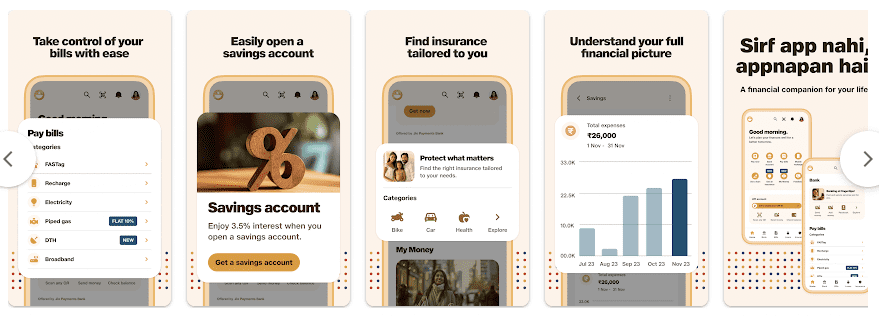

PYUSD is issued and managed by Paxos Trust, a company whose products are subject to regulatory oversight by the New York State Department of Financial Services. Users can purchase PYUSD in the PayPal and Venmo wallets, as well as on crypto.com, Phantom, and Paxos. All platforms offer a fiat-to-crypto user experience.

Photo by Muhammad Asyfaul on Unsplash