What makes the nCino Bank Operating System the cloud banking solution of choice for a growing number of financial institutions (including “more than 130 FIs of all asset classes and from multiple countries” in the words of nCino CMO Jonathan Rowe)?

As Rowe said during nCino’s live demonstration at FinovateEurope 2017 earlier this year, “with nCino your customers get a transparent, digitally-optimized process, quick access to capital, and a true valued long-term relationship with your financial institution.” And for financial institutions themselves, he added, nCino brings increased loan growth “while lowering costs and increasing productivity and maintaining the highest levels of safety and soundness.”

Pictured (left to right): Jonathan Rowe (Chief Marketing Officer), Trisha Price (EVP, Product Development & Engineering), and Nathan Snell (Chief Innovation Officer) demonstrating the nCino Bank Operating System at FinovateEurope 2017.

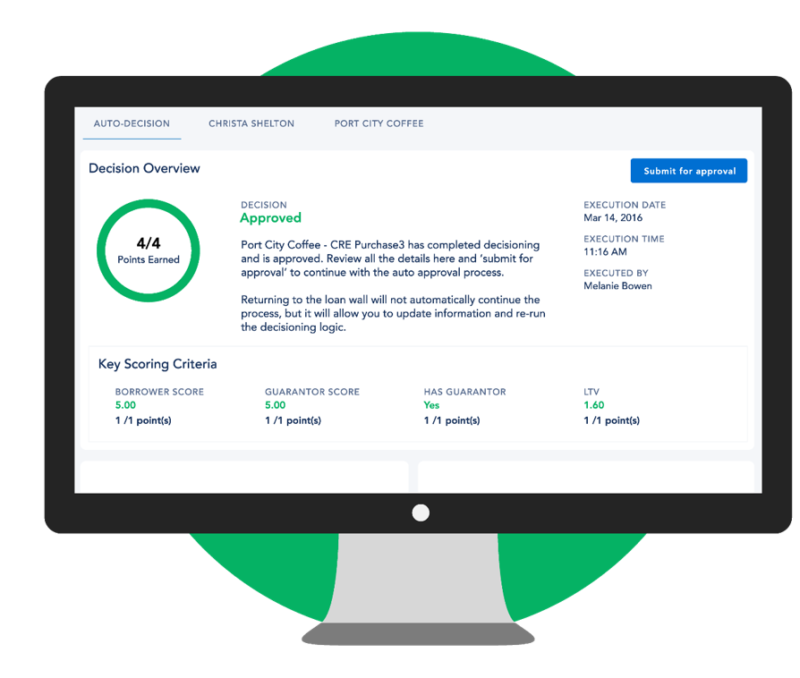

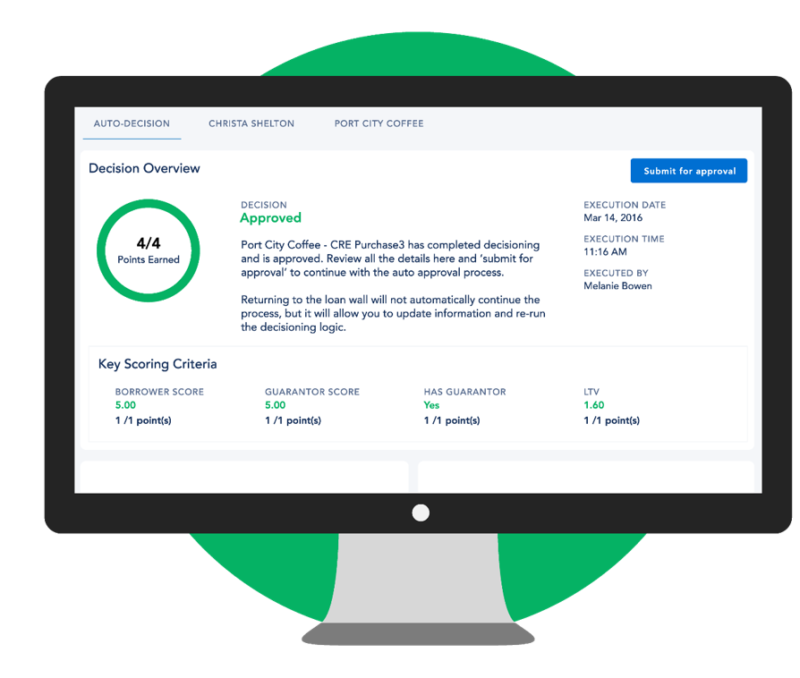

nCino used the example of a bank loan to demonstrate some of the features of the nCino Bank Operating System. Along with Product Development & Engineering EVP Trisha Price and Chief Innovation Officer Nathan Snell, the nCino team showed how a customer could apply for a small business loan using their smartphone, and get an instant real-time decision from the technology’s automated decisioning engine. The demo also showed how the platform provided workarounds like an automated counter offer when an applicant requested a loan amount that was too large. The technology also enables the customer to capture and upload images of documents like financial statements to help customers make the case for a larger loan.

On the bank’s side, the nCino team showed how the platform’s auto decision engine processed online loan applications and can be configured to match the FI’s own credit policies. And by leveraging both the OCR and AI built into the nCino platform, bank professionals are able to quickly do deeper dives into applicant financials to find opportunities for funding that might have otherwise gone unfunded or cost the borrower more. “This is how banking and technology should work, and does work with nCino,” Rowe said, reminding the audience that nCino’s technology supports not just commercial banking, but also treasury management, and retail and consumer banking, as well.

Since nCino’s Finovate debut in February, the company has announced new enhancements to its platform that make it easier to serve small business borrowers. Named to Planet Compliance’s RegTech Top 100 Power List this spring, nCino partnered with North State Bank in April and teamed up with Valley National Bank in March to power commercial loan operations at both institutions.

Company Facts

- Founded in 2012

- Headquartered in Wilmington, North Carolina

- Raised more than $79 million in capital

- Works with more than 130 clients

- Maintains more than 275 employees

We met with the nCino team in London to talk about the company’s debut at FinovateEurope. We followed up with a few questions by e-mail for Nathan Snell, nCino’s Chief Innovation Officer. His responses are below.

We met with the nCino team in London to talk about the company’s debut at FinovateEurope. We followed up with a few questions by e-mail for Nathan Snell, nCino’s Chief Innovation Officer. His responses are below.

Finovate: What problem does your technology solve?

Nathan Snell: nCino is the worldwide leader in cloud banking. Its Bank Operating System, built on the Salesforce platform, enables financial institutions to deliver the speed and digital experience that customers expect, backed by the quality and transparency that bankers need.

nCino’s Bank Operating System acts as a financial institution’s single source of truth, eliminating the need for multiple, disparate software systems by combining customer relationship management (CRM), loan origination, workflow, enterprise content management, business processing and instant reporting all in one secure, cloud-based environment. Sitting alongside the bank’s core, nCino’s Bank Operating System drives increased profitability, productivity gains, regulatory compliance and operating transparency across all business channels and organizational levels. The platform facilitates a seamless and secure interaction between bank employees, customers and other third parties, providing bankers with an efficient and configurable way to digitally operate their institution.

Finovate: Who are your primary customers?

Snell: nCino’s client portfolio consists of more than 130 financial institutions in North America and Europe. Our customers span all asset classes – from $150 million in assets to over $200 billion – and include community and regional banks, credit unions, challenger banks and large enterprise institutions. Because of the flexible and scalable nature of our platform, the Bank Operating System is customizable for any size organization.

Pictured: The nCino Bank Operating System environments displayed on a laptop, a tablet, and a smartphone.

Finovate: How does your technology solve the problem better?

Snell: The nCino Bank Operating System is a comprehensive, end-to-end, cloud-based solution that offers a single platform across all lines of business (commercial, small business, retail), distinguishing us in a market category of our own. nCino was built from day one as an integrated solution on Salesforce’s Force.com platform, the world’s leading cloud computing platform. Because of how we’ve built the nCino Bank Operating System, it’s also one of the first times a financial institution has a platform that can respond, in a configurable way, to their business needs as quickly as they come up as opposed to being constrained by their platform. While there are other companies that may offer point solutions or software systems that provide certain aspects of our technology, none combine our full spectrum of features and functionality into one cohesive offering.

Designed by bankers who understand the nuances of the marketplace, nCino revolutionizes the way financial institutions operate, helping them regain their competitive advantage and beat alternative lenders at their own game, while simultaneously satisfying customers’ demand for superior service in the digital era.

Finovate: Tell us about your favorite implementation.

Snell: It’s hard to pick a favorite implementation as they are all important; however, one that stands out is our successful implementation last year at SunTrust, a $205 billion-asset institution and a top 10 bank in the U.S. The implementation at SunTrust was a truly collaborative effort consisting of a multi-layered, multifunctional program team that included not only nCino, but also a system integration team from Accenture, and a large operational and technology team from SunTrust.

In less than 18 months, the nCino Bank Operating System was deployed to thousands of SunTrust teammates across sales, risk and lending operations. When asked about the process, Pam Kilday, head of operations for SunTrust, said, “This has been one of the finest implementations that we have had at SunTrust. We are now being looked at as a model of best practices to implement something of this range at SunTrust.”

Pictured: The automated decision engine of the nCino Bank Operating System.

Finovate: What in your background gave you the confidence to tackle this challenge?

Snell: Because nCino was designed specifically by bankers who understand both the challenges and opportunities in the marketplace, nCino is uniquely qualified to deliver a solution that best addresses a financial institution’s needs. In today’s environment, bankers are expected to do more with less, manage regulation, ensure data security, digitally engage with customers to foster stronger relationships, and deliver increased profit to shareholders. And, as customer demands and expectations rapidly evolve and non-traditional third parties enter the scene, the financial services industry is more competitive than ever before. nCino’s Bank Operating System enables a financial institution to improve efficiency, productivity and compliance across numerous departments and business lines, all while creating a more transparent and digitally engaging experience for customers.

Finovate: What are some upcoming initiatives from nCino that we can look forward to over the next few months?

Snell: This year, we’ll continue to expand the scope of the Bank Operating System. In 2016 alone, we added new functionality such as deposit account opening and automated decisioning that extended the platform to other areas of the bank – and that’s just the beginning. With additional functionality across small business lending and retail already in the pipeline, nCino continues to develop technology to help financial institutions save costs and increase productivity while simultaneously protecting their market share against emerging marketplace lenders.

There’s really so much opportunity in the financial services space today, that even beyond the next few months, we have quite a few exciting things planned that we believe will continue to help shape the landscape of banking.

Finovate: Where do you see nCino a year or two from now?

Snell: Over the past five years, we’ve experienced significant growth in our customer portfolio, technology roadmap and employee base – and we expect that growth to continue into the next year and beyond. We look forward to expanding our international presence in the U.K. and Europe, adding fresh talent to our workforce and introducing new and exciting functionality to our Bank Operating System as it touches additional areas of the financial institution.

Trisha Price (EVP, Product Development & Engineering), Nathan Snell (Chief Innovation Office), and Jonathan Rowe (Chief Marketing Officer) demonstrating the nCino Bank Operating System at FinovateEurope 2017.

With rampant regulatory hurdles and minefields, it’s never been easy to operate a financial services company, and 2017 is no exception. TrustedKey CEO, Prakash Sundaresan, will have more on this topic during a roundtable discussion at FinDEVr London next month. Sundaresan will lead an exploration of Fintech climate change: Top challenges & regulatory impacts facing the financial services environment.

With rampant regulatory hurdles and minefields, it’s never been easy to operate a financial services company, and 2017 is no exception. TrustedKey CEO, Prakash Sundaresan, will have more on this topic during a roundtable discussion at FinDEVr London next month. Sundaresan will lead an exploration of Fintech climate change: Top challenges & regulatory impacts facing the financial services environment. To learn more about how to participate in the roundtable discussion or the presentations, check out FinDEVr.com. Register before May 27 to get a discounted ticket.

To learn more about how to participate in the roundtable discussion or the presentations, check out FinDEVr.com. Register before May 27 to get a discounted ticket.

We met with the nCino team in London to talk about the company’s debut at FinovateEurope. We followed up with a few questions by e-mail for Nathan Snell, nCino’s Chief Innovation Officer. His responses are below.

We met with the nCino team in London to talk about the company’s debut at FinovateEurope. We followed up with a few questions by e-mail for Nathan Snell, nCino’s Chief Innovation Officer. His responses are below.

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

to run the tech side of your company?

to run the tech side of your company?