With the holidays right around the corner, excitement for the new year is building and you won’t want to miss getting a headstart on opportunities available at FinovateSpring 2018. Now is the time to apply: the very early-bird deadline for presenter applications to demo is Friday, December 15.

The event will take place at the Santa Clara Convention Center on May 8 – 11, and will feature our signature seven-minute demo format. Presenters who are selected won’t just receive time up on stage — they’ll also have the opportunity to connect directly with senior-level financial executives, venture capitalists, other entrepreneurs, and influential press, analysts, and bloggers.

Competition to get on stage at Finovate events is high, with more companies applying than the demo slots we have available. And with the fintech scene continuing to grow and pave the way for new technology, now is the time to join your competitors on stage and gain the attention of new clients, investors, and potential partners.

If you’d like to learn more, please email us at [email protected] and we’ll send you a presenter packet outlining the selection criteria, presenter package, demo costs, deadlines, and a link to the online application (applying is completely free and 100% confidential, so there’s nothing to lose!). Plus, if you apply by Friday, December 15, and are selected to demo, you’ll benefit from the very early-bird savings in your final demo cost. Hope to see you apply!

FinovateSpring 2018 is partners with: Aite Group, BankersHub, Banking Technology, BayPay, BeFast.TV, BigData-MadeSimple.com, Breaking Banks, Byte Academy, Celent, FemTech, Financial IT, Fintech Finance, Headcount, Holland Fintech, IBS Intelligence, Innovate Finance, Mercator Advisory Group, NexChange, The Nilson Report, Ovum, The Paypers, Plug and Play, SME Finance Forum, and Swiss Finance + Technology Association.

Raise your profile and showcase your thought leadership

Grow your business at FinovateSpring by becoming an event sponsor. We can provide flexible and tailored solutions to maximize your time at the event and ensure you meet your business goals. For more information please contact us via email.

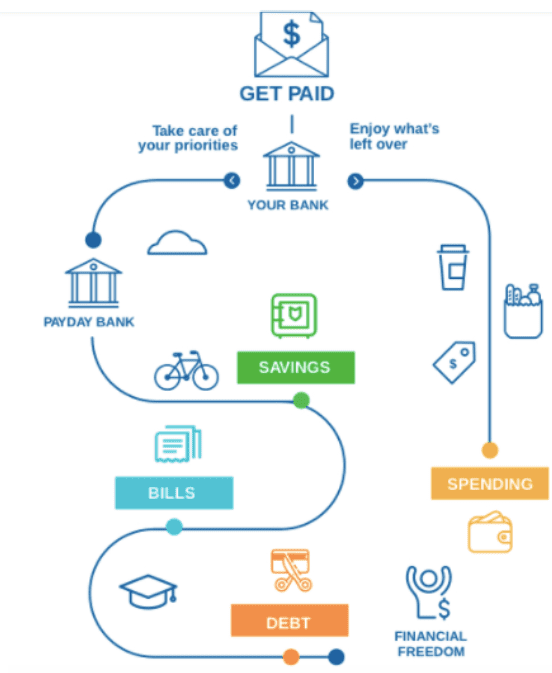

Financial management technology startup

Financial management technology startup