The amount of the funding was undisclosed. But cloud-based banking innovator nCino has just picked up a fresh infusion of capital courtesy of a round led by Salesforce Ventures. The investment adds to the company’s known total capital of more than $81 million, which includes a $17 million private equity round back in August.

“From day one, our vision has been to be the worldwide leader in cloud banking,” nCino CEO Pierre Naude said. “We are successfully executing on that vision and empowering financial institutions around the globe to grow their business and better serve their customers. Our strong alignment with Salesforce has been a key factor in our growth and success.”

nCino will use the funds to help drive its global expansion, as well as speed innovation on its Bank Operating System technology. The solution is built on the Salesforce platform and is integrated with Salesforce Financial Services Cloud. nCino has been a Salesforce partner since it was founded in 2012.

SVP and GM of Financial Services for Salesforce, Rohit Mahna highlighted the long-term relationship between the two companies. “nCino extends the power of the Salesforce platform, enabling banks to get closer to their customers than ever before,” Mahna said. “The investment from Salesforce Ventures is the latest evolution in our strong partnership, and we’re thrilled to help fuel nCino’s global growth and innovation.”

The company’s Bank Operating System integrates with core banking and transactional systems. The technology combines CRM, deposit account opening, loan origination, workflow, enterprise content management, digital engagement, and real-time reporting to enable financial institutions to provide the kind of personalized, streamlined experience customers and bank employees alike have come to expect. nCino notes that on average its client institutions have experienced:

- 17% reduction in operating costs

- 19% increase in loan volume

- 22% increase in staff efficiency

- 34% decrease in loan closing time

- 54% reduction in policy exceptions

nCino demonstrated its Bank Operating System at FinovateEurope 2017. Headquartered in Wilmington, North Carolina, the company began the year with a major new partnership with Navy Federal Credit Union, the largest credit union in the world with more than $87 billion in assets, more than seven million members, and 300 branches. 2017 was a big year for nCino, with deployments of its Bank Operating System announced with CFCU Community Credit Union in December, Iberiabank in November, and Pacific Western Bank in August – to name just a few recent wins. The cumulative result was that nCino ended the year with 10 of the 30 largest U.S. banks by asset size as customers and 180 financial clients around the world.

Presenters

Presenters

Presenter

Presenter

BlueVine’s news comes just a few days after announcing its new Chief Financial Officer. After joining BlueVine as Vice President of Finance and Capital Markets in 2016 – and being

BlueVine’s news comes just a few days after announcing its new Chief Financial Officer. After joining BlueVine as Vice President of Finance and Capital Markets in 2016 – and being

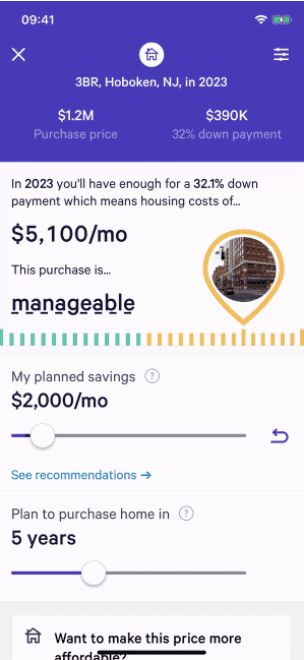

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.

The Path home planning tool aims to help buyers understand what they can afford today and what it may take for them to be able to afford a larger home in the future. Also importantly, the tool shows users how this purchase may impact future goals, such as retiring early or paying for a child’s college tuition. Path extends beyond traditional affordability calculators to show a cost estimate that considers the user’s financial standing and other financial goals.

Gary Singh, VP of Marketing

Gary Singh, VP of Marketing