The votes have been counted and the winners of our FinovateSpring 2018 Best of Show awards have been named. Congratulations to the five companies whose live demonstrations of their latest technologies wowed our attending crowd in Santa Clara, California this week.

Every Best of Show competition teaches us something about the state of fintech innovation in the world today. How are fintechs helping improve the customer experience in lending? How can financial institutions get a better understanding of their customers needs and preferences? How can we make it safer to bank and shop – to say nothing of simply communicate – safely online without fear of interference (or worse) from cybercriminals?

This year’s FinovateSpring 2018 Best of Show winners were no exception to this rule. The companies highlighted by our Best of Show awards reflect impressive innovations across the broad spectrum of financial technologies.

![]() Conversation.one for its build-once-deploy-anywhere platform for conversational applications that enables FIs to build, deploy, and enhance their Alexa Skills, Google Home Actions, Facebook Messenger bots, and chatbots in one single process, in just a few minutes. Video.

Conversation.one for its build-once-deploy-anywhere platform for conversational applications that enables FIs to build, deploy, and enhance their Alexa Skills, Google Home Actions, Facebook Messenger bots, and chatbots in one single process, in just a few minutes. Video.

Dynamics, Inc. for its network-approved “connected” payment card with a 65k pixel display, organic recharge, and telecommunications chip to facilitate wireless data downloads and customer notifications. Video.

Dynamics, Inc. for its network-approved “connected” payment card with a 65k pixel display, organic recharge, and telecommunications chip to facilitate wireless data downloads and customer notifications. Video.

![]() Kasasa for its Kasasa Loan that lets borrowers pay ahead to reduce debt and take that extra money back if they need it. Kasasa Loans feature a mobile app that allows borrowers to manage their debt and access take-backs instantly. Video.

Kasasa for its Kasasa Loan that lets borrowers pay ahead to reduce debt and take that extra money back if they need it. Kasasa Loans feature a mobile app that allows borrowers to manage their debt and access take-backs instantly. Video.

![]() Trusona for its Trusona Executive solution that enables frictionless #NoPasswords multi-factor identity authentication at scale, including identity-proofing, step-up authentication using a person’s government-issued ID. Video.

Trusona for its Trusona Executive solution that enables frictionless #NoPasswords multi-factor identity authentication at scale, including identity-proofing, step-up authentication using a person’s government-issued ID. Video.

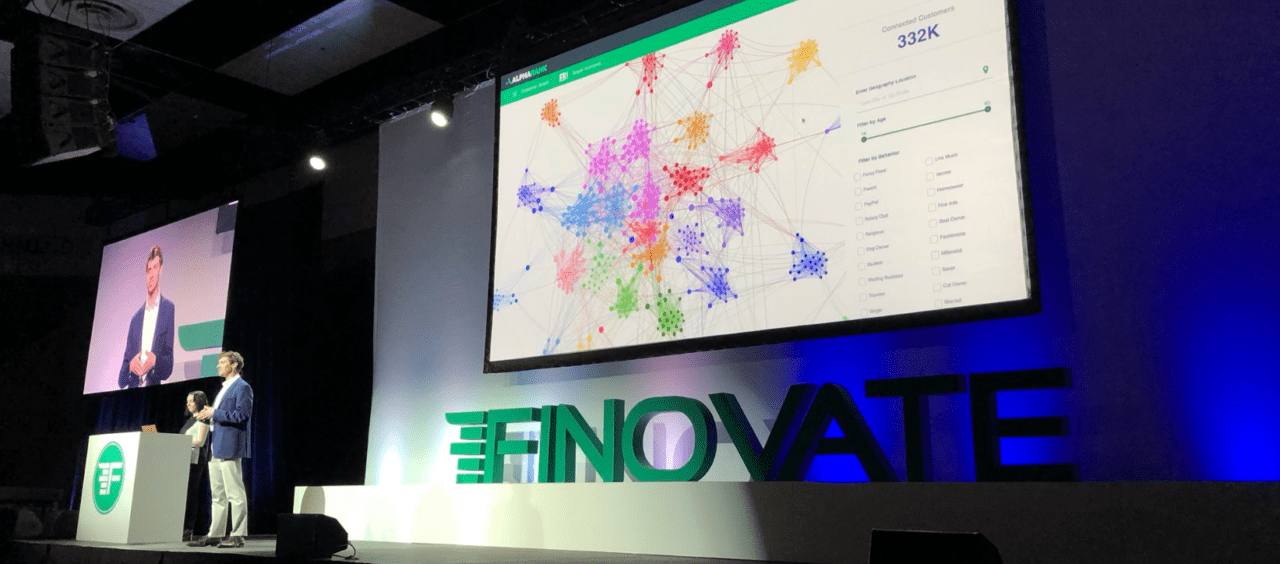

![]() Alpharank for its innovative Customer Graphs¬†that leverage FIs’ anonymous transaction card data to help them understand how products and behaviors spread through customer networks and how to leverage network effects to their advantage. Video.

Alpharank for its innovative Customer Graphs¬†that leverage FIs’ anonymous transaction card data to help them understand how products and behaviors spread through customer networks and how to leverage network effects to their advantage. Video.

We hope you have enjoyed the first two days of FinovateSpring. The conversation continues on Thursday and Friday as we launch into deeper dives into many of the themes introduced on the first two days of our spring conference.

From the power of AI and Big Data to the rise of voice technologies as the interface of the future, the second half of FinovateSpring will help provide both context and insight into how many of the most exciting technologies of our time are creating ever more engaging, personalized, and relevant experiences for consumers of financial services. To learn more about the keynotes, panel discussions, and fireside chats we will host on Thursday and Friday, be sure to check out our FinovateSpring 2018 agenda for Days Three and Four for more information.

Presenter

Presenter

Presenters

Presenters Eran Cedar, CTO

Eran Cedar, CTO

Presenters

Presenters Ori Hay, Founder & Chairman

Ori Hay, Founder & Chairman