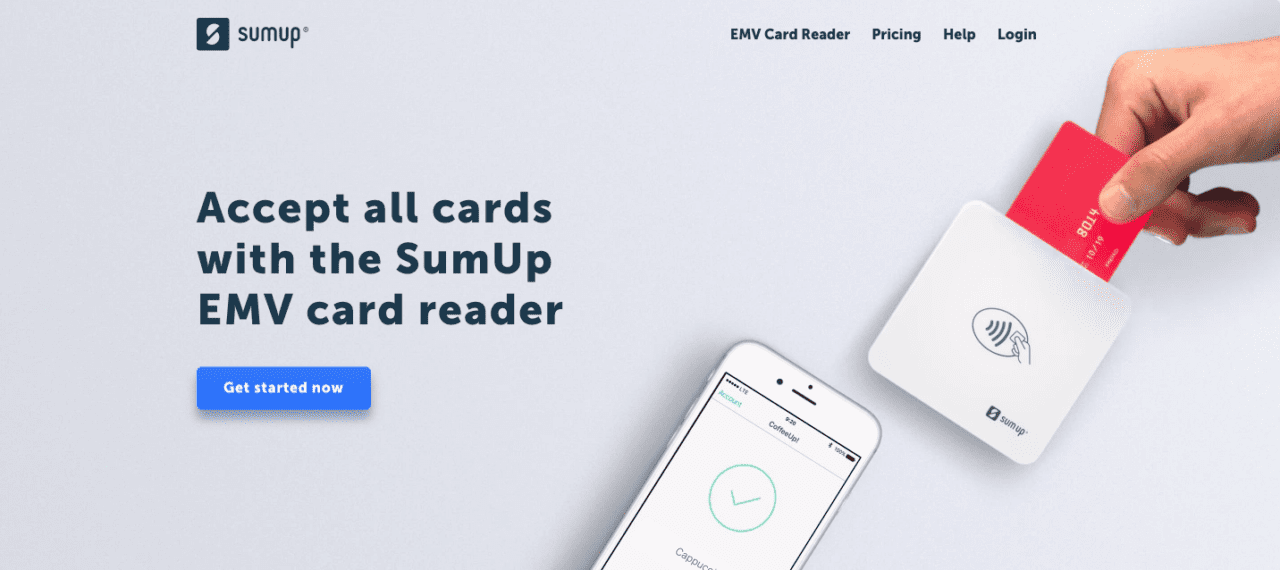

Mobile payments company SumUp is making it easier for church congregations to donate thanks to a partnership with the Church of England. The Ireland-based company’s mobile point of sale (mPOS) technology will be available for congregations to make contributions at weddings, funerals, christenings, and other church events such as concerts. This follows a successful trial of contactless payments in around 40 churches last summer.

Specifically, SumUp will facilitate contactless, virtual terminal, and mobile SMS donations for the church, which regularly receives more than $800 million (£580 million) in donations per year. This is expected to not only make payments faster and easier but also to adapt to a younger congregation demographic in an increasingly cashless society.

All of the Church of England’s 16,000 churches will have access to a portable SumUp Air card reader. These terminals accept contactless payments, Apple Pay, and Google Pay, as well as chip & PIN and can process 500 transactions on a single charge.

If you’re worried the biblical parable of the widow’s offering will be less relevant, do not fear– the terminals will not be used to accept regular tithes and offerings from the church pews. There is still too much friction involved, since each transaction must be entered into the terminal by a church deacon or other representative, and because a card transaction still takes more time than simply dropping cash into the collection plate.

In a press release, National Stewardship Officer of The Church of England John Preston said, “How we pay for things is changing fast, especially for younger church-goers, who no longer carry cash, and we want all generations to be able to make the most of their place of worship. Installing this technology does mean that one-off fees can be done via card, as can making one-off donations. The vast bulk of regular giving will continue to be done by standing order as we continue our trial with various technologies.”

SumUp was founded in 2011 and was recently named Europe’s fastest-growing company in the Inc. 5000 rankings. That achievement is difficult to contest– SumUp onboards more than 2,000 new companies each day, processes more than 100,000 global transactions every day, and exceeded $98 million (£70 million) in annual revenue last year. The company’s clients include DHL, black cab drivers, Tupperware, and Bosch. SumUp demonstrated its mPOS system at FinovateEurope 2013 in London. The company has raised $44 million from investors including American Express, BBVA, Groupon, and Holtzbrinck Ventures.