FinovateSpring Best of Show winner Conversation.one is among four U.S.-based fintechs that are joining Finastra’s FusionFabric.cloud open platform. Conversation.one, which offers a voice banking and chatbot building solution for banks and credit unions, will leverage FusionFabric.cloud’s developer environment to boost its technology’s deep learning capabilities.

“Accessing Finastra technology and APIs through the FusionFabric.cloud platform is extremely efficient. It brings additional value to our solutions and, importantly, to our clients,” Conversation.one CRO and co-founder Rachel Batish explained. “The platform gives us access to more than 9,000 financial institutions across the globe. Our goal over the next two years is to deliver the capability to build cross-channel conversational solutions in minutes to close to 30% of Finastra’s clients, so they become our customers as well.”

Also among FusionFabric.cloud’s latest round of early adopters this week were Tradle, a blockchain-based KYC solutions provider; Active Allocator, a digital asset allocation platform; and regtech solution provider for banks and insurance companies, GreenPoint Financial.

Chief Cloud Officer for Finastra Natalie Gammon pointed to the “broad financial service spectrum” available to fintechs via FusionFabric.cloud. “It means fintechs and developers can dramatically reduce build time for apps, bringing them to market faster. We see FusionFabric.cloud gathering significant pace, championing a collaborative ecosystem and changing the way the financial services industry develops and deploys software for the better,” Gammon said.

The news comes just days after Conversation.one announced that First Abilene Federal Credit Union, a Texas-based credit union with $71 million in assets and nearly 11,000 members, had leveraged Conversation.one’s technology to launch its Amazon Alexa Skills and Google Home Action offerings.

Conversation.one CEO Chen Levkovich credited First Abilene FCU with recognizing the potential of voice and chat technology to improve customer engagement. “First Abilene can now provide their members with a wider range of services, from multiple digital touch-points,” Levkovich said. “We are extremely excited to work with such an innovative team and we are looking forward to their expansion into additional channels.”

Founded in 2017 and headquartered in Sunnyvale, California, Conversation.one demonstrated its build-once-deploy-anywhere platform for conversation apps at FinovateSpring 2018, winning Best of Show honors. Conversation.one’s solution enables banks and credit unions to build, deploy, and enhance Alexa Skills, Google Home Actions, FB Messenger Bots, as well as phone and texting intelligent assistants in a single process that takes as little as a few minutes.

Finastra, which formed via a merger between Misys (FinovateEurope 2017) and D+H last summer, has been gaining early adopters to its FusionFabric cloud open architecture since the fall and began 2018 with a trio of new platform users, as well as a partnership with Thomson Reuters as a data provider. A strategic alliance with Microsoft announced in March meant that the company’s enterprise-ready trusted cloud platform, Microsoft Azure, would underpin FusionFabric.cloud. Shortly afterward, Finastra announced another trio of APAC fintech companies that would leverage its solution to develop and deploy their apps.

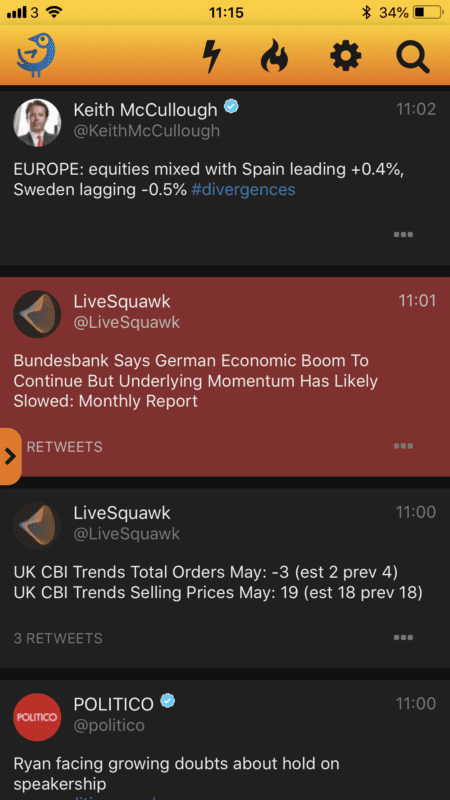

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.