BMO is rolling out new payments hub, reports Tanya Andreasyan of Fintech Futures (Finovate’s sister publication).

Canada’s BMO Financial Group has implemented a new payments hub based on the ACI Worldwide UP solution. The project was completed in nine months.

BMO is involved in the modernization of national payment ecosystems in Canada and the US.

“The launch of our payment hub is a cornerstone of our payment modernisation strategy and a very exciting step forward for BMO and our clients,” said Sharon Haward-Laird, head, North American treasury and payment solutions at BMO.

“Our speed-to-market differentiates BMO and has been a significant win that has positioned us well to adapt quickly to shifting demands and enable the new payment rails we are working toward in the coming months.

“It’s all about delivering faster and more efficient payment experiences for clients and with the hub, we’re well positioned to do that.”

ACI said its UP Real-Time Payments solution is “the only global solution that allows financial institutions to address their real-time gross settlement (RTGS), Swift messaging, ACH and real-time payments needs with a single, universal offering”.

Founded in 1975 and headquartered in Naples, Florida, ACI Worldwide participated in our developers conference, FinDEVr Silicon Valley, in 2016. The company’s Wolfgang Berner and Grit Ruehling led a presentation titled Simple, Global, and Secure eCommerce Payments with ACI Worldwide’s Next-Generation API that showcased ACI Worldwide’ s SAQ-A compliant JavaScript payment-form solution. The technology enables merchants to readily add dozens of alternative payment methods to their checkout page.

A publicly-traded company on the Nasdaq, ACI Worldwide trades under the ticker “ACIW”. The company has a market capitalization of $3 billion. More than 5,100 organizations around the world, as well as more than 1,000 of the world’s largest FIs use ACI’s technology to process $14 trillion in payments and securities every day.

Presenters

Presenters Abhishek Joshi, Senior Associate

Abhishek Joshi, Senior Associate

Presenters

Presenters Bodo Grauer, Head of Digital Strategy and Transformation

Bodo Grauer, Head of Digital Strategy and Transformation

Presenters

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO

Presenters

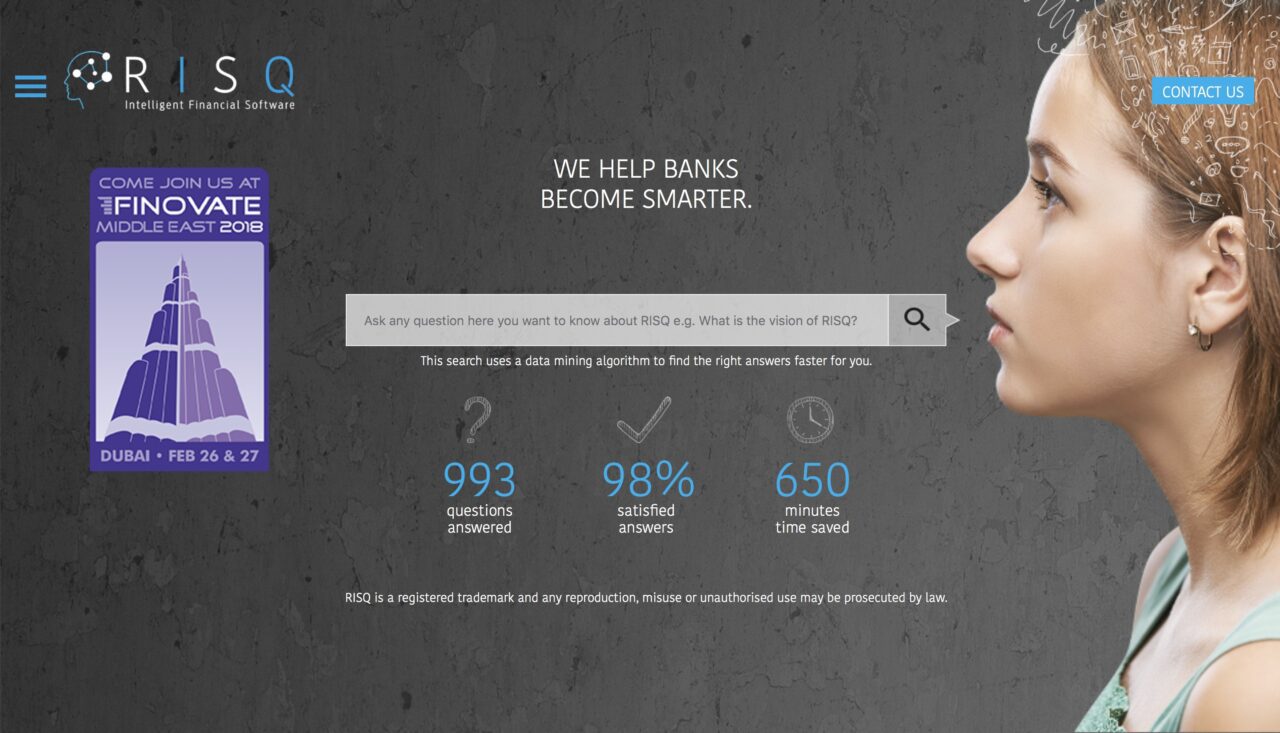

Presenters Justin Lai, Sales and Marketing Director

Justin Lai, Sales and Marketing Director

Presenters

Presenters Piyachat Kunthachaem, Business Platform Officer

Piyachat Kunthachaem, Business Platform Officer Sukanya Bowornsettanan, Project Manager, Transformation

Sukanya Bowornsettanan, Project Manager, Transformation