Why is platformification an important development in financial services? And what will happen to financial services companies when financial decisions are made less by people, than by their trusted, AI-enabled personal assistants?

Answers to these questions were among the most compelling content on Day One at FinovateEurope this week. Our morning session, featured a pair of presenters, Nicolai Schattgen, founder and CEO of Match-Maker Ventures, and author and entrepreneur Steven Van Belleghem. Both speakers’ insights on platformification and the relationship between the customer and major enabling technologies like AI, respectively, were especially well-received by our FinovateEurope audience.

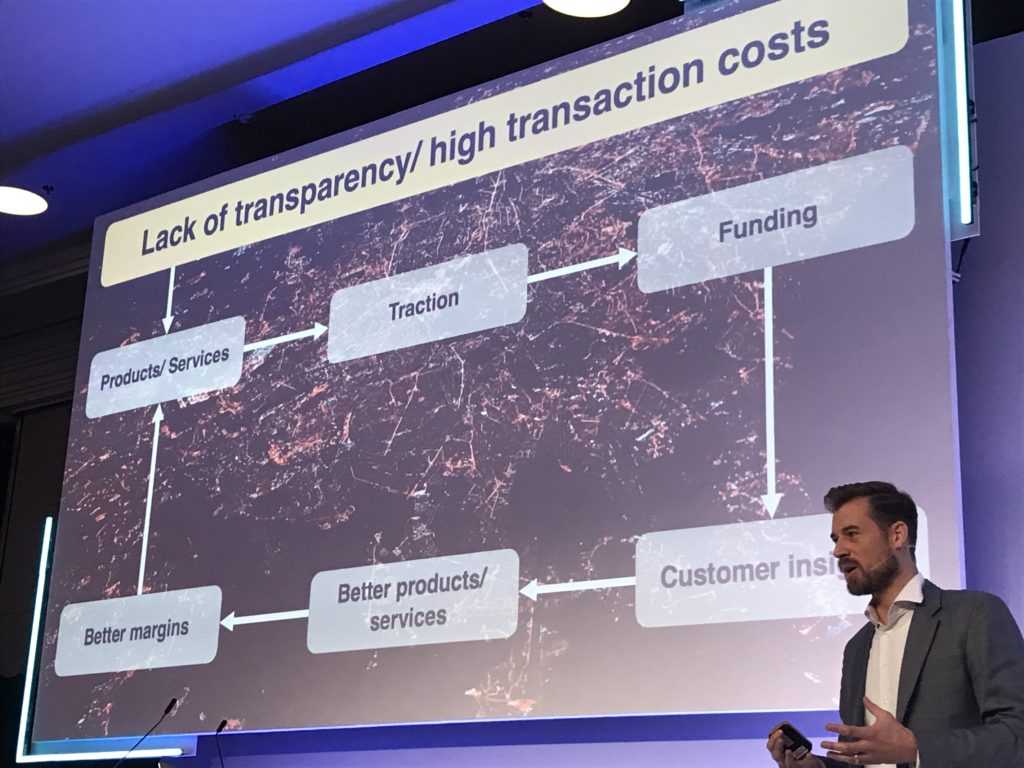

Opening his conversation on the role of the platform in financial services, Schattgen explained that platforms thrive in areas of low transparency and high transaction costs. He used the example of Airbnb, asking audience members to consider how Airbnb as a platform has helped revolutionize the industry of global online property rental. Calling this ability to transform opaque and expensive markets into accessible, consumer-friendly opportunities “the platform economy rules,” Schattgen implored the audience to understand that “the world will never be as slow as today” and that financial services companies and fintechs alike could receive “massive benefits” from the platform economy.

The plan? Financial services companies must accept the shifting realities of their markets, including the preferences of customers. They must believe in what they do as innovators; as Schattgen put it, “you’ve got to be IN it.” This includes committing the appropriate amounts of both capital and mindshare from leadership. It is not something that can be effectively outsourced. Lastly, Schattgen encouraged partnerships, and praised the value of collaborations between “corporates” and “startups” to drive business value by combining leadership with innovation.

A little later in the day, a special address from Steven Van Belleghem was an entertaining and informative journey from the land of selfies, 4G, and Instagram to the precipice of a world driven by powerful enabling technologies like AI and machine learning, quantum computing, 5G, and robotics. Author of Customers The Day After Tomorrow, Belleghem discussed these technologies in the context of how they will change the relationship between customers and the products and services they buy – from the favorite and trusted brands to impulse purchases – once they are mature and widely distributed throughout the economy.

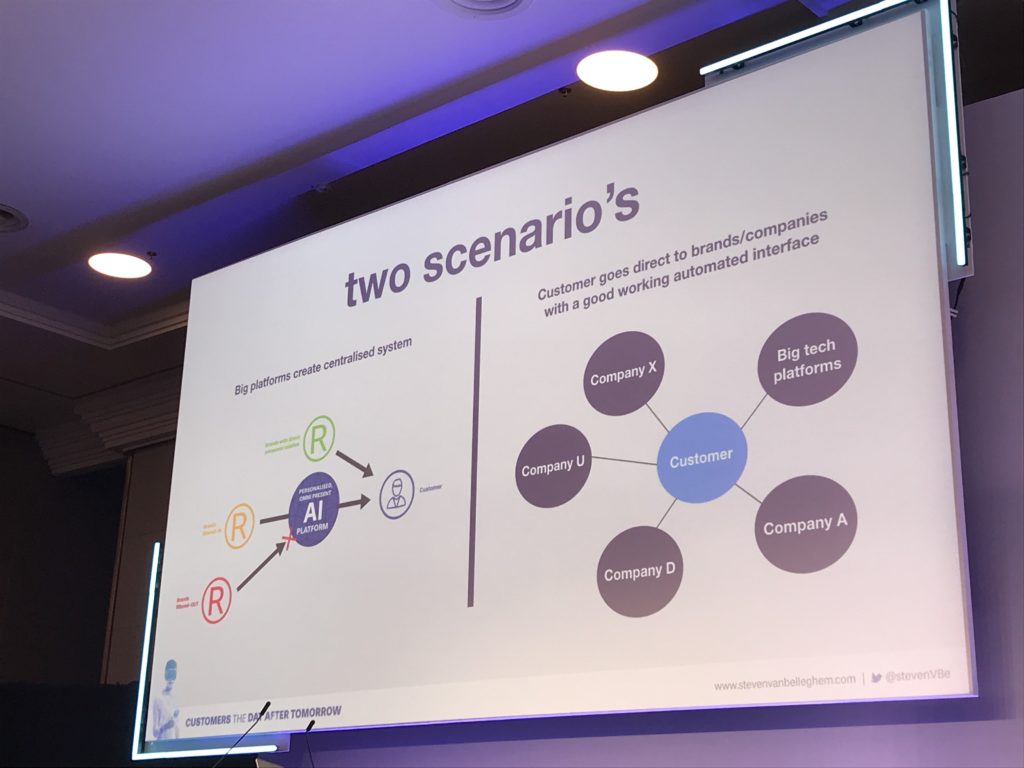

He refers to this future as B2A – business-to-assistant, as in virtual assistant, and asks the question of what companies will do to retain customers in a world in which customers rely on enabling technologies to either help them make purchasing decisions or to make those same purchasing decisions on their own.

In other words, Belleghem asks, what if the customer is no longer part of the decision flow? In much the same way that Facebook has become effective for its ability to filter information, Belleghem notes that algo-driven, B2A commerce will create product filters and digital shelves that are significantly more personalized and less diverse than brick-and-mortar shelves. The implications for brands of all kinds are significant.

Belleghem sees two possible futures as a result of this. In one future, mega platforms create centralized systems that serve as gatekeepers and distribution networks leveraging an AI-enabled understanding of consumers’ past and likely future buying preferences. In another future, customers access their preferred brands directly via a strong and user-friendly, automated interface. Belleghem he has no crystal ball to tell him which path is the one we are more likely to pursue as a society. Nevertheless, he recommends that businesses spend a significant amount of time on brand-building, and said understanding that managing a customer’s top three resources: time, money, and energy – and especially “time” – can be a gamechanger when it comes to determining which product or service is the one a customer will stick with over the long term.