The following is a guest post from John Mason, Senior Director at Zafin.

Open Banking in Australia kicked-off in earnest in July when it became mandatory for the country’s big four banks to share product reference data (including interest rates, fees and charges, and product eligibility criteria) with accredited data recipients, typically fintech companies who provide alternative products and comparison shopping services to consumers. Also, in July, the same big four started sharing their consumer customers’ data—specifically data associated with deposit, credit, debit and transaction accounts—with alternative providers as requested by the customer.

In an effort to anticipate what lies ahead for Australian banks and consumers as the country joins the worldwide movement to give consumers greater access to products and services that can improve their financial lives via Open Banking, we decided to take a look at an island nation more than 9,000 miles away, boasting 2.5x Australia’s population but just 3% of its land mass—the U.K.

The United Kingdom embarked on its own Open Banking journey almost exactly four years back. In August 2016, the United Kingdom Competition and Markets Authority (CMA) directed its nine largest banks to provide accredited fintechs with access to previously proprietary customer data (pending customer approval, of course) down to the transaction level for current accounts.

Here is what’s happened in the U.K. that may be instructive for Australia:

- Consumer up-take for Open Banking capabilities is sizable. As of January 2020, according to the Open Banking Implementation Entity (OBIE), there are one million users of Open Banking services in the U.K., representing a two-fold increase in just six months’ time. Further, the ecosystem of regulated open banking service providers is expanding rapidly. As of May 2020, it stands at 249, up from 100 at year end 2018.

- Open Banking’s impact on the payments arena is particularly notable, with 50,000 consumers turning to third party applications to make payments from their current accounts in the month of December 2019 alone.

- Investment is strong and widespread. Tink, the open banking platform, surveyed almost 300 senior financial services executives about their Open Banking investments. Almost ¾ indicated that spend had risen year-over-year, while a third stated that their financial institution was spending €100 million or more on Open Banking initiatives, and half projected positive payback on capital invested in Open Banking in four years or less.

- Despite strong adoption and investment, consumer awareness of Open Banking is low—perhaps pitifully so. In a 2019 study by Crealogix, two thirds of respondents had no idea what Open Banking was, much less its potential benefits.

- Some banks see opportunity in the transition to Open Banking, whereas others view Open Banking as just another compliance obligation. One example of a visionary is Barclays, who empowered its U.K. customers to better manage their finances with the ability to attach non-Barclays accounts to its mobile app—taking a big and bold step forward to participate in the industry’s emerging platform economy.

- Interest in the capabilities Open Banking enables varies substantially by different generational cohorts. For example, according to Crealogix research in the U.K., GenZs and millennials are twice as likely to adopt new open-banking capabilities and applications relative to baby boomers.

- Many positives and much innovation notwithstanding, for the most part, Open Banking’s promise to drive positive changes for financial inclusion have not yet been realized.

Based on what we’ve observed in the U.K., here are three predictions for how we expect Open Banking to play out in Australia.

- Some banks will respond with vision and vigor, delivering new experiences that resonate with their customers and create advantage in the marketplace.

- Other banks will view a more open financial ecosystem as a threat and put their heads in the sand, leading to short term investment savings and long-term competitive disadvantages.

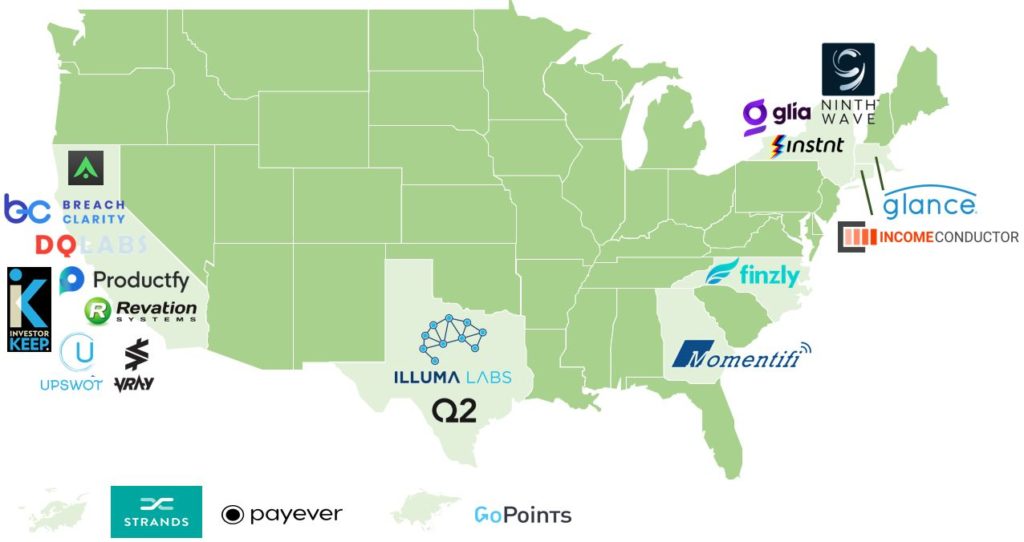

- Investors—inside banks and outside in the broader fintech ecosystem—will bet on advancing technologies and evolving customer expectations by placing smart bets on future possibilities in the Open Banking arena.

While consumers may never know what Open Banking is, their desire to benefit from new and compelling digital banking services will ultimately lead the overall banking industry to a brighter future—in Australia and the rest of the world. As in the U.K., the advent of Open Banking in Australia will hasten progress, create opportunity and change an industry.

Photo by Catarina Sousa from Pexels