New York City-based Rho Technologies has inked a partnership with Sterling National Bank, the principal subsidiary of Sterling Bancorp that specializes in serving small-to-medium sized businesses as well as consumers. Sterling will leverage Rho’s digital Banking-as-a-Service platform, Rho Business Banking, to support its customer growth and expansion objectives.

Sterling National Bank’s Matthew Smith, Executive Managing Director for Direct Banking and BaaS, called the partnership “an important step” in expanding its portfolio of BaaS arrangements, as well as speeding up the bank’s “organization-wide digital transformation to offer customer-centric, digitally-enabled solutions to the marketplace.”

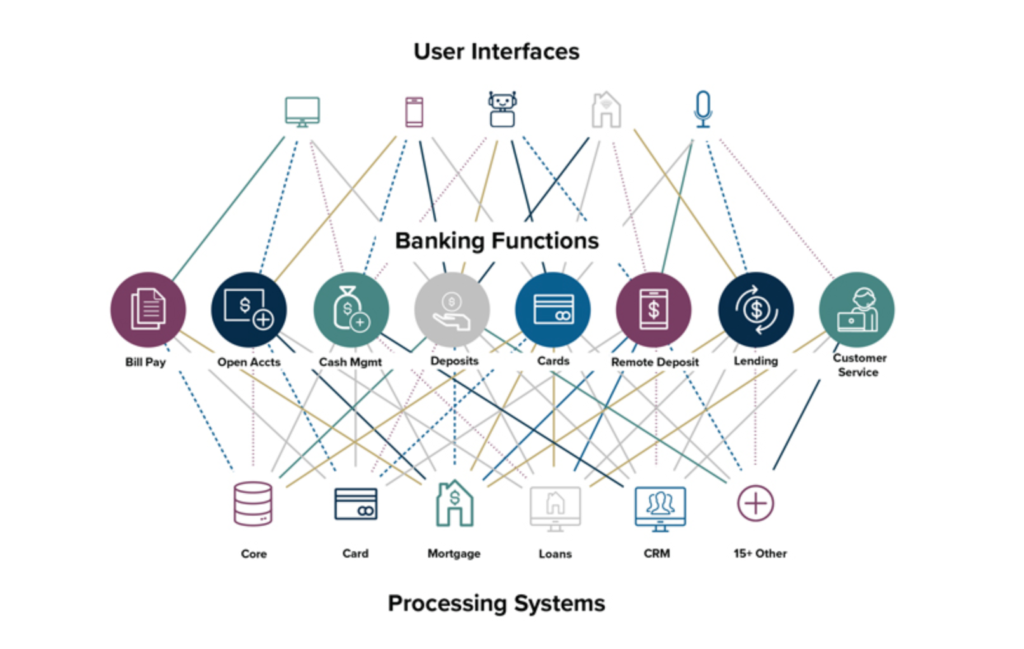

The Rho Business Banking platform combines collaborative finance software and commercial-grade banking in a single solution. Relying on a unified platform, team members can take advantage of integrated, intelligent solutions for A/P, budgeting, data automation, and accounting integrations. Rho offers no-fee global payments, up to 1.5% cash back on all spending, and access to its team of “world-class bankers.”

“Rho is thrilled to collaborate with Sterling National Bank,” Rho Technologies CEO and co-founder Everett Cook said. “We spent a lot of time seeking a partner that had the capabilities and scale that our current and future customers need. We look forward to working with Sterling in supporting our future product and service offerings.

With more than $30 billion in assets, Sterling National Bank made fintech headlines earlier this year when it announced a partnership with Google Pay to offer digital checking and savings accounts through the Google Pay platform. Headquartered in New York, Sterling National Bank also teamed up with Goalsetter during African American History Month to provide seed funding for a program to support financial inclusion and literacy among students in underserved communities.

“This critical initiative reinforces Sterling’s commitment to financial education and empowering young people to reach financial independence,” Smith said. “Black History Month provides an important opportunity to celebrate and promote Black achievement. We are excited to play a part in supporting these inspiring young men to become the next leaders, savers, and investors.”

Rho Technologies began the year with news of a $15 million investment courtesy of a Series A round led by M13 Ventures. The funding, which took the company’s total capital to $19.9 million according to Crunchbase, enabled Rho to launch an integrated accounts payable platform as part of an expansion of its flagship Business Banking offering.

“We’ve developed the modern commercial banking platform built around the way companies operate today: distributed, team-oriented, transparent, and built for scale,” Cook said when the funding was announced in January. “AP is the next step on our mission to help teams work better together with money.”

Photo by Florencia Potter from Pexels