As Finovate Global has chronicled, the boom in fintech investment in Latin America is one of the most interesting trends in global fintech right now. From challenger banks to MSME lenders, a growing number of entrepreneurs and businesses in Latin America are bringing innovative, digital solutions to problems of financial opportunity and financial inclusion.

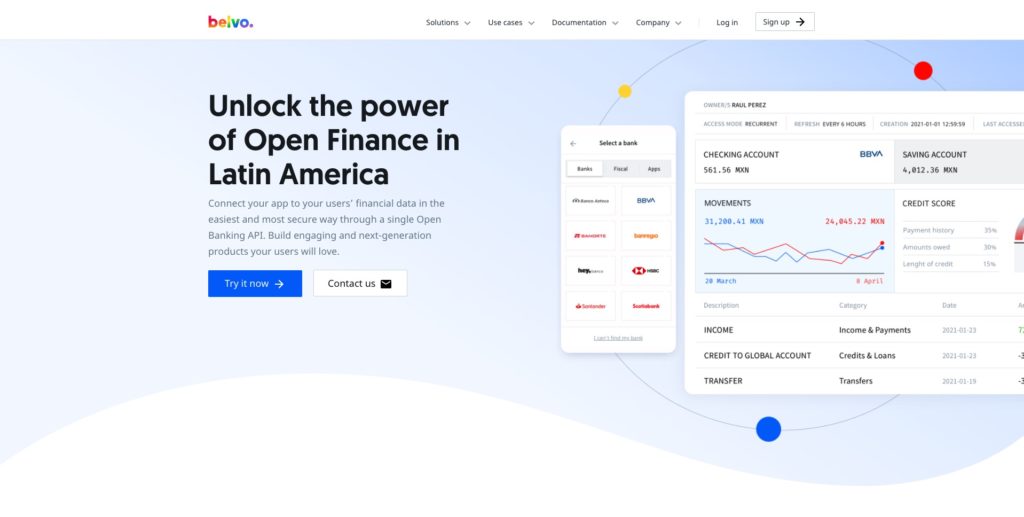

We caught up with Pablo Viguera, co-founder and co-CEO of Belvo in the wake of the company’s $43 million Series A round announced earlier this month. Dubbed “the Plaid of Latin America” by TechCrunch, Belvo offers an open finance API platform that facilitates data connections between apps, banks and other financial institutions, gig economy companies, and more.

What does this new investment mean to Belvo?

Pablo Viguera: We are extremely proud of this milestone and believe that it’s the result of the rapid growth our company has experienced during the last year – underpinned by the continued and unprecedented expansion of fintech in Latin America in the last 18 months.

The funding demonstrates that open finance represents a truly transformational opportunity for Latin America’s financial sector in the next decade. Investors believe that Belvo is poised to continue building category-defining infrastructure and API tools to power the next generation of financial services in the region.

The newly raised funds will help us scale and enhance our product offering, continue expanding our geographic footprint, and double the size of our team.

What is the distinction between open banking and open finance?

Viguera: Open finance is the next step after open banking. If the first aimed to make banking data available to third parties through APIs, this new model extends its scope to financial data from other sources beyond banks.

This is particularly important in regions where a big percentage of the population is still unbanked or underserved, such as Latin America. In these cases, the more financial data sources you have on your platform, the better it is for companies building innovative financial services or innovative apps on top of it.

One example of how this works is the use of financial data from gig economy platforms such as Uber and Rappi in Latin America.

Thanks to open finance APIs, companies can access one-of-a-kind financial data from these alternative sources, not accessible anywhere else, to build new and more inclusive financial services. It’s the case for Minu, a startup offering financial services for gig workers in Mexico, that uses our platform to connect their app with financial data from one of the largest delivery companies in Latin America.

What is driving the embrace of open finance in Latin America?

Viguera: One of the keys to our growth lies in our nature as an infrastructure company that offers its services to the rapidly expanding fintech sector. As this sector grows, as has been the case in recent years (and even more so since the onset of the pandemic, which has accelerated the adoption of digital financial services), we grow as well.

The trend that this sector is experiencing in Latin America is a tailwind for us. If only 12 months ago we had a handful of clients, today we have over 70, and we see that demand continuing to grow.

What are some of the chief obstacles to the broader adoption of open finance?

Viguera: Probably the biggest challenge today is the fact that we operate in a market where open finance is still a young concept and relatively unknown to many. There is still a lot of work to be done to make visible the benefits it offers, both to the companies that implement it and to its end users, in order to increase adoption.

However, we believe that this is the direction in which the market is heading. As has happened in other regions such as Europe and the United Kingdom, this aspect will improve as regulations progress.

Where do you see the greatest untapped opportunities right now?

Viguera: Latin America is possibly the most exciting and dynamic place to be in right now, given the exponential growth that the fintech sector is experiencing. It is also a great place to build infrastructure for the next generation of financial products for a huge market.

We believe it’s only going to get more exciting over the next decade as open banking and open finance will continue to be a key transformational driver for the entire region.

What can we expect to see from Belvo over the balance of 2021?

Viguera: This year we will focus on continuing to scale our product development efforts to meet rapidly increasing market demand and support its exponential customer growth. Our focus will be on expanding our offering of data enrichment solutions (beyond our income verification product) across markets and launch our bank-to-bank payment initiation offering in Mexico and Brazil.

In addition, this year will continue to explore opportunities to expand our open finance platform to new countries within the Latin American market. We expect to double our existing financial data providers’ connection coverage, reaching over 80 integrations by the end of the year.

The new funds will also be used to strengthen our team across functions and locations. We currently employ 70 people and we plan to double our headcount by the end of the year. As part of this plan, we will be hiring more than 50 engineers in Mexico and Brazil in the upcoming months.