Last week, I attended the second annual Bank Innovation 2013 conference in San Francisco. Finovate alums PayPal, Fiserv, Backbase, Andera, MoneyDesktop, Holvi, Strands Finance, Yodlee, and many others were represented on panel discussions and in the audience.

There was much conversation about obstacles that inhibit innovation in financial institutions. Two themes arose around this discussion:

1. Corporate bureaucracy

Most people agreed that in order to successfully implement a new type of innovation, you need to have the right players involved. Leaders within the organization must actively support and rally for the innovation.

2. Regulation

Working in an industry that’s strictly regulated isn’t easy. And the volume of new and changing rules is intimidating. But, it’s important for both startups and financial institutions to focus on how they can work in tandem within the regulations.

While these two inhibiting factors seem like good reasons to give up on implementing new innovations all together, they actually both serve as reasons for financial institutions to innovate.

Among the many topics of innovations that were discussed, three in particular stood out:

1. Big Data

Big data is powerful. If properly harnessed, it can help financial institutions to:

- Predict consumer behavior

- Help marketers determine consumer trends and preferences

- Provide insight into consumer habits to provide a better customer experience

At Bank Innovation, however, the vein in which Big Data was discussed centered more around using it for underwriting purposes. Companies like Bermuda-based Entrepreneurial Finance Lab (

FinovateAsia 2012 demo) use psychoanalytic tactics to underwrite loans, but using such measures in the United States can be illegal.

As Co-founder and Chief Risk Officer at ZestFinance, Shawn Budde, discussed, big data is a key piece to help lenders manage risk. By pulling “signals” from multiple sources, financial institutions are able to make more educated decisions about risk.

2. Personal touch

Most in attendance agreed that banks should give their customers some level of personal touch. After all, customers prefer to be treated like human beings, and not a number. For banks of all sizes, however, this raised a couple of questions:

- How do we scale this?

While Mechanics Bank wishes its members a happy birthday by mailing them a birthday card, Wells Fargo implemented a happy birthday note that appears when their customers use an ATM on their birthday month. Even though Mechanics Bank’s strategy is much more difficult to scale than Wells Fargo’s they both require additional time and money to implement.

- What is the right level of personalization before the “creepy factor” sets in and the benefit deteriorates?

Banks have visibility to many consumer habits (good and bad) through their debit and credit purchases. They can also use geolocation, when enabled, to find out where a consumer has checked in. The “creepy factor” can result when a bank attempts to personalize the banking experience by offering more relevant and timely rewards. Finding the balance between pleasing your customers and creeping them out is key.

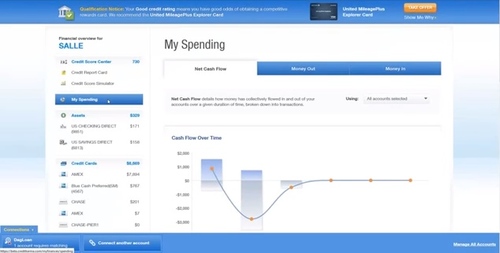

3. PFM

The PFM discussion began with what PFM is, what it’s not, and what it could be. Though there were disagreements among the panel and throughout the audience, it was the general consensus that account aggregation is a must-have. However, even if consumers have a complete picture of all of their accounts, a budget is meaningless if you don’t have goals.

This is why PFM needs to be personalized for each user. Everyone has trouble with a different type of money issue whether it’s spending, loans, savings, or credit. These issues, combined what stage of life users are in, and their specific goals, will paint a different PFM picture for each individual. It’s up to their financial institutions to help them determine where they are, where they want to be, and what tools they need to accomplish their goals.

Pictured from left to right: Stephen Armstrong, Director of Emerging Channels, USAA; Jim Reynolds, Vice President, Regional Site Director, U.S. Bank; Geoff Knapp, VP, Digital Channels & Online Banking, Fiserv; Jelmer De Jong, Global Head of Marketing, Backbase; and JJ Hornblass, who moderated the panel.

Throughout the two-day event, it was great to see startups actively engaged in discussions on how to help their customers–banks.

For more coverage on the event, refer to the following posts by Bank Innovation:

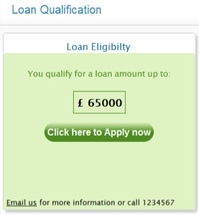

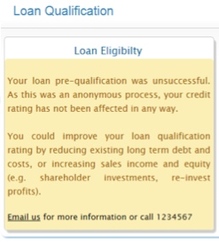

Benefits to lenders

Benefits to lenders