For all the anticipation of draft day, there’s nothing like the excitement on the day when fans get to see the new addition finally take the field.

That team is PayPal and their newest addition, Braintree has just made its first big play: v.zero.

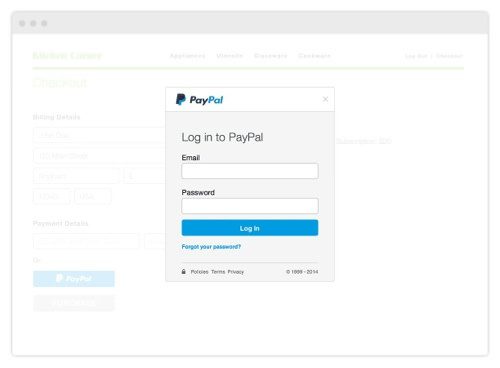

V.zero is a

major overhaul of Braintree’s Software Development Kit (SDK) that puts PayPal integration front and center for app developers eager to add in-app payment functionality to their solutions.

Writing at the Braintree v.zero blog, Ben Mills and Tony Pitluga point to the new SDK as a major, post-acquisition goal. “From the moment we joined forces with PayPal in December 2013, we have been working hard to make accepting PayPal as simple as we made accepting credit cards.”

Braintree also provides a Sandbox to let developers test v.zero without needing a PayPal account. The SDK offers both online/web integration via Javascript, and mobile by way of Android and iOS. A complete PayPal integration guide is available

here.

Here’s a look at some of the issues raised in the coverage of the announcement late last week.

Forbes focused on the “D” in Braintree’s SDK, making the point that the new tools will make it that much easier for mobile app developers to get paid for their work. This is no accident. Forbes notes how Braintree is pursuing the “long tail” of startups whose services tend to require “payments on the spot” and are “built exclusively for smarphones.”

Forbes also highlights on beta tester, retailer Jane.com. The company says that it now gets 11% of its sales through PayPal since integrating Braintree’s new tools.

TechCrunch makes sure to put the new SDK in the context of the recent acquisition that brought Braintree into the PayPal tent. In addition to noting that the SDK is the “first significant product announcement” since the acquisition, TechCrunch underscores how the technology has been “rebuilt from the ground up.”

The goal of the rebuilding is to make it easier and faster for merchants to integrate the tools into their own systems. Speed (10-15 minutes) is one factor, but TechCrunch also noted features like the “drop-in” user interface that makes it easier for smaller startups to further minimize the time spent in integration.

TechCrunch’s reporting also provides a handful of interesting quotes from PayPal CEO, Bill Ready. In particular, Ready’s idea of being able to change payment methods in app as simply as “flipping a switch” is part of what he considers “future proofing” the technology.

And with a bit of prompting, it is clear that the future Ready is proofing for includes everything from international commerce, non-card payments, and even crypto currencies like Bitcoin.

We also get the names of some additional beta testers, with Chargify, GitHub, and ParkWhiz also reportedly taking v.zero out for a spin. Twilio is also said to be planning to integrate the SDK.

Other interesting observations included a note in

VentureBeat that PayPal’s current mobile API will continue to exist. But that it is clear that the v.zero will be treated as the “preferred way to integrate PayPal” going forward.

Founded in 2007, Braintree

demoed its recently-acquired Venmo Touch technology at FinovateSpring 2013 in San Francisco. See the company on stage

here.

And if you like coverage of developer issues, then you’ll love

FinDEVr. Brought to you by a team from Finovate, FinDEVr is the first event for fintech developers and will take place September 30 and October 1 in San Francisco. Take a look at some of the innovators who are already on board:

Join us! Early bird discounts are in place until July 25. Visit our registration page

here to save your spot.

How Big is the Braintree SDK? PayPal’s Acquisition Launches Toolkit Reboot.

How Big is the Braintree SDK? PayPal’s Acquisition Launches Toolkit Reboot.