Many fintech startups have an impressive array of informed investors backing them up. But not every fintech startup can cite the support of a knight.

Along with Peter Thiel’s Valar Ventures, Index Ventures, and addition investors, Sir Richard Branson has thrown his financial support behind TransferWise, the P2P money transfer specialist. Branson’s investment, along with that of his fellow investors, means that TransferWise now sits with $33 million in total funding.

Branson

said in a statement, “Financial services such as foreign exchange have been ripe for disruption for decades, and it’s great to see TransferWise bring transparency to the market.”

According to

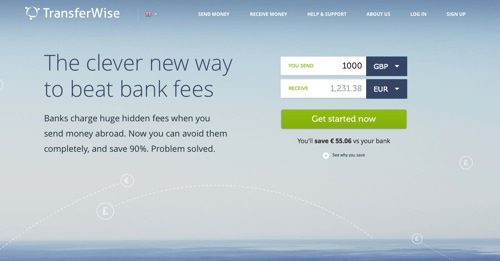

reporting in TechCrunch, TransferWise plans to put the capital to use adding talent and intensifying marketing efforts. Said TransferWise CEO Taavet Hinrikus, “We’re going to use this money to lead the charge against hidden bank fees and expose the problem to a wider audience.”

The company has backed up this talk with a tough (Hinrikus calls it “cheeky”)

ad campaign that directly takes on the idea of bad bank behavior when it comes to hidden charges and fees. The ad has been somewhat controversial in the U.K.,

to say the very least.

TransferWise was recently in the news announcing that it had

surpassed £1 billion in cumulative total volume of cash transferred across the border since May 2013. The company provides P2P money transfer services in more than 175 countries. TransferWise’s reliance on P2P technology is one of the company’s biggest edges on its competition, helping lower costs and provide money transfers to consumers that are less expensive than similar services offered by banks.

Founded in March 2010, TransferWise was most recently on the Finovate stage as part of our conference in London in 2013. See a demo of the company’s technology at work

here.

Views: 1,723

![]()