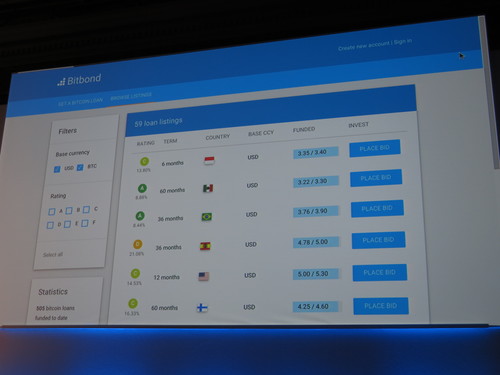

Bitbond AutoInvest allocates funds on behalf of lenders according to their chosen investment profile. AutoInvest will create a loan portfolio according to predefined criteria. The criteria are: investment amount, risk category, base currency, and regions. The regions are North America, Latin America, the Caribbean, Europe, Central Asia, the Middle East, North Africa, Sub-Saharan Africa, Asia, and the Pacific.

The exciting thing about portfolio building according to a profile is that Bitbond allows you to invest automatically into a globally diversified loan portfolio at 0% fees.

Author: Julie Muhn (@julieschicktanz)

WS Integration’s New Xceptor Version Adds Flexibility to Back Office Operations

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Xceptor v4.0 is the next generation of our platform product and is a significant step forward in terms of usability and functionality. Responding to client requests, we have improved many core pieces of the product, such as data-input methods, administration pages and analytics/reporting.

These changes increase the efficiency of setting up and maintaining new processes, adding further flexibility to the use of Xceptor within back and middle office operations.

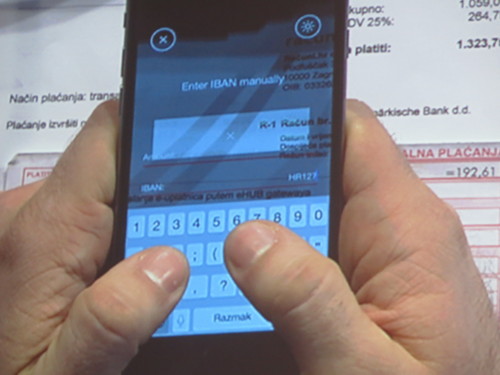

PhotoPay Debuts BlinkOCR to Replace Data Entry

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

PhotoPay showed how its blinkOCR replaces manual data entry.

PhotoPay’s blinkOCR is a camera text recognition SDK for mobile apps. blinkOCR allows real-time operation for customers to replace manual payment or other data entry. It uses a smart scan through a mobile-device camera in customers’ mobile-banking and payment apps.

Smart, contextual scanning works from nonstandardized paper, card or other onscreen documents and forms. blinkOCR contextually recognizes data often required to be manually typed in, such as IBAN, BIC/SWIFT, reference numbers, amounts, emails, URL or other data fields. blinkOCR reduces integration costs and risks by performing locally on the device without the use of an internet connection. Its simple API and small footprint makes it very easy to integrate.

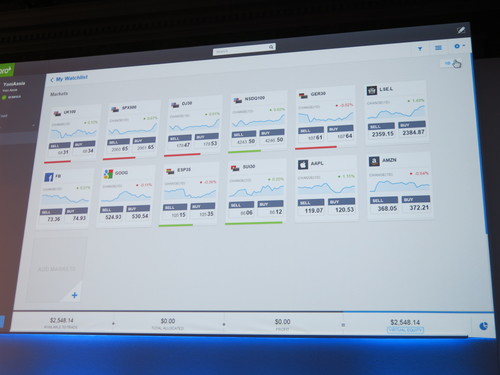

eToro Introduces Social Trading for Generation Y

The company that started out as a gamifier of trades, introduced the world to its social investing network, and created the concept of CopyTrading, is now reinventing its own domain. eToro is introducing a whole new way to trade for the Gen Y population – social trading like you’ve never seen before.

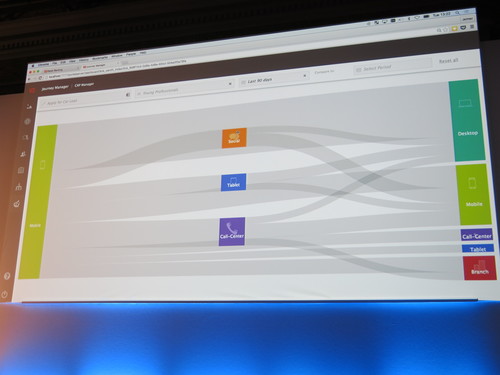

Backbase Launches Omnichannel Journey Manager

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Backbase is launching the latest version of the Backbase Customer Experience Platform at FinovateEurope 2015, with a strong focus on the omnichannel customer journey and journey management.

Completely new in this release of Backbase CXP is the Backbase Omnichannel Journey Manager, giving direct insight in the multiple touchpoints in a customer’s typical journey, with the option to directly dive in and fix inconsistencies.

A lot of digital banking providers and software vendors talk omnichannel. We make it real and visible. With the new Backbase Journey Manager, we give Channel Managers at Financial Institutions direct insight into how multiple channels are being used and where the most common handover points are (the moments of truth).”

Dynamics Debuts its Multi-Currency Card to Help Travelers Avoid Cross Border Transaction Fees

Dynamics was founded and seeded in 2007 by Jeff Mullen, its president and CEO. Dynamics produces and manufactures intelligent powered cards, such as advanced payment cards. Focused on introducing fast-cycle innovation to top card issuers, the company’s first commercial application is the world’s first fully card-programmable magnetic stripe for use in next-generation payment cards.

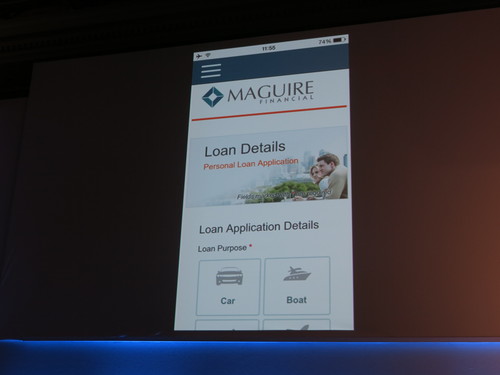

Avoka’s 3-Minute Loan Application Streamlines Account Opening

The 3-Minute Loan Application: Fastest Onboarding Experience in the World

Product and pricing are not differentiators in financial services—customer experience is. In particular, frictionless customer experiences have proven effective for attracting and retaining customers. Avoka helped a client go from 36% conversion rate for personal loan applications to 51% in just 4 weeks by focusing on delivering a frictionless experience for the customer. Because online, seconds matter.

We are demonstrating how combining social, cloud services, and crowd sourcing streamlines account opening, and how credit origination minimizes customer effort and takes the friction out of customer acquisition.

VATBox Takes the Headache Out of Tracking VAT

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

VATBox is demoing a first-of-its-kind, cloud-based, truly automated solution. The automated VAT recovery solution and dashboard enable customers to build one global process that tracks and manages VAT spend with ease. Automation guarantees reduce risk, simplicity, and ease of use by eliminating human error and reducing the inefficiencies of manual processes. But, automation and transparency isn’t only about the money, it’s about data integrity. Qualified and validated data delivers visibility, control, and compliance.

VATBox empowers companies like Teva, PPG, and Broadcom by maximizing returns while enabling transparency. Deployment is simple; all it takes is a few simple steps.

With Wipro’s ngGenie myAdvisor, Users Receive Personalized Banking Assistance

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Wipro ngGenie™ myAdvisor truly provides the ‘Next Generation Banking Experience’ for customers. The Wipro ngGenie™ myAdvisor can have an interactive conversation with you in natural language using voice and gestures. Wipro ngGenie™ myAdvisor learns from your spend patterns, banking transactions, retail transactions, and your social transactions and provides personalized assistance.

It is able to adapt to the user, understand context, and provide the right kind of assistance. It learns from the user’s actions and is able to predict user action as well as provide timely help. Wipro ngGenie™ myAdvisor covers a broad range of functionalities across branch, call center, and web, and provides omnichannel experience.

Strands Launches Loop to Combine PFM and Card-Linked Offers

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Strands Loop is a combination of three solutions: Business Financial Management (BFM), Card-Linked Offers (CLO) and Personal Financial Management (PFM). Strands BFM is a white-label product that helps SMEs make better financial decisions. With this intuitive tool, business owners can analyze and forecast future financial needs.

Thanks to the tight integration with Strands CLO and Strands PFM, SMEs are also empowered to influence their future cash flow. With predefined marketing strategies and PFM data insights, SMEs can easily set up campaigns and target highly relevant deals to the card holders. With Strands Loop, financial institutions can create a more seamless and personal banking experience and build better relationships with their SME clients.

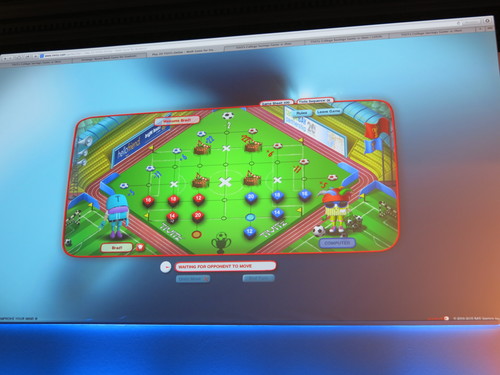

TiViTz College $avings Game-a-thon Helps Kids Save for College

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

The TiViTz College $avings Game-a-thon is a market-disruptive tool that complements existing financial savings vehicles and provides a solution for families to offset potential student-loan debt and to help cover the cost of higher education.

The Game-a-thon—where students solicit pledges online from friends and family for playing TiViTz games—is similar to a Walk-a-thon, only fully automated from pledge solicitation to fund deposit into a savings vehicle. The Game-a-thon can fundamentally change the way families think about affording college and significantly empower children to take responsibility for, and contribute to, their own advanced education, all while improving their math skills and financial literacy.

ebankIT’s Solution Brings Contextual Banking to Multiple Channels

ebankIT aims to materialize in a solution that is much more than a banking application, maximizing the interaction of financial institutions and clients by extending the concept of omnichannel and social banking. In the world of omnichannel banking, customers are in control of the channels they wish to use.For example, they can begin an interaction using one channel, such as mobile, while at home, and end it in another, such as SmartTV or Internet banking. Omnichannel banking brings the industry closer to the promise of true contextual banking in which financial services become seamlessly embedded into the lives of individual and business customers.