While voice biometrics usage is small, it is gaining popularity as a second authentication factor and password replacement. VoicePIN’s easy-to-use voice-authentication system hopes to become the industry standard. CEO Łukasz Dyląg explains it, “Your voice is the most natural and convenient way of communication.”

Company facts:

- Headquartered in Poland

- Founded in 2011

- Offers on-premise solution for enterprise customers

- Offers a cloud-based API for smaller customers

CEO Łukasz Dyląg and Jakub Gałka, R&D director, demoed VoicePIN at FinovateEurope 2016.

CEO Łukasz Dyląg and Jakub Gałka, R&D director, demoed VoicePIN at FinovateEurope 2016.

At FinovateEurope 2016, the company launched VoicePIN, its multichannel, voice-biometrics solution for IVR, mobile app or website login, and for use during call-center service. VoicePIN offers three main advantages:

- A better customer experience

- Enhanced security

- Multichannel access

We chatted with the company’s CEO Łukasz Dyląg (photo circle right) after the demo to discuss the company and future initiatives.

We chatted with the company’s CEO Łukasz Dyląg (photo circle right) after the demo to discuss the company and future initiatives.

Finovate: What problem does VoicePIN solve?

VoicePIN solves one of today’s issues which is having too many passwords, logins and PIN numbers to remember. Customer experience is currently one of the biggest challenges for every company caring about its customers. We have designed VoicePIN for convenient multichannel user-authentication. Once the user registers his voiceprint, he is able to log in by voice into all available customer channels like a help line, IVR, website or mobile application.

Finovate: How does VoicePIN solve the problem better?

VoicePIN enhances the multichannel customer experience by giving the user a chance to use his voice to log in or authorize payments in every interaction field. Our simple API can even be integrated with IoT devices. Moreover, the enrollment process can be passive, so the voiceprint is generated from the previously collected recordings and the user doesn’t have to engage in this step. We have designed our system as really easy to integrate and install. No matter which deployment model the client chooses, he can integrate it on his own.

Finovate: Who are your primary customers?

VoicePIN is available as an on-premise or SaaS model. On-premise is designed for banks, telcoms, insurance companies and state or self-government institutions, while our SaaS solution is an opportunity for web platforms, e-commerce, mobile applications or IoT devices to use the advantages of cloud-based voice biometrics.

Finovate: Tell us about your favorite implementation of your solution.

We had the pleasure to deliver voice biometrics technology in the first such deployment in mobile banking in Europe. Our system operates in Smart Bank’s mobile application, available for both individual and business customers. Since the implementation, they can simply log into their accounts just by saying the set phrase.

The other impressive implementation covered 10,000,000 voiceprints in the Polish Ministry of Finance. This deployment was really challenging. Voice authentication was deployed to improve taxpayer service.

Finovate: What in your background gave you the confidence to tackle this challenge?

We were ready for it as we knew our system works fine and meets the high-level security requirements. It is also scalable, so implementing the 10,000,000 voiceprints was not a problem at all.

Finovate: What are some upcoming initiatives from VoicePIN that we can look forward to over the next few months?

In the coming weeks we will launch VoicePIN as-a-service web platform. It will be the first off-the-shelf voice biometrics service available for smaller B2B enterprises. By this move we want voice biometrics to be no longer associated as severe, complicated, and difficult-to-use technology. Our easy-to-install API is designed to work fine in every customer interaction channel.

Finovate: Where do you see VoicePIN a year or two from now?

We would like to see a broad usability of voice biometrics as a simple, natural and convenient way of authentication and more. We believe that soon our system will work in the different areas such as Internet of Things, intelligent vehicles, houses and other fields where hands-free voice operation is very useful.

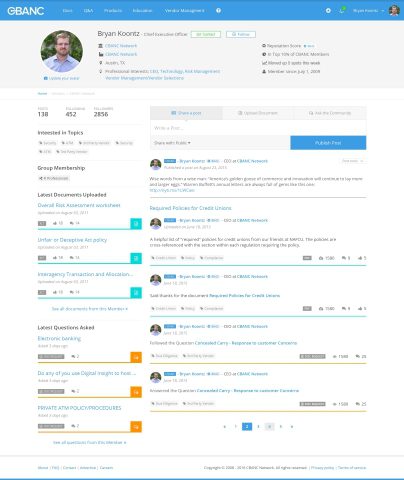

We’re

We’re

Password management platform

Password management platform

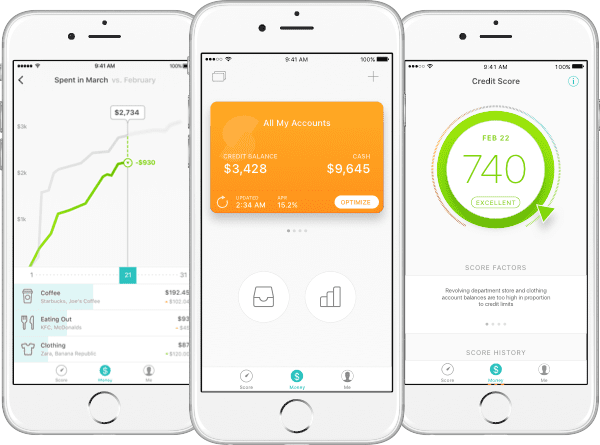

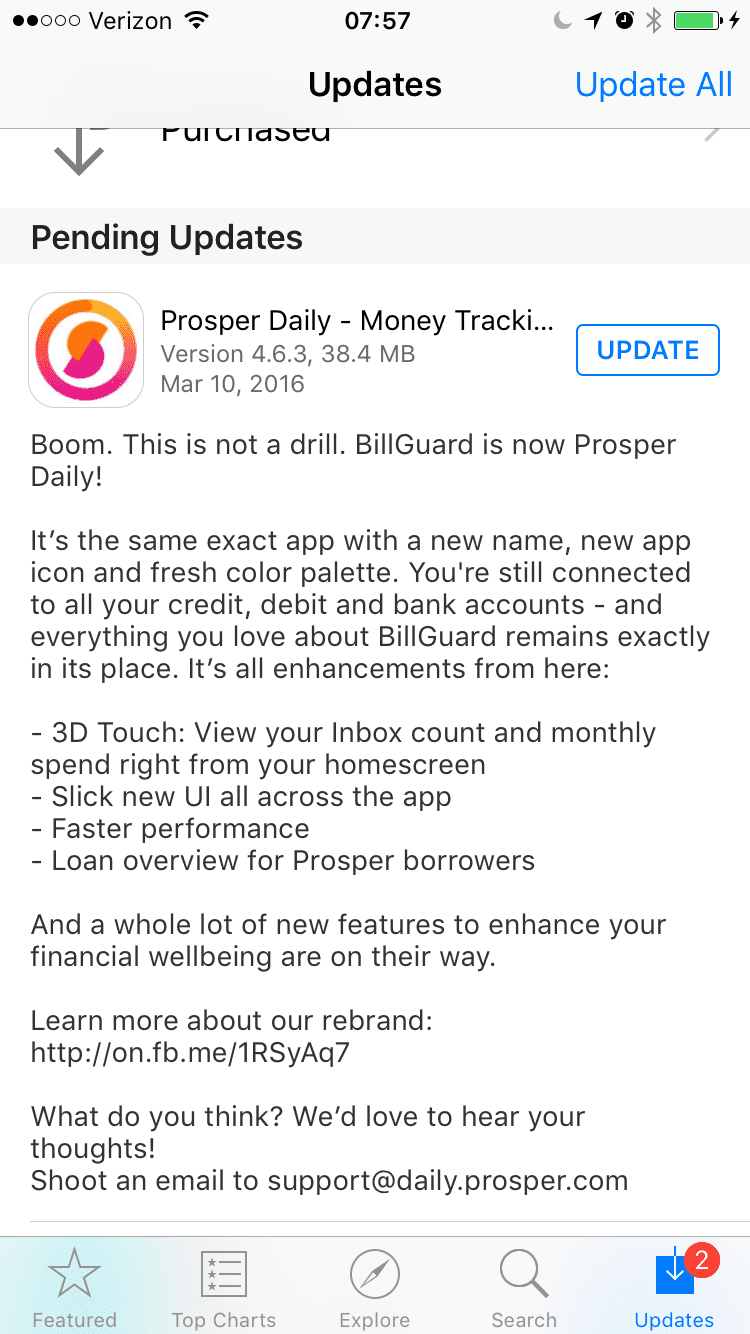

BillGuard users will be automatically migrated to the new platform automatically upon updating the app. The core of the app, which helps users flag suspicious charges, check their credit score, and track spending, is the same (aside from the rebrand). Today’s update brings added 3D Touch capability that lets users view inbox count and monthly spend from their home screen. Also new is a loan overview for Prosper borrowers.*

BillGuard users will be automatically migrated to the new platform automatically upon updating the app. The core of the app, which helps users flag suspicious charges, check their credit score, and track spending, is the same (aside from the rebrand). Today’s update brings added 3D Touch capability that lets users view inbox count and monthly spend from their home screen. Also new is a loan overview for Prosper borrowers.*

Today, cloud-accounting platform

Today, cloud-accounting platform

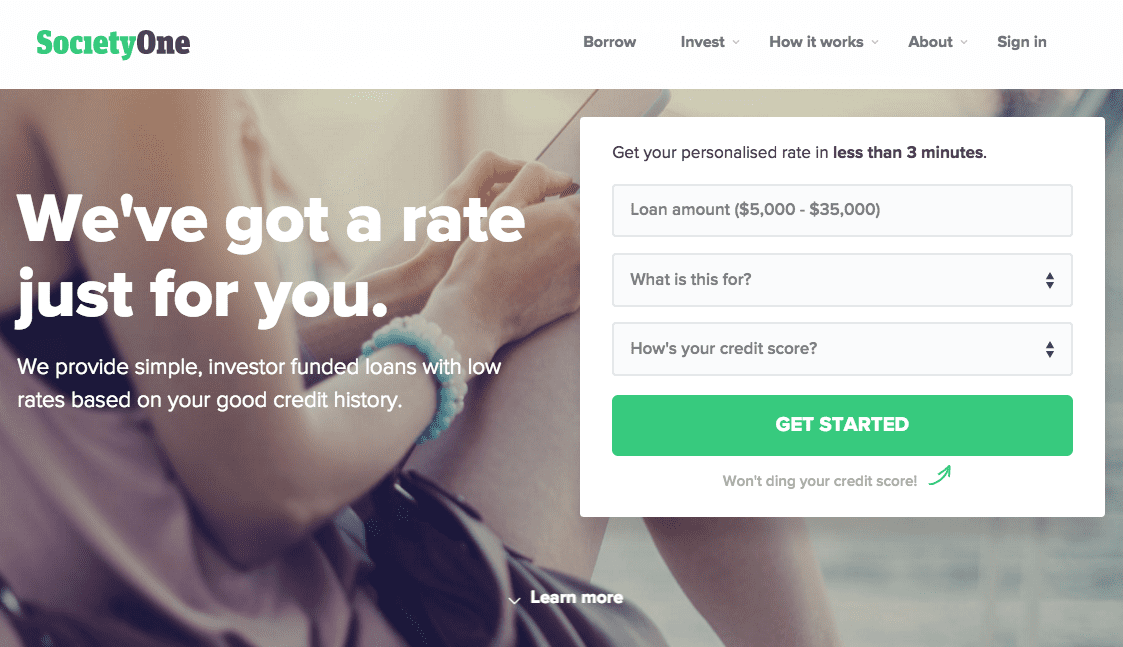

Australia-based P2P lender

Australia-based P2P lender