Australia-based P2P lender SocietyOne landed an all-star player for its newly-created chief investment officer position. The company has appointed John Cummins, industry veteran and former Westpac, RBS, and Macquarie employee to serve in the newly-created position.

Australia-based P2P lender SocietyOne landed an all-star player for its newly-created chief investment officer position. The company has appointed John Cummins, industry veteran and former Westpac, RBS, and Macquarie employee to serve in the newly-created position.

Cummins previously served as head of institutional markets at FIIG Securities. In his new role at SocietyOne, Cummins will manage the company’s funding requirements and be in charge of investor relations.

SocietyOne’s online platform uses risk-based pricing to connect borrowers and investors to loans using its ClearMatch technology, which it launched at FinovateAsia 2012. ClearMatch allows investors to bid together at different interest rates and amounts against a single loan.

Jason Yetton, who was appointed SocietyOne’s CEO in April 2016, said Cummins has “specialist knowledge of the fixed income and credit markets, which will be of critical importance to our future growth given the opportunities that we offer our growing base of investor funders to earn solid returns from a new asset class.” Yetton also mentioned Cummins will be key in growing the company’s borrower base to 100,000 within five years and increasing its share in the $100 billion consumer lending market.

Founded in 2011, SocietyOne has facilitated a total of $200 million in loans. Of that amount, $129 million was done in 2016 alone, which indicates a 320% increase in loan bookings in the course of a single year. The company recently took in a $1.5 million equity investment from Beyond Bank Australia, bringing its total funding to $55 million.

Somewhat ironically, the same day SocietyOne announced Cummins as its new CIO, U.S.-based alternative lender OnDeck announced it appointed SocietyOne’s former chief financial officer, Jerry Yohananov, to its management team. OnDeck most recently presented at FinDEVr New York 2016. At FinovateSpring 2012, the company debuted OnDeck Connect.

Malcolm van Raalte, CTO and Co-Founder

Malcolm van Raalte, CTO and Co-Founder

Guillaume Teixeron, Product Manager, VASCO

Guillaume Teixeron, Product Manager, VASCO

Matthew Pearch, Commercial Director

Matthew Pearch, Commercial Director

Balázs Zotter, Head of Product Line

Balázs Zotter, Head of Product Line

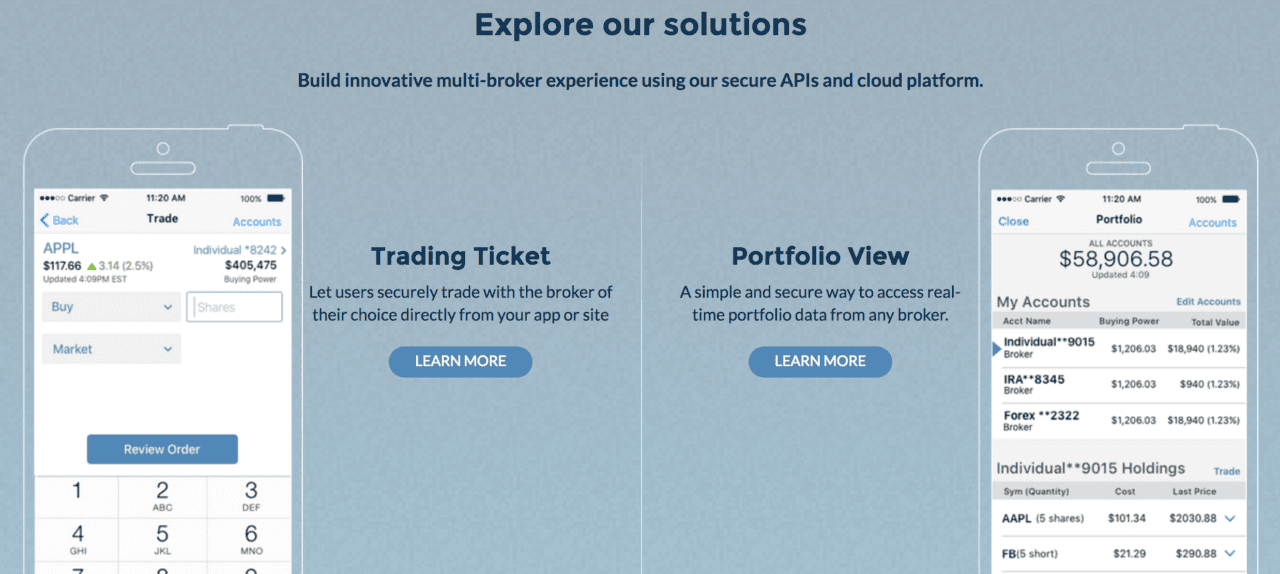

Prism’s bill presentment

Prism’s bill presentment