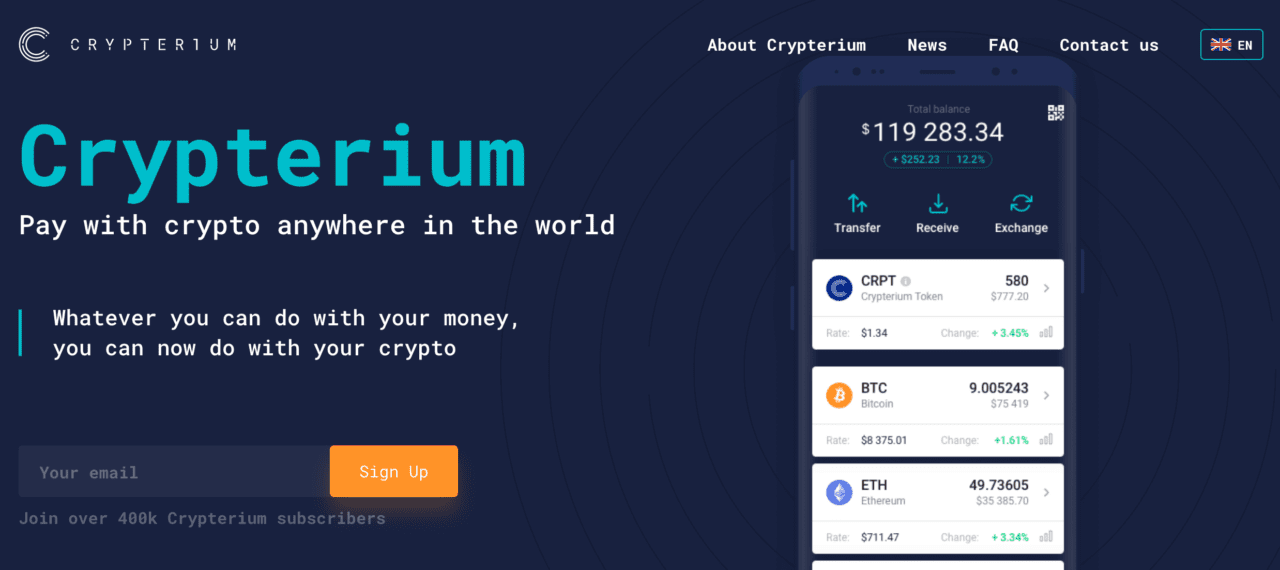

Crypterium, a company that turns cryptocurrencies into fiat money, launched an update to its first crypto-fiat solution today with a tool that allows users to top up their mobile phone balance.

The company’s mobile app, which launched in the Apple App and Google Play stores in March, aims to leverage existing in-store payment infrastructure, such as NFC terminals and QR code readers, to allow users to make instant payments in cryptocurrency with their smartphone. The company sees today’s development as a first step in that direction; it allows the nearly 3.5 billion prepaid mobile users across the globe to use their bitcoin balance to instantly top-up the balance on their mobile phone account.

To top up their account, consumers open the Crypterium app, enter their phone number, select the amount, and pay with bitcoin. The payment clears as soon as the bitcoin transaction settles. Users can also top up phone accounts of friends and family across the globe.

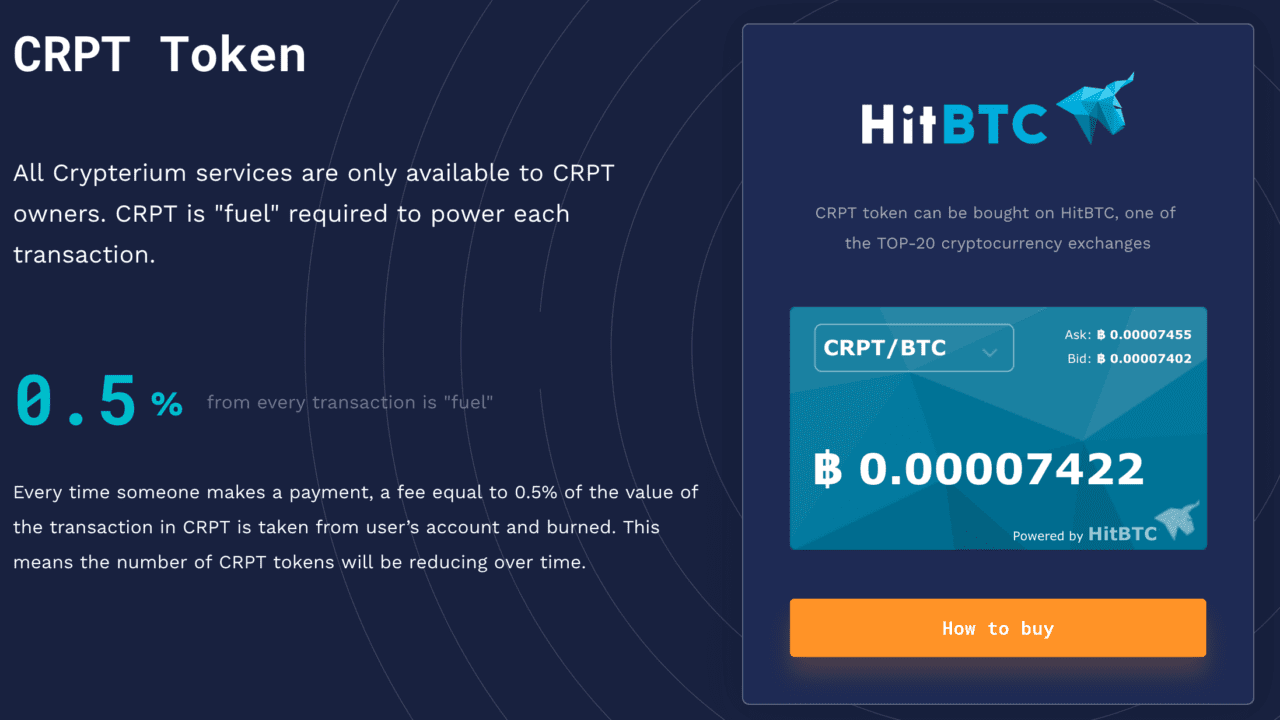

Because this is the first Crypterium app feature to implement a crypto-fiat solution, it is also the first to use Crypterium’s CRPT token, a cryptocurrency that is used as a fee payment device for transactions. The company describes CRPT as the “fuel required to power each transaction.” For each crypto-fiat payment, Crypterium’s smart contract technology charges 0.5% of the transaction value in CRPT.

Because this is the first Crypterium app feature to implement a crypto-fiat solution, it is also the first to use Crypterium’s CRPT token, a cryptocurrency that is used as a fee payment device for transactions. The company describes CRPT as the “fuel required to power each transaction.” For each crypto-fiat payment, Crypterium’s smart contract technology charges 0.5% of the transaction value in CRPT.

Crypterium is headquartered in Estonia and first listed its CRPT tokens on the HitBTC exchange in March. In May, the company appointed former CEO of Visa U.K., Marc O’Brien, as CEO. In addition to unveiling its newest offering at FinovateFall next month, Crypterium also plans to release its first IBAN solution, NFC payment solution, and release new crypto-fiat capabilities.