At a time of uncertainty in both politics and policy, an entreaty to think about “what’s possible” might sound naive—if not terrifying.

Yet, at the onset of FinovateFall 2025, which just wrapped up last week, thinking about “what’s possible” was the challenge laid down by Finovate VP and Master of Ceremonies Greg Palmer. And to the delight of our FinovateFall audience, it was a challenge that our demoing companies, keynote speakers, and insightful panelists were more than ready to accept.

What we heard from the experts

What’s possible … AI as a tool to empower and augment human action was an especially persistent theme over the three days of FinovateFall. In fact, even our pre-conference, invitation-only, Leaders+ event on Sunday evening featured a reminder that AI was increasingly the tool of choice for those under 30 when it came to a range of financial tasks from establishing a budget to making better credit decisions. Crucially, as J.D. Power’s Jennifer White pointed out, Gen Z is using AI for answers to more immediate questions, not exclusively for long-term planning. For them, AI is a co-pilot rather than a forecasting or projecting tool.

This sentiment was elaborated on by Alex Johnson of Fintech Takes in his Analyst All Stars presentation Tuesday morning. Johnson took on the notion of AI as a tool for automation, suggesting instead that AI—and Large Language Models (LLMs) more specifically—be thought of as ways to augment human activity rather than replace it outright. Johnson underscored LLMs as “probabilistic guessing machines” rather than “determinist systems,” and explained that to the extent that the latter is what’s required in financial services, LLMs alone can fall short.

That said, Johnson noted that by applying LLMs in ways that maximize what they are good at, financial institutions can leverage processes like mortgage servicing to better understand the diverse and even niche preferences of their customers. This data can be used not only to introduce new products and services, but also to scale up entire new businesses built around these edge cases.

No conversation about AI at FinovateFall would be complete without a reference to Jon Lakefish’s return to the Finovate stage for another mind-bending conversation on the latest AI tools. His Wednesday morning keynote—Creating Trust and Loyalty through AI-Enhanced CX—helped attendees understand the powerful resources available to not only build new products, but also to discover what new solutions are possible given a deeper, AI-enabled analysis of a business, its customers, and goals. In less than five minutes, Lakefish showed how a variety of readily available AI tools could enable, say, a Finovate sponsor, to uncover and pursue a new niche product line. From the latest innovations in ChatGPT—”the LLM platform for almost everything”—to Manus.AI, the first publicly available Agentic AI platform Lakefish has felt comfortable showcasing, the message was clear: the world of what’s possible is becoming larger every day and AI is a primary resource for navigating and creating within it.

One telling insight shared during our Investor All Star panel at the end of Day Three underscored the power and potential for AI when it comes to emerging fintechs, in particular. During a discussion on which trends investors were most drawn to, our panelists cited fraud prevention and compliance technology among the most attractive areas for investment, with personal finance management (PFM)-related solutions increasingly less so. Nevertheless, panelist Lindsey Fitzgerald of Vesey Ventures noted that even within this group, it was possible for truly innovative startups to stand out if they are able to deploy enabling technologies like AI in new and novel ways. “AI changes the possibility of a startup being 10x better (than its rivals) in any category,” she explained.

What we saw from the innovators

I have long contended that the roster of companies that win Best of Show at Finovate conferences in any given year is as good a heat check on the state of fintech innovation as you’re likely to find. This year’s batch of FinovateFall Best of Show winners was no exception.

By theme, FinovateFall attendees were impressed by innovations in a wide range of areas. Nevertheless companies innovating in the fraud prevention space probably experienced the greatest amount of on-stage competition—a point I’ll return to. Kudos to Casap for standing out from an impressive pack with its technology that helps combat fraud, including an especially pernicious form of e-commerce crime called “first-party fraud.” Founded in 2023 and headquartered in New York, Casap recently raised $25 million in Series A funding for its payment dispute resolution solution.

Arguably the most compelling case for financial institutions to offer services like investments came from Eko CEO Mart Vos. His company, now a two-time Finovate Best of Show winner, provides a solution that enables financial institutions to integrate digital investing functionality directly into their platforms. Vos warned banks and credit unions not to be complacent as their customers open investment accounts with innovative brokerages like Robinhood. While mere brokerages today, many of these firms are looking at ways of expanding their banking offerings, or obtaining banking licenses outright. By integrating investment services into their platforms and making them seamlessly accessible, financial institutions incentivize customers and members to keep their funds “at home.”

Enabling more qualified borrowers to secure funding is a cause championed by many innovative fintechs and it is no surprise to see two such companies among this year’s Best of Show winners. This year at FinovateFall, New York-based Krida demonstrated its AI intelligence layer for business lending. The company’s solution leverages AI to provide bankers with automated workflows for document collection, lead tracking, and data management. This enables new bankers to be more effective sooner and empowers all bankers to spend more time with their client relationships and less time with paperwork. Hailing from the other side of the country, Irvine, California-based LendAPI is a super orchestration platform that enables CTOs, CROs, and CCOs to work together to build enterprise platforms. At FinovateFall, LendAPI CEO Timothy Li demonstrated how to use the technology to launch a 1003 mortgage application in minutes. Both Krida and LendAPI are newcomers to the Finovate stage.

Another Finovate newcomer to take home Best of Show honors from FinovateFall last week was VerticeAI. The Atlanta, Georgia-based fintech provides credit unions and community banks with tools for predictive analytics, AI-powered marketing content, and targeted customer acquisition. The company began the year announcing new partnerships with Texas-based Education Credit Union and North Carolina-based Duke University Federal Credit Union.

Last but certainly not least, it was great to see the positive impression LemonadeLXP made on our FinovateFall audience last week. A Finovate alum since 2022 and, like Eko, now a two-time Best of Show winner, LemonadeLXP offers a learning experience and digital adoption platform for both the staff and customers of financial institutions. At the conference, the Ottawa, Canada-based company demoed its InsightAI solution which enables firms to develop and deploy their own employee training programs.

Where we go from here

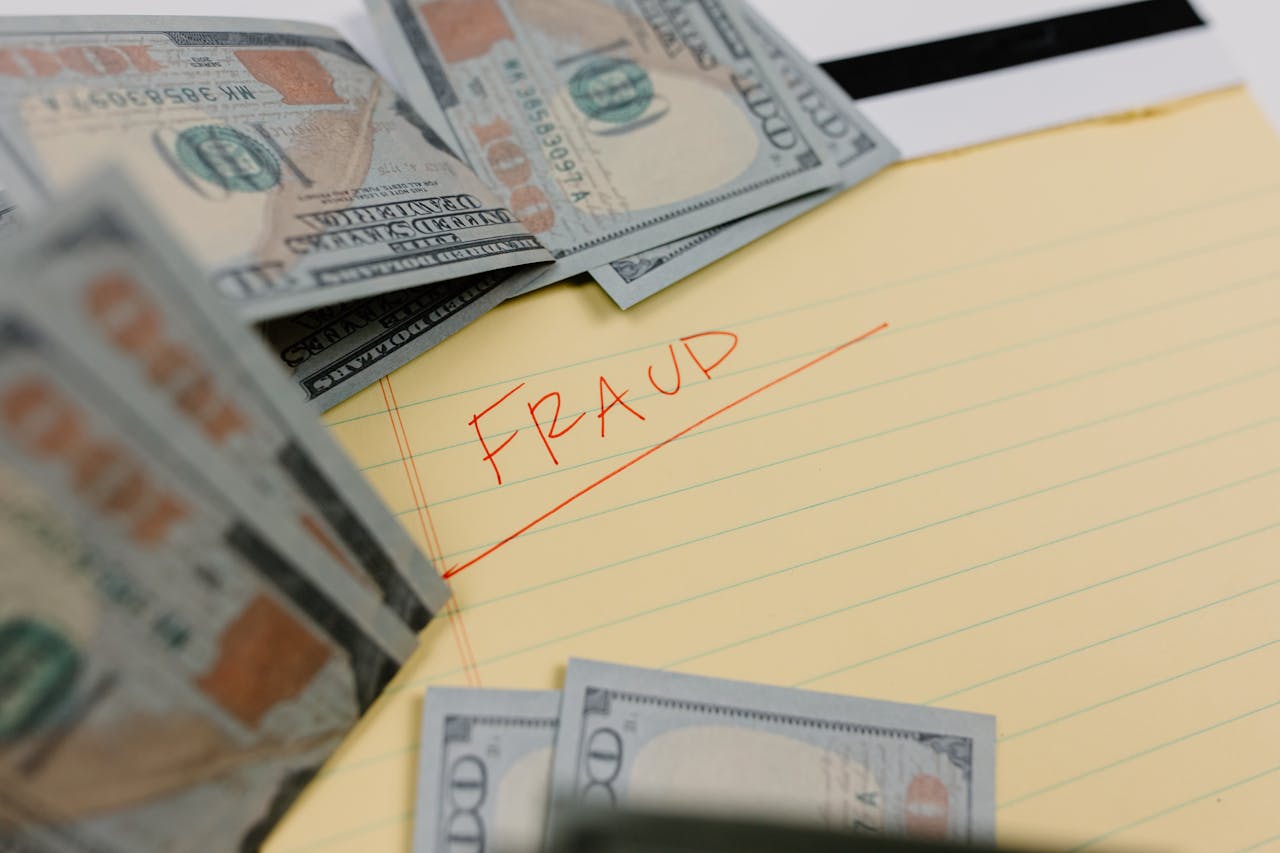

This year I was struck by the number and quality of solutions on display that were dedicated to fighting fraud and dealing with related concerns like dispute management and chargebacks.

Fraud prevention may not be the most glamorous corner of fintech. Fraud in the digital space is a persistent, if not growing, threat to all of us; someone very close to me lost their life savings in a phishing scam earlier this year. But it’s not something that we like to talk about very much. Victims feel shame. Institutions suffer reputational damage. Providers scramble to offer their own proprietary solutions. The fraud lifecycle, so to speak, is silent and siloed. And this makes fraud harder to fight.

Perhaps this is why some of the most novel technology innovations and business strategies are found among those engaged in the fight against fraud. Consider the aggressive deployment of AI to combat deepfakes or the increasingly common collaborations between institutions—particularly credit unions and community banks—to share best practices to keep their members and customers safe. At a time when personal security concerns are paramount—in financial services and beyond—it is heartening to know that so many of fintech’s best and brightest are on the case.