If financial institutions could ask one thing of technology, it might be improving the ease, speed, and security of customer on-boarding. After all, if there is too much friction here at this first impression, a bank may not get a chance to make a second one.

In its Finovate debut, on-boarding specialist

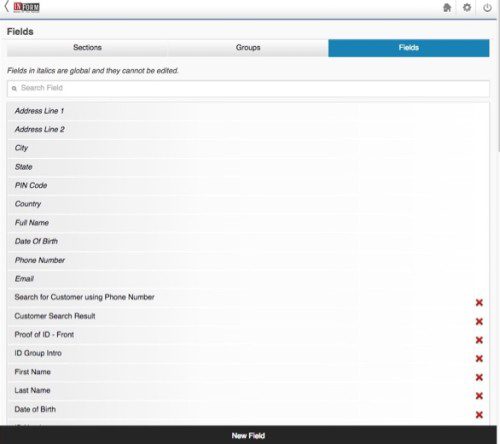

IDmission demonstrated its solution to this challenge: a fully-configurable, HTML, front-end application, INFORM. The technology allows users to build a variety of customized experiences without coding. Using the platform, users integrate document management, image processing, biometric authentication and KYC, payments and more into the documents they create.

“We are a platform that allows you to create your own experiences for on-boarding,” IDmission CEO Ashim Banerjee explained from the Finovate stage in February. “The idea is you define what product you have, what the data associated with that product should be, and what the data associated with that product should be in every different geography around the world.”

The Stats

- Founded in 2011

- Headquartered in Louisville, Colorado

- Has 70 employees in the U.S. and India

- Ashim Banerjee is CEO

The Story

IDmission recognizes the importance of taking advantage of the mobile channel to improve the on-boarding experience and make engagement more rewarding in general. The company is also well aware that on-boarding experiences can vary widely from one financial institution to another, to say nothing of the differences between regions or countries. A robust platform takes this into account, allowing FIs to make specific choices in the data they extract during the on boarding process.

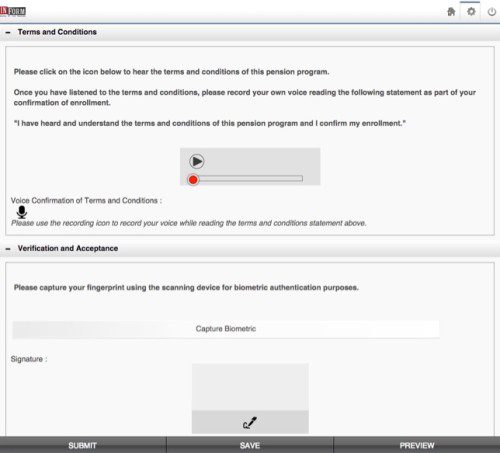

The sophistication of data types also needs to be taken into account. In addition to text fields, images, voiceprints, other non-typical data such as biometrics may be part of the FI on-boarding process. That information must be both easily applied to the form by the new customer, as well as easily extracted from the form by the FI.

Above: Select and customize from a variety of field options

One interesting use case highlights both the security and mobile aspects of the platform. A change in the regulatory environment in a country in Latin America meant new requirements for companies managing pensions. These changes included a move from paper to tablet-based applications, as well as the use of a voice recording to confirm understanding of the transaction, and a fingerprint (actually two, one from the applicant and one from the agent).

The new regulations were the very definition of friction in the on-boarding process. Yet IDmission was able to partner with a local firm to develop a product that met all the regulatory requirements, from the new role of the mobile device to the multiple biometric data points that had become key parts of the authentication process.

“The data you collect in the U.S. is not the same as the data you collect in the U.K. It is certainly not the same as the data you collect in Mexico and India and so on,” Banerjee insisted. “Therefore you need either a big IT team developing products for you all the time, or a configurable tool. That’s the choice we have taken.”

Above: Form fields can include biometric data, such as voice and fingerprint

The Future

IDmission’s Finovate experience was a positive one, according to the company. The range of countries represented, as well as the diversity of companies from small to very large also impressed the Finovate newcomers. The company CEO was interviewed at the event by Finextra, and IDmission is slated to present at the NACHA Payments 3D event in April. Looking further into 2015, IDmission’s main objective for is to grow the platform. “We are expanding aggressively into new markets,” CEO Banerjee said. “We are looking for partners and resellers in Brazil, Argentina, Malaysia, and Indonesia.”

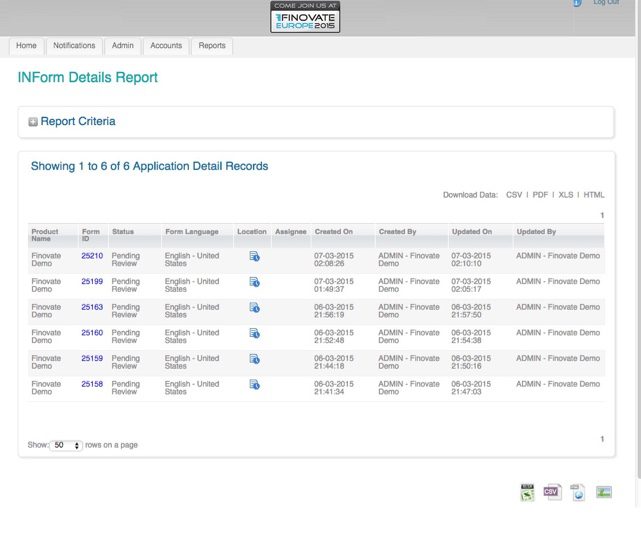

Above: Web-based detail report provides information on accounts.

Asked for a key takeaway about IDmission and INFORM, Banerjee highlighted three aspects. The first was the importance of being able to offer paperless automated on boarding worldwide, taking advantage of the growth of the mobile channel especially in developing areas in Asia and Latin America. Second was the idea that biometrics can be integrated into the on-boarding experience in a compliant and seamless way. And third, IDmission’s technology manages to be highly configurable without requiring programming knowledge to set up.

“We’ve been building technology platforms for the past twenty years,” Banerjee said, a point he repeated from the Finovate stage at the beginning of his company’s demonstration. “Perhaps even before the word fintech had come into the general vocabulary.” With any luck, and with more innovations like INFORM, IDmission will be here serving the fintech community for many more years to come.