Real-estate crowdlender, Patch of Land, has gone commercial.

Investors on the crowdlending platform will now be able to put their capital in commercial real estate opportunities instead of simply residential ones. Patch of Land said the addition of commercial real estate gives investors greater diversification, provides the opportunity for “consistent cash-flowing returns” and serves as a “complement” to the platform’s shorter-term residential real estate investment opportunities.

Patch of Land says investors can expect annual yields of between 6% to 10% with the commercial real estate, and terms of as few as 12 months and as many as 60 months are expected to be offered.

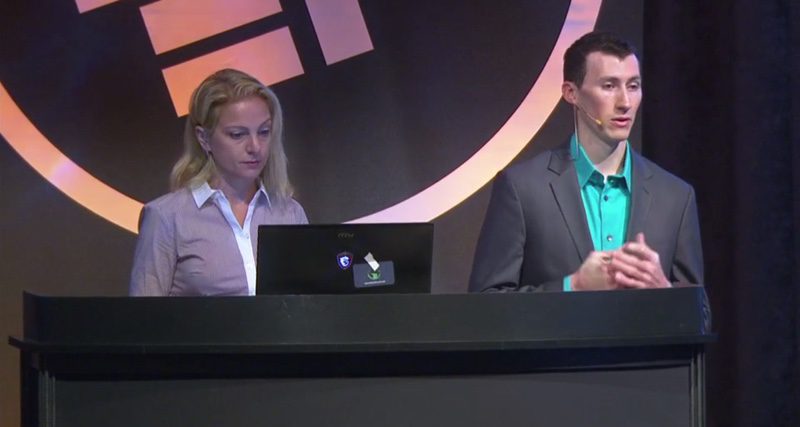

From left: Patch of Land CMO AdaPia d’Errico, and CTO Brian Fritton, co-founder, demonstrated the Patch of Land platform at FinovateFall 2014 in New York.

One of the largest real estate crowdfunding platforms in the United States with more than $32 million invested through the platform, Patch of Land is a peer-to-real-estate (P2RE) marketplace that connect accredited and institutional investors seeking asset-backed, high-yielding, short-term investments with borrowers looking for alternative funding sources.

Patch of Land was named to Entrepreneur magazine’s 100 Brilliant Companies to Watch 2015 earlier this year. The company raised $23 million in new funding in a round led by SF Capital Group in April.

Here are a few more metrics on Patch of Land since inception in October 2013:

- Total loans funded: $40,148, 500

- Number of loans funded: 134

- Total funds returned to investors: $6,866,745

- Average loan size: $301,110

Patch of Land has investments in 25 states including California, Texas, New York, Florida, Ohio, and Massachusetts. Just over half (56%) of the projects funded by Patch of Land have been single-family residential, with multifamily residential coming in second at 36%. It will be worth watching to see how these numbers change now that commercial real estate is available as an investment option on the platform.

Founded in February 2013 and headquartered in Los Angeles, California, Patch of Land demonstrated its crowdfunding platform at FinovateFall 2014 in New York.