There are few challenges greater for FIs than turning massive amounts of customer data into valuable insights on how to serve those customers better. “Everybody today seems to be focused on customer experience, and giving your customers whatever they want. But what is it that you are you getting from your customers?” Liferay Sr. Customer Experience Manager Henry Nakamura asked from the Finovate stage in September. “I bet you’re pretty overwhelmed by the amount of data that you have, and possibly pretty underwhelmed by the results. Where’s the payoff?”

Liferay helps banks create meaningful digital experiences for their customers. The company’s Digital Experience Platform (DXP) enables FIs to leverage the data and their existing systems to bring the right products and services to the right customers, as well as uncover new potential revenue and sales opportunities. Additionally, Liferay DXP ensures that the FI is able to deliver a consistent, digital experience from the PC to mobile “right through the front door of a brick and mortar location,” Nakamura said.

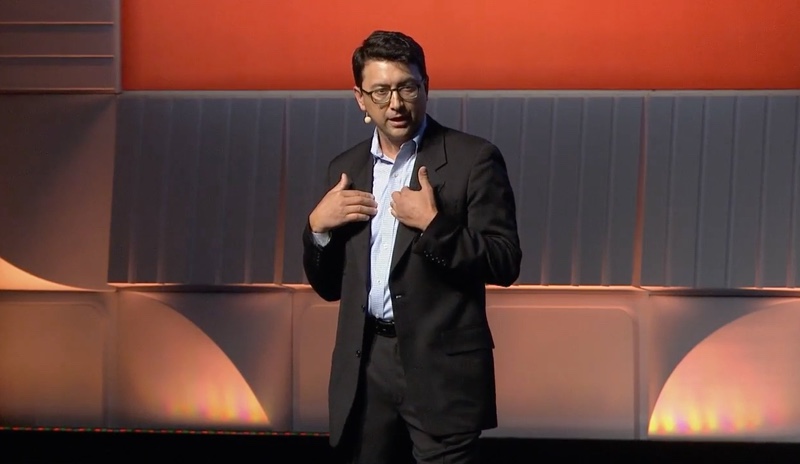

Pictured: Henry Nakamura, Sr. Customer Experience Manager, demonstrating the Liferay Digital Experience Platform at FinovateFall 2016.

At their Finovate debut this fall, Nakamura and Keval Mehta, Account Manager for Global Services, demonstrated the latest edition of the Liferay DXP platform. Among the features the two men presented was the platform’s audience targeting engine. This customizable feature enables advisors to set up rules to push relevant financial information and actionable planning advice to the client’s dashboard based on the their budgeting, saving, and investing behavior. Nakamura and Mehta also demonstrated a geolocation feature that enables financial service professionals to know the identity – and financial profile – of a customer as soon as they enter the branch.

Company facts

- Founded in 2004

- Headquartered in Diamond Bar, California

- Has 20 offices in 17 countries; 150 partners worldwide; 150,000 open source community members

- Bryan Cheung is CEO

We caught up with Henry Nakamura (pictured) the morning before FinovateFall and followed up with him later with a few questions by email. His responses and our questions are below.

We caught up with Henry Nakamura (pictured) the morning before FinovateFall and followed up with him later with a few questions by email. His responses and our questions are below.

Finovate: What problem does Liferay solve?

Henry Nakamura: Liferay’s Digital Experience Platform allows financial institutions to unlock valuable customer information and then take advantage of new insights to create more engaging customer experiences across channels and devices. In many cases, banks already possess a wealth of customer data that could be used to assemble more complete profiles of users to accurately engage with them as individuals. But too often that crucial data is scattered to the winds – or, in the case of many banks, siloed in disparate departments and systems within the institution.

This siloing creates an inability to properly understand customer data that would otherwise lead to actionable insights if only the information were collected and harnessed in one accessible location. On that same point, siloing prevents easy access to customer data when a bank – and/or its customers – has a need of it. Liferay’s platform is built to solve these pervasive problems in the financial services industry.

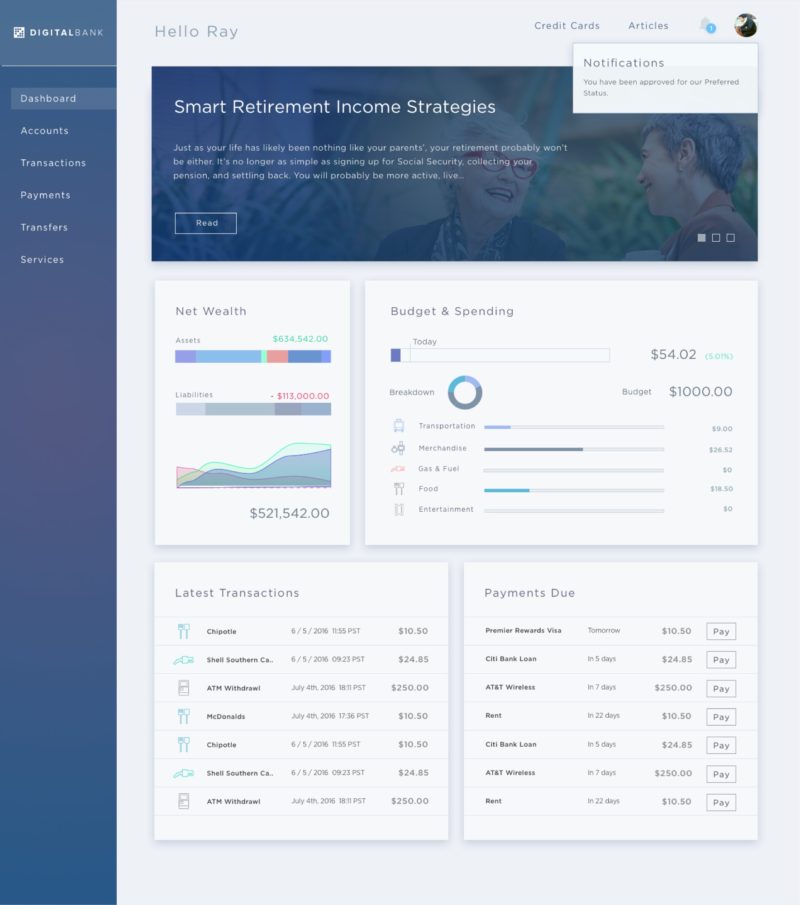

Pictured: Liferay DXP – Customer view – Financial Dashboard

Finovate: Who are your primary customers?

Nakamura: Businesses using Liferay (across all industries) are those seeking to drastically improve customer experiences through forward-looking digital transformation strategies. This is, of course, a particularly big deal among financial institutions. Technological change within industry organizations – and perhaps particularly when it comes to customer engagement technology – has historically been slow. But we’re now seeing significant growth in financial services organizations implementing Liferay’s solutions, from credit unions to regional banks to multinational banks. The need to address omnichannel continuity between a bank’s online, mobile, and in-brand experiences is becoming increasingly critical as a cohesive, engaging experience becomes the expectation of customers. Liferay’s customer trends certainly exemplify this industry-wide imperative.

Finovate: How does your technology solve the problem better?

Nakamura: Liferay offers banks the most complete set of organically developed features available on the market within a single, omnichannel, digital experience platform. Every aspect of our toolset is designed from the ground up to work together as a singular solution. Other vendor offerings tend to be Frankenstein-esque pieces of software made out of disjointed solutions that were acquired and then stitched together as best they could. In contrast, all features included in Liferay DXP have been purpose-built to function well alongside each other – and they do.

We provide a platform that, among other things, ties together customer information and experience across interactions. It’s also worth noting that Liferay DXP is highly (and easily) customizable, and works with existing technology investments and a bank’s legacy systems to build exactly what’s needed.

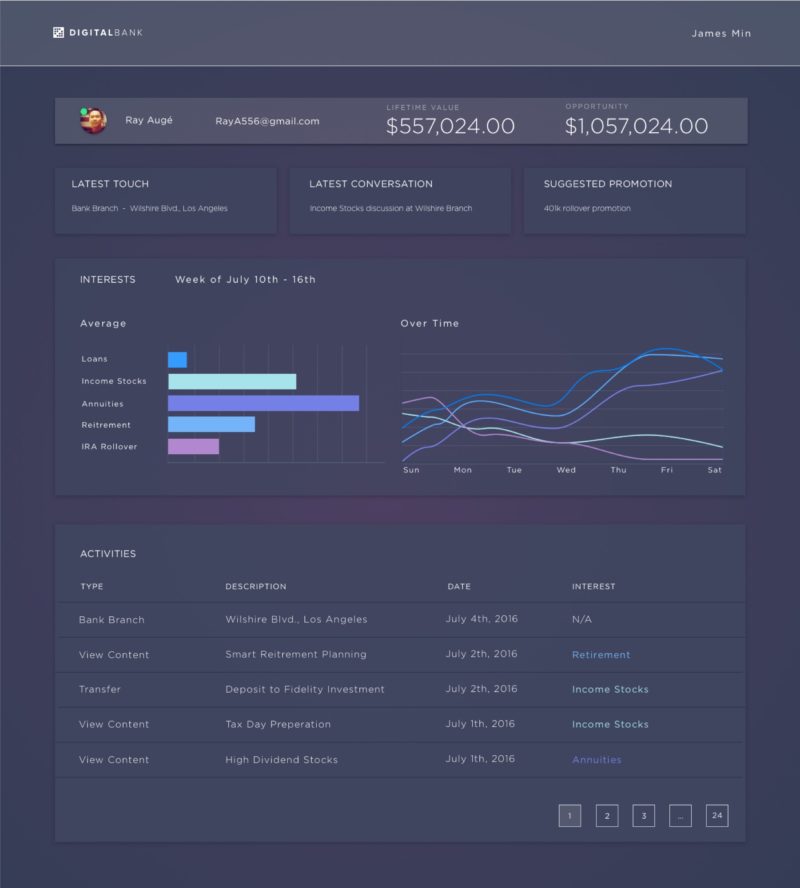

Pictured: Liferay DXP – Single Customer View – Teller View

Finovate: Tell us about your favorite implementation of Liferay’s technology.

Nakamura: U.S. Bank’s use of Liferay is a really interesting example of how Liferay DXP can resolve longstanding issues that have arisen from (all-too-common) disparate and conflicting internal systems. We’re proud that Liferay’s platform enabled this huge financial institution to offer a singular, consistent and effective user experience to its customers.

U.S. Bank’s Securities Services clientele had historically been required to log into multiple accounts across different sites (and complete manual processes) in order to access the data they needed. These multiple logins and non-uniform user experiences within applications made completing day-to-day activities much more difficult than they ought to have been. As a result (and as you might expect), customers avoided logging into these applications and were hesitant to adopt these tools – while demanding better ones that could streamline online interactions. With Liferay, U.S Bank developed Pivot, a single sign-on portal solution allowing all banking customers to interact based on their particular needs. User feedback has been very positive and adoption has increased.

Finovate: What in your background gave you the confidence to tackle this challenge?

Nakamura: We draw confidence from our experience and history of product and customer successes. Liferay has a uniquely rich heritage as a portal solution, having now been recognized as a Gartner Magic Quadrant Leader for seven years in a row. As an integration platform, we genuinely understand how businesses benefit when information and applications are seamlessly pulled together to create a single, unified user experience. We’re up for helping businesses solve that challenge every day.

CR2 Chairman Kieran Nagle praised both executives’ “strong track records and weighty experience within the financial services and financial technology sector.” In addition to his tenure at Mastercard, Byrne (pictured) previously served as Managing Director, General Manager, Europe; and VP Sales, UK and Ireland for Transaction Network Services. He also spent five years in sales and marketing at NCR. Byrne has degrees from Marist College and University of Limerick, as well as an MBA from the University College Dublin.

CR2 Chairman Kieran Nagle praised both executives’ “strong track records and weighty experience within the financial services and financial technology sector.” In addition to his tenure at Mastercard, Byrne (pictured) previously served as Managing Director, General Manager, Europe; and VP Sales, UK and Ireland for Transaction Network Services. He also spent five years in sales and marketing at NCR. Byrne has degrees from Marist College and University of Limerick, as well as an MBA from the University College Dublin.

Presenters

Presenters

Presenter

Presenter

Presenters

Presenters Paulina Powązka, Senior Business Solutions Consultant

Paulina Powązka, Senior Business Solutions Consultant

Presenters

Presenters Gonçalo Garcia, Head of Product

Gonçalo Garcia, Head of Product