In crypto, when the going gets good, the good go institutional.

Digital asset platform Coinbase has launched a set of new tools and resources designed to help institutional investors take advantage of the boom in cryptocurrencies. The solutions, as Coinbase General Manager Adam White described them in a blog post earlier today, represent the sort of “institutional grade products and services” that will enable FIs to participate in the cryptocurrency markets.

First up is Coinbase Custody. Designed in partnership with an SEC-regulated broker-dealer, Coinbase Custody provides secure crypto storage and third-party auditing and financial reporting validation. We first reported on Coinbase Custody last fall when the company announced that access to an early version of the technology would be available in 2018.

Second, Coinbase announced further development of its electronic marketplace, Coinbase Markets, with the launch of a new engineering office in Chicago. The company plans to leverage the area’s “large talent pool of engineers with deep exchange infrastructure experience” to add new features to Coinbase Markets, such as low latency performance, on-premise data center colocation services, institutional connectivity and access, and settlement and clearing services. The goal, White wrote, was “tighter markets, deeper liquidity, and increased certainty of execution.”

Third, Coinbase Prime will give institutional investors the specialized resources they need in order to effectively trade cryptocurrencies. This includes lending and margin financing for qualified customers, high touch and low touch execution services, as well as new market data and research products. Coinbase Prime will also feature multi-user permissions and whitelisted withdrawal addresses.

Last in the company’s suite of solutions launched today was the Coinbase Institutional Coverage Group. These sales, research, operations, and client services support professionals work exclusively with institutional clients and bring years of experience from companies like the New York Stock Exchange and Morgan Stanley, and agencies like the SEC and CFTC.

“The cryptocurrency market is maturing rapidly as more sophisticated institutional participants enter the space,” White wrote. He noted that 100 hedge funds have been created to speculate and invest in cryptocurrencies in recent months and that “some of the world’s largest financial institutions” have gone on record with plans to develop crypto trading desks.

Founded in 2012 and based in San Francisco, California, Coinbase demonstrated its Instant Exchange platform at FinovateSpring 2014. The company added its first Chief Technology Officer last month, appointing Balaji Srinivasan to the post as part of the its acquisition of digital currency startup, Earn.com. Also in April, Coinbase launched a new fund, Coinbase Ventures, to support early-stage crypto startups. With a valuation of $1.6 billion, Coinbase is one of fintech’s more recent unicorns (startups with more than $1 billion valuation) and the first bitcoin company to achieve unicorn status.

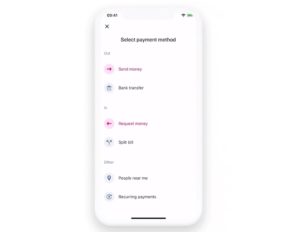

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.

To use the new feature, users with the latest version of the Revolut app select the People Near Me option from the Payments tab. Enable Near Me and choose your location sharing preferences. When the list of Revolut users appears, make your selection, choose “send” or “receive” and confirm the amount. Note that the person or persons on the other end of the transfer will need to have their Near Me screen open and select their location sharing preferences, as well.

Dynamics, Inc.

Dynamics, Inc.