JP Morgan Chase is more than halfway through its 5-year $30 million commitment to startup innovation in its partnership with CFSi’s FinLab. Each of the past three years, fintech startups have been invited to apply to the accelerator which is focused on finding financial solutions for low- and moderate-income consumers (for example, this year’s challenge).

JP Morgan Chase is more than halfway through its 5-year $30 million commitment to startup innovation in its partnership with CFSi’s FinLab. Each of the past three years, fintech startups have been invited to apply to the accelerator which is focused on finding financial solutions for low- and moderate-income consumers (for example, this year’s challenge).

So far, CFSi/Chase have invested $250,000 each in 24 for-profit companies for a total of $6.0 million (notes 1, 2). In addition, they’ve made two grants totalling $500,000 The investments (note 3) were made in June 2015, June 2016, and this month, so it’s too early to see how well the venture is at picking winners (official rules here).

We do know that two of last year’s class are already out of business, Bee and Remedy, a surprising result for companies winning a quarter-million investment from the third largest bank in the world just 12 months ago. On the other hand, the class of 2015 already has six early winners from the 9 investments (below), so things look good overall:

- Digit, the impulse savings app which has raised $36.5 million

- LendStreet, a marketplace-lending platform which has raised $28.25 million

- Ascend, the loan management service, which has raised $12.75 million

- Even, the income smoothing service, which has raised $12.25 million

- SupportPay, the child-support management app, which has raised $7.1 million

- Propel, the food-stamp support app, which has raised $5.4 million

Since the average investment is just 12 month’s old, it’s too early to judge CFSi/Chase’s seed-stage investing prowess. And that isn’t even the primary goal of the joint program with CFSI. But it’s always nice to turn a profit while doing good. Based on the excellent performance of its first class, we estimate that the venture is already sitting on a paper gain in excess of $1.5 million (note 3) across the 21 for-profit companies still in business, a 50% total gain on an average of $3 million invested. And they may have had some return of capital with the acquisition of Prism by PayNearMe.

Total Return (2015 to 2017)

Total invested: $6.0 million in 24 companies (note 2)

Total grants: $500,000 in 2 non-profits (note 3)

Total returned: 1 exit, unknown valuation

Total market value: $7.5 million+ (note 4)

Paper gain: $1.5 million+ (50% total gain on average of $3 million invested from July 2015 to date)

Results by cohort:

2017 Investments

Total invested: $2.0 million

Total market value: $2.0 million

Paper gain/loss: $0

Blueprint Income: Creating the future pension – a simple, pre-determined income stream backed by insurance companies.

Total funding: $250,000

Dave: Predicts your “7-day low” checking account balance and offers advances on your paycheck at 0% interest to help prevent overdraft.

Total funding: $3.25 million

EverSafe: Monitors seniors’ bank and investment accounts, credit cards and credit reports — serving as an extra set of eyes to detect fraud, scams, and identity theft.

Total funding: $250,000 (Finovate alum)

Grove: Personalized, comprehensive financial advice that is accessible and affordable.

Total funding: $250,000

Nova: World’s first cross-border credit reporting agency by building data partnerships across the globe.

Total funding: $250,000

Point: Home-equity platform giving homeowners cash today for a share of their home’s future appreciation.

Total funding: $250,000

Token Transit: Mobile app to quickly and easily pay for public transportation.

Total funding: $250,000

Tomorrow: Providing long-term financial security to busy millennials and working families.

Total funding: $2.85 million

2016 Investments

Total $ invested: $2.0 million + $250,000 non-profit grant

Total $ returned: 2 startups shut down, assume $0 return to investors

Total market value: $1.5 million

Paper gain/loss: ($500,000)

Albert: Mobile app that improves financial health with practical, actionable financial recommendations.

Total funding: $2.85 million

Value to Chase/CFSi: $250,000+

Bee: Mobile banking alternative to the under/un-banked (In process of shutting down)

Total funding: $4.85 million

Value to Chase/CFSi = $0

Earn: Non-profit leveraging technology to solve America’s savings crisis.

Total funding: $250,000

Value to Chase/CFSi: $0 (non-profit grant)

EarnUp: Platform that intelligently automates loan payments and identifies earning opportunities for the 200 million indebted Americans.

Total funding: $3.25 million

Value to Chase/CFSi: $250,000+

CreditHero: eCreditHero helps consumers fix their credit report errors for free.

Total funding: $250,000

Value to Chase/CFSi: TBD

Everlance: App for freelancers to automatically track their business miles and expenses.

Total funding: $250,000

Value to Chase/CFSi: TBD

Remedy: Protects people from medical bill errors and overcharges, saving the average family over $1,000 per year (shut down 14 July 2017)

Total funding: $2.15 million

Value to Chase/CFSi: $0

Scratch: Modern-day loan servicer that delivers a borrower-first experience.

Total funding: $250,000

Value to Chase/CFSi: TBD

WiseBanyan: Free financial advisor.

Total funding: $250,000 (Finovate alum)

Value to Chase/CFSi: TBD

2015 Investments

Total invested: $2.0 million + $250,000 non-profit grant

Total returned: 1 exit, unknown valuation

Total market value: $4 million+

Paper gain: $2 million

Ascend: Reduces risk on current loans and rewards the borrower by lowering interest payments for positive financial behaviors.

Total funding: $12.75 million

Value to Chase/CFSi: $500,000+

Digit: Automated savings tool that identifies small amounts of money that can be moved from checking into savings based on spending habits.

Total funding: $36.5 million

Value to Chase/CFSi: $1 million+

Even: Turns the inconsistent income of hourly and part-time workers into a steady salary.

Total funding: $12.25 million

Value to Chase/CFSi: $500,000+

LendStreet: Marketplace-lending platform that helps borrowers reduce their debt and rebuild their credit.

Total funding: $28.25 million

Value to Chase/CFSi: $1 million+

PayGoal: Non-profit workplace tool that enables financially underserved workers to improve their financial health.

Total funding: $250,000

Value to Chase/CFSi: $0 (non-profit grant)

Prism: Comprehensive bill payment and management app that helps people better manage their personal finances. In early 2016, Prism was acquired by fintech company PayNearMe.

Total funding: $3.8 million

Value to Chase/CFSi: Exited at unknown price

Propel: Simplifies the food stamp application process by streamlining the initial enrollment form.

Total funding: $5.4 million

Value to Chase/CFSi: $500,000+

Puddle: Reduces risk on current loans and rewards the borrower by lowering interest payments for positive financial behaviors.

Total funding: $250,000

Value to Chase/CFSi: TBD

SupportPay: Automated payment platform that enables parents to share child expenses and exchange child support.

Total funding: $7.1 million

Value to Chase/CFSi: $500,000+

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as Principal of BUX Advisors, a financial services user-experience consultancy.

Notes:

- We only know that Chase is a “founding partner” in the $30 million effort. We don’t know if Chase is the sole investor, or merely the lead. And we don’t know what happens with any investment gains, whether they go back into CFSi’s balance sheet or accrue to Chase and any other investors involved.

- It appears that the companies are each offered a $250,000 convertible note. But we don’t know the overall terms, how many companies accept the financing, or if they are all $250,000. For the sake of this post, we are assuming everyone takes the full $250,000. We also don’t know if Chase is earmarking part of the $30 million commitment for add-on investments. So far, there are no public record of add-on investments in the 26 companies.

- Non-profits receive restricted grants of $250,000.

- Since none of the companies have revealed valuations in their subsequent financings, to value Chase’s stake, we are assuming a 2x valuation on A-rounds and a 4x valuation on B-rounds.

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

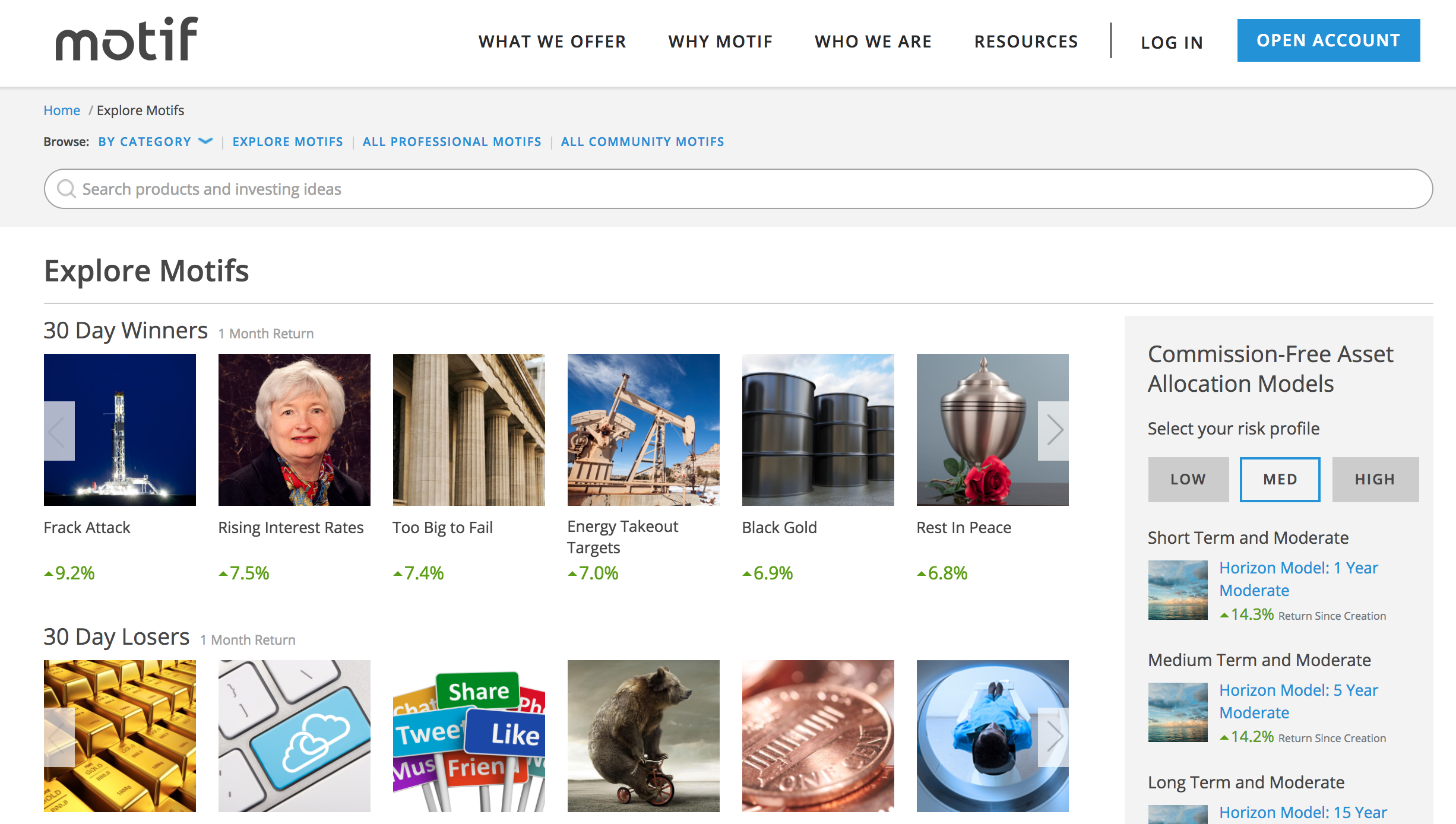

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

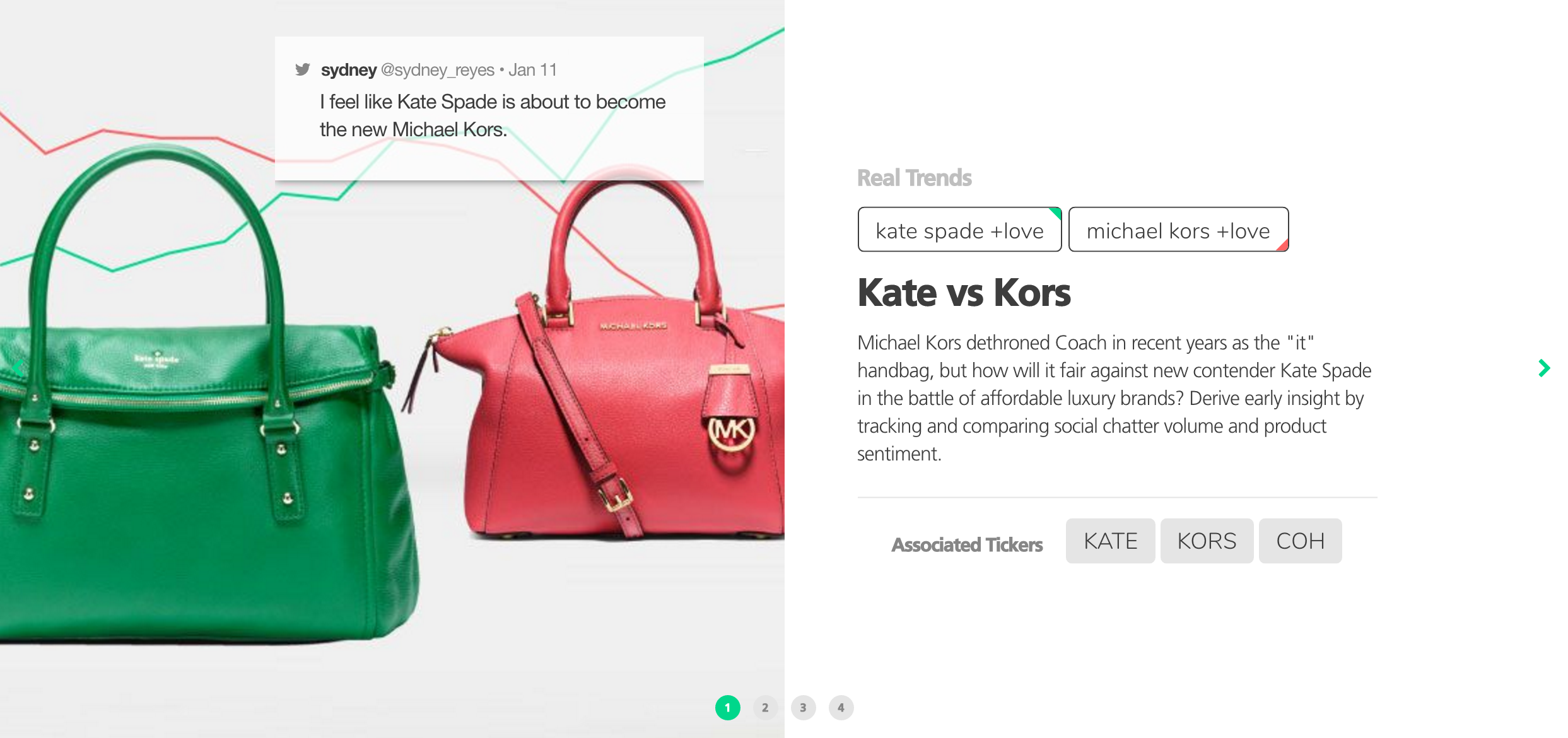

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme TickerTags helps users discover trends even before they become news

TickerTags helps users discover trends even before they become news