Not letting any grass grow beneath its feet in the wake of the U.S. Justice department’s decision to block its acquisition by Visa, fintech infrastucture company Plaid has since launched its FinRise incubator to support early-stage founders who are members of ethnic minority groups.

“While technology has come a long way to level the playing field, the reality is that many minority-owned businesses are still frequently denied access to some of the most basic resources needed to start and grow their businesses,” Nell Malone and Bhargavi Kamakshivalli wrote on the Plaid blog when the program was announced in January. Highlighting in particular the plight of African-American owned businesses as noted in a report from the Small Business Administration, Malone and Kamakshivalli wrote: “It is a shared responsibility to help power a financial system that works for everyone, and we recognize that one way to achieve that is to support and promote a diverse ecosystem of entrepreneurs.”

All this makes today’s announcement that FinRise has chosen the first companies to participate in its accelerator program that much more exciting for supporters of financial inclusion and diversity. Out of more than 100 applications, five early-stage fintechs were selected, offering solutions in everything from identity verification and authentication to financial wellness and lending.

The qualifications for consideration were startups with at least one founder who is African-American, indigenous, or a “person of color,” has two or more employees, and is post-seed, pre-Series B in its funding status. The members of the incoming class are below:

Global Data Consortium: a global identity verification API that provides KYC and eKYC services for businesses

Guidefi: a financial wellness marketplace to help members of ethnic minority groups connect with “vetted, culturally-attuned” financial advisors

OfColor: a financial wellness program that offers personalized PFM and loans to help ethnic minority employees maximize their 401(k) contributions

Walnut: a point-of-sale lending platform that works with healthcare providers to make it easier for patients to pay for their medical bills

Zeta: a financial wellness company that specializes in PFM solutions for couples and families

FinRise begins with a three-day bootcamp of workshops covering issues ranging from regulatory and policy concerns to marketing and communications strategy. After the bootcamp, startups will be paired with Plaid mentors to help them further develop and scale their products. The nine-month program consists of workshops and networking opportunities with accelerator partners, as well as discounts on services offered by Plaid network partners. Even those startups not selected for the accelerator this session will be eligible for discounts and credits from companies supporting the program.

FinRise’s network partners include: Alloy, AWS Activate, Brex, Fintrail, FS Vector, Hummingbird, Very Good Security, and Zendesk.

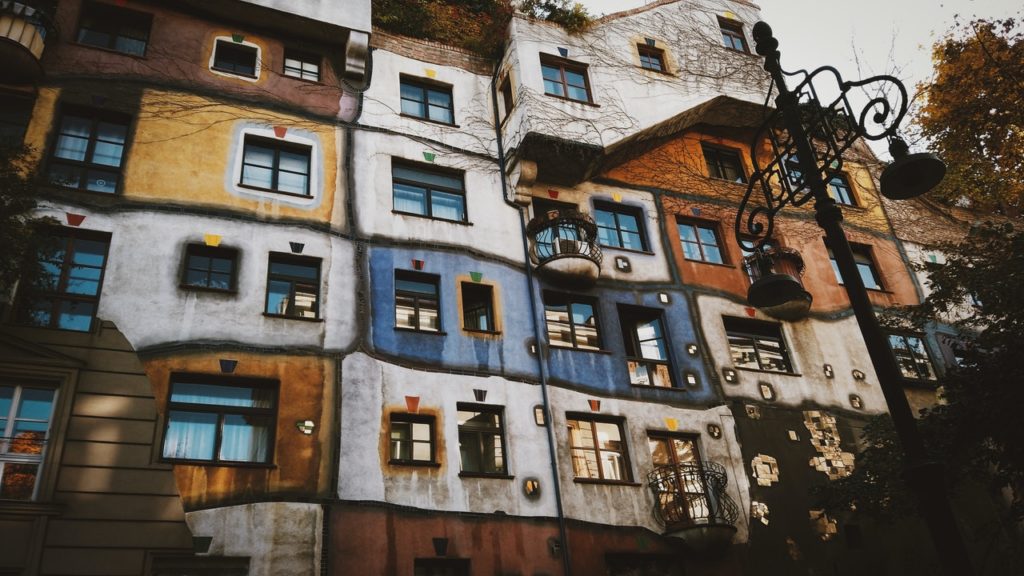

Photo by RF._.studio from Pexels