This week’s edition of Finovate Global takes a look at recent fintech developments in Germany.

German fintech Bling launched its SavingsTrees solution this week. The new offering helps German families invest sustainably starting with as little as €1 a month. The solution is offered in partnership with wealthtech Evergreen, and represents an evolution in Bling’s product line, expanding from its origins as a family money management educational app and prepaid card.

“Simplicity and sustainability were paramount in the development of our investment offering,” Bling CEO and co-founder Nils Feigenwinter explained. “We prioritize families in our product development to offer a tailored solution that meets their needs. Everyone underestimates the market potential of families, which is why banks have neglected this area for decades. With Bling, we are addressing this.”

Cost savings was one of the reasons why Bling reached out to Evergreen. Cost is also one of the main reasons why more than 80% of German parents do not invest in the country’s capital markets, according to Bling. The complexity of investing and a lack of knowledge about investment products also have contributed to this lack of participation. To this end, Bling leverages visualizations and explanations from finance experts to make the investment process easier to understand.

Funds invested in SavingsTrees are globally diversified and are allocated specifically to sustainable investments. Direct investments in sustainable projects and companies, are available, as are investments in funds that support sustainability initiatives.

Read more about Bling in this TechCrunch profile from December.

Banxware, an embedded lending technology provider headquartered in Germany, has teamed up with Netherlands-based Rabobank to help SMEs secure the financing they need in order to grow. Rabobank will take advantage of Banxware’s embedded lending solution, which enables businesses to apply for short-term financing in as little as 15 minutes. After approval, funds can be available in the borrower’s account within 24 hours.

“This partnership brings Embedded Financing products tailored to the need of SMEs to popular business platforms,” Banxware CEO Miriam Wohlfarth said. “Together with Rabobank we now provide the full financing supply chain, including funds and end-to-end loan management to bridge cash flow shortfalls before they become an issue.”

The deployment will let business founders and owners apply for financing in familiar, everyday digital environments such as e-commerce platforms and booking software. Each firm will focus initially on marketing the solution in their home markets of Germany and the Netherlands, respectively.

Banxware’s partnership announcement follows news that the Berlin-based fintech had teamed up with liquidity management and financial planning company Agicap. Based in France, Agicap helps businesses automate, manage, and forecast their cash flows. Via its strategic partnership with Banxware, Agicap will add access to quick and tailored growth capital to its liquidity management offering.

“From now on, (SMEs) can not only see and manage their cash flows in a centered way, but they can also get new money when there are opportunities for growth,” Agicap Country Manager DE Stephan Krehl said.

Founded in 2020, Banxware is headquartered in Berlin. The company has raised $15 million (€14 million) in funding from investors including Varengold Bank and Element Ventures.

Finovate is proud to showcase fintech innovations from companies headquartered in Germany. This includes hosting our annual European fintech conference in Berlin in 2020.

Here’s a quick list of some of the Germany-based companies that have demoed their fintech innovations on the Finovate stage over the years.

- aixigo

- ayondo

- Bitbond

- BörseGo

- Cash Payment Solutions

- Coconet

- collectAI

- Device Ident

- Ecolytiq

- figo

- Fincite

- FinTecSystems

- Fintura

- HAWK:AI

- iBrokr

- IND Group

- Kreditech

- Mambu

- Modifi

- NDGIT

- Nextmarkets

- Open Bank Project (OBP)

- payever

- Payworks

- Pockets United

- Risk Ident

- Scalable Capital

- Smartify.it

- SOFORT

- SwipeStox

- TeamViewer

- TESOBE

- Vaamo

- YUKKA Lab

Here is our look at fintech innovation around the world.

Middle East and Northern Africa

- Egypt-based fintech Axis launched its new digital payments platform, AxisPay

- Dubai Islamic Bank launched its DIB ‘alt’ product, a new digital umbrella brand for the bank’s digital offerings.

- UAE-based B2B fintech solutions provider FOO introduced its prepaid travel card and white label digital wallet.

Central and Southern Asia

- India-based digital lender Lentra raised $27 million in a Series B extension round.

- BNE Intellinews profiled Uzbekistani SME lender, Oasis.

- India’s PayU partnered with Visa and Yes Bank to launch its Business Payment Solution Provider program.

Latin America and the Caribbean

- Argentina-based mobile banking company Uala launched a new saving account offering in Mexico.

- Brazil’s Nubank reached one million accounts in Mexico milestone in one month.

- Lanistar introduced crypto trading on its app for users in Brazil.

Asia-Pacific

- Singapore-based B2B payment infrastructure platform Thunes raised $60 million in Series C funding.

- International payments software provider OpenWay launched a second hub in Vietnam.

- Wise platform inked its first Japanese partnership, teaming up with GMO Aozora Net Bank.

Sub-Saharan Africa

- Nigerian fintech Flutterwave forged a partnership with account-to-account (A2A) payments company Token.io.

- International payment solutions company Unlimit secured license to operate in Kenya two months after expanding to Nigeria.

- Harvard Business Review asked and answered the question “What African Fintech Startups Can Teach Silicon Valley About Longevity?”

Central and Eastern Europe

- Klarna brought its Pay in 3 offering to Romania this week.

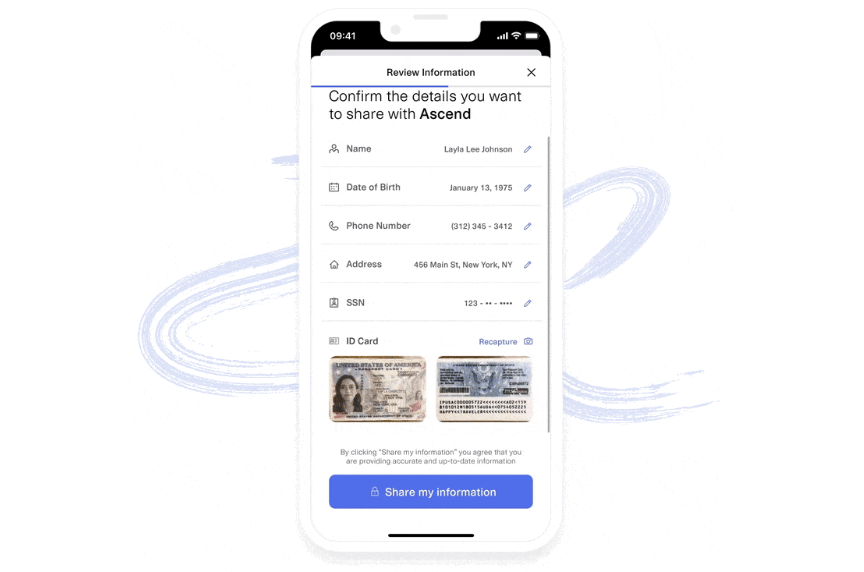

- German identity verification company IDnow added automated document liveness capabilities, financial risk checks, and more to its platform.

- International development agency USAID partnered with Albanian business solutions provider CBS to launch, Lores Plus, a platform to help Albanian SMEs get access to financing.