How they describe themselves: Cymonz provides software and business processes to easily integrate a currency exchange and international payments service into your business. Banks, financial companies, and established brands using the Cymonz application can easily offer a branded online currency exchange and international payments service to their clients.

Cymonz is delivered as a software as a service, is extremely quick to launch and allows providers to either integrate direct with our liquidity and payment partners or manage this themselves.

The business processes, developed from over 20 years experience in the industry, that are built into the system greatly reduce operational costs and risk.

How they describe their product/innovation: The Cymonz application includes a client transactional website and the back office management application with specific currency and international payment business processes, customization and integrations. The application addresses a wide spectrum of needs, including client management, currency transactions, risk management, settlements and compliance.

Cymonz integrates with third party applications and can be configured to allow for liquidity, payments, customer service as well as anti money laundering, marketing and support tasks.

iOS and Android applications are also available along with the ability for you to white label your currency application and provide it to your partners to increase currency and payment flows.

Contacts:

Bus. Dev., Press & Sales: Simon Lynch, CEO, [email protected], +64 21 883 844

How they describe themselves: TraitWareID™ is a patent pending process that authenticates the identity of an end user and certain digital personality traits on their mobile device. This provides real-time, in-transaction authentication of the person and device. Combined with PhotoAuth, our patent pending image-based activation method, ease-of-use and heightened security allow only the registered user to access sensitive data, or initiate financial transactions.

How they describe their product/innovation: TraitWareID simplifies and secures access to protected web sites and applications by employing the user’s mobile device as a login token, eliminating the use of inconvenient and problematic usernames and passwords. TraitWareID does this with patent-pending technology, which begins with user authentication, then binds the user’s identity to their device. TraitWareID utilizes digital identity mapping to analyze the user-created content of the authentication device.

Adding the patent pending, user friendly, PhotoAuth image-based activation method to TraitWareID will enhance the security and user experience for transactions of all types on an end user’s device.

Contacts:

Bus. Dev.: Harlan Hutson, President, [email protected],

Tina Henson, Bus. Dev. Director, [email protected]

Press: Marc Gendron, MarComm PR, [email protected]

Sales: Tina Henson, Bus. Dev. Director, [email protected]

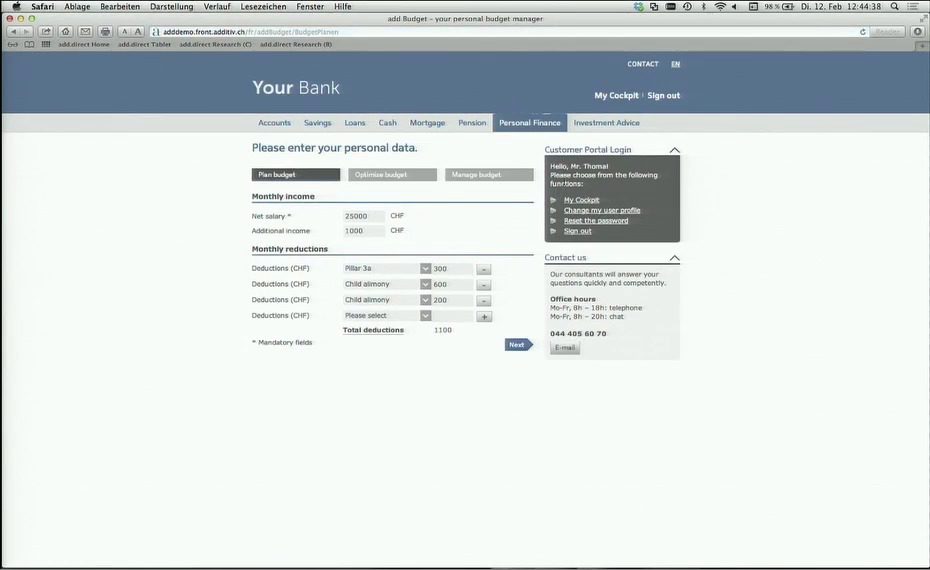

How they describe themselves: additiv is a Swiss software company providing bank 2.0 solutions based on its superior add.direct platform. add.direct was awarded the Banking IT-Innovation Award 2012. It allows customers and banks to handle and manage banking business faster, easier and cheaper.

How they describe their product/innovation: With add.direct we solve two major issues in banking today:

- Costs! add.direct allows for a major step in the industrialisation of banks by automating the mid- and front-office processes. It enables a true end-to-end business process along the complete customer journey.

- Differentiation in the marketplace: add.direct allows for a highly improved customer experience along all touchpoints and is the basis for serious 2.0 banking.

Contacts:

Bus. Dev., Press & Sales: Michael Stemmle, CEO & Founder, [email protected], +41444056070

How they describe themselves: Akamai® is a leading cloud platform for helping enterprises provide secure, high-performing user experiences on any device, anywhere. At the core of the company’s solutions is the Akamai Intelligent Platform™ providing extensive reach, coupled with unmatched reliability, security, visibility and expertise. Akamai removes the complexities of connecting the increasingly mobile world, supporting 24/7 consumer demand, and enabling enterprises to securely leverage the cloud. To learn more about how Akamai is accelerating the pace of innovation in a hyperconnected world, please visit akamai.com or blogs.akamai.com, and follow @Akamai on Twitter.

How they describe their product/innovation: Akamai’s Kona Site Defender is the first cloud-based Web security solution to help financial services institutions protect against both large scale denial of service and sophisticated application-layer threats seeking to compromise their brands, applications and associated data. Web based attacks have been on the rise, with Financial Services being one of the primary targets of criminal, political, and chaotic actors. These attacks can cost institutions millions in lost transactions and business productivity each year, and even higher losses in their brand value and reputation. With the introduction of Kona Site Defender, real-time web security monitoring, adaptive rate controls and other powerful features are bundled into a single, always on, cloud-based solution that can protect an institution’s most critical online business functions.

In a unique demonstration, Akamai will command agents and attack servers across the Internet to launch attacks commonly directed at financial services sites (including SQL injection, slow HTTP post, and denial of service attacks) at a pair of live demonstration banking sites on the public Internet one in the clear, and one protected by Kona Site Defender. The demonstration will show how these attacks can compromise an unprotected site and how Kona Site Defender is able to detect and mitigate these attacks automatically, live, in real-time. The demonstration will feature innovative adaptive rate control and real-time Web security monitoring security technologies.

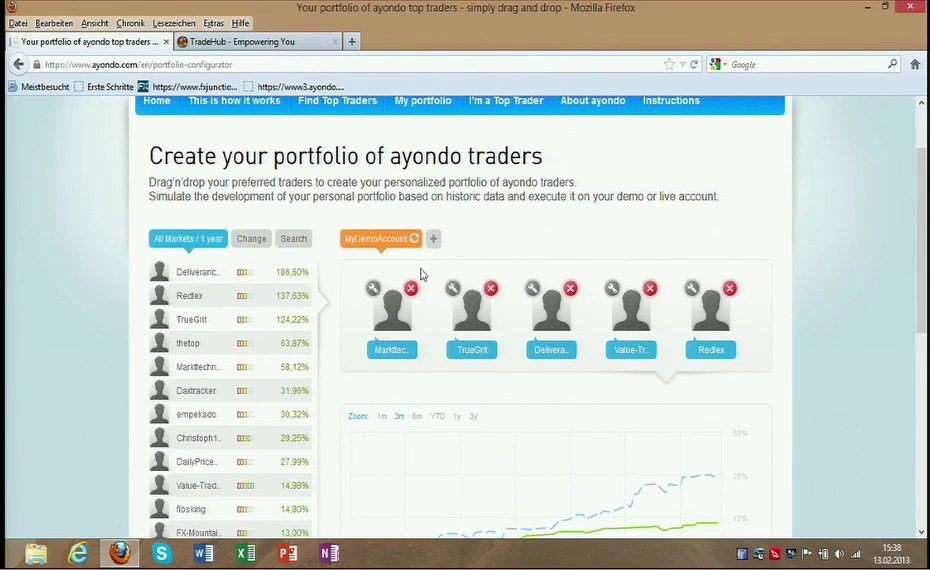

How they describe themselves: The best traders. Now on your account. The idea is temptingly simple: Why should we make trades ourselves if we can get the best day traders on our accounts automatically? Doing away with fees such as issue surcharges, transaction costs, and management and deposit commission? Build your own portfolio of top traders and change them as often as you like – for free!

How they describe their product/innovation: The third generation of ayondo brings social trading to a complete new level in terms of usability, social interaction, and guidance of top traders.

Contacts:

Bus. Dev.: Manuel Heyden, CEO, +49 69 9999 941 50

Press: Alexander Surminski, CMO, +49 69 9999 941 50

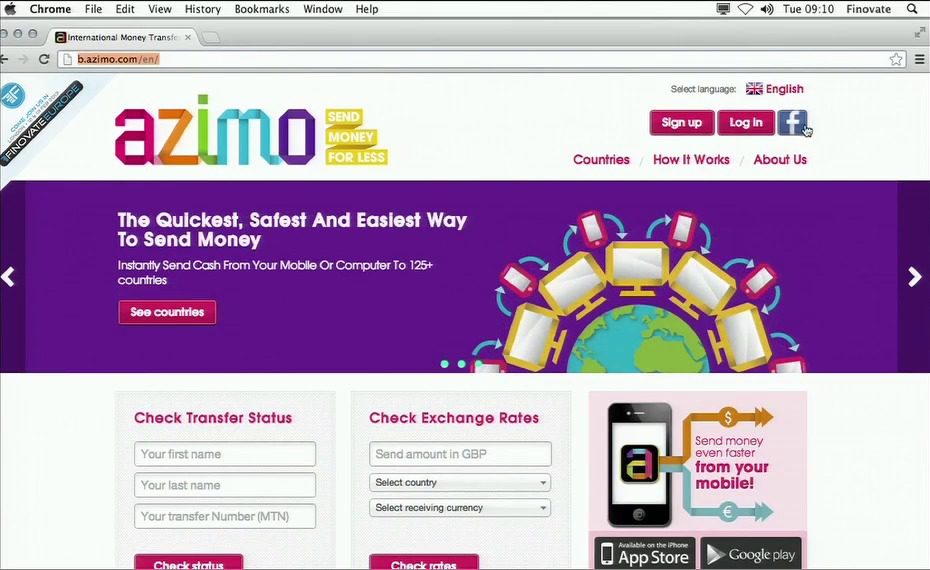

How they describe themselves: Azimo is a digital international money transfer service. We offer a simple, secure, fast, and inexpensive way to send money from a mobile or PC to friends and family in over 125 countries around the world.

Recipients can receive funds to any bank account or from over 150,000 cash collection points. Senders can fund their money transfer with a debit card or bank account using their social media account to speed up the process.

How they describe their product/innovation: Social sending – the ability to send funds to 125+ countries via mobile or PC using Facebook.

Contacts:

Bus. Dev.: Michael Kent, Founder & CEO, [email protected]

Press: Kirsty Jarvis, [email protected]

Sales: Marta Krupińska, [email protected]

How they describe themselves: Backbase is a software company specialized in Bank 2.0 Portal Software. The Backbase Bank 2.0 Portal empowers financials to create a new customer-experience layer that streamlines their online customer interactions across multiple devices (e.g. desktops, tablets and smartphones).

Within the Backbase Bank 2.0 Portal, you can unify content, data, and functionality from the underlying back-end systems into a seamless customer journey and target relevant information to your customers based on their preferences and behavior.

Unlike traditional IT vendors, Backbase has created a business-driven portal solution that makes portal management easy for e-business professionals. This means less programming and easy configuration of portal pages, resulting in faster time to market and more flexibility to optimize online channels with less IT support.

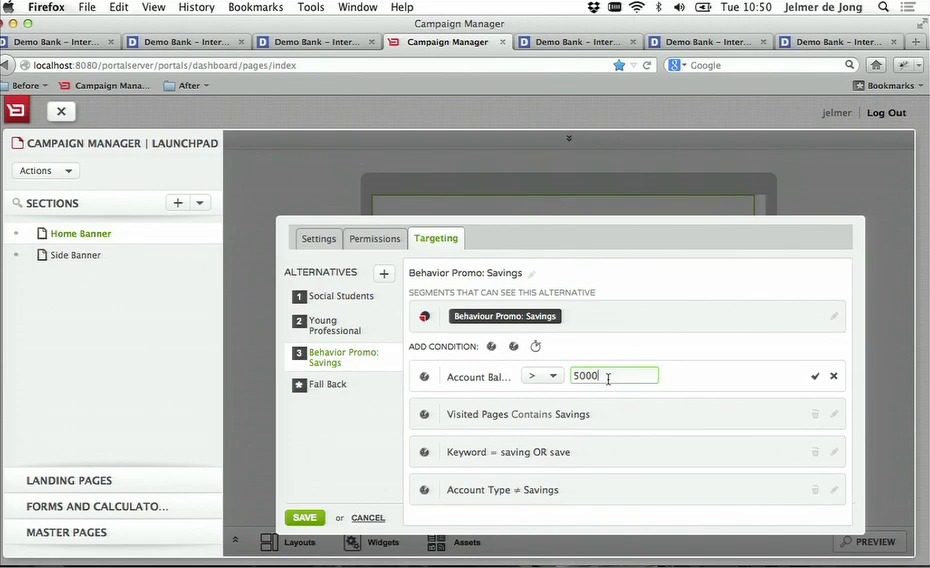

How they describe their product/innovation: Backbase is demoing Backbase Digital Marketing, a new module within Backbase Bank 2.0 Portal. With Backbase Digital Marketing, banks get the option to easily create and manage:

- Cross- & up-sell campaigns

- Lead generation campaigns

- Closed loop marketing

- Loyalty features

The Backbase Digital Marketing module does not only work on regular desktop browsers but is optimized to work in a multi-channel setting (from desktop to tablets and smartphones). Backbase Digital Marketing can be used in any existing website or Internet Banking platform, offering banks a simple point solution to start working with Backbase Bank 2.0 Portal.

Contacts:

Press: Jelmer de Jong, Global Head of Marketing, [email protected], +31 6 230 260 12

Sales: Frank Uittenbogaard, EMEA Sales Manager, [email protected], +31 6 51 0000 41

How they describe themselves: BBVA is a global group that offers individual and corporate customers the most complete range of financial and non-financial products and services. It enjoys a solid leadership position in the Spanish market, where it first began its activities over 150 years ago. It also has a leading franchise in South America; it is the largest financial institution in Mexico; one of the 15th largest US commercial banks and one of the few large international groups operating in China and Turkey. BBVA employs 117,500 people in over 30 countries around the world, has more than 47M customers and 900,000 shareholders.

For many years BBVA has been known for investing in innovation and development in different areas such as: new technology (e.g. new ATMs and self-service), new delivery models (internet banking, new retail models, electronic payments, etc.), social media (communities, social media presence, etc.), and a long list of projects pursued by its innovation center and innovation teams.

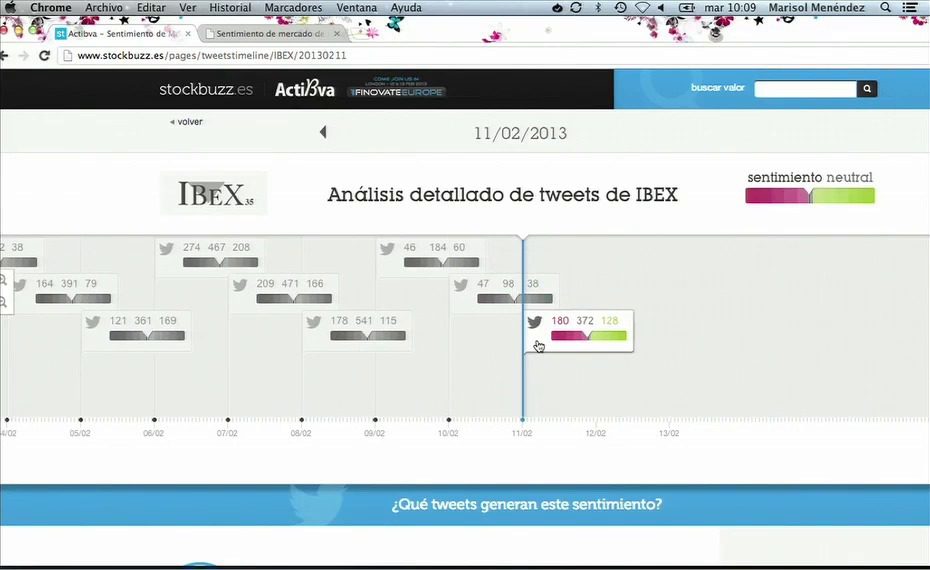

How they describe their product/innovation: To find out if the “market sentiment” expressed in Twitter is correlated with actual market behavior, we at BBVA have launched Stockbuzz (stockbuzz.es). This is a site where the user can view the sentiment that Twitter users feel on the IBEX 35 and the securities that make up the index, and compare it with their actual share price on the stock exchange. The website is user friendly, easily understandable and attractive. It shows graphs and data based on the information that is posted on Twitter, but also promotes interaction with this social network, as it contains a section where site visitors can leave their own messages on the analyzed stocks.

Contacts:

Bus. Dev., Press & Sales: Jose Antonio Gallego, [email protected]

Marisol Menendez Alvarez, [email protected]

How they describe themselves: Biletu is your new way to organise events and share the expenses between friends and pay for it using your smartphone.

How they describe their product/innovation: All-in-one, state-of-the-art app to join events, chat, gamification, mobile payments and social networks together in a simple way. Biletu is a new, simple way to allow users to connect and for companies to engage innovatively with targeted users.

Contacts:

Bus. Dev., Press & Sales: Felipe Millan, Founder & CEO, [email protected]

How they describe themselves: Birdback enables consumers to link apps to their existing payment cards. We provide a platform for advertisers and retailers to create and link loyalty programs, offers, digital receipts etc. to payment transactions. We partner with retailers, financial institutions and advertisers to deliver effective card-linked solutions. We’re headquartered in the heart of London and have offices in Paris and Copenhagen.

How they describe their product/innovation: Our technology platform enables features such as loyalty programs, offers and automatic receipts to run on consumers’ existing payment cards. This is made possible through a simple plug & play API that retailers and advertisers can easily use to link their applications to payment cards. Birdback’s API handles security, compliance and privacy aspects of card-linking. Card-linked applications range from traditional cash-back schemes to virtual gaming currency redemption. Birdback is demoing a use-case of its REST API at FinovateEurope 2013.

Contacts:

Bus. Dev.: Halim Madi, Bus. Dev. Director, [email protected]

Press: Morten Jensen, Marketing Development Director, [email protected]

How they describe themselves: The BörseGo AG is a privately held company focused on bringing financial information and well-grounded research to retail customers. With godmode-trader.de, we operate the most popular internet portal for technical analysis in German speaking countries. At the same time we develop innovative software solutions for banks, issuers and brokers while also providing editorial content for these partners. Based on these two main pillars of our business, we are in the unique position of being able to structure databases, websites, brokerage solutions, and mobile apps in such a way that they meet the needs of both ends of the market.

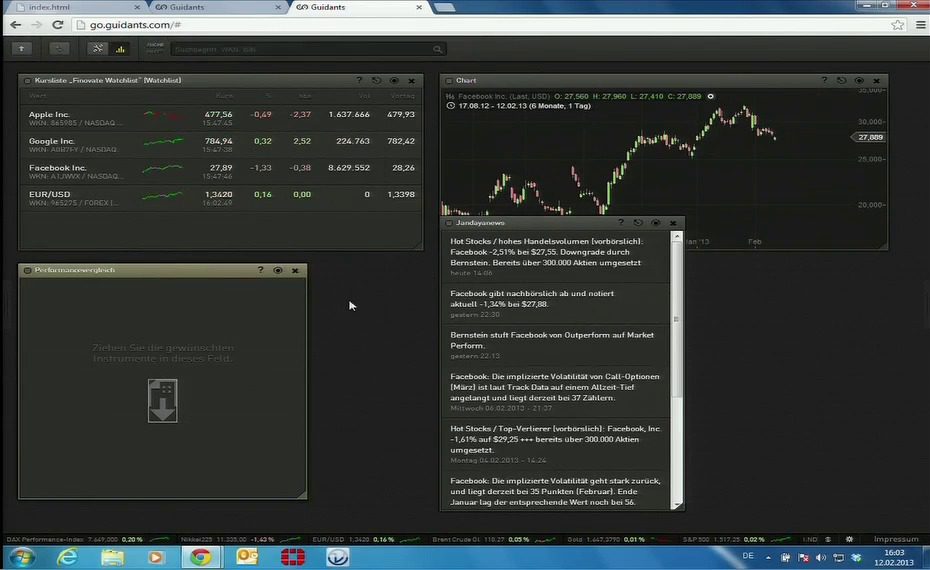

How they describe their product/innovation: Guidants (guidants.godmode-trader.de) is a unique html5 based platform to access any imaginable kind of financial information and calculations. Guidants comprises more than thirty small widgets the user can freely add, arrange and save on his workspace. Each such widget has one task like displaying a chart, the fundamentals of a stock, showing a video stream or giving direct access to a broker. The user can modify each widget according to his needs (size, content, appearance) and connect single widgets with others so that they interact with each other. All widgets make use of real-time push technologies and thus life up to the heightened requirements of our information society.

Guidants is free of charge although users can subscribe for premium content and additional widgets.

Contacts:

Bus. Dev.: Thomas Waibel, CIO & Co-Founder, [email protected], +49 (89) 767369 – 200

Press: Désirée Biedermann, Press Officer, [email protected], +49 (89) 767369 – 135

Sales: Daniela Meister, Head of Sales, [email protected], +49 (89) 767369 – 130

How they describe themselves: Cardlytics is the leader of the cutting-edge field of transaction-driven marketing™, expected to grow into a multi-billion dollar global industry. Cardlytics’ solution enables financial institutions to deliver rich, relevant rewards to their customers based on previous shopping behavior, while fully protecting their privacy. The platform is purely “pay for performance” with advertisers targeting consumers based on holistic spend patterns from debit, credit, ACH and bill pay transaction data. The company’s targeted advertising platform assesses US $500B-worth of transactions (25% of durable personal consumption) and UK over £64B worth of transactions.

How they describe their product/innovation: Cardlytics’ latest innovation is a Facebook app, initially launched from an online banking session, containing a rewards summary page showing all available offers. The innovation is a working prototype with a release available to banks in Q2 2013.

Contacts:

Bus. Dev. & Sales: Jason Brooks, Managing Director UK, [email protected]

Press: Andrew Lewin, Fishburn Hedges, [email protected]