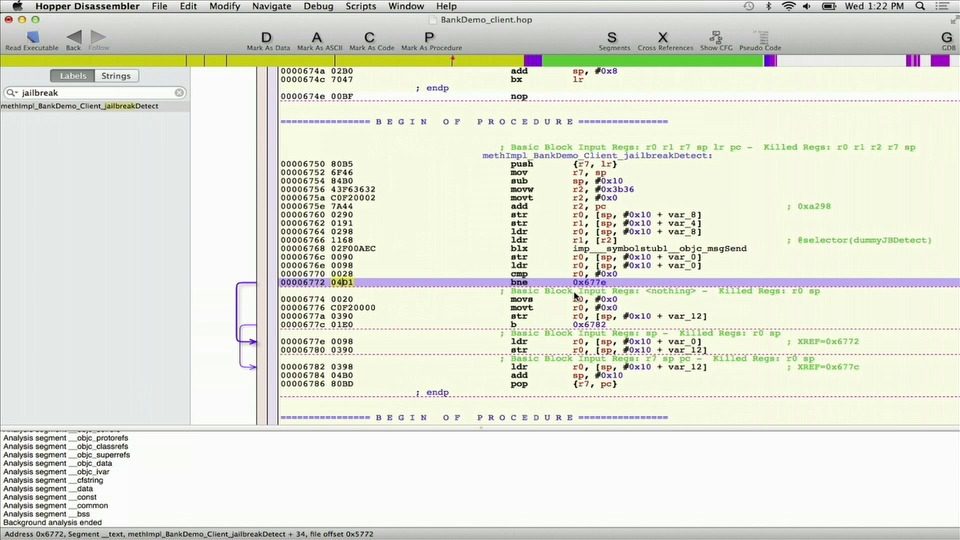

How they describe themselves: Arxan protects the Global App Economy from attacks in distributed or untrusted environments with the world’s strongest and most deployed application integrity protection products. Arxan’s patented ‘Guarding Technology’ is embedded directly into apps enabling them to proactively protect their own integrity with customized defend, detect, alert, and react security capabilities. Arxan’s self-defending and tamper-proof apps are deployed on over 200 million devices by leading Fortune 500 organizations in high-tech, ISV, financial services, digital media, gaming, healthcare, and other enterprises.

How they describe their product/innovation: Arxan’s Mobile Application Integrity Protection™ products deliver critical defense and shielding at the application layer with static and active self-defend and tamper-proof attributes. By deploying Arxan protected apps, financial institutions can launch advanced and feature-rich mobile financial services with confidence. Our state-of-the-art ‘Guards’ are small units of object code that “lockdown” applications with multiple and performance sensitive protection against attacks such as: malware, fraud, data breach repackaging, unauthorized access, IP theft, removal of security or critical business logic; all of which would have significant consequences for financial institutions.

Contacts:

Bus. Dev: Jukka Alanen, VP Business Development, [email protected], 650-861-9659

Press: Jodi (Jyoti) Wadhwa, VP Marketing, [email protected], 301-968-4290

Sales: Tom van Gorder, VP Worldwide Sales, [email protected], 301-968-4290

How they describe themselves: As our tagline states, authenticID is “True Identity Made Simple.” Our solutions work worldwide – and our pictureID solution is 100% accurate – a claim no other identity verification product can make. Traditional identity analytic companies’ solutions leave holes that allow ID Fraudsters to easily penetrate their defenses, as reflected by the skyrocketing increase in new account and account takeover fraud in 2012. authenticID takes a completely different approach by creating highly innovative solutions that are immune to commonly deployed fraud schemes.

How they describe their product/innovation: authenticID’s identity authentication solution, pictureID, annihilates ID Fraud. It is the only system that’s invulnerable to fraud schemes. Our unique agreement with DHS allows pictureID to connect with all document issuers in the US and Canada. This enables financial institutions and telecoms to go directly to the source for identity authentication. Unlike identity data analytic providers – we don’t “guess”. We provide absolute ID confirmation since document issuers’ records are unique to every citizen. There’s no way to trick pictureID – it returns a picture of the real consumer on file with the document issuer – with 100% accuracy.

Contacts:

Bus. Dev.: Andrew (Andy) Patrick, VP Business Development, [email protected],

855-825-4343 x 103

Press: Ria Romano, CEO, RPR Public Relations, Inc., [email protected], 786-290-6413

Sales: Courtney Lee, Director Sales, [email protected], 855-825-4343 x 105

How they describe themselves: Balance helps financial advisors, loan officers & private bankers drive revenue growth, improve client engagement and scale service delivery with a powerful suite of client facing technologies.

Our white-labeled digital workspace application includes common PFM features, bill payment, file sharing and much more in a white labeled SaaS admin suite to enable financial service teams to more easily leverage digital technologies to service their clients.

How they describe their product/innovation: Wealth management and private banking represent a great opportunity for financial institutions looking to increase revenue. Competition for affluent clients is heavy and most FIs lack sufficient client facing technology to deliver exceptional client experiences that help attract, engage and retain affluent clients while also helping to scale service delivery.

Our new digital workspace application is a simple and effective way to create a custom workspace for collaborating with clients & colleagues. With Balance, service professionals can create a simple client facing workspace in minutes for sharing files, financial data and managing projects while improving the efficiency and effectiveness of their service offerings.

Contacts:

Bus. Dev., Press & Sales: Devin Miller, CEO, [email protected], 425-458-4400

How they describe themselves: Banno’s enabling technologies unlock unrealized financial opportunities. Through Banno’s proprietary data-enrichment and interpretation processes, financial service providers and their customers can identify, engage and retain their most valuable relationships.

How they describe their new innovation/product: Banno Kernel enables financial institutions to leverage the way consumers interact with their business by delivering on the promise of true one-to-one marketing. Kernel positions the next best product to each individual consumer based on interest, across any channel. It exposes a modern web API for integration across all channels – online, mobile, ATM, e-statements and more. Through a real-time dashboard, financial institutions receive an exact picture of the next best product for each individual user. Kernel continues working the lead opportunity throughout any channel on which the user chooses to engage.

Contacts:

Bus. Dev. & Sales: Charles Potts, President, [email protected], 678-575-0971

Press: Heather Sugg, Account Supervisor & Regional Manager, William Mills Agency, [email protected], 954-854-6203

How they describe themselves: BBC Easy offers cloud-based software that automates the collection of financial data from borrowers. Data is read directly from borrower accounting systems and is used to provide financial insights to lenders on the risk and trends of their commercial borrowers.

How they describe their product/innovation: BBC Easy reads lender-specified data directly from the borrower’s accounting systems for verifying loan compliance and financial viability. BBC Easy also fully calculates the borrowing base certificate for borrowers saving massive time for lenders and borrowers. It is mind-bogglingly simple to use for lenders and borrowers and provides brilliant growth potential for commercial lenders.

Contacts:

Bus. Dev.: James Walter, CEO, [email protected], 206-922-4502

Press & Sales: Corey Ross, VP Sales, [email protected], 206-922-4502

How they describe themselves: Better ATM Services is a technology innovator with patented technology that leverages the latent capacity of the world’s existing fleet of more than 2 million ATMs. This technology enables ATMs to load, activate and dispense specially designed prepaid cards just like cash directly from ATM cash trays. Our current product line includes ATM-dispensed Visa prepaid gift cards and Discover multi-merchant cards. We are partnered with the world’s major ATM deployers, ATM manufacturers, card brands and card payment networks to capture a share of the more than $549 billion loaded onto prepaid cards in 2012.

How they describe their product/innovation: We’ve bridged the gap between ATMs and prepaid cards! Better ATM Services worked with major card payment networks to develop thinner, yet durable 3-panel cards that can roll through ATM cash mechanisms, yet function like normal payment cards at point-of-sale terminals. We also worked with major ATM manufacturers to develop very minor modifications that allow existing ATMs to select, load, activate and dispense these new cards. This new card design is now approved for use by financial institutions throughout the U.S. and international approvals are underway. Financial institutions can now automate their prepaid programs through their existing ATM fleets.

Contacts:

Bus. Dev.: Troy Bowman, VP Operations, [email protected], 480-296-2033

Press: Sharon Schultz, Public Relations, [email protected], (o) 480-296-2033, (m) 301-351-0109

Sales: David Schnepf, VP Sales & Marketing, [email protected], 480-296-2033

How they describe themselves: Braintree is the fastest growing payment platform for online and mobile businesses, offering all the tools merchants need to accept payments and provide consumers a frictionless experience at checkout. Braintree provides merchants with a secure payment gateway, merchant account, recurring billing and credit card storage, as well as industry-leading customer service and an easy-to-integrate API. Braintree operates internationally and allows merchants in 40 countries in North America, Europe and Australia to accept payments in over 130 currencies. Braintree’s consumer brand, Venmo, offers a digital wallet and person-to-person payment application that makes it easy for consumers to make payments on mobile devices.

How they describe their product/innovation: Venmo Touch eliminates the need to constantly re-type your credit card information when making purchases on your mobile device. It provides a connective layer across all the apps on your phone, designed to make every payment in a new app as easy as buying a song in iTunes. The next time you enter your card details in one of the apps in our network, just check “Save card with Venmo.” When you use other in-network apps on the same device, you will see the option to use the saved card to pay with just a single touch.

Contacts:

Bus. Dev.: Aunkur Arya, GM Mobile, [email protected]

Press: Lisa Kornblatt, Communications Director, [email protected]

Sales: James Hyde, SVP Sales, [email protected]

How they describe themselves: Bright Funds brings an investment approach to individual philanthropy, a $300 billion market in the U.S. alone. By combining the sophistication of investing with innovations in design and technology, Bright Funds provides a financial service that addresses a growing need in online charitable giving. In addition to individual and workplace giving, Bright Funds offers an intuitive charitable giving management solution to the financial services sector.

How they describe their product/innovation: Bright Funds offers a simple, elegant tool to the financial services sector for effective charitable giving management. With Bright Funds, individuals create personalized giving portfolios and contribute to thoroughly researched funds of highly effective nonprofits addressing the greatest challenges of our time. Bright Funds combines the power of research, the reliability of a trusted financial service, and the convenience of centralized contributions and tax reporting.

Contacts:

Bus. Dev. & Sales: Ty Walrod, Co-Founder & CEO, [email protected]

Press: Julia Streuli, Head of Communications, [email protected]

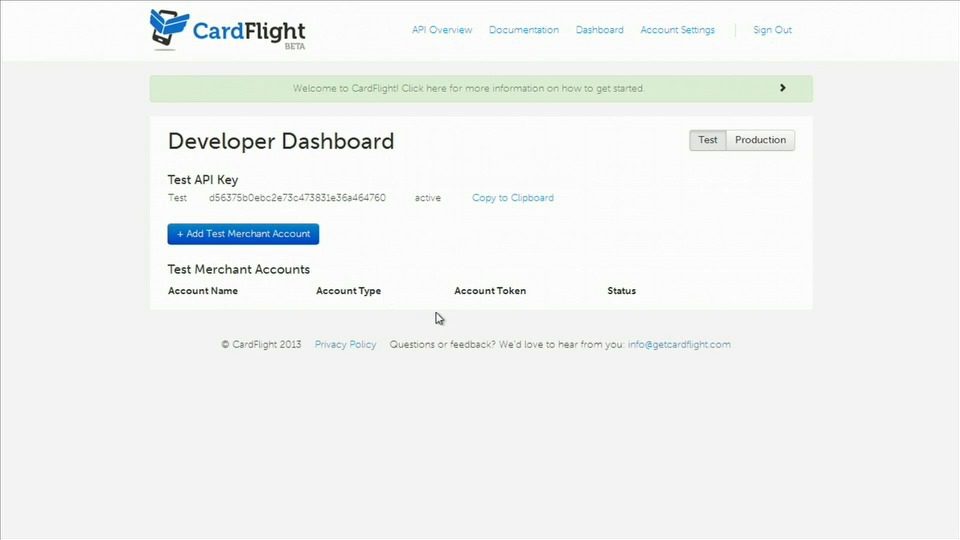

How they describe themselves: CardFlight is the easiest way to accept credit card payments in your own app. We provide mobile payment infrastructure that can work across almost any payment provider, enabling developers to build and integrate card‐present mobile payments into their own apps with ease. We provide secure, encrypted readers and a simple SDK that makes it ridiculously easy to build applications that include payment acceptance. CardFlight works with most leading payment processors, including Stripe, First Data, TSYS, Vantiv, Chase Paymentech and WorldPay – with more in the pipeline.

How they describe their product/innovation: We bring the same developer‐friendly, transparent approach to payment processing as Stripe and Braintree. However, we focus on the ~90% of payment transactions that happen offline. Unlike other mobile payment services, we offer a very simple and secure SDK/API and work with the developer’s existing merchant account. Developers retain full control of their integrated app experience. They simply use our encrypted mobile mag stripe reader and API so that they can safely and securely accept payments in their apps.

Contacts:

Bus. Dev., Press & Sales: Derek Webster, Founder & CEO, [email protected]

How they describe themselves: Corduro® is revolutionizing payments for consumers and organizations with its OMNI-Channel Enterprise platform, payment acceptance across Mobile, Online and POS. Corduro PayMobile™ is integrated to social networks, provides both merchant and consumer payment acceptance. Corduro Register serves untethered, tethered, and store-in-store innovation for merchants and allows individuals to pay free of devices, cards and checks. Corduro SNAP™ provides a complete online/e-commerce solution for shopping, payments, fund-raising, and events. Corduro PayNow™ is an innovative and robust online gateway that provides recurring payments, contract payments, least cost routing, real-time reporting, b2b services, and support your preferred processor/acquirer or gateway provider.

How they describe their product/innovation: At the show, find a Corduro Girl and experience payments free from devices, cards and checks. You can use a card if you want, but you’ll miss the innovation. When you arrive, download Corduro PayMobile, register and add a credit/debit/gift card to the wallet to be part of the innovation and get the chance to win Top Influencer of the show.

Contacts:

Bus. Dev. & Sales: Anthony Cacheria, VP Corporate Development, 817-204-0800

Press: Robert Ziegler, CEO, 817-821-5620

How they describe themselves: Credit Sesame is the consumer’s credit and lending expert, providing smarter financing for your life. We provide a complete picture of your credit and loans in one place, including your credit score, credit monitoring, personalized financing analysis, and unbiased, pre-qualified loan and savings recommendations — all for free.

Our proprietary recommendation engine, with bank-level analytics, monitors the market, runs thousands of scenarios and analyzes your credit and debt to identify the best loan opportunities to save you money. You receive unbiased recommendations on mortgages, auto loans, credit cards and other loans, customized for your financial goals.

How they describe their product/innovation: Credit Sesame’s iPhone app with integrated Goals, Visual Mortgage Comparison Tool and Free Credit Monitoring

———————–

In the market for a new home? Get a complete analysis of your financial profile to understand what you can afford from discovery to decision. Easily find properties in your area that match both your requirements and your budget. Receive offers from multiple lending institutions and easily compare them to determine the right one for you. Make sure you’ll get the best mortgage rates by monitoring your credit for free on the go.

It’s the one mobile app that provides the information, analysis, advice and offers you need for every important financing decision.

Contacts:

Bus. Dev.: Adrian Nazari, Founder & CEO, [email protected]

Press: Merridith Ingram, CommStrat, [email protected], [email protected]

Sales: Anton Commissaris, COO, [email protected]

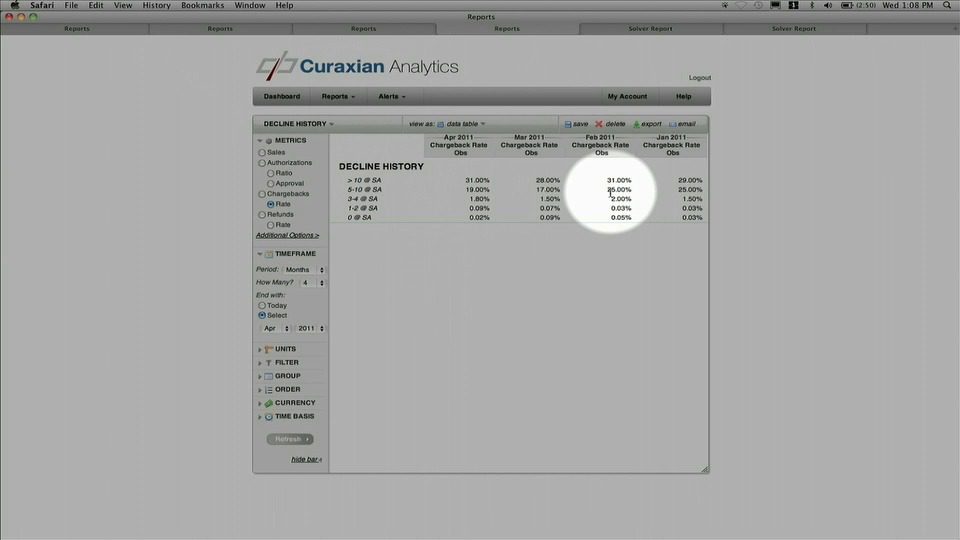

How they describe themselves: Curaxian helps merchants and processors manage the economics of risk through solutions based on real-world experience. Key areas of focus include fraud risk management, authorization decline optimization, and interchange cost management. Our SaaS based analytics and reporting platform can be used by merchants to manage their own risk or can be used by processors/acquirers to manage risk of portfolio merchants. Processors or acquirers can also offer Curaxian Analytics to their merchants as a value-added white label reporting and analytics solution.

How they describe their product/innovation: Curaxian Analytics is a software service that helps merchants or processors quickly identify fraud attacks and build better rules that find the optimal balance between stopping fraud, protecting good orders, and minimizing manual review volume. It also helps merchants and processors reduce authorization declines and control interchange costs.

Contacts:

Bus. Dev., Press & Sales: Mitch Muroff, CEO, [email protected]