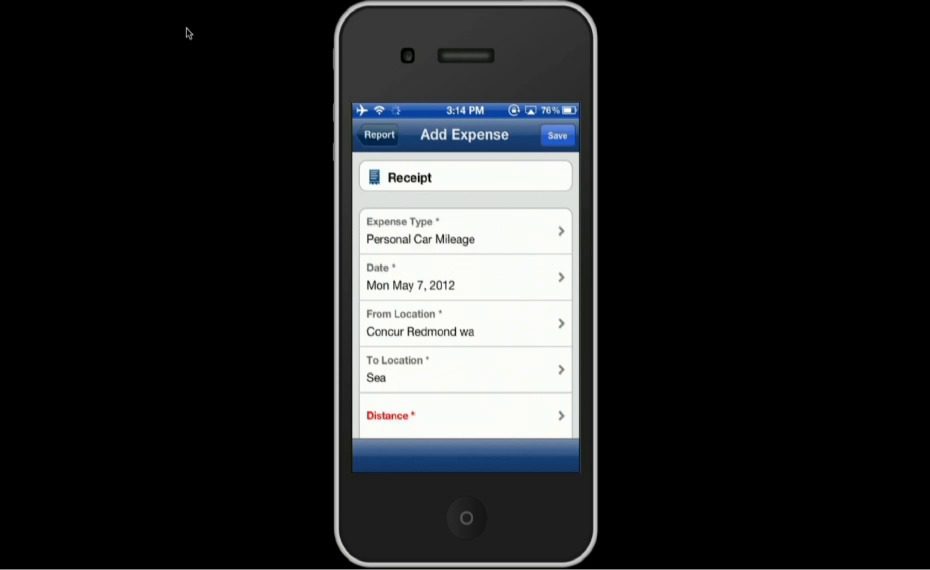

How they describe themselves: Concur is a leading provider of integrated travel and expense management solutions. Concur’s easy-to-use Web-based and mobile solutions help companies and their employees control costs and save time. Concur Connect is the platform that enables the entire travel and expense ecosystem of customers, suppliers, and solution partners to access and extend Concur’s T&E cloud. Concur’s systems adapt to individual employee preferences and scale to meet the needs of companies from small to large. Learn more at www.concur.com.

How they describe their product/innovation: SmartExpense is an easier way to do expense reports and does a lot of the work for you. Snap photos of business receipts with your smartphone while you travel and SmartExpense will automatically upload them to your expense report. Or, simply forward electronic receipts from hotels, mobile carriers, conferences, and more to [email protected] to easily add them to any expense report. To make travel expense reporting even easier, connect your SmartExpense account with TripIt. SmartExpense automatically creates and pre-populates expense reports with flight, hotel, and car rental reservations from your TripIt itinerary, no matter where you book.

Contacts:

Bus. Dev.: Tim FitzGerald, EVP of Business Development, [email protected]

Press: Amy Jackson, Director of Public Relations, [email protected], 415-401-1152

Sales: Kellie Zimmerman, Director of SMB Sales, [email protected]

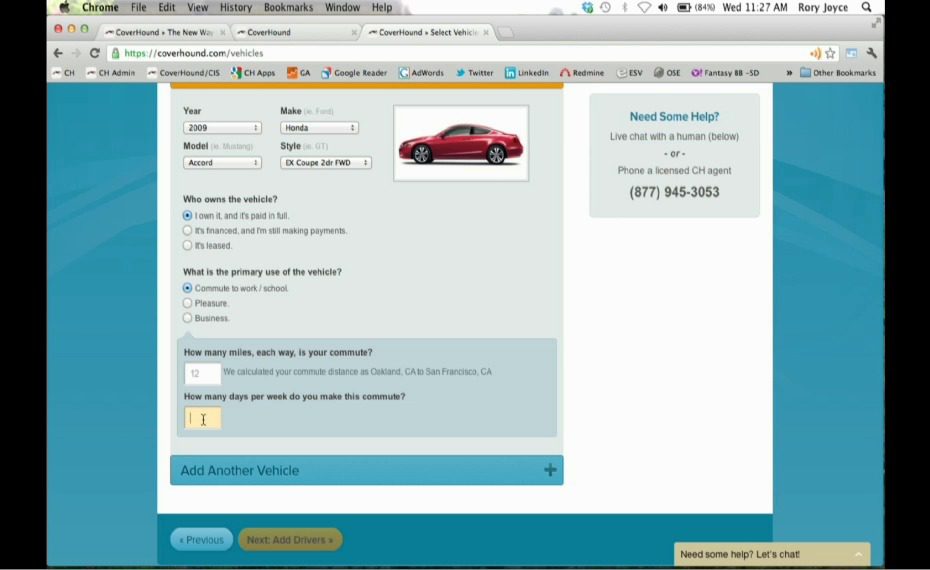

How they describe themselves: CoverHound is a technology company powering consumer searches for insurance. Founded by insurance veterans, CoverHound is building the first brand in insurance shopping that users trust. Consumers use CoverHound to find and buy the right insurance policy at the right price.

CoverHound Insurance Solutions is a national, full-service independent agency staffed with licensed agents supporting the site’s comparison shopping engine. The tandem services give consumers instant and accurate rates from leading insurance carriers with the option of speaking directly to an agent.

How they describe their product/innovation: CoverHound’s comparative shopping engine gives users real, instant and actionable rates from leading insurance brands.

CoverHound tools let partners offer consumers purchasable insurance quotes – supercharging monetization and user experience in new and lucrative ways.

Contacts:

Bus. Dev.: Basil Enan, Founder and CEO, [email protected]

Press: Josh Anish, VP of Communications, [email protected]

How they describe themselves: Our company’s twenty-three year tradition of leadership, continued improvement and rich history of delivering one-of-a-kind corporate financial products has evolved to a highly customizable and flexible suite of business solutions, including the CSI Global-Fleet MasterCard®, CSI MasterCard® Multi Card, CSI globalVCard™ Paysystems, and the globalVCard™ Mobile App for smartphones and tablets to allow secure single and multiuse Virtual MasterCard account numbers to be accessed directly on a business user’s mobile device.

How they describe their product/innovation: CSI globalVCard™ mobile app is a virtual MasterCard® application designed for on-the-go businesses of any size. Create secure single-use MasterCard® account numbers from your mobile device. Even create virtual cards in another user’s name with options to securely send via email or SMS. Pay Online, On the Phone, Wherever MasterCard is accepted. Safe, secure mobile payments sent to Anyone. Anywhere. Anytime.

Contacts:

Bus. Dev., Press & Sales: Angela Davis, Product Director, [email protected],

239-947-5169

How they describe themselves: DCisions uses big data to drive transparency in retail investing. The database provides insight into the investment performance actually experienced by consumers and tracks their behaviors over time, including investment and saving decisions, using a US-patented process. DCisions holds data on nearly 1.5 million UK investors, which enables it to index portfolios to provide both consumers and the market with fact-driven benchmarks for risk, return, and asset allocation. The model is applicable not just to the UK but also to the US, Australia, and other regions around the globe.

How they describe their product/innovation: InvestorBee puts data at consumers’ fingertips so they can make smart, confident investments.

- It’s fact, not opinion. Users can tap into the database to learn from the experiences of other investors.

- It’s an investment health check. Users can compare their portfolios and multi-asset products with fact-based, relevant benchmarks to understand whether they receive fair value.

- It’s simple investing without guesswork. Users can choose an objective risk-based strategy to track what’s right for them in a few easy steps.

Our users extract wisdom from the crowd to make better, simpler investment decisions – all for free at InvestorBee.

Contacts:

Bus. Dev.: Maya Kuzalti, Director, Product & Analytics, [email protected],

+44 (0) 20 7297 2510

Press: Kritika Ashok, Marketing Manager, [email protected], +44 (0) 20 7297 2508

How they describe themselves: DeviceFidelity, Inc. develops plug-and-play technologies that empower a variety of institutions to deploy their services and applications on millions of mobile phones worldwide. Its patent-pending In2Pay microSD and In2Pay iCaisse solution transforms popular mobile phones into an interactive contactless transaction device. Committed to bringing contactless innovation to the mobile phone, the company developed moneto, the world’s first multi-platform mobile wallet. moneto uses the patented In2Pay iCaisse4 and microSD-based secure element, which not only offers portability across a wide range of smartphone devices but also enables secure provisioning by banks using their existing processes and adhering to current standards.

How they describe their product/innovation: Launched at CES by DeviceFidelity, Inc., moneto became the world’s first commercially available mobile Near Field Communication (NFC) wallet supporting both iPhone and Android platforms for mobile payments using the In2Pay® microSD, which enables secure contactless transactions. The moneto mobile wallet is powered by MasterCard® PayPass™ technology and linked to a general-purpose reloadable MasterCard prepaid card to enable iPhone and Android users to make purchases with their phone at the hundreds of thousands of merchants that accept MasterCard PayPass.

Contacts:

Bus. Dev.: Amitaabh Malhotra, COO & Co-Founder, [email protected],

Youri Bebic, General Manager, NFC Prepaid Services, [email protected]

Press: Stephanie Barrueto, Marketing Manager, [email protected]

Sales: [email protected]

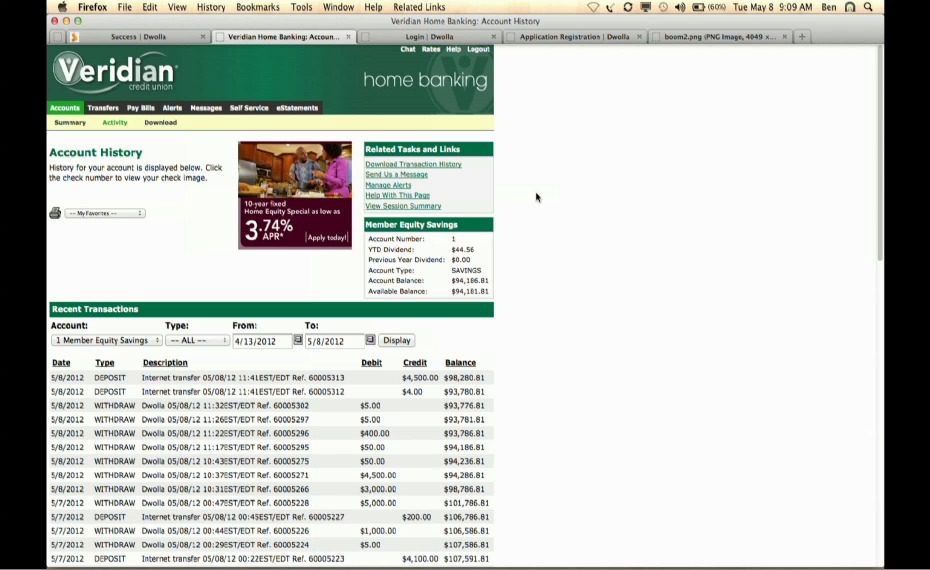

How they describe themselves: Dwolla securely works with users’ bank or credit union accounts to pipe money into its next generation payment network. Once the funds are safely inside Dwolla, users are able to send the money through any of our online, mobile, social and location-based tools. There are no costs affiliated with a Dwolla account other than the quarter per transaction, which we charge for transfers over $10 (transactions under $10 are free).

How they describe their product/innovation: Dwolla is releasing the newest iteration of FiSync, the company’s revenue generating financial services product.

Contacts:

Press: Jordan Lampe, [email protected], 515-250-4616

How they describe themselves: Dynamics Inc. was founded and seeded in 2007 by Jeff Mullen, its President and CEO. Dynamics produces and manufactures intelligent powered cards such as advanced payment cards. Focused on introducing fast-cycle innovation to top card issuers, the company’s first commercial application is the world’s first fully card-programmable magnetic stripe for use in next-generation payment cards.

Contacts:

Bus. Dev.: Chris Rigatti, Sr. Director of Business Development, [email protected]

Press: Kevin Schwaba, Edelman, [email protected]

How they describe themselves: AcceptEmail enables simple & secure electronic billing, dunning, and payment utilizing the power of e-mail or SMS. Real-time generated images convey the current bill status, resulting in a comprehensive EBPP experience in the customer’s inbox. In a 3-click process, bills are paid straight from e-mail without manual data (re)entry, resulting in full process transparency & control for the payer. Apart from improved customer service, the biller realizes lower DSO and reduced collection costs. The service can be applied in various stages of the invoice-to-cash process. Low implementation requirements result in easy deployment. AcceptEmail can be utilized with most online payment methods, debit cards, credit cards and wallets.

How they describe their product/innovation: Recently we have added a Short Invoice Service, which creates an electronic bill, including payment capability for mobile phones using SMS, WhatsApp or Twitter. This new feature of AcceptEmail adds the mobile space to the service and enables fully automated credit management.

AcceptEmail has also expanded their set of payments methods that can be used via PSP’s with the availability of many new international online payment methods, debit, and credit cards.

Contacts:

Bus. Dev. & Sales: Peter Kwakernaak, CEO, [email protected]

Press: Claudia op den Velde, Marketing Manager, [email protected]

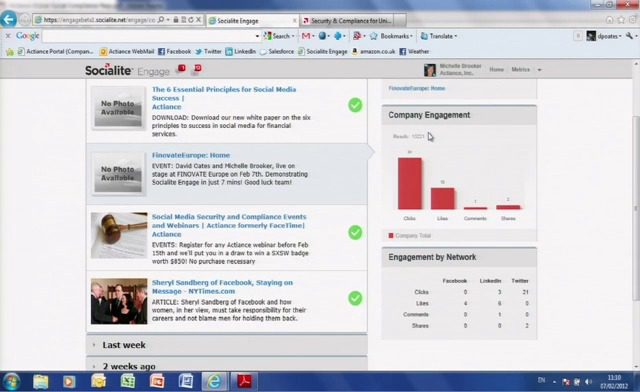

How they describe themselves: Actiance ‘Enables the New Internet’ by addressing the security, management, and compliance challenges posed by the evolving real-time communications landscape. The Actiance platform provides coverage for unified communications platforms, public instant messaging networks, Skype, Blackberry PIN, Web 2.0 applications, and social networks. Our solutions address issues of data leakage, record retention obligations, and a requirement to enforce corporate policies across an increasing number of real-time communication modalities. This enables organizations to productively and safely use communications and collaboration technology, regardless of security threats, loss of confidential information, or regulatory compliance requirements.

How they describe their product/innovation: Achieving success on social networks is largely linked to the size of one’s network. By harnessing the marketing power of employee networks, companies can dramatically increase the power to distribute and share content and the number of leads generated. Socialite Engage empowers distributed teams to share pre-approved content, engage with clients and prospects, and analyze the impact of the content on social media sites such as Facebook, LinkedIn, and Twitter. Socialite Engage has been designed specifically to enable investment and insurance professionals to manage social media securely and comply with FINRA and FSA regulations.

Contacts:

Bus. Dev.: Mark Sheridan, VP Business Development, [email protected]

Press: Sara Claridge, [email protected]

Sales: David Oates, VP EMEA, [email protected]

How they describe themselves: Backbase delivers Bank 2.0 Portal Software that provides a new user experience layer on top of underlying infrastructure and IT systems. It empowers financials to create interactions that link customers to relevant information and applications that fit their needs and preferences. With its efficient widget-based architecture, Backbase Bank 2.0 Portal gives financials the flexibility and speed to create modern portals that truly empower their customers.

Unlike most traditional IT portal vendors, Backbase has created a modern business-driven portal solution that makes portal management easy for e-business professionals. This means faster time to market and more flexibility to optimize online channels with less IT support.

How they describe their product/innovation: Backbase is presenting major new features in its Bank 2.0 Portal Manager at FinovateEurope 2012, focusing on the following key points:

– Improved editor for page composition on regular browsers and mobile devices

– Advanced segmentation and targeting for different customer groups

– Fully integrated forms editor for enrollment and BPM

– Advanced analytical and performance tools

Backbase’s Portal Manager is an easy to use, graphical interface for the e-business and marketing teams at banks to manage online and mobile customer interactions and to bring power to the business by giving them complete control of the online customer journey.

Contacts:

Press: Jelmer de Jong, Head of Marketing, [email protected], +31 6 230 260 12

Sales: Frank Uittenbogaard, Sales Manager EMEA, [email protected], +31 6 51 0000 41

How they describe themselves: BCSG creates and distributes value adding products and services to over 135,000 small businesses through financial institutions. BCSG products provide real, tangible solutions for small businesses to survive and succeed, while simultaneously providing financial institutions with the opportunities to differentiate their proposition, enhance customer loyalty, and grow wallet share.

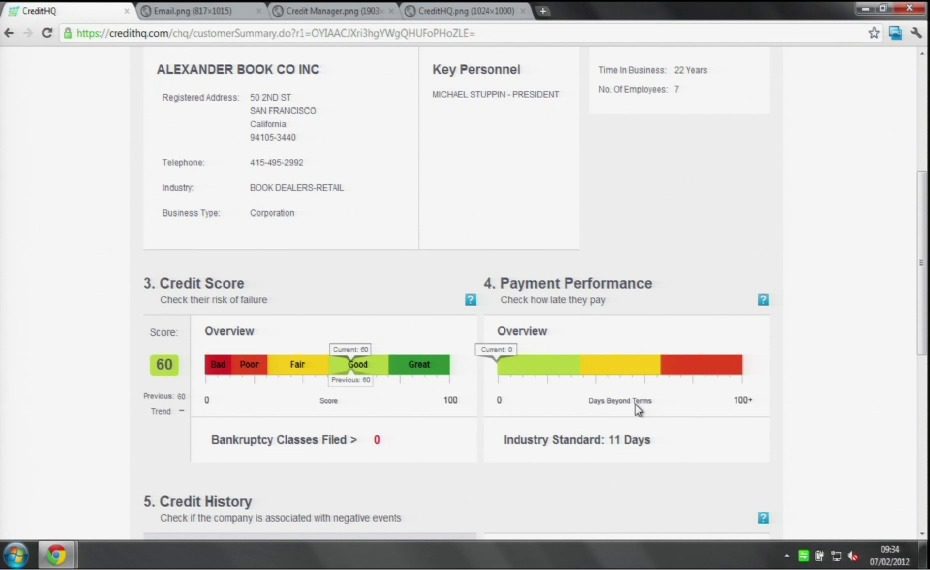

How they describe their product/innovation: Credit HQ provides small businesses with unlimited access to a database of customers, outlining their risk profile and payment performance in a simple and easy-to-use format. The platform allows small businesses to develop monitoring plans for each customer/supplier, which sends e-mail alerts directly to the business owner when there is a material change in the credit/risk profile. The platform also allows businesses to create best practice credit terms letters to issue to customers to ensure all parties understand their relationship at the outset of any relationship. Should there be any delays in payments from customers, the platform allows the user to create a 10-day final demand letter free of charge, which will be issued directly to the customer. Should this not deliver payment, then the user can issue debt instructions directly through the platform to be collected for a market leading 20% no win, no fee payment by one of the leading business to business debt collectors in the market.

Contacts:

Bus. Dev.: Tom Davies, Commercial Manager, [email protected]

Press: Carole Wood, Marketing Manager, [email protected]

Sales: Tom Platt, Commercial Director, [email protected]

How they describe themselves: Aimia’s unique advertising platform, powered by Cardlytics, enables banks to deliver rich, relevant rewards to its customers based on purchasing history while fully protecting their privacy. The platform is entirely funded by retailers with advertisers targeting consumers based on spending patterns: where, how much and how frequently they spend at a store and in the broader retail category. Aimia is a global leader in loyalty management. Since its founding in 2008, Cardlytics has been the leader in Transaction-Driven MarketingTM. The company has raised over $60MM in venture capital from leading investors in both Silicon Valley and Boston, and a strategic investment from Aimia.

How they describe their product/innovation: Aimia will be demonstrating the merchant-facing portal, powered by Cardlytics, that is used by merchants to track offers served, activated, and revenue earned. All bank-facing channels and capability are pointless elements if the merchants aren’t engaged. The Aimia solution enables that merchant engagement.

Contacts:

Bus. Dev.: Jason Brooks, MD, UK, [email protected]

Press: Rod Witmond, SVP Product & Marketing at Cardlytics, [email protected],

404-425-5957

Sales: Jason Brooks, MD, UK, [email protected], UK Office: +44 (0) 203 480 9122,

US Office: +1 (404) 425 5937