How they describe themselves: Comarch is one of the leading international software houses and systems integrators of central Europe, based in Krakow, Poland. Comarch provides services in areas such as telecommunications, finance and banking, services & trade, public administration, and SME. Its services include, among others, billing systems, enterprise resource planning applications, IT security and architecture, management and outsourcing solutions, customer relationship management and sales support, electronic communication and business intelligence.

Comarch Financial Services specializes in designing, implementing and integrating solutions and services for banks, insurers, asset management companies, pension & investment funds, brokerage houses, etc. Our expertise and flexibility has gained worldwide recognition with a significant portfolio of customers such as Aviva, Allianz, ING, Delta Lloyd Life, Generali, AXA, BNP Paribas Fortis, Aegon, Nordea, GE Money Bank, and Raiffeisen.

How they describe their product/innovation:

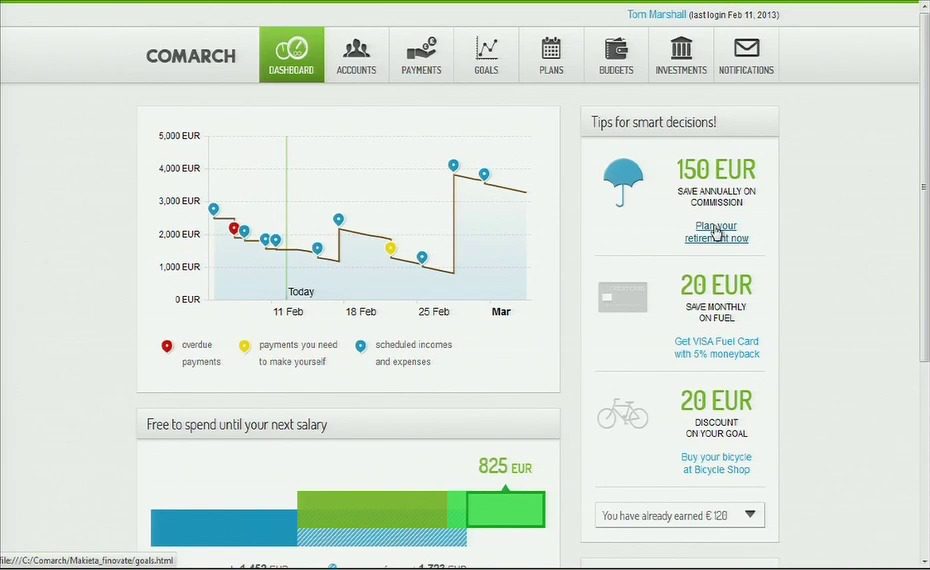

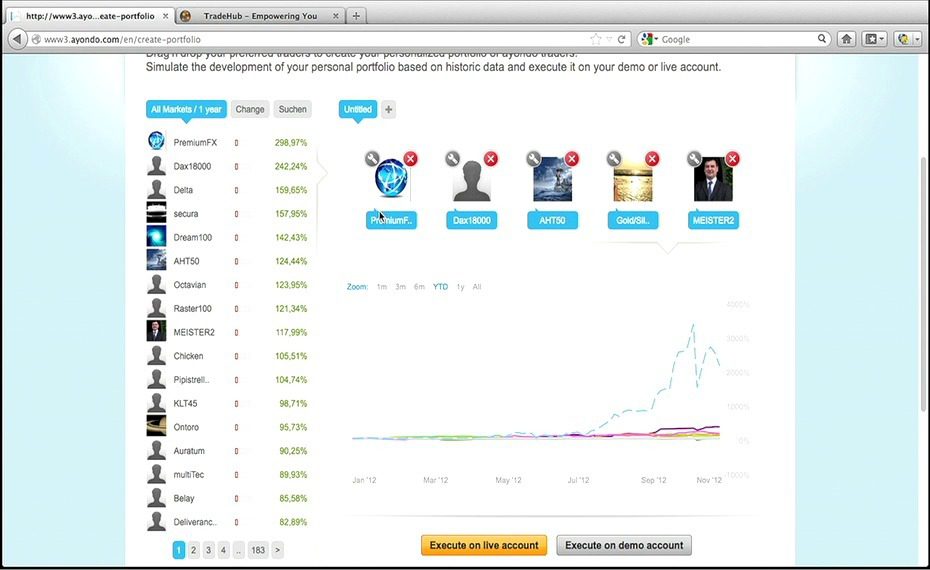

Comarch Smart Finance is an innovative system that combines functionalities of online banking and personal finance management in one powerful solution, making banking more personal. It helps banks address the needs of their customers with relevant offers. Comarch Smart Finance comes with complementing mobile applications for tablets and smartphones, offering an intuitive interface, easy access to operations, and broad functionality.

Comarch Investment Advisor is a multi-channel solution dedicated to private banking and wealth management. It combines CRM and investment advisory and supports an optimal selection of investment, pension and insurance products for the client. The most important benefit is access to client financial and wealth analysis based on historical, today and forecast records as well as client-oriented sales advice.

Contacts:

Press: Anna Lik, PR Manager, [email protected]