How they describe themselves: Arkalogic offers a variety of payment, transaction, and remittance systems for businesses and consumers in the form of combined mobile wallet, e-money, mobile POS, and m-commerce, seamlessly. We process payments securely.

Our mission is to address the problem of closed payment ecosystems that technology, telco companies, and banks try to create and offer exclusively on their own, with different technology platforms and different user interfaces.

For Arkalogic Transaksi, a mobile financial solution must be cost efficient for the institutions. It must also be amusing and help the consumers as opposed to confusing and taxing them. Arkalogic is an innovator, incubator, and an investor in secure mobile financial technology.

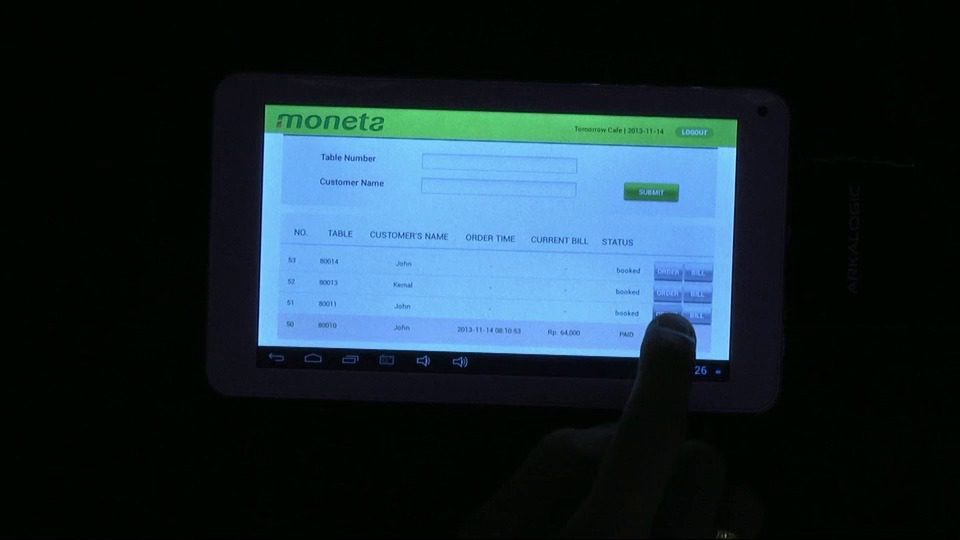

How they describe their product/innovation: For Arkalogic Transaksi, a mobile financial solution must be cost efficient for institutions. It must also be amusing and help consumers as opposed to confusing and taxing them. Advanced yet simple technology combined with great design of customer experience and meticulous customer care are the key ingredients to Arkalogic Transaksi’s latest solution, Moneta.

Moneta’s dream essentially is to create a mass and “seamless” payment system for bank and telco customers in the form of combined mobile wallet, e-money, mobile payment, and mobile commerce, in Indonesia and globally.

With one registration and with one platform that is easy for partners to integrate into their existing system and for end consumers to ‘plug and play,’ Moneta believes that transactions and life should be simple and secure. Always.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B) & through financial institutions

Contacts:

Bus. Dev.: John Chard, Chief Strategy Officer, [email protected], +62 818 07029500

Press: Nila Marita, 9Comm, [email protected], +62 813 17060623

Sales: Omar Stamboel, Business Manager, [email protected], +62 815 9141343