How they describe themselves: BehavioSec Inc. (Swedish Reg. Behaviometrics AB) is a Swedish award winning company that was selected as part of “Cool Vendors in Security: Identity and Access Management, 2012” for their patented Continuous Authentication & Verification technology.

The company focuses on innovation in behavioral biometrics, is commercializing research from Luleå University of Technology, and counts DARPA and leading international financial institutions among our clients.

The organizations supporting the development of BehavioSec are Conor Venture Partners and Partner Invest Norr with their 2011 investment combined with seed capital funding from Innovationsbron, Lunova, and PNF venture capital.

How they describe their product/innovation: Spotting the gap between user-friendly adaptive user authentication via risk based authentication, or behaviour biometrics, and the reality of legacy systems at our current customers.

BehavioSec extended its award winning BehavioWeb and BehavioMobile solutions to offer policy based behaviour authentication actions.

This allows the web fraud detection system to define cause and effect authentication, removing the burden of troublesome security from the end user.

Product Distribution Strategy: Through financial institutions, through other fintech companies and platforms, & licensed

Contacts:

Bus. Dev. & Sales: Hans Bergman, [email protected]

Press: Olov Renberg, [email protected]

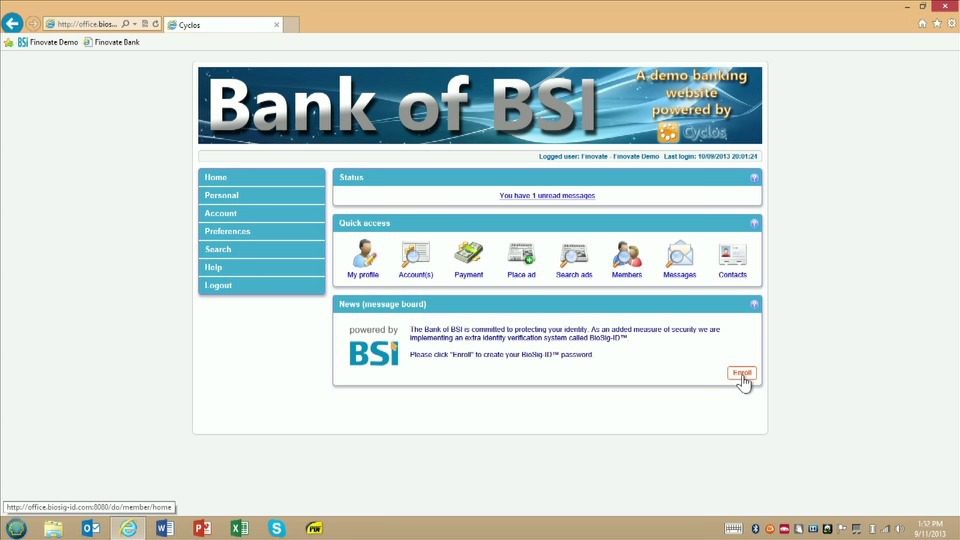

How they describe themselves: Biometric Signature ID (BSI) is a patented, 3rd party validated at 99.97% accuracy, software-only gesture biometric for online ID verification with 1M uses and 98% +ve user experience rating. The next evolution in easy to use, highly secure password security.

How they describe their product/innovation: BioSig-ID complies with the new gold standard – multi factor authentication. BioSig-ID requires NO additional hardware, and measures the unique biometric patterns of a user as they “draw” their password to log in. A user is authenticated against a stored pattern from enrollment and after identity is confirmed, access to the device, files, or accounts is granted.

Product Distribution Strategy: Direct to Business (B2B) & through distribution partners

Contacts:

Bus. Dev. & Press: Jeff Maynard, CEO & President, (o) 972-436-6862, (m) 214-244-7679

Sales: Lauren Vaughan, Account Director, [email protected], 972-436-6862

Cindy Maynard, VP Marketing & Sales, [email protected], 214-663-0080

How they describe themselves: BizEquity is the creator of the “Valuation-as-a-Service” or VaaS™ business valuation cloud for all private companies and their financial advisors. The BizEquity system generates a full 17 page customized Business Valuation and Performance report in real-time for 1/30th the cost of offline methods. The BizEquity Business Report provides essential business valuation figures as well as industrial comparison of 40 key performance metrics across 17M active businesses. BizEquity has democratized the business valuation market.

How they describe their product/innovation: There are more than 28M business owners in the US – 75% don’t know what they are worth and 50% are under-insured. The market for business valuation is a $2.8B dollar market, with 99.7% being conducted offline at $8,000 per report and taking up to 6 weeks. BizEquity has revolutionized the market by putting it online helping to enable more businesses to discover-manage-and optimize their value. BizEquity helps every financial institution help business owners better understand their value and what they can do to better protect themselves.

Product Distribution Strategy: Direct to Businesses online at BizEquity.com and indirect via the channel and private label agreements with leading financial and data institutions.

Contacts:

Bus. Dev., Press, & Sales: Michael M. Carter, CEO & Founder, 415-341-2728

How they describe themselves: Capital Access Network (CAN) is the largest and most experienced small business finance specialist for small businesses. CAN’s technology-based Daily Remittance Platform™ and proprietary risk models enable it to quickly evaluate businesses based upon their actual, recent performance, resulting in increased access to capital. Through its subsidiaries, NewLogic Business Loans and AdvanceMe, CAN has given small businesses access to more than $3B in working capital over the past 15 years. (All business loans obtained through NewLogic are made by WebBank, a Utah-chartered Industrial Bank, Member FDIC.)

How they describe their product/innovation: Mobile Funder is a tablet-based tool enabling time-starved, “on the move” financial sales/ISO representatives selling alternative capital to small businesses with the ability to complete their sales process in one visit. Mobile Funder empowers reps to securely pre-qualify prospects, authorize credit checks, propose multiple finance options and submit applications in minutes, eliminating paper applications and the need for multiple visits. The result: This all-in-one tool gives small business finance reps the power to close more deals and deliver capital faster.

Contacts:

Bus. Dev. & Sales: Joe Valeo, [email protected], 877-500-8282 x123

Press: Allison+Partners for Capital Access Network, [email protected], 646-428-0618

How they describe themselves: Cardlytics, the leader in Card-Linked Marketing, provides businesses – for the first time – with a timely and complete view of consumer purchase behavior. The company has unmatched, exclusive access to current and historical purchase behavior for ~70% of US households, capturing spending across all stores and categories. The advertising platform is built upon information provided securely by its premier network of nearly 400 financial institution partners, including Bank of America, PNC, and Regions Bank. Cardlytics can finally answer the question: what share of your customer’s wallet do you capture?

How they describe their product/innovation: Cardlytics will demonstrate our new geo-locator technology that empowers our partner banks’ customers to receive ads and offers based on their recent purchase behavior, no matter where they are in the US.

Product Distribution Strategy: Through financial institutions

Contacts:

Bus. Dev.: Julio Farach, Chief of Staff, [email protected]

Press: Kasey Byrne, SVP Marketing, [email protected]

Sales: John Brown, EVP Financial Institutions, [email protected]

How they describe themselves: CoverHound provides consumers with a smarter way to buy and manage insurance online. We help people easily compare rates from numerous insurance carriers and then purchase an insurance policy within minutes. CoverHound is a nationwide, online insurance agency that includes top insurance carriers on its platform such as Progressive, Safeco, Travelers, as well as many others. Our team has deep insurance experience and includes veterans from companies like State Farm, 21st Century, Farmers, Kemper, LendingTree, and Insweb. A Winter 2011 AngelPad graduate, CoverHound’s investors include RRE Ventures, Bullpen Capital, and Blumberg Capital.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

How they describe themselves: CR2 is the innovative provider of self-service banking solutions, providing robust and highly flexible ATM, Internet, and Mobile channels.

CR2 helps banks meet their business challenges by reducing operational costs, generating new revenue, and improving customer satisfaction through best-in-class technology.

CR2’s BankWorld lets banks actively manage all electronic channels from a single platform. BankWorld enables banks to design and deliver a personalised offering to the right customer at the right time and right channel.

How they describe their product/innovation: Although mobile and internet channels have evolved, the ATM has been subject to little change. CR2 brings an innovative perspective to the ATM channel through a never seen before touch screen interface inspired by kiosk and mobile practices. With CR2’s BankWorld, ATMs become interactive, promote cross-selling, and provide a unique tailored customer experience. ATM screens are designed with functionality as simple to use as PowerPoint. Screen space is maximised with features such as bubble button styles to highlight services and facilitate ease of use. Additionally, BankWorld provides a meaningful source of revenues for banks.

Product Distribution Strategy: Direct to Business (B2B) & licensed

Contacts:

Bus. Dev. & Sales: Kieran Kilcullen, CCO, [email protected]

Press: Nadia Benaissa, Marketing Manager, [email protected]

How they describe themselves: Deluxe Corp. provides business products and online marketing services for small businesses and FIs. The partnership between Deluxe and VerifyValid will soon introduce secure electronic check payments to the 4M small business and 5,700 bank customers currently served by Deluxe. Using an unprecedented secure platform and patented fraud prevention, VerifyValid can lower an organization’s costs while increasing efficiency, sustainability, and financial security with every payment.

How they describe their product/innovation: VerifyValid lets customers make/receive check payments entirely online, utilizing virtual lockbox and remote deposit capture systems, or by printing checks on plain paper.

Product Distribution Strategy: In presenting VerifyValid to its customer base, Deluxe will employ a multi-channel strategy, including printed and electronic marketing, a direct sales force, FI and telecommunication client referrals, purchased search results from online search engines,

Contacts:

Bus. Dev.: Patrick Lethert, VerifyValid, [email protected], 651-755-2884

Press: Ryan McCormick, Deluxe PR, [email protected], 312-552-6316

Brian Burch, VerifyValid PR, [email protected], 616-828-9813

Sales: Todd Tracey, VerifyValid, [email protected], 616-822-9666

How they describe themselves: DoubleBeam powers mCommerce. Our solutions help merchants by enabling low-cost payments inside mobile applications, speeding up customer signup, improving the customer experience, and streamlining operations.

How they describe their product/innovation: Our SDK for iOS and Android is an ingredient that runs inside other mCommerce applications. It links users’ bank accounts just by taking a picture of a blank check, then can store that information to process low-cost eChecks as a method of payment, saving merchants up to 80% off the cost of credit card interchange fees. It is being leveraged in pure mCommerce applications as a method to reload stored value accounts, and in brick and mortar retail apps where it also improves visibility into customer behavior for improved marketing ROI.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, & licensed

Contacts:

Bus. Dev., Press, & Sales: Ted Tekippe, CEO, [email protected], 626-372-1718, @tedtekippe

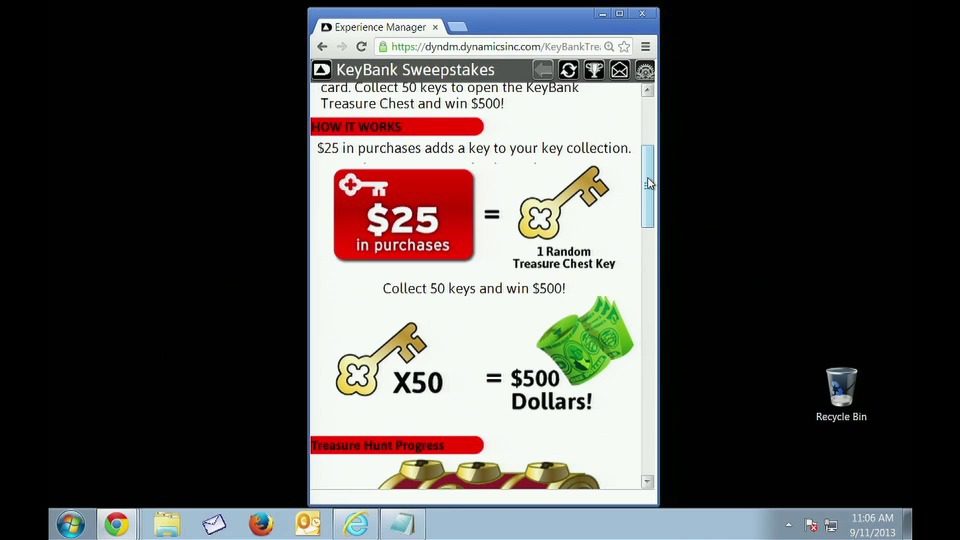

How they describe themselves: Dynamics Inc. was founded and seeded in 2007 by Jeff Mullen, its President and CEO. Dynamics produces and manufactures intelligent powered cards such as advanced payment cards. Focused on introducing fast-cycle innovation to top card issuers, the company’s first commercial application is the world’s first fully card-programmable magnetic stripe for use in next-generation payment cards.

Contacts:

Bus. Dev.: [email protected]

How they describe themselves: Adobe is changing the world though digital experiences. We help our customers develop and deliver high-impact experiences that differentiate brands, build loyalty, and drive revenue across every screen. The Adobe Marketing Cloud gives you a complete set of analytics, social, advertising, targeting and web experience management solutions and a real-time dashboard that brings together everything you need to know about your marketing campaigns. So marketers can get from data to insights to action, faster and smarter than ever.

How they describe their product/innovation: Capture data-driven customer insights and boost customer loyalty through useful online experiences. Captivate and connect with customers across business-critical digital channels using the Adobe Marketing Cloud. Maximize the value and impact of your institution’s online presence and drive online customer conversion using the robust analytics and powerful visualization tools in Adobe Marketing Cloud. Launch, analyze, and refine lead-generation campaigns across channels, including web, mobile, and email. Get real-time insight into online campaign performance and engagement. Modify in-progress campaigns to increase response rates, conversion rates, and revenue. Then refine and personalize experiences to encourage repeat visits.

Contacts:

Press: Steve Ballerini, Director Public Relations, [email protected]

Sales: Donald Matejko, VP Sales, [email protected]

How they describe themselves: Allied Payment Network is a visionary and innovative company that applies emerging bill pay technologies for the financial industry and its customers. The company was created to make the bill paying process easier and more convenient for the consumer and more efficient and cost effective for financial institutions. With its solution, Picture Pay™, Allied has pioneered the first mobile point, shoot and pay application for smartphones. For additional information on how Picture Pay is enabling financial institutions to more successfully promote mobile bill pay to their customers and members, visit www.AlliedPayment.com.

How they describe their product/innovation: Allied’s Picture Pay™ is the nation’s first mobile bill payment application that enables financial institutions’ customers to pay bills using the camera on their mobile device. With Picture Pay, users simply take a picture of the bill, enter the amount and date, and the bill is paid. Picture Pay’s technology does the rest by reading the data from the bill, then syncing with the customer’s bank or credit union to process the payment. Additionally, Picture Pay can automatically add a new biller to the user’s online banking system, eliminating the hassle of entering the payee and account information online.

Contacts:

Bus. Dev.: Gary Daniel, EVP, [email protected], 678-525-2595

Press: Lauren Schuster, Account Coordinator, William Mills Agency, [email protected], 678-781-7209

Sales: Steve Paradine, SVP Sales, [email protected], 260-918-6501