How they describe themselves: Atsora provides financial institutions with innovative, agile, and customer-driven tools for providing value to business owners. We move SME to the Bank 3.0 world. Our goal is to change the way Banks communicate and collaborate with SME customers. We combine financial analytics and cutting edge mobile and online technology with UX focused functionality. We offer two business variants for Banks: (1) Bank offers the application as a third company service in addition to SME existing e-banking or as a standalone application, (2) white-labeled solution bank integrates Momentum into existing SME e-banking service. Atsora is composed by ex- financial technology consultants, bank, and insurance managers backed up with a software house team.

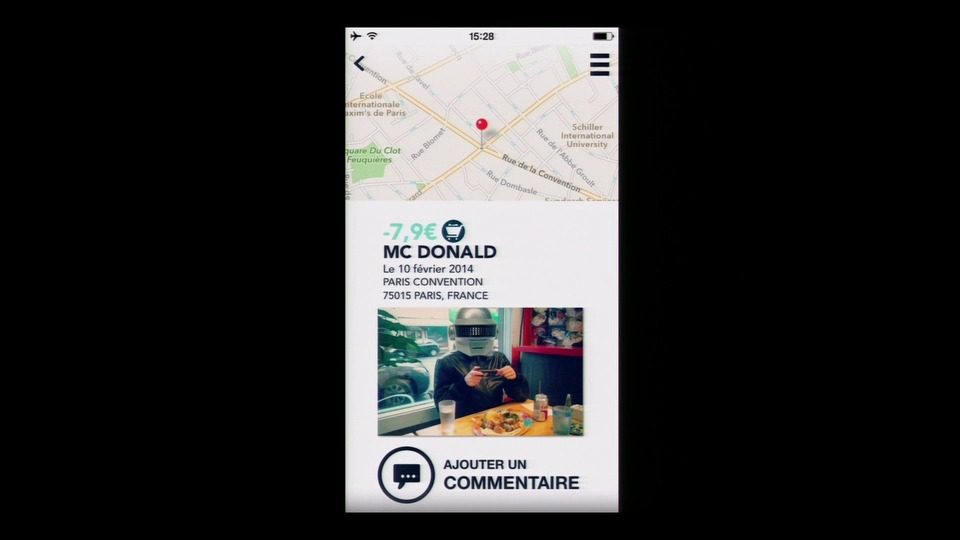

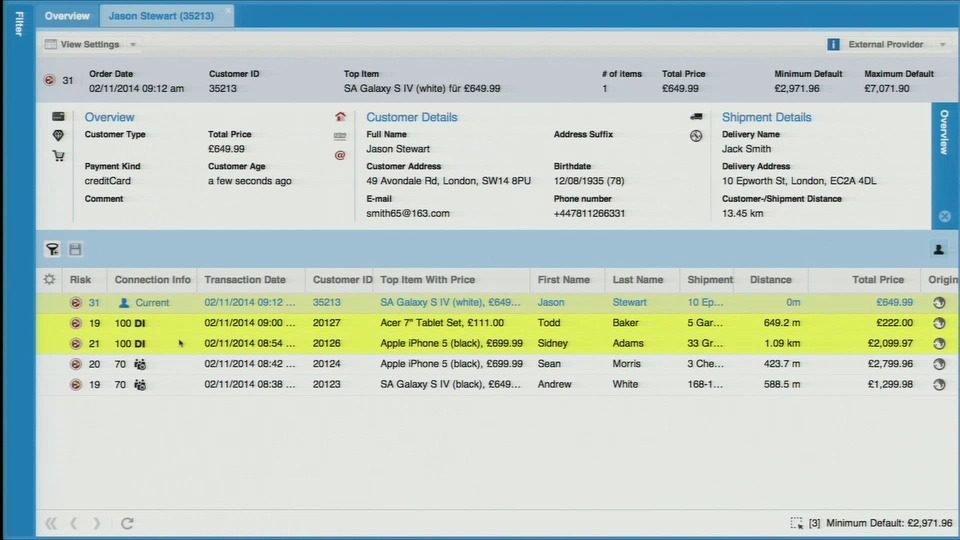

How they describe their product/innovation: Momentum is a software placed between the SME and Bank. One, integrated online and mobile application is used for planning business models and monitoring the cash flow and growth based on financial data. Users can easily share selected information with the Bank in order to get tailor-made offers and on-time support. The SME receives a complimentary set of functionality helping with cash flow and business model planning, cost optimization, and client profitability management. Everything seamlessly integrates with bank accounts, providing a real-time view on business. The Bank in turn gets better insight and can deliver the products exactly as needed. We support all phases of the SME lifecycle in order to improve cross selling and proactively manage retention.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev., Press & Sales: Anna Ciesielska (COO), [email protected]