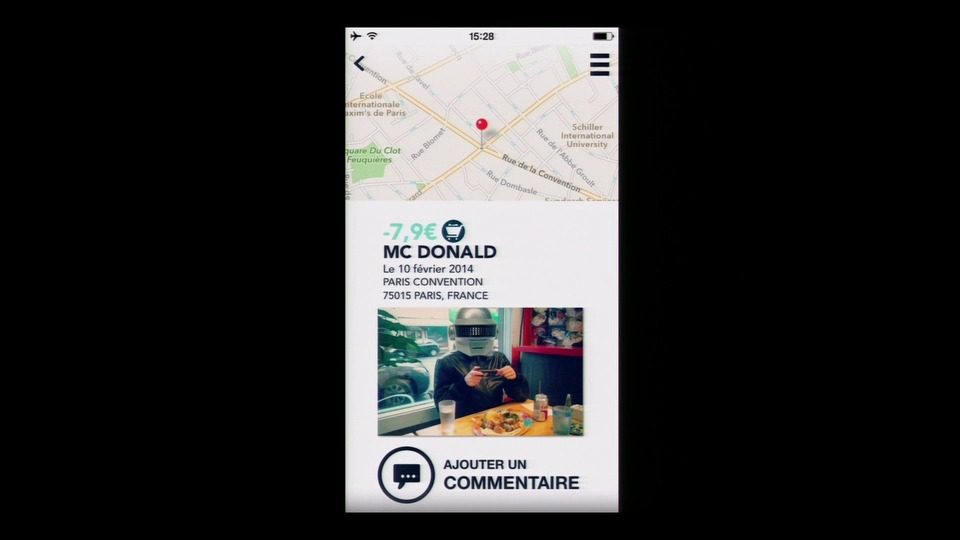

How they describe themselves: DRA is a mobile platform that improves the in-store experience to better match the natural shopper flow. We focus on discovery and engagement through payments, completely on a shopper’s mobile device. SelfPay provides an open and consistent Shop+Pay experience across retailers, carriers, devices, payment methods, processors and POS platforms. DRA enriches the shopper & retailer relationship and integrates with third parties to create a seamless, open and integrated solution. Shoppers receive a consistent experience while our partners make use of a shared platform with goals to boost adoption and increase mobile transactions.

How they describe their product/innovation: SelfPay helps merchants engage each shopper in-aisle, item in hand and on their mobile device. As a shopper nears a store, they’re located via iBeacon and location services – no need to check in or search for an app. SelfPay welcomes the shopper and displays the store’s brands, items, descriptions and pricing. Shoppers can purchase items in-app to take home right away – no more waiting in line just to pay. SelfPay extends the POS to the shopper’s mobile device and purchases are settled with the existing merchant account, posting immediately to the POS. As a wallet aggregator, SelfPay offers a wide choice of payment methods from credit cards to e-wallets. Also included is a patent-pending wireless purchase verification method, SP Verify.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Wendy MacKinnon Keith, CEO & Founder, [email protected],

416-994-4771

Press: Catherine Seeds, PR+Marketing, Ketner Group, [email protected],

512-794-8876