How they describe themselves: Founded in 2009, CrowdFlower is the leading data enrichment platform for data scientists. Its quality-control technology is the most accurate and fastest way to collect, label, and clean data from an on-demand workforce.

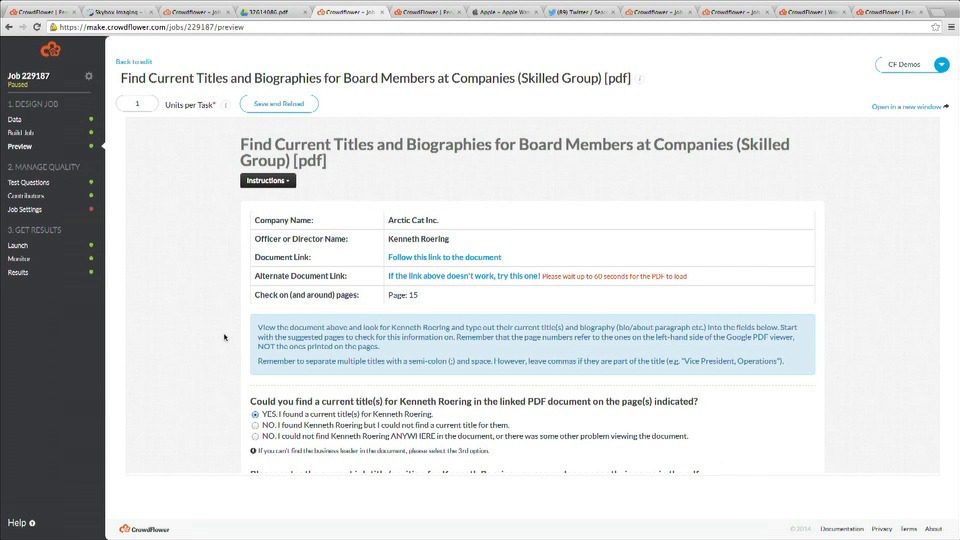

The platform automates the management of their online workforce to tackle tasks that require human intelligence – like search relevance tuning, data categorization, image annotation, metadata creation, sentiment analysis, transcription, and deduplication.

Backed by Trinity Ventures and Bessemer Venture Partners, CrowdFlower has secured over 150 customers, which include LinkedIn, Intuit, Flickr, Edelman, and eBay.

How they describe their product/innovation: Financial statements are notoriously difficult to decipher. CrowdFlower puts an end to messy and incomplete financial services data that contributes to a poor customer experience. We are demonstrating how CrowdFlower can quickly and easily collect, clean, and label financial transaction data, from an online, on-demand workforce of over 5M contributors to help businesses provide a superior customer experience.

Product distribution strategy: Direct to Business (B2B), licensed

Contacts:

Bus. Dev.: Seth Teicher, Parternships & Bus. Dev., [email protected]

Press & Sales: Renette Youssef, VP Marketing, [email protected]