CopSonic is a French company founded in 2013 specialized in the development and marketing of its sonic and ultrasonic authentication technology. The company is composed out of a strong team of researchers and engineers specialized in security, payment, sonic and ultrasonic authentication protocols. Recently, CopSonic joined the Microsoft Partner Network and became a member of the FIDO Alliance organization.

Presentation

Sonic and Ultrasonic Authentication Solution Working on All Mobile Phones

The CopSonic SDK allows contactless multi-factor authentication based on ultrasounds or sounds. This SDK is the first to introduce an “airgap” with encrypted analog information into the digital circuit. The security level thus achieved by CopSonic reaches current military security levels.

CopSonic is a universal solution working on all feature phones, smart phones, smart watches, tablets, computers, smart devices, internet of things, etc. as long as they are equipped with speakers and/or a microphone. It is operational on all standard GSM networks, on the internet or any other TCP-IP compatible network. The solution requires no change of Telco or of the existing hardware.

CopSonic enables e-commerce, financial and cybersecurity industries to propose a universal and secure solution for strong authentication to all of their customers worldwide. This authentication solution is an alternative to the use of online and/or offline passwords.

PhonicAccess and GateSonic are anti-phishing use cases of this highly secured technology. Also, for the first time, CopSonic enables the use of smart-bracelets as a secure access key.

Avoka is a leading customer experience management company specializing in multi-channel customer transactions. Avoka powers customer engagement applications for banking and insurance organizations worldwide, capturing and delivering business-critical customer transactions into back-office systems.

Presentation

Build an Omni-Channel Account Opening

Avoka demonstrates omni-channel account opening through their engagement platform:

- Responsive & adaptive design

- Cross-over between channels

- Pre-fill from social profiles

- ElectID verification

- Separation of information capture from core systems to facilitate easy cross-sell

Workshop

Build an Omni-Channel Accounting Opening Experience in Under 60 Minutes

Avoka builds an account opening experience in under an hour that:

- Is responsive & adaptive

- Supports cross-over between channels

- Is integrated to social media for pre-fill

- Is integrated to electronic ID verification

- Facilitates cross-sell with loose coupling to core systems

Leaders in frictionless behavioural user verification & authentication. BehavioSec examines how you interact with a website or mobile device to provide a frictionless layer in web fraud prevention.

Presentation

BehavioSec Offers the Most Mature ID System that Uses Behaviour Analytics

BehavioSec presents the latest in real-time security through the ability to monitor the way users interact with their device. By monitoring the environment and interactions such as typing rhythm or mouse patterns, our technology is able to recognize if someone other than the intended user is operating the device. If a security breach is detected, additional security measures can be carried out to prevent fraud and stop identity theft.

- Robust proven technology with more than 10 million active users in 2014

- Scalable with more than 500 million mobile transactions processed

- High performance with more than 20 banks using the service

- Available now for cloud or onsite deployment

Workshop

Real-time Scoring of Behavioural Biometrics via Web Services

Presenting our web & mobile SDK, we are diving deep into the backend services and showing how easy it is to instrument a website or mobile app with frictionless behavioural biometrics to add a new layer of security.

In an interactive session we are demonstrating a number of use cases of both real-time scoring and ‘after the fact’ biometrics forensics. We open up the client SDK to show the APIs, file formats, etc. In parallel, we expose the typical integration points to see the architecture and the power the backend web service APIs offer developers to represent additional transaction security in a way that suits your organization’s business needs.

Bluefin is a leading FinTech company focused on processing, integrating, and securing payments. Bluefin offers P2PE, tokenization, mobile payment SDK’s, payment gateways, merchant accounts, PCI Compliance, transparent redirect, recurring billing, and branded online merchant account enrollment.

Presentation

Bluefin, Point-to-Point Encryption (P2PE)

Bluefin is the first validated Point-to-Point Encryption (P2PE) Solution listed by the PCI Security Standards Council, North America. P2PE can reduce the scope of card data environment and related PCI requirements. Your software doesn’t need to be PCI Compliant if card data is encrypted using P2PE.

Contacts

Ruston Miles, Chief of Product Innovation: [email protected], 918-236-2840

Tim Barnett, Chief of Technology: [email protected], 678-894-2631

CardFlight is a leading provider of mobile POS technology and tools that make it easy for anyone to accept swiped (card present) payments in any mobile app with virtually any merchant account. They offer both iOS/Android mobile payment applications and software development kits (SDKs) that can be incorporated into custom applications. CardFlight’s platform also includes encrypted card readers and a payment gateway that supports over 20 different processors, to provide clients with complete mobile payments and mobile POS (mPOS) solutions. CardFlight won the Electronic Transactions Association’s 2014 Technology Innovation Award.

Presentation

CardFlight SDK for Mobile Payments

The CardFlight SDK allows any mobile developer to build mobile point-of-sale functionality into his or her own mobile apps. CardFlight supplies three things:

- Encrypted mobile card readers that fit into the audio jack of any smartphone or tablet

- Easy-to-integrate software development kits for iOS and Android, complete with developer-friendly documentation and support

- A PCI Level 1 compliant payment gateway that works with all major processors/merchant accounts

This allows developers to easily process swiped credit card payments within their own apps without the complexity of typical payment integrations. By using the CardFlight SDK, developers can fully customize their user experience and keep control of their product, while being able to integrate payment data into their other back-end systems (CRM, inventory management, analytics and reporting, etc.).

The CardFlight SDK and gateway is compatible with merchant accounts from leading processors, including Braintree, Chase Paymentech, Global Payments, First Data, Stripe, TSYS and Vantiv.

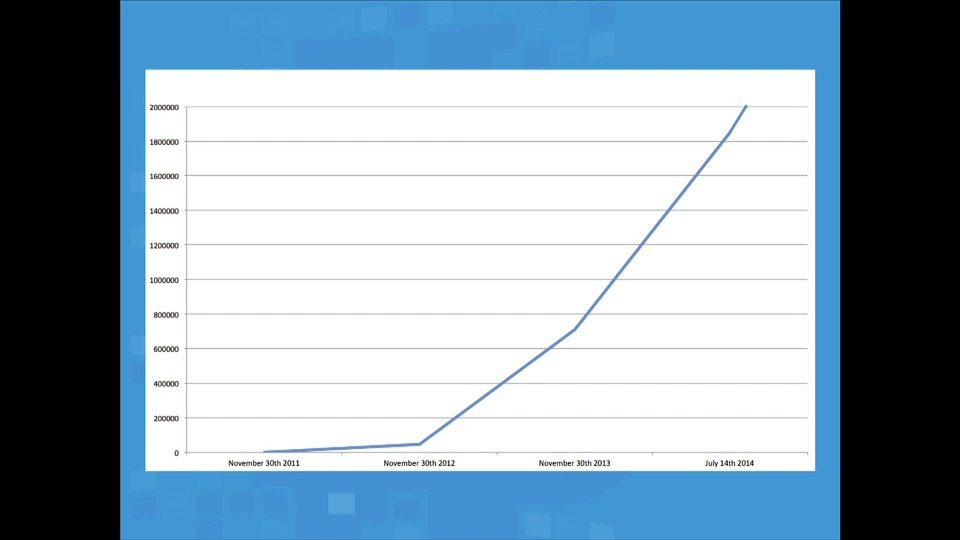

Blockchain is the world’s most popular web-based Bitcoin wallet and the most highly trafficked Bitcoin website. Blockchain is the de facto search engine for the Bitcoin economy. Blockchain has over 2 million wallets and our footprint continues to grow quickly.

Presentation

Blockchain: The Core API for Bitcoin Development

Blockchain’s APIs power most of the Bitcoin companies in the ecosystem. Utilizing our APIs, you can start a Bitcoin business in minutes. From wallet creation to transaction verification, Blockchain’s APIs have you covered.

Toronto-based Bionym is a team of experts in cryptography, biometrics and security. Our first product is the Nymi, a wearable device that enables the user to authenticate once via unique cardiac rhythm and securely and seamlessly assert Persistent Identity to any system.

Presentation

Here I Am: Revolutionizing FI and Banking Experiences with Persistent Identity and the Nymi

Balaji presents the Nymi Persistent Identity vision and User flow and reviews the key aspects of the SDK and Developer offering. In addition, he proposes and inspires discussion on select use cases in FinTech where the Nymi can improve engagement, security and customer satisfaction.

BCL Technologies develops API’s for Financial Text Extraction that unlock Big Data in unstructured documents and websites, enabling FinTech Developers to easily extract structured Financial Triplets from any source.

Presentation

Unlocking Financial Text

Explore the different use cases for BCL’s Financial Data Extraction API’s for unstructured text, to generate structured data Triplets.

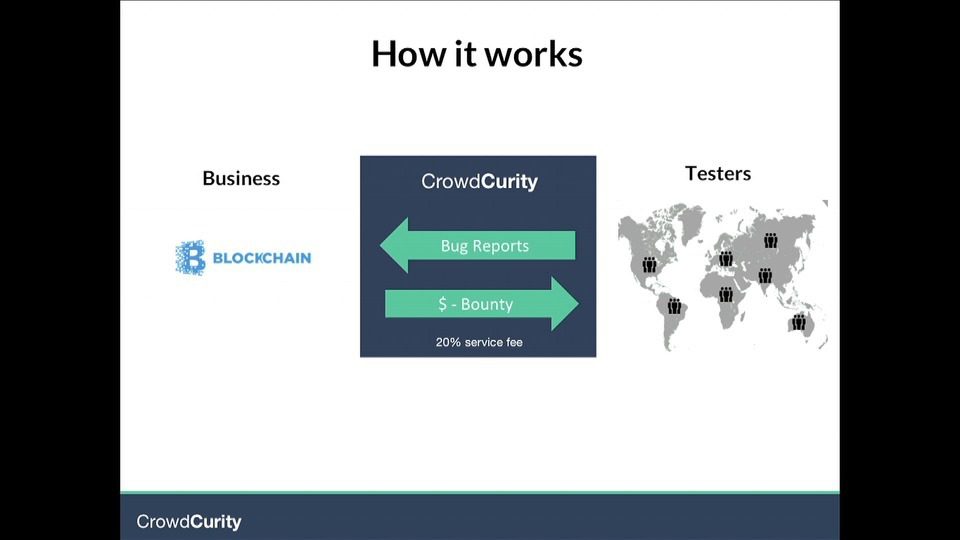

CrowdCurity is a web security marketplace. We connect businesses with security testers. We do bug bounty programs as-a-service. Bitcoin First.

Presentation

How to Invite Hackers to Your Website

Too many websites are being exploited, and we need to rethink web security. The best way to stay secure and ahead of the bad guys is to invite good white-hat hackers to test your security. We have made it easy to connect businesses to a crowd of security researchers.

Cloud Lending is an enterprise cloud lending solution provider. Our agile solutions are designed to empower lending businesses to simplify business processes, stay compliant and be future ready.

Presentation

Cloud Lending – Enterprise Lending Software

Cloud Lending products enable financial institutions to achieve scale and flexibility by moving the core back office to the cloud. Why did we choose Salesforce? The results that have been achieved by our customers using applications built on the Force.com platform – three-digit growth every quarter.

How they describe themselves: Ayasdi is transforming how the world uses data to solve complex problems by automatically discovering and operationalizing insights from complex datasets. Founded in 2008 after a decade of DARPA and NSF funded research at Stanford, the Ayasdi Platform executes and merges the results of hundreds of machine learning algorithms using Topological Data Analysis (TDA), enabling users to explore their data within interactive and intuitive applications. Funded by Khosla Ventures, Institutional Venture Partners (IVP), GE Ventures, Citi Ventures, and FLOODGATE, Ayasdi’s customers include General Electric (GE), Citigroup, Anadarko, Boehringer Ingelheim, the University of California San Francisco (UCSF), and Mount Sinai Hospital.

How they describe their product/innovation: Ayasdi’s finance application allows capital markets businesses to automatically identify persistent relationships between market conditions and client trading behaviors and generate alerts based on this dynamic information. In addition, this application utilizes Ayasdi’s novel mathematical framework to predict model failure and systematically update the model in states where it fails.

This application leverages Ayasdi’s powerful platform, which integrates machine learning algorithms within a topological framework. This platform gives the application its ability to generate results that take several types of data into account, including, but not limited to: social data, numeric data, and the macro economy.

Product distribution strategy: Direct to Business (B2B), licensed

Contacts:

Bus. Dev.: Andrew Bowles, VP Bus. Dev.

Press: Dan Reidy, Reidy Communications Principal, [email protected]

Sales: Eric Knapp, VP North American Sales, [email protected]

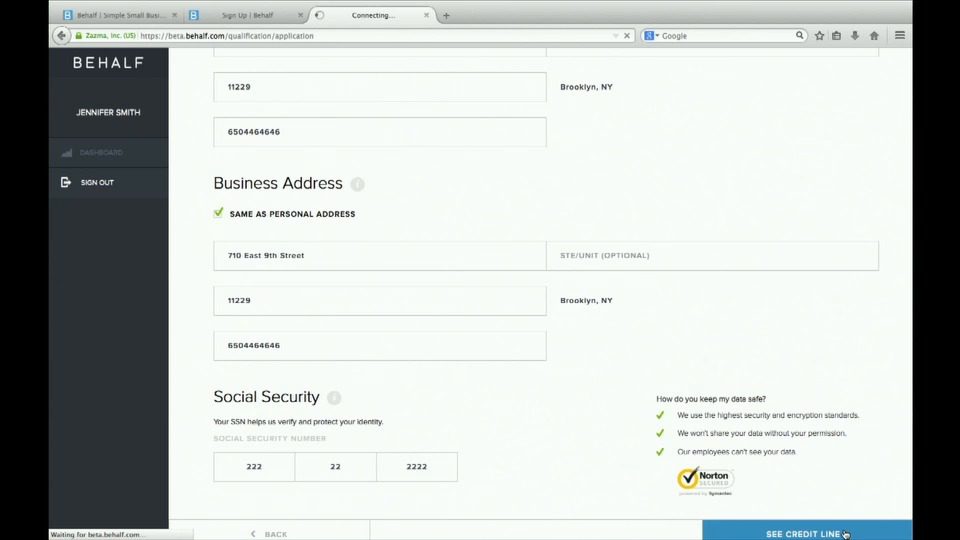

How they describe themselves: Behalf is a smart, new way for small businesses to finance almost any purchase, fast and fairly.

It starts with our proprietary method of credit scoring, which looks at both the business and its owner in a new way, enabling us to bring much-needed short-term purchase financing to more SMBs.

We pay vendors directly on behalf of SMBs, and take care of collecting repayments on behalf of the vendor. An intelligent twist on the traditional model, it’s better and more efficient for both parties.

No matter where your business is on its growth curve, Behalf is the smartest way to pay.

How they describe their product/innovation: We are showing the value of our platform to vendors through a simple demonstration of how easy it is for a vendor to preapprove his customers, onboard them, and offer them the Behalf credit line they need.

Next, we are demonstrating Behalf’s value for the SMB, including how our flexible credit line increases over time as the SMB demonstrates good credit behavior. We are showing all of this through the view of the customer dashboard and what’s possible there.

Product distribution strategy: Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev. & Press: Jennifer Soffen, Director, [email protected]

Sales: Shai Feinberg, Co-Founder & VP Sales, [email protected]