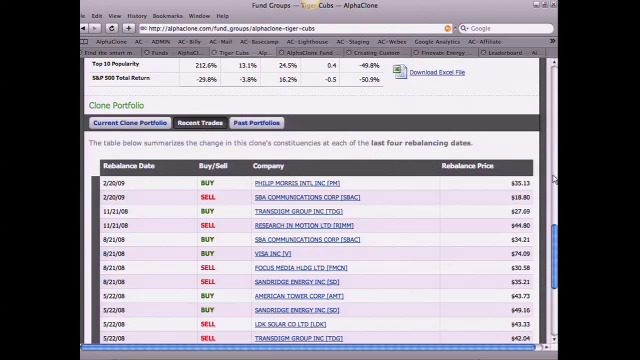

How they describe themselves: AlphaClone is a web-delivered stock research service that lets any investor replicate the performance of the world’s top fund managers. AlphaClone’s technology platform combines public disclosures and private data with proprietary algorithms to instantly create and backtest thousands of “smart money” portfolios. For example, a replicated portfolio of Warren Buffet’s top 10 holdings has outperformed the market by over 8% annually since 2000. AlphaClone’s backtests give investors the confidence to apply the stock ideas they discover because each backtest assumes investment at the time ideas are made public – a process called “cloning”. Our mission is to give investors smarter tools.

What they think makes them better: Intelligent, easy-access, cost effective tools to discover and replicate top investor performance are largely unavailable. AlphaClone is the only service that offers:

- Professional-grade backtests that avoid performance bias

- Automated algorithms that instantly derive and backtest replicated portfolios

- On-demand customization that allows users to instantly create private portfolios

- Painless discovery and tracking of top performing portfolios.

- Proprietary dataset that is expansive, quality tested and hard to replicate.

Contacts:

Bus. Dev., Sales, & Press: Maz Jadallah, Founder & CEO, 415-568-0370, [email protected]

How they describe themselves: Aradiom designs, develops and markets a broad range of secure mobile solutions based on a proprietary platform, QuickFramework™, which allows users to easily build rich mobile applications in just hours with a fully flexible interface design environment, deploy to all Java-enabled handsets, and have full control over already deployed clients by delivering, managing and updating the clients in seconds. Our vision is to provide the best and most secure mobile solutions integrated with appropriate technologies for public and private institutions to meet their increasingly complex business needs.

What they think makes them better: QuickBank, Aradiom’s flexible and feature-rich mobile banking solution, is now fully integrated with SolidPass, Aradiom’s mobile security soft token, allowing multi-factor authentication to be done from one mobile device even for mobile banking transactions. This embedded soft-token solution provides the protection against online and mobile banking fraud threats without sacrificing usability. Users can conduct banking transactions on their mobile devices securely and use the phone to generate OTPs for online banking. More than 450 mobile devices are supported, including iPhones, Windows Mobile phones and BlackBerry devices.

Contacts:

Bus. Dev.: Regina Jun, Director of Business Development, [email protected]

Sales: Michael Larsson, Director of Sales, [email protected]

Press: Michelle Bowling, Director of Marketing, [email protected]

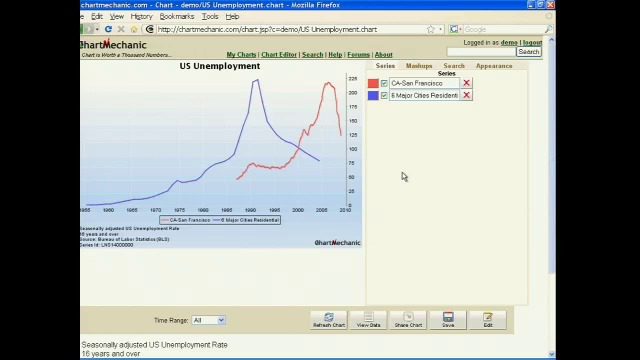

How they describe themselves: ChartMechanic lets users easily combine their own data with a broad library of public domain financial data, from sources like the Federal Reserve, the Bureau of Labor Statistics, or stock/bond prices. ChartMechanic loads data from a variety of sources, such as Microsoft Excel spreadsheets, Google Docs spreadsheets, or even HTML tables on the web. Common financial functions are built in, like adjusting for inflation or year-over-year/month-over-month changes. ChartMechanic lets users compose highly customized charts, and the data is continuously updated, making the charts suitable for financial dashboard and reporting applications.

What they think makes them better: Established financial data vendors offer very high-priced products, requiring special terminals, and often are not easily accessible to their users. ChartMechanic offers an easy-to-use data and charting service, with an intuitive web interface, at a much lower price.

Contacts:

Bus. Dev. & Sales: Jolly Chen, Founder, [email protected], 510-551-7577

Press: Dave Brown, Founder, [email protected], 415-509-2239

How they describe themselves: BillShrink is a free cost-savings tool that saves consumers money on their everyday bills. BillShrink asks users a few quick questions and then searches millions of data points to find and instantly present money-saving alternatives that match actual usage. BillShrink continues to track market changes and can provide an email alert if a better savings opportunity becomes available. Currently BillShrink helps consumers save money on Cell Phone Plans, Credit Cards, and Gas and will be rolling out more bill-saving opportunities.

What they think makes them better: In under a minute, BillShrink conducts an analysis of the consumer’s bill then instantly scans millions of possible product combinations to deliver an unbiased set of savings recommendations. Recommendations are presented in an easy to use interface, so consumers can compare service provider plans – apples-to-apples – against their actual use or needs. Billshrink automatically repeats the analysis on an ongoing basis to ensure their users are always getting the best deal. The personalized recommendations are possible because BillShrink has the largest dataset for each vertical. We monitor over 10 million wireless data points, our credit data deciphers all the points programs down to a dollar amount, and our commute-based gas savings tool factors in the cost of detouring to any station.

Contacts:

Bus. Dev., Sales & Press: Peter Pham, CEO, [email protected]

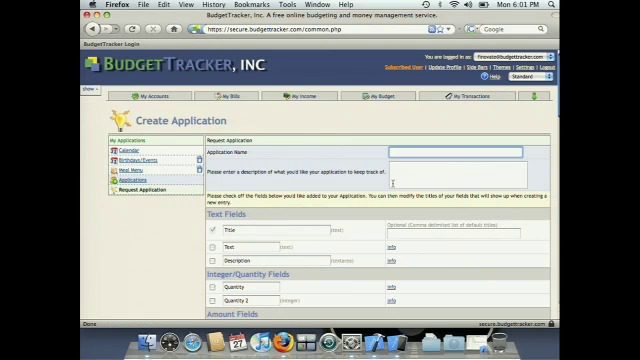

How they describe themselves:

- Money Management – The financial aspect of the site allows users to keep track of their Budget, Bills, Income, Accounts, and Transactions and tie all these together into an easy to read calendar.

- Small Business – This covers the ability to Create and send Invoice/Estimates, Tax Deductions, Expense Reporting capabilities, Income Statements, and Balance Sheets.

- Organization – Along with personal finance, BudgetTracker also gives users organization tools such as Tasks, Shopping Lists, Recipes, and more to track not only their finances but things in their daily life.

- Add-Ons – The add-ons section allows users to create their own applications. They check off the form fields and give names and the application is automatically created for them without having to write any code. In addition, each application is reviewed and if we feel it could be useful to the public, we make it available for everyone but the data remains private.

What they think makes them better: The BudgetTracker product offers the widest range of services for both end-users and small businesses alike. For small businesses, we stand out by offering the ability to track Invoices, Time Sheets, Expense Reports, Employee Accounts, Tax Deduction capabilities, Income Statements, and Balance Sheets. All of these services are tied in with a complete Money Management tool that allows regular users to manage their personal finances from any Internet connection. We’ve also come up with a way to allow users to create their own applications allowing them to track anything they can think of. While other companies specialize in only a few of these fields, BudgetTracker offers a complete package.

Contacts:

Bus. Dev., Sales and Press: Kyle Kirman, 425-444-2332, [email protected]

How they describe themselves: CalendarBudget is a unique online personal finance organizer combined with a powerful planning tool. Easily embedded into and branded for an existing web site, CalendarBudget presents your financial data in an easy to use calendar interface. Your account balance is shown at the top of every day in the past, present and future. Your bills and spending are shown in the context of all other transactions. With CalendarBudget, planning for future purchases and avoiding surprises such as overdraft and bounced checks is easy. Category budgets, along with charts, reports and reminders make planning your future easy and even enjoyable.

What they think makes them better: CalendarBudget stands out for two reasons: the interface and planning your future. First, CalendarBudget’s main view is a calendar. Everyone already knows how to use a calendar. There’s no strange proprietary interface to learn how to use, so you are immediately comfortable and productive with the tool. Second, because we are a calendar, you can move forward into the future and see what your account balance is going to be like, according to your spending habits and plan. Where other tools simply analyze historical data, CalendarBudget helps you plan your future spending so you can live within your means.

Contacts:

Bus. Dev.: Robin Poulin, 905-434-4927, [email protected]

Sales: Gavin Bourne, 717-659-4851, [email protected]

Press: Kristen Keller, 609-644-4896, [email protected]

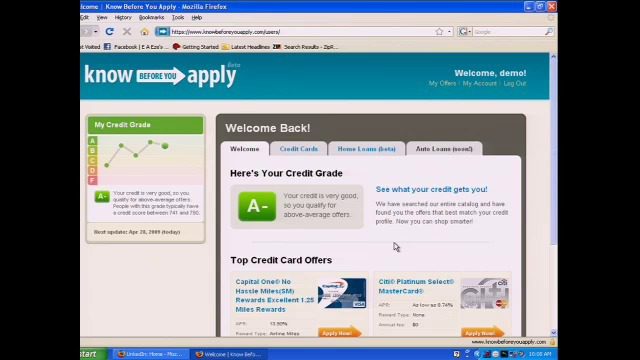

How they describe themselves: Centrro, with its KnowBeforeYouApply service, helps consumers find financial products (such as credit cards, mortgages and other personal finance services) that match their credit risk profile. This is a $4 billion annual online financial services advertising market with 154 million online, credit-active consumers. KnowBeforeYouApply targets this market with a free service for consumers to know which loan products they would qualify for before ever applying. Also, we track consumers’ credit grades over time, and make relevant and timely recommendations that benefit their unique situation. KnowBeforeYouApply saves consumers time and money, and significantly improves lender approval rates and lowers rejection costs.

What they think makes them better: KnowBeforeYouApply can tell a consumer what they would be approved for before they ever apply. This can substantially increase the lead match rate from less than 15% to 80%. Unlike competitors, we access consumer credit reports and scores in real-time (without affecting their FICO grades), and use a proprietary credit accessing and matching engine to perform sophisticated pairings using lender-supplied guidelines. Unlike lead generation firms, our consumers completely control who they are ultimately paired with. KnowBeforeYouApply also tracks a consumer’s credit grade for free over time while comparable services charge the consumer more than $100 per year.

Contacts:

Bus. Dev.: Matt Murray, [email protected], 408-499-3076

Press: Ike Eze, [email protected], 510-384-7900

Sales: Tuyen N. Vo, [email protected], 510-269-4199

How they describe themselves: Walt Mossberg (Wall Street Journal) described CircleUp’s products as “truly useful” and TheNextWeb called SmartPay a “game changer.” With SmartPay, CircleUp is at the nexus of the last frontier in the shift to collecting money electronically: casual group expenses. The company estimates this to be a large, untapped $40B+ market. SmartPay provides an easy, secure and integrated way for groups and teams to collect money by email. CircleUp distributes its services via integrations with large membership sites like Active Networks and Blackbaud, bringing SmartPay to their to millions of members in sports, education, faith and non-profit segments.

What they think makes them better: For SmartPay, the biggest “competition” is the old way of doing things: the soccer mom running around a field harassing parents and asking them to stuff money into a white envelope or to “send a check in the mail.” Stand-alone money transfer services like PayPal are OK for basic 1-to-1 payments. However, they do NOT work well for groups or teams, especially when those groups and teams also need to communicate and collect information. In addition, unlike other payment or messaging services, SmartPay is fully integrated with the sites that groups use every day, providing shared email address books and accessibility across multiple networks including Facebook, AOL, AIM, Yahoo! IM, Active/eteamz or Blackbaud Sphere.

Contacts:

Bus. Dev.: Daniel Scalisi, VP Partner Development, [email protected], 310-228-7184

Press & Sales: Brad Cooper, VP of Marketing, [email protected], 949-870-2107

How they describe themselves: Cooler delivers software that automatically generates the global warming impact of an individual or small business using the data that already exists in their financial management software. Then gives them context-specific actions they can perform to save money/energy and mitigate their impact.

What they think makes them better: As far as we know there is no other offering on the marketplace that can do this.

Contacts:

Bus. Dev.: Michel Gelobter, 510-439-5006, [email protected]

Sales: Michael Stewart, Director Sales, 415-235-9433, [email protected]

How they describe themselves: Credit Karma is a pro-consumer site that provides consumers free access to their credit scores plus a range of tools and information resources such as online credit score modeling and rate comparison tools, information resources and specific Q&A services for people to better educate themselves about the behavior of their credit score and to help them in monitoring and managing the credit aspect of their financial health.

What they think makes them better: Most of the other sites that are related to credit scores exist to sell access to credit reports. They are transactional sites, where you are charged a fee for a product. Credit Karma is much more of a consumer advocacy site. We give people free access to their credit score, plus tools, information resources and question and answer support to help them actively manage their score. And Credit Karma is a lot easier than digging though the pages and pages of credit data and analytics from the paid services.

Contacts:

Bus. Dev. & Sales: Nichole Mustard, VP Business Development, [email protected]

Press: Michelle Sabolich, Atomic Public Relations, 415-402-0230, [email protected]

How they describe themselves: BillShrink is a new, free online service that helps consumers save money by making continuously updated, personalized, usage-based recommendations on everyday services such as cell phones and credit cards. BillShrink automatically monitors the market’s millions of continuously changing product combinations, as well as each user’s individual usage behavior, and makes unbiased recommendations on plans and cards, as ranked by the technology. BillShrink seeks to provide transparency between consumers and service providers, and is the only service of its kind to translate layers of technical babble designed to confuse consumers into actionable, money-saving recommendations. BillShrink will soon expand into other complex services.

What they think makes them better: In September 2008, BillShrink added credit cards to its product offering, revealing the true costs and value of rewards for cardholders. For the first time, consumers can access a quantified, dollar-for-dollar comparison of credit cards tailored to their personal usage and spending behavior. No other online credit card resource goes to the same level of detail and personalization as BillShrink, which makes unbiased recommendations based on data from more than 200 of the most popular credit cards from major banks. By simply entering a few details about their credit card usage and preferences, consumers can quickly access personalized recommendations.

Contacts:

Bus. Dev.: Peter Pham, CEO BillShrink, [email protected]

Press: Amy Jackson, Atomic PR, 415-402-0230, [email protected]

How they describe themselves: Boulevard R offers consumers independent, unbiased financial advice to help them reach their goals. Boulevard R leverages technology to scale and streamline the delivery of actionable financial advice, while providing an online Dashboard that offers highly relevant content to help consumers make smart decisions. For forward-thinking financial services companies, Boulevard R can help them instill trust and better serve the middle and emerging affluent markets.

What they think makes them better: Boulevard R effortlessly makes sense of your entire financial life, not just your cash flow. By working with some of country’s leading independent financial planning experts, we’ve created a unique 3-step process that puts the interests of consumers first and lays out a clear, actionable path to financial security. By putting Certified Financial Planners™ in the planning process, Boulevard R makes high-quality, unbiased financial advice available for everyone, regardless of their assets or income.

Contacts:

Bus. Dev. & Sales: Jon Iverson, [email protected], 707-481-1845

Press: Matt Iverson, CEO, [email protected], 415-250-6727